Espp Form 3922

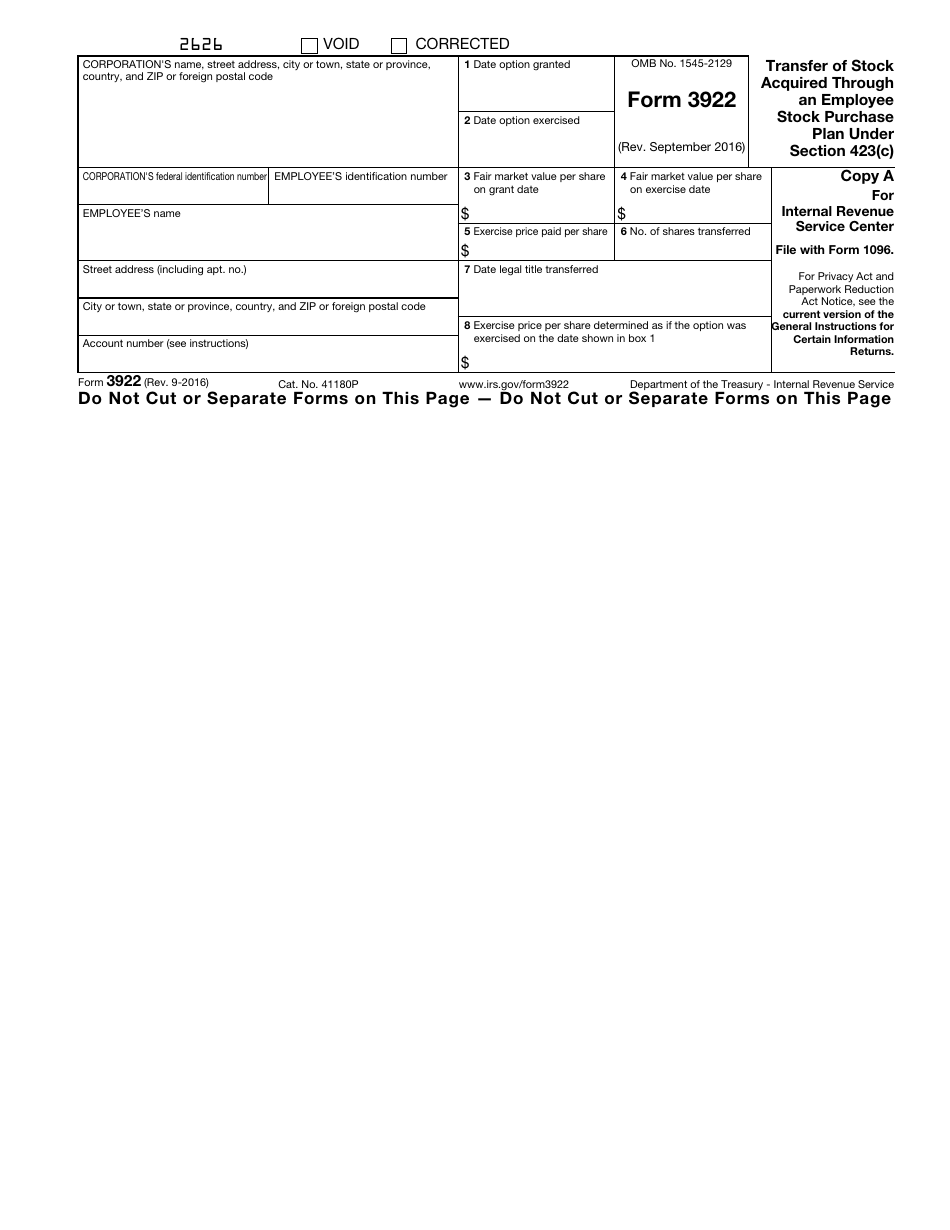

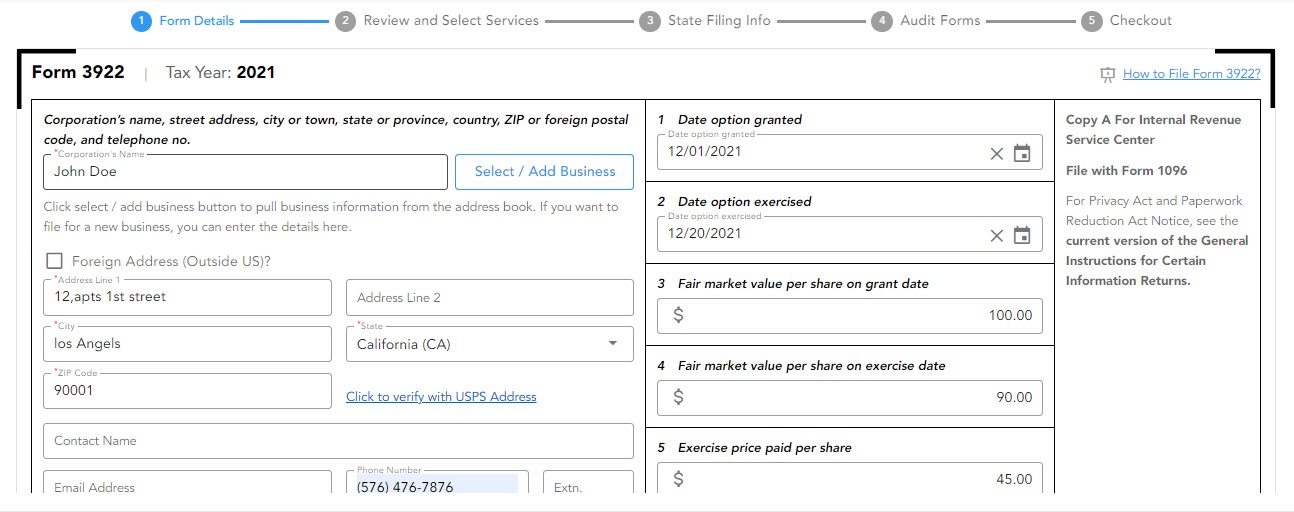

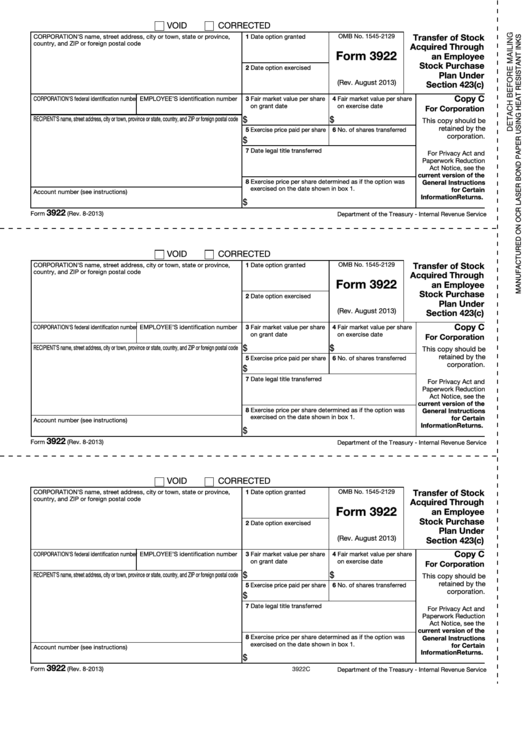

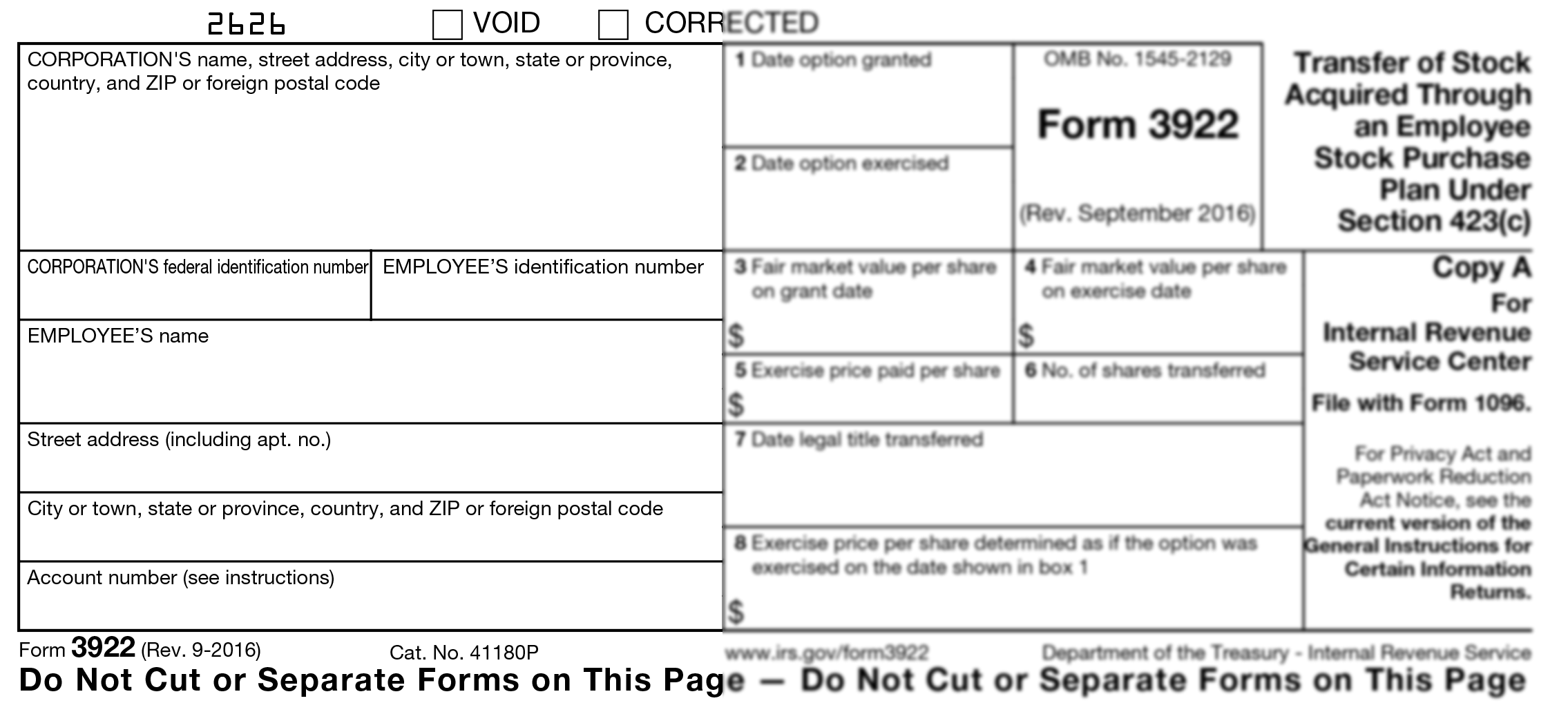

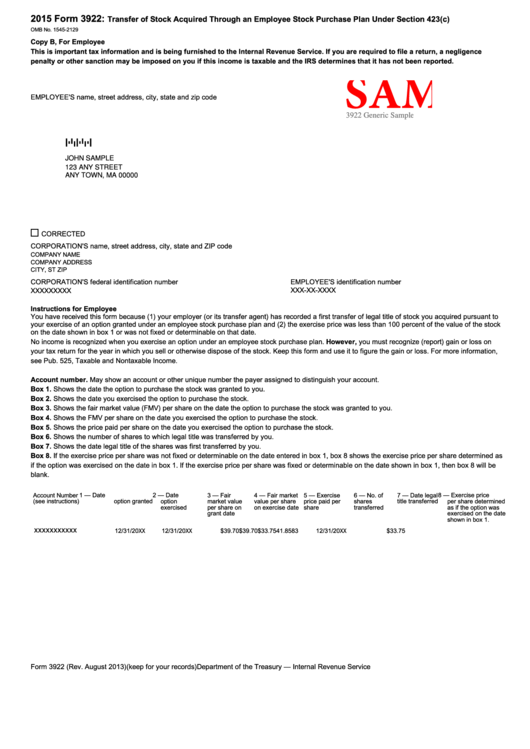

Espp Form 3922 - Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web please find enclosed a form 3922, which provides certain information regarding your 2021 purchase of shares under the company’s employee stock purchase plan (espp). Web what is irs form 3922? Web the espp, known as employee stock purchase plan, is a program that is run by the company that employees can purchase the shares of the company at a set price. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Hi, i purchased shares through espp and sold the shares as soon as they were available in 2022. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web service highlights everything we do is with you and your company's plan participants in mind. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan.

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Nathan curtis cpa • october 20, 2010. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Some of our standard services. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web certain information must be included in forms 3921 and/or 3922 (or substitute forms), including for espp transactions, the price per share of espp stock. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web service highlights everything we do is with you and your company's plan participants in mind.

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. I work with employee stock ownership plans, not employee stock purchase plans, but from my limited understanding. Web what is irs form 3922? Web please find enclosed a form 3922, which provides certain information regarding your 2021 purchase of shares under the company’s employee stock purchase plan (espp). Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Hi, i purchased shares through espp and sold the shares as soon as they were available in 2022. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return.

3922 2020 Public Documents 1099 Pro Wiki

Web certain information must be included in forms 3921 and/or 3922 (or substitute forms), including for espp transactions, the price per share of espp stock. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web irs form 3922, transfer of stock acquired through an.

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Web what is irs form 3922? Web stock purchases made through an espp during a calendar year must be reported by the company to you and the irs on form 3922 by january 31 of the following year. Web service highlights everything we do is with you and your company's plan participants in mind. Web form 3922, transfer of stock.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web certain information must be included in forms 3921 and/or 3922 (or substitute forms), including for espp transactions, the price per share of espp stock. Some of our standard services. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under.

