Expense Form Pdf

Expense Form Pdf - Pdf (portable document format) is a file format that captures all the. Employees file this form to deduct. Whether you’re a business owner or head of hr, keep. Web a expense form is a pdf form that can be filled out, edited or modified by anyone online. January 1, 2019] income and expense declaration. Web user enters expense claim via a form which collects all the relevant data and a copy of the receipt. 27 free expense report forms; Web here are six samples of employee expense reports that you can utilize as references when you are creating an employee expense report for your business trip. Web blank expense report 2022: Web 29 expense report forms in pdf;

Web a expense form is a pdf form that can be filled out, edited or modified by anyone online. Employees file this form to deduct. Web blank expense report 2022: Web up to 30% cash back this expense report template is available as an excel workbook, a word document, or a pdf. Pdf (portable document format) is a file format that captures all the. 21 expense report forms in word; Whether you’re a business owner or head of hr, keep. The irs will process your order for forms and publications as. Web foreign source taxable income is foreign source gross income less allocable expenses. Run chart excel profit loss statement excel business flyer word business expense.

21 expense report forms in word; January 1, 2019] income and expense declaration. Getapp has the tools you need to stay ahead of the competition. 27 free expense report forms; Ad sap® concur® software offers an easier solution for expense reporting. Web a expense form is a pdf form that can be filled out, edited or modified by anyone online. Web description this reimbursement form was designed to allow employees to request reimbursement for general business expenses. Web user enters expense claim via a form which collects all the relevant data and a copy of the receipt. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Web foreign source taxable income is foreign source gross income less allocable expenses.

