Empower Withdrawal Form

Empower Withdrawal Form - Remember that, except with roth accounts, you must start making required minimum withdrawals at age 72. Mta 457 plan enrollment election form. 2 rollover options ira and new employer rollover Saving, investing and advice need help? Qualified birth or adoption distribution form use this form to request a withdrawal for a qualified event. Talk to a representative about your unique situation. It contains important tax information. The enclosed instruction guide will help you as you fill out this form. Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option.

Mta 457 plan enrollment election form. Read the enclosed notice carefully. Talk to a representative about your unique situation. Allowable reasons as defined by irs safe harbor hardship regulations. It contains important tax information. Web plan may allow a participant to take a hardship withdrawal from their retirement plan account when they experience an immediate and heavy financial need. Web this retirement withdrawal calculator can help you understand the impact of various withdrawal rates. Request for unforeseeable emergency withdrawal. Web mta 457 plan forms. We’d be happy to help.

The plan document defines which of these hardship types is allowed: Web this retirement withdrawal calculator can help you understand the impact of various withdrawal rates. Empower reviews withdrawal requests and returns requests that lack required information to participants. Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: Read the enclosed notice carefully. Qualified birth or adoption distribution form use this form to request a withdrawal for a qualified event. 2 rollover options ira and new employer rollover Download the qbad form pdf file opens in a. Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option. Remember that, except with roth accounts, you must start making required minimum withdrawals at age 72.

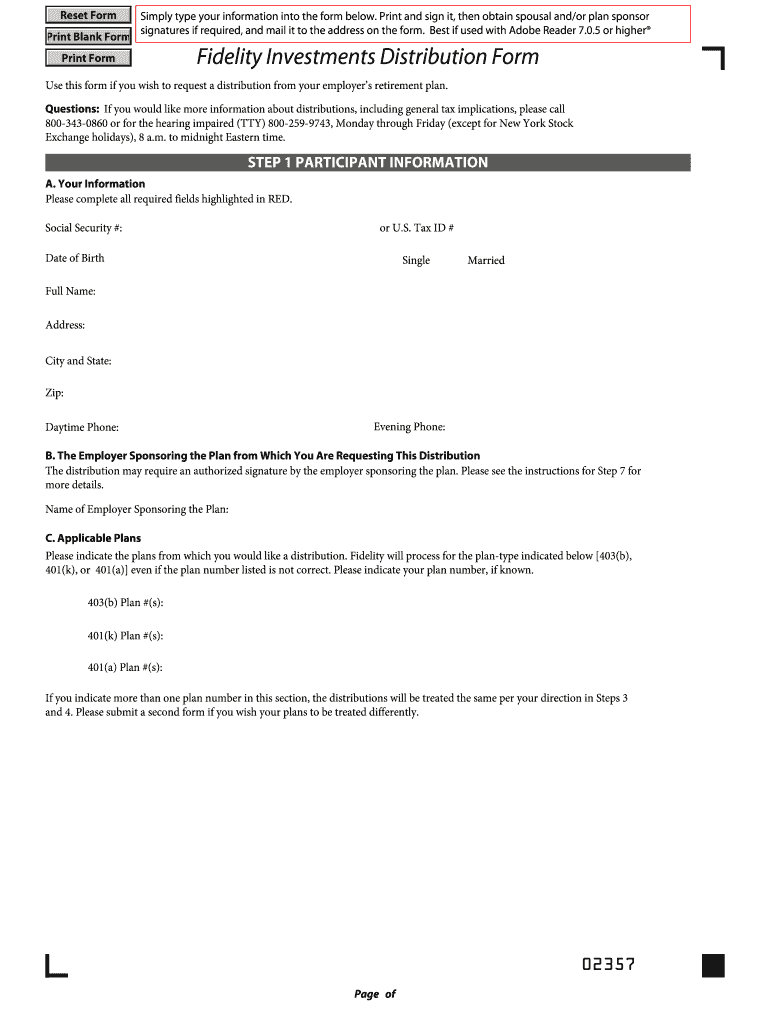

Distribution From 401K Fill Out and Sign Printable PDF Template signNow

Web this retirement withdrawal calculator can help you understand the impact of various withdrawal rates. The plan document defines which of these hardship types is allowed: Remember that, except with roth accounts, you must start making required minimum withdrawals at age 72. The enclosed instruction guide will help you as you fill out this form. We’d be happy to help.