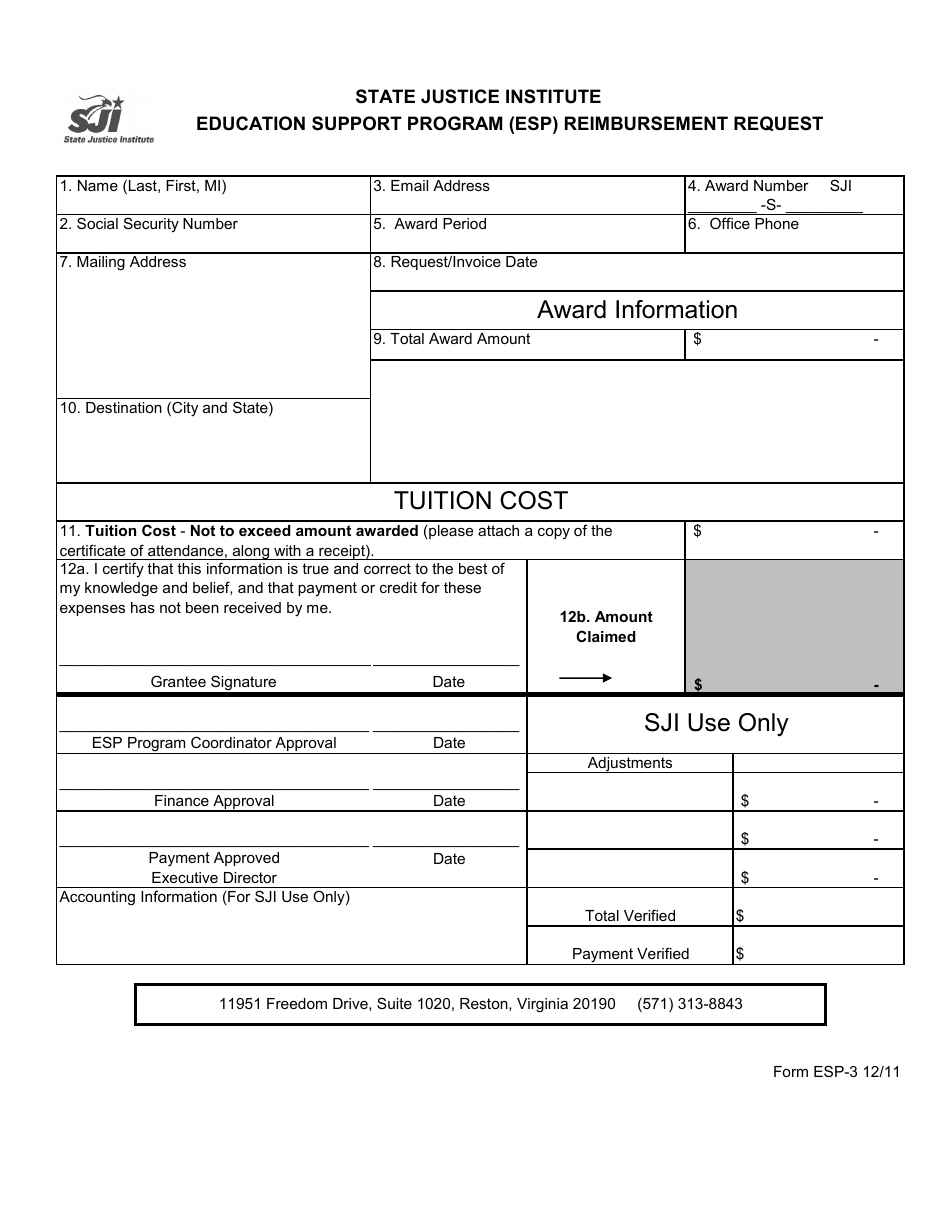

Form ESP3 Download Fillable PDF or Fill Online Education Support

Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Some of our standard services. Get answers to these five common questions about reporting espp. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web only if.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web what is irs form 3922? Web only.

A Quick Guide to Form 3922 YouTube

We tailor our solutions to fit your unique needs. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Nathan curtis cpa • october 20, 2010. I work with employee stock ownership plans, not employee stock purchase plans, but from my limited understanding..

Form 3922 Transfer Of Stock Acquired Through An Employee Stock

Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web stock purchases made through an espp during a calendar year must be reported by the company to you and the irs on form 3922 by january 31 of the following year. Hi, i purchased shares through.

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web certain information must be included in forms 3921 and/or 3922 (or substitute forms), including for espp transactions, the price per share of espp stock. I work with employee stock ownership plans, not employee stock purchase plans, but from my limited understanding. Web form.

IRS Form 3922

Web please find enclosed a form 3922, which provides certain information regarding your 2021 purchase of shares under the company’s employee stock purchase plan (espp). Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. We tailor our solutions to fit your unique.

Form 3922 Sample Transfer Of Stock Acquired Through An Employee Stock

Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. We tailor our solutions to fit your unique needs. Web irs form 3922 transfer of stock acquired.

Web Form 3922 Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C) Is For Informational Purposes Only And Isn't Entered Into Your Return.

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Hi, i purchased shares through espp and sold the shares as soon as they were available in 2022. Nathan curtis cpa • october 20, 2010.

Web What Is Irs Form 3922?

Web certain information must be included in forms 3921 and/or 3922 (or substitute forms), including for espp transactions, the price per share of espp stock. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Some of our standard services. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan.

Get Answers To These Five Common Questions About Reporting Espp.

Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web the espp, known as employee stock purchase plan, is a program that is run by the company that employees can purchase the shares of the company at a set price. I work with employee stock ownership plans, not employee stock purchase plans, but from my limited understanding. Web stock purchases made through an espp during a calendar year must be reported by the company to you and the irs on form 3922 by january 31 of the following year.

Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C) Copy A.

We tailor our solutions to fit your unique needs. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web please find enclosed a form 3922, which provides certain information regarding your 2021 purchase of shares under the company’s employee stock purchase plan (espp). Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your.