Does Form 1310 Need To Be Mailed

Does Form 1310 Need To Be Mailed - Complete, edit or print tax forms instantly. Ad access irs tax forms. You do not need to file form 1310 to claim the refund on mr. Our experts can get your taxes done right. Web 9 rows surviving spouses must file form 1310 only when they request reissuance of a refund check in the surviving spouse's name. Get ready for tax season deadlines by completing any required tax forms today. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web estate and you file form 1040 for mr. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Web in general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Web estate and you file form 1040 for mr. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web this information includes name, address, and the social security number of the person who is filing the tax return. Web support community discussions taxes get your taxes done still need to file? You do not need to file form 1310 to claim the refund on mr. Complete, edit or print tax forms instantly. On april 3 of the same year, you.

Complete, edit or print tax forms instantly. Web taxpayer, you must file form 1310 unless either of the following applies: Ad access irs tax forms. You do not need to file form 1310 to claim the refund on mr. Complete, edit or print tax forms instantly. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web in general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Our experts can get your taxes done right. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Ad access irs tax forms.

Breanna Form 2848 Irsgov

Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person claiming. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Web taxpayer, you must file form 1310 unless.

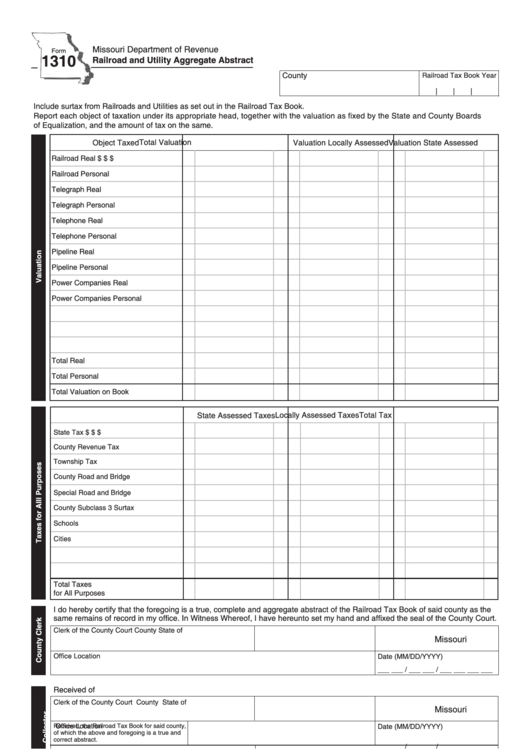

Fillable Form 1310 Railroad And Utility Aggregate Abstract printable

Please click below to claim. However, you must attach to his return a copy of the. Get started > samhouston76 new member. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or.