401k Opt Out Form Template Fill Online, Printable, Fillable, Blank

Qualified birth or adoption distribution form use this form to request a withdrawal for a qualified event. Pacific time, and saturdays between 6 a.m. The enclosed instruction guide will help you as you fill out this form. Allowable reasons as defined by irs safe harbor hardship regulations. We’d be happy to help.

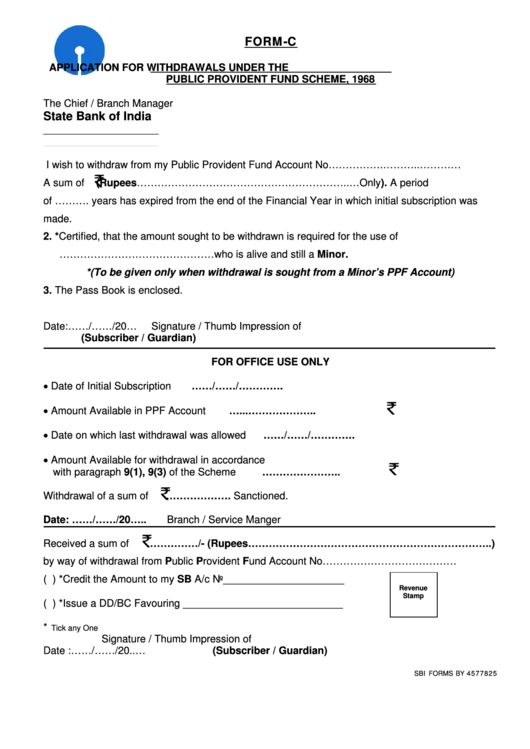

Top Pf Withdrawal Forms And Templates free to download in PDF format

It contains important tax information. Remember that, except with roth accounts, you must start making required minimum withdrawals at age 72. Web this retirement withdrawal calculator can help you understand the impact of various withdrawal rates. Pacific time, and saturdays between 6 a.m. Read the enclosed notice carefully.

401k Withdrawal Form Fill Out and Sign Printable PDF Template signNow

Allowable reasons as defined by irs safe harbor hardship regulations. The plan document defines which of these hardship types is allowed: Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option. Read the enclosed notice carefully. It contains important tax information.

Withdrawal Request 401 K Form Fill Online, Printable, Fillable, Blank

Remember that, except with roth accounts, you must start making required minimum withdrawals at age 72. The plan document defines which of these hardship types is allowed: Qualified birth or adoption distribution form use this form to request a withdrawal for a qualified event. Mta 457 plan enrollment election form. Web withdrawal options1 when you begin making withdrawals from either.

2020 Form MetLife NonErisa 403(b) Withdrawal Request Fill Online

Mta 457 plan enrollment election form. The enclosed instruction guide will help you as you fill out this form. The plan document defines which of these hardship types is allowed: Allowable reasons as defined by irs safe harbor hardship regulations. Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include:

withdrawal form DriverLayer Search Engine

Allowable reasons as defined by irs safe harbor hardship regulations. Talk to a representative about your unique situation. Request for unforeseeable emergency withdrawal. Read the enclosed notice carefully. We’d be happy to help.