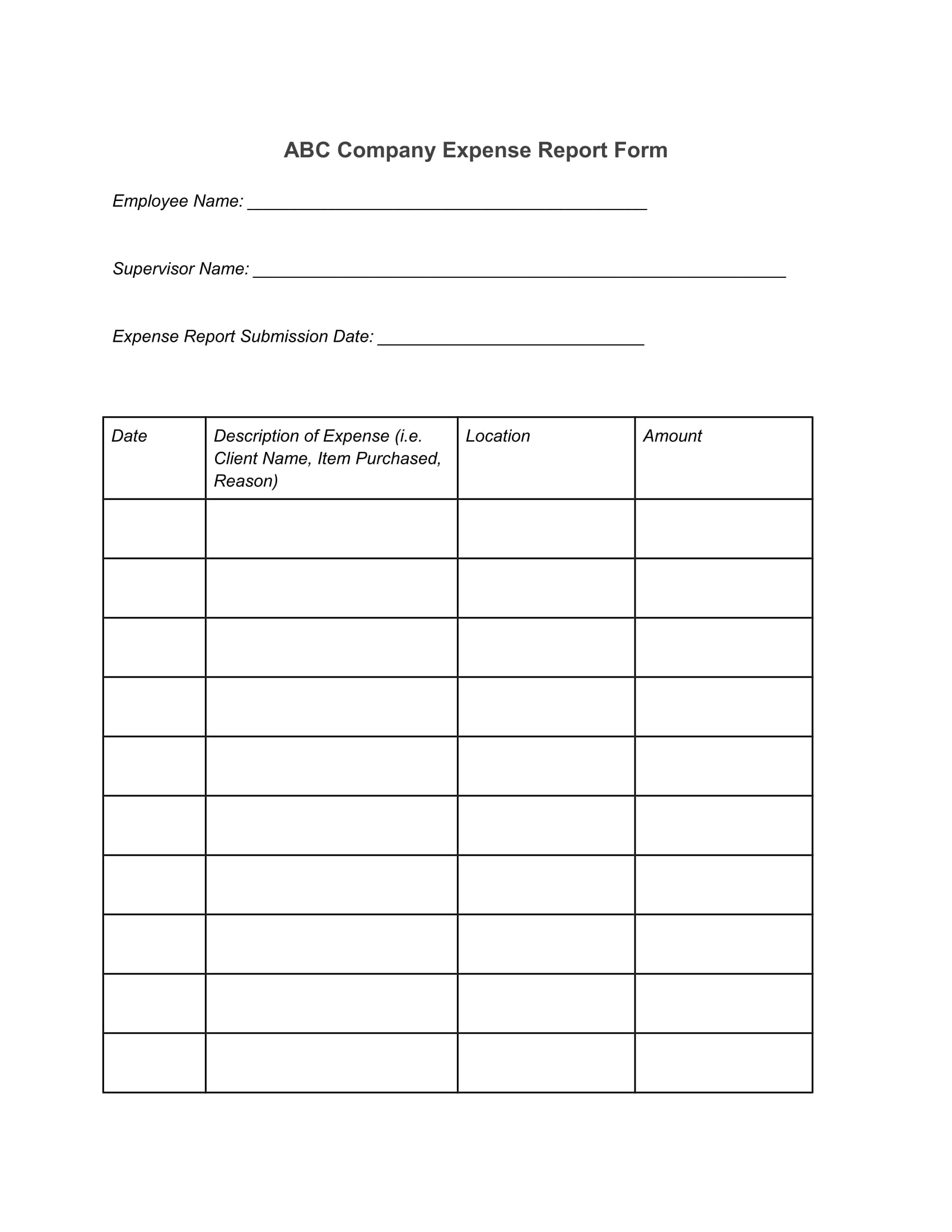

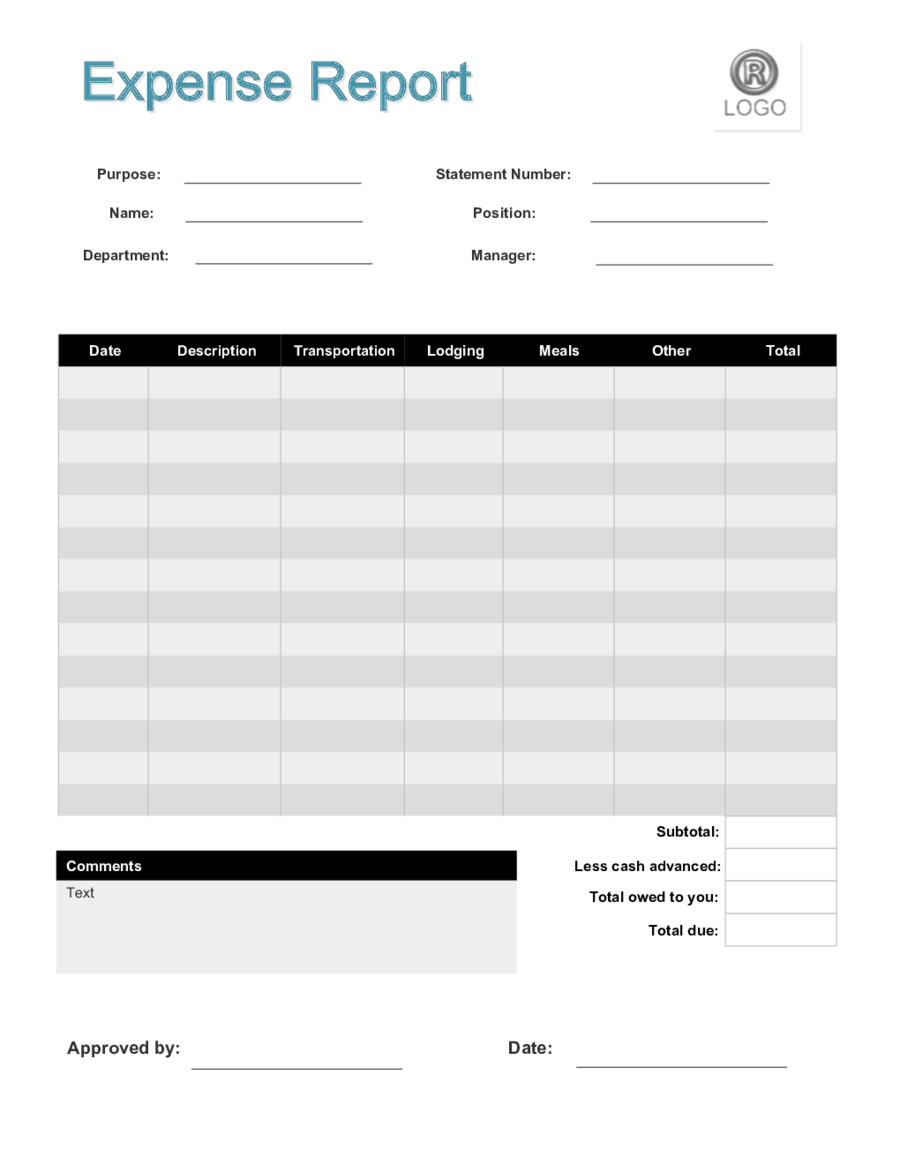

Free Expense Report Form Pdf Template Business

Employees file this form to deduct. Web description this reimbursement form was designed to allow employees to request reimbursement for general business expenses. Web a expense form is a pdf form that can be filled out, edited or modified by anyone online. 21+ sample expense report forms; Web up to 30% cash back this expense report template is available as.