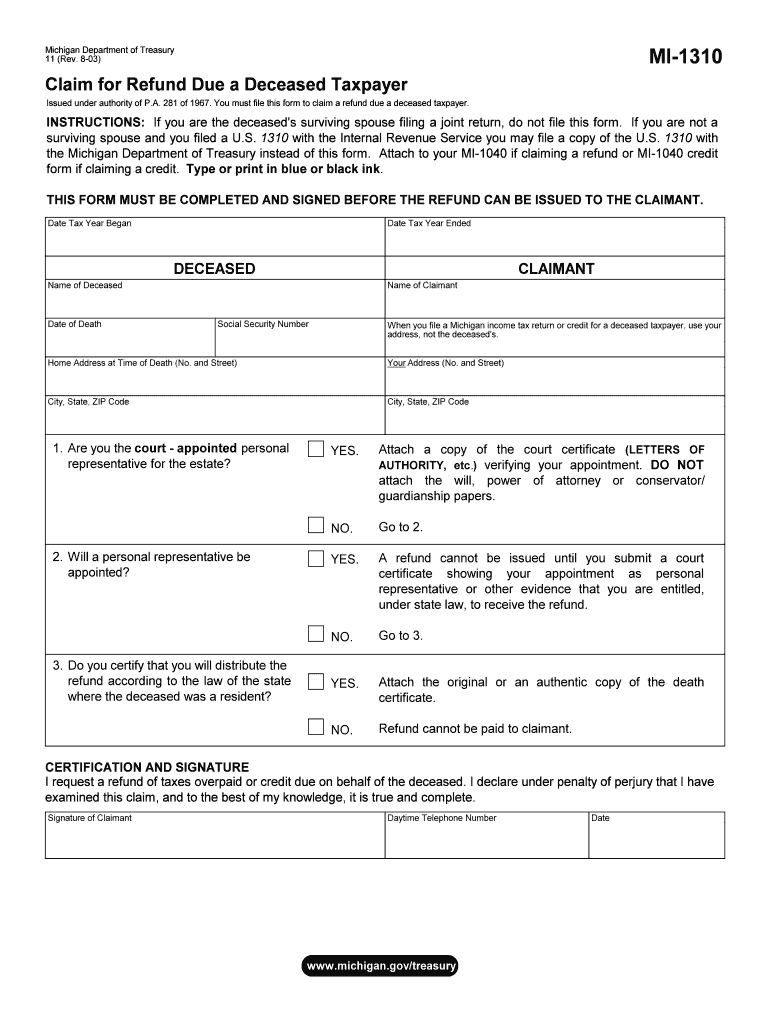

Mi 1310 Form Fill Out and Sign Printable PDF Template signNow

Web the “statement of person claiming refund due a deceased taxpayer” can be used by a deceased taxpayer’s surviving spouse, the decedent’s estate executor or administrator,. Web 9 rows surviving spouses must file form 1310 only when they request reissuance of a refund check in the surviving spouse's name. Our experts can get your taxes done right. Web estate and.

Download Fillable dd Form 1309

Ad access irs tax forms. Green died on january 4 before filing his tax return. Please click below to claim. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Get started > samhouston76 new member.

Mi 1310 Instructions Pdf Fill Out and Sign Printable PDF Template

Web this information includes name, address, and the social security number of the person who is filing the tax return. Web estate and you file form 1040 for mr. Please click below to claim. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Get started >.

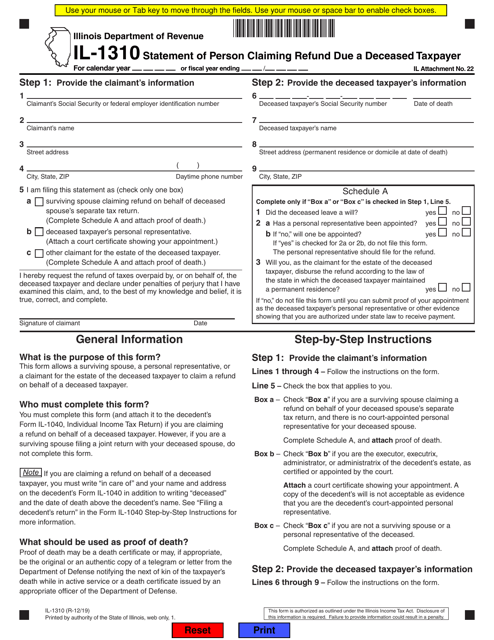

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

Get ready for tax season deadlines by completing any required tax forms today. Web support community discussions taxes get your taxes done still need to file? Get ready for tax season deadlines by completing any required tax forms today. Web 9 rows surviving spouses must file form 1310 only when they request reissuance of a refund check in the surviving.

Irs Form 1310 Printable 2020 2021 Blank Sample to Fill out Online

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web taxpayer, you must file form 1310 unless either of the following applies: Personal representatives must file a. However, you must attach to his return a copy of the.

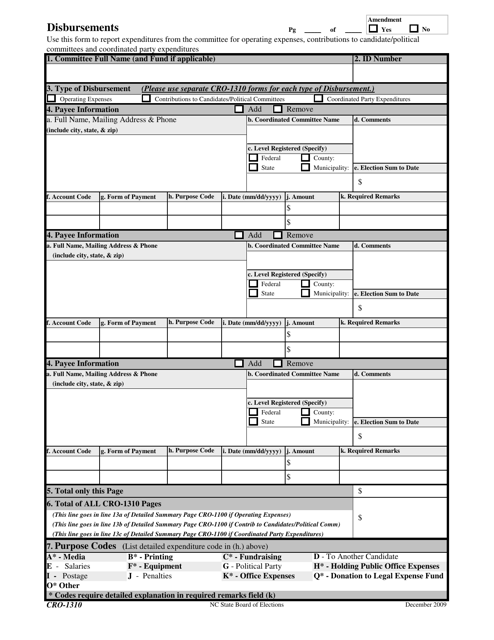

Form CRO1310 Download Printable PDF or Fill Online Disbursements North

Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. Web yes, you can file irs form.

Irs Form 1310 Printable Master of Documents

Ad access irs tax forms. Web estate and you file form 1040 for mr. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web line a check the box on line a if you received a refund check in your.

Ad Access Irs Tax Forms.

Get ready for tax season deadlines by completing any required tax forms today. You do not need to file form 1310 to claim the refund on mr. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Web estate and you file form 1040 for mr.

Web Line A Check The Box On Line A If You Received A Refund Check In Your Name And Your Deceased Spouse's Name.

On april 3 of the same year, you. Personal representatives must file a. Then you have to provide all other required information in the. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund.

Web Support Community Discussions Taxes Get Your Taxes Done Still Need To File?

Complete, edit or print tax forms instantly. Web 9 rows surviving spouses must file form 1310 only when they request reissuance of a refund check in the surviving spouse's name. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. Get started > samhouston76 new member.

Please Click Below To Claim.

Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)