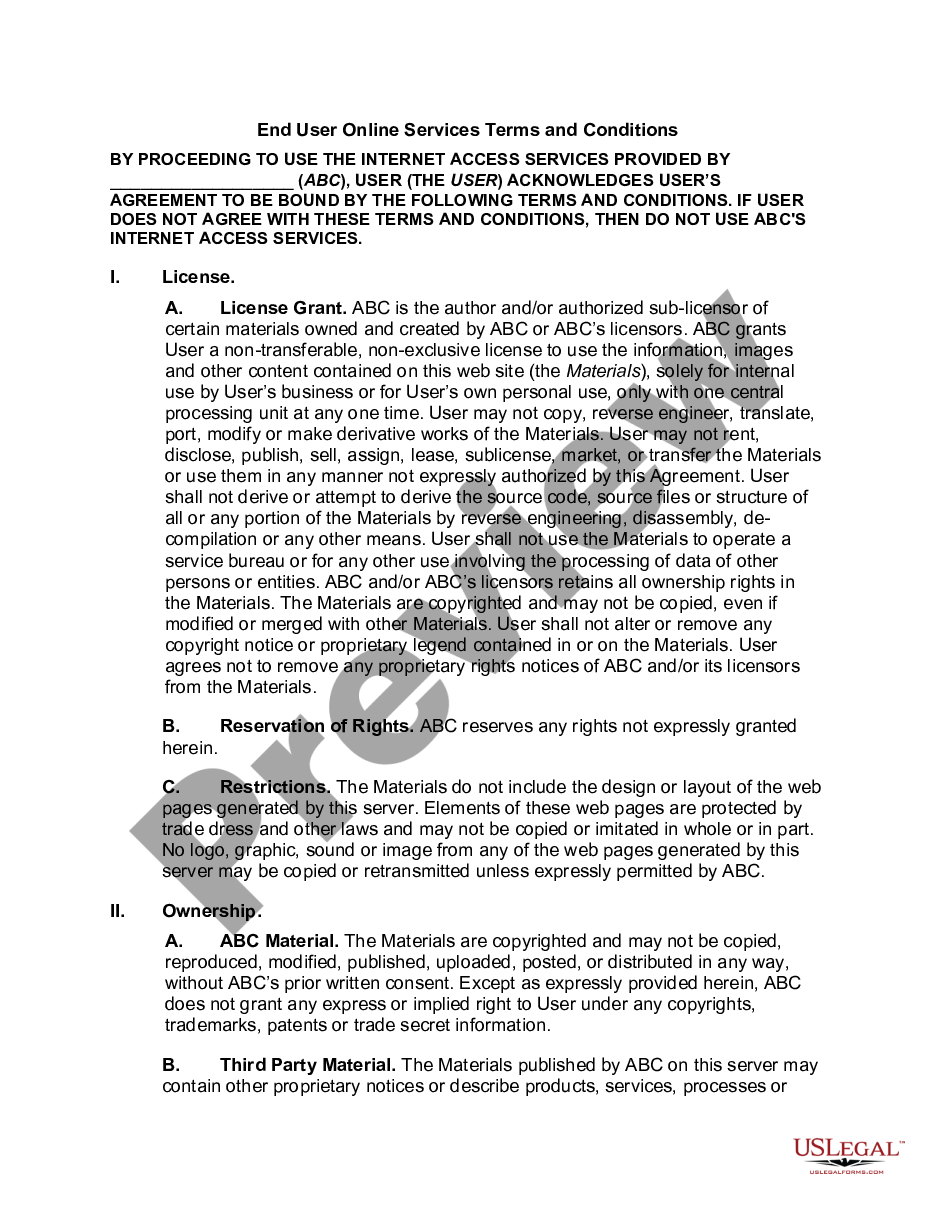

Online Terms Conditions With Withdrawal From Empower Retirement US

Web mta 457 plan forms. Pacific time, and saturdays between 6 a.m. The enclosed instruction guide will help you as you fill out this form. Remember that, except with roth accounts, you must start making required minimum withdrawals at age 72. Empower reviews withdrawal requests and returns requests that lack required information to participants.

request for withdrawal form Equal Employment Opportunity Commission

Request for unforeseeable emergency withdrawal. It contains important tax information. The plan document defines which of these hardship types is allowed: Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: Allowable reasons as defined by irs safe harbor hardship regulations.