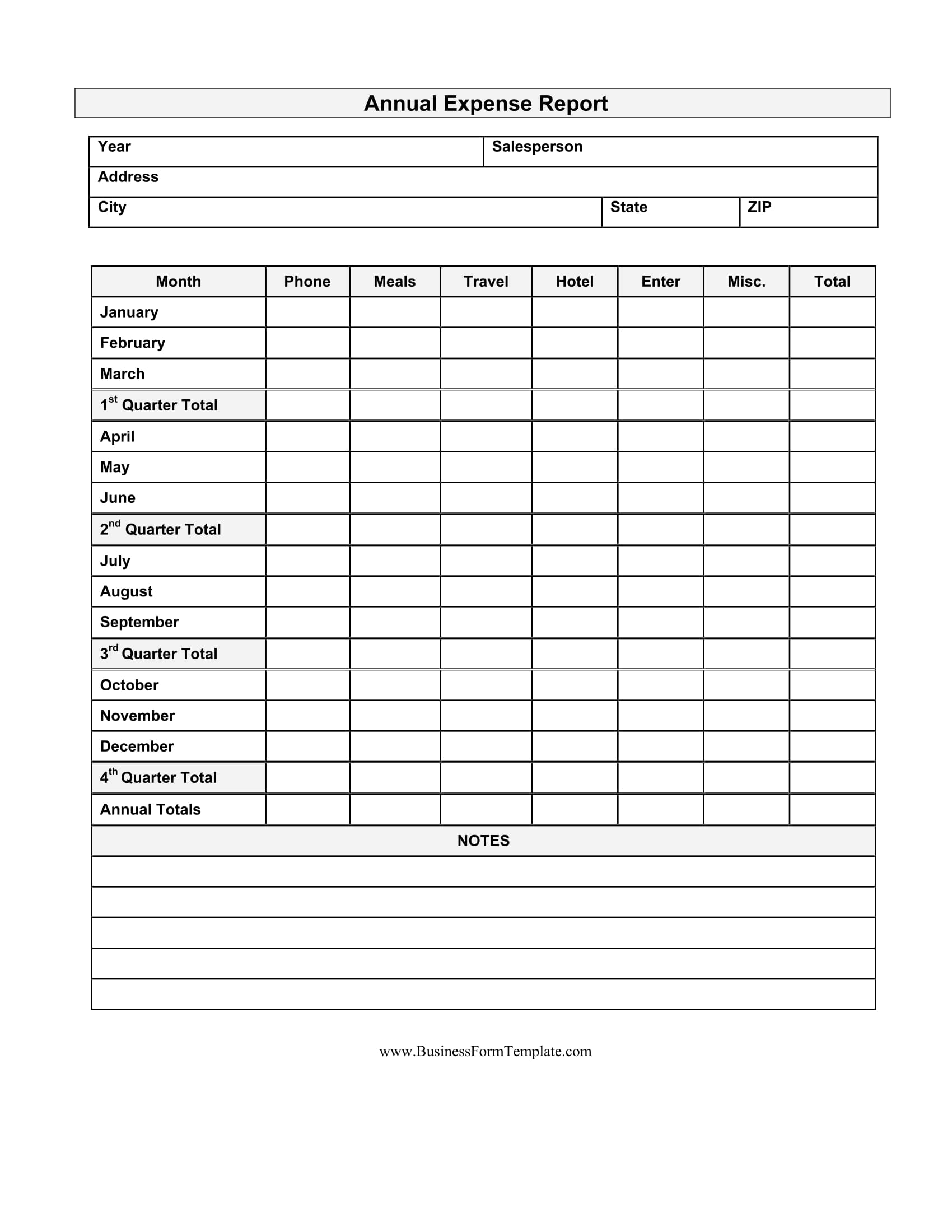

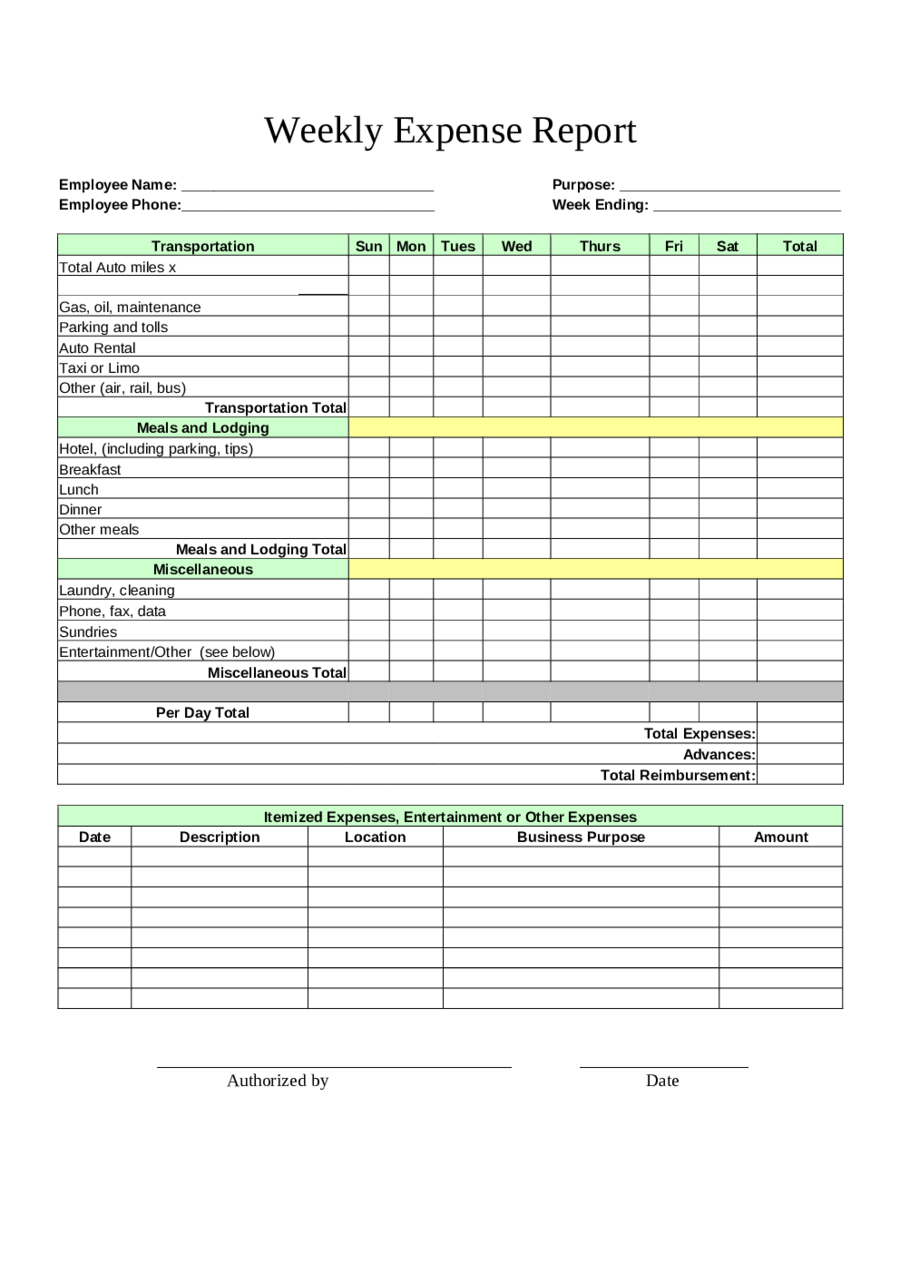

FREE 13+ Expense Report Forms in MS Word PDF Excel

The irs will process your order for forms and publications as. Web here are six samples of employee expense reports that you can utilize as references when you are creating an employee expense report for your business trip. Getapp has the tools you need to stay ahead of the competition. Web foreign source taxable income is foreign source gross income.