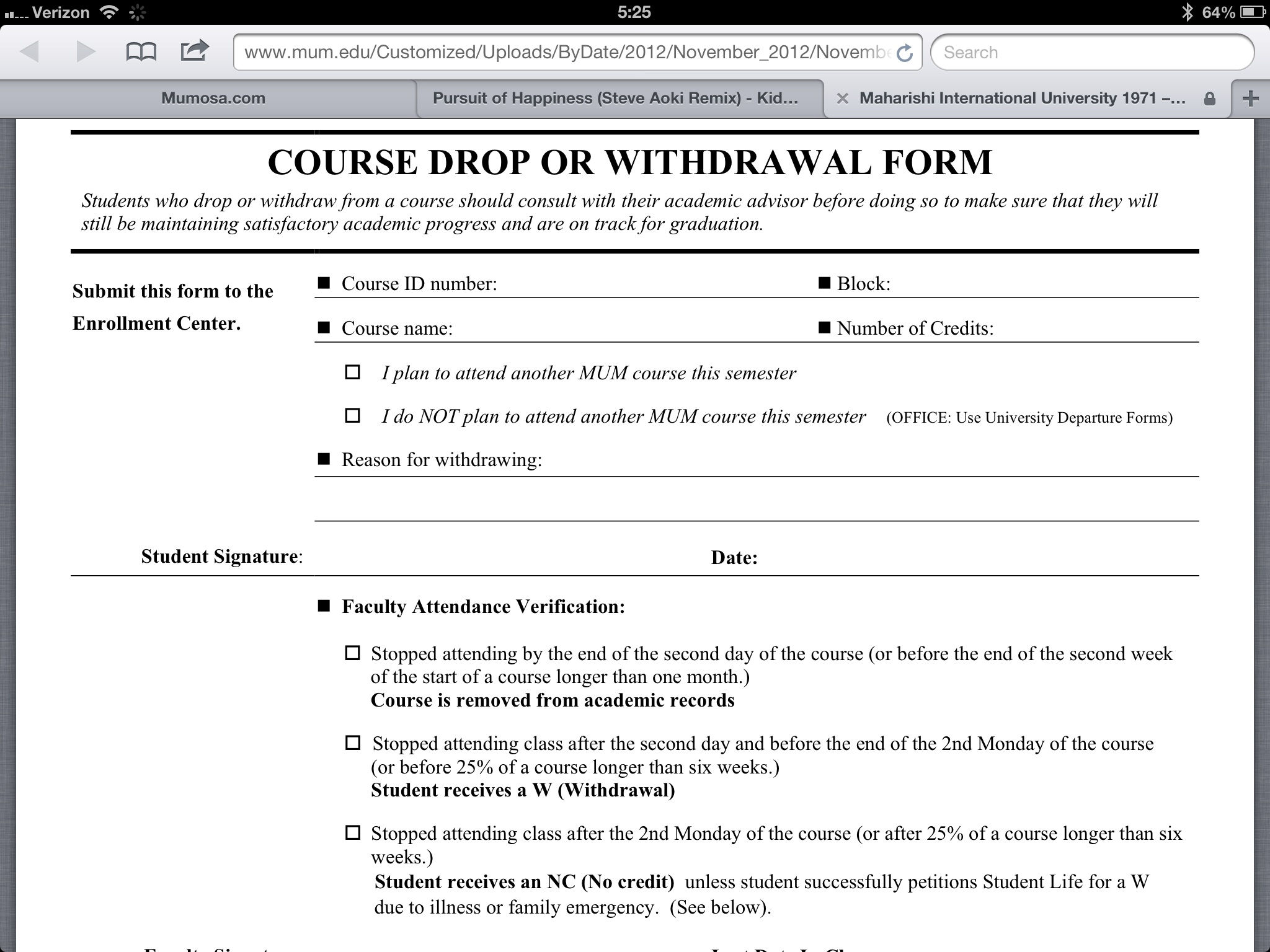

Withdrawal Request Form — York College / CUNY

Saving, investing and advice need help? Web this retirement withdrawal calculator can help you understand the impact of various withdrawal rates. Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: Request for unforeseeable emergency withdrawal. Talk to a representative about your unique situation.

Web Plan May Allow A Participant To Take A Hardship Withdrawal From Their Retirement Plan Account When They Experience An Immediate And Heavy Financial Need.

Empower reviews withdrawal requests and returns requests that lack required information to participants. The plan document defines which of these hardship types is allowed: Mta 457 plan enrollment election form. Remember that, except with roth accounts, you must start making required minimum withdrawals at age 72.

Talk To A Representative About Your Unique Situation.

Allowable reasons as defined by irs safe harbor hardship regulations. Pacific time, and saturdays between 6 a.m. Not available for plans offering a qualified joint and survivor annuity (qjsa) payout option. Web mta 457 plan forms.

2 Rollover Options Ira And New Employer Rollover

We’d be happy to help. Qualified birth or adoption distribution form use this form to request a withdrawal for a qualified event. It contains important tax information. Download the qbad form pdf file opens in a.

Read The Enclosed Notice Carefully.

Web withdrawal options1 when you begin making withdrawals from either a traditional or roth ira account, your options include: Web this retirement withdrawal calculator can help you understand the impact of various withdrawal rates. The enclosed instruction guide will help you as you fill out this form. Saving, investing and advice need help?