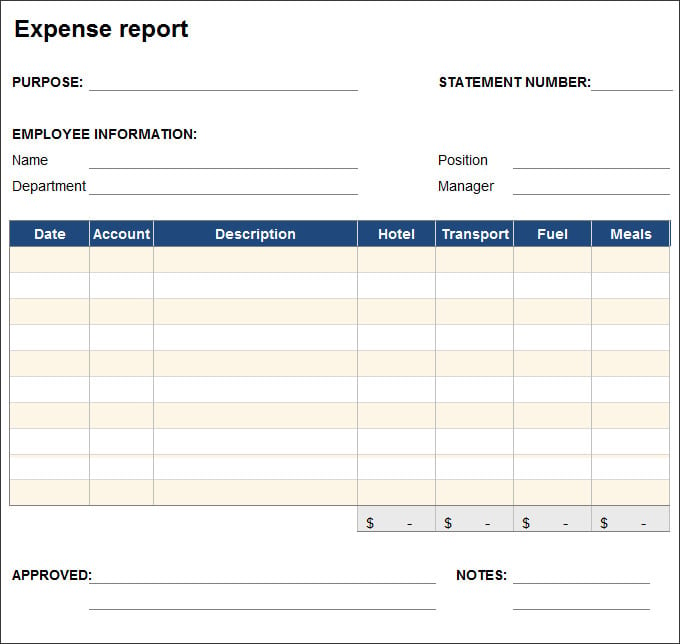

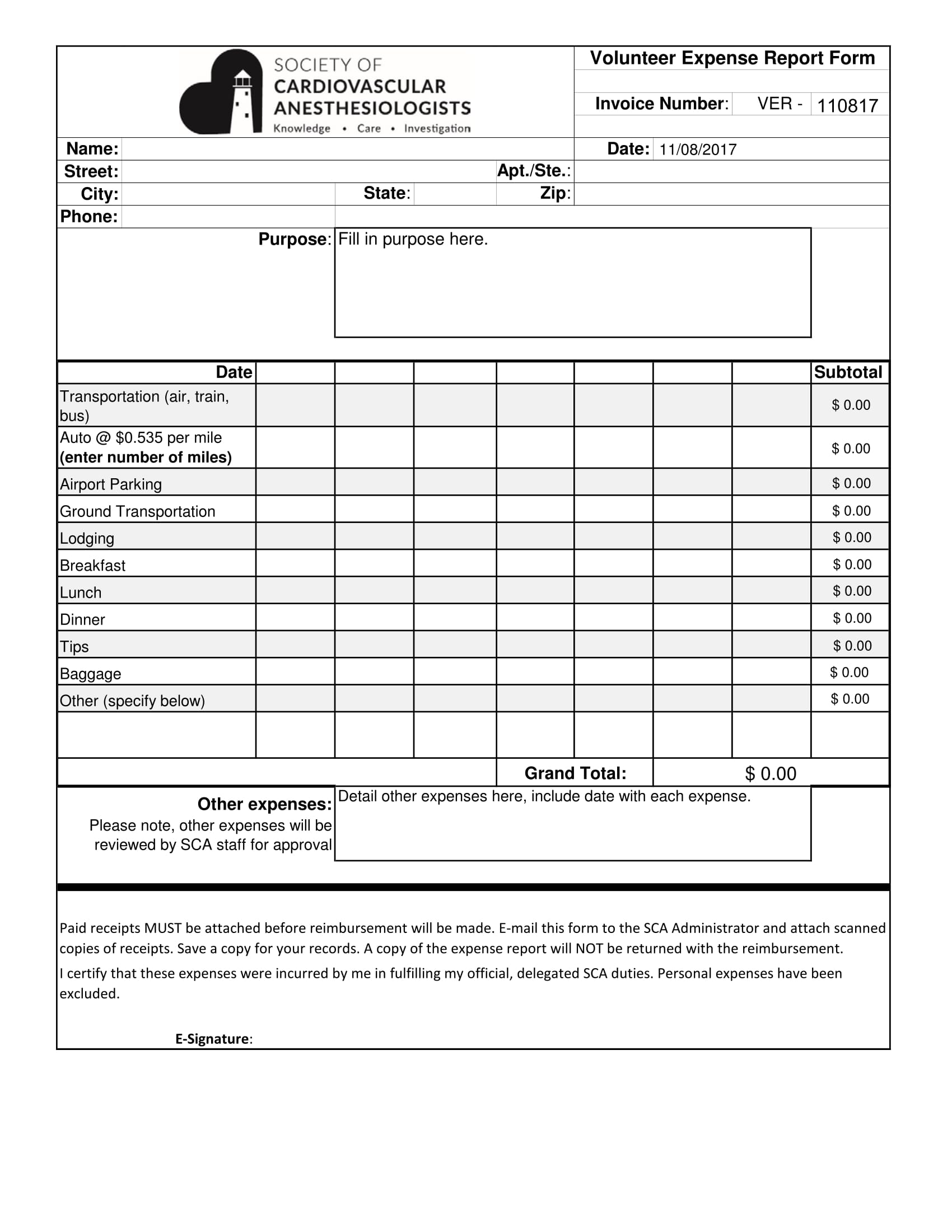

FREE 13+ Expense Report Forms in MS Word PDF Excel

Form data is sent to two managers via teams who. Getapp has the tools you need to stay ahead of the competition. Web here are six samples of employee expense reports that you can utilize as references when you are creating an employee expense report for your business trip. Ad sap® concur® software offers an easier solution for expense reporting..

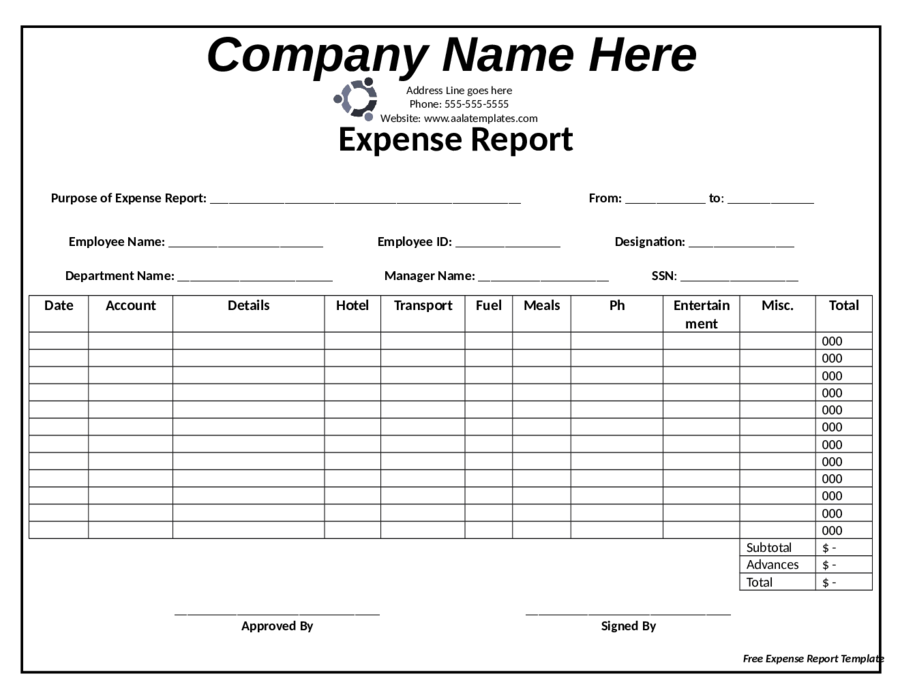

24+ Expense Form Template Excel Templates

Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Begin by completing the information in the upper left corner of the report. Web excel | adobe pdf | google sheets this daily expense report template is perfect for small business owners and employees to track expenditures. Web up to 30%.

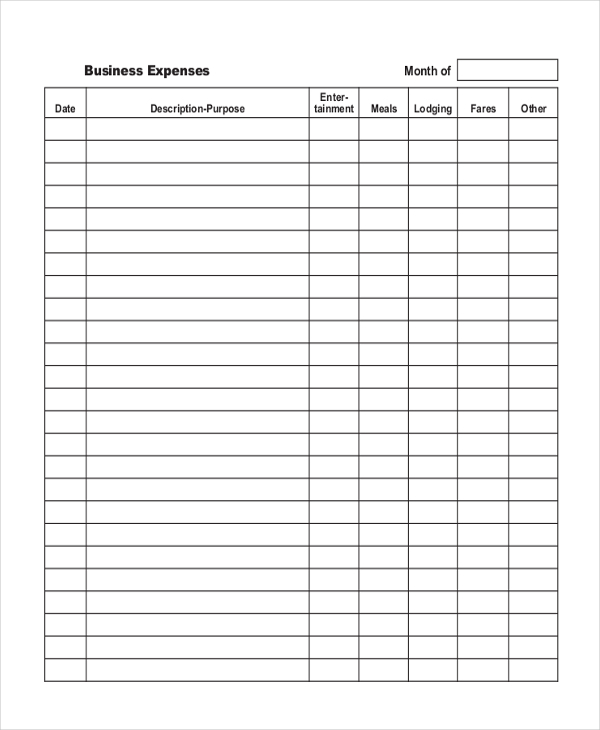

FREE 11+ Sample Business Expense Forms in PDF Excel Word

Run chart excel profit loss statement excel business flyer word business expense. Form data is sent to two managers via teams who. Pdf (portable document format) is a file format that captures all the. The irs will process your order for forms and publications as. Also, use the worksheet to plan for next month’s budget.

2022 Expense Report Form Fillable, Printable PDF & Forms Handypdf

Employees file this form to deduct. Web blank expense report 2022: Also, use the worksheet to plan for next month’s budget. Whether you’re a business owner or head of hr, keep. Web 29 expense report forms in pdf;

FREE 13+ Sample Expense Sheet Templates in PDF

Pdf (portable document format) is a file format that captures all the. Web 29 expense report forms in pdf; Also, use the worksheet to plan for next month’s budget. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Whether you’re a business owner or head of hr, keep.

Free Expense Report Form New Edit, Fill, Sign Online Handypdf

Employees file this form to deduct. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Form data is sent to two managers via teams who. Web excel | adobe pdf | google sheets this daily expense report template is perfect for small business owners and employees to track expenditures. The.

FREE 13+ Expense Report Forms in MS Word PDF Excel

Web here are six samples of employee expense reports that you can utilize as references when you are creating an employee expense report for your business trip. 27 free expense report forms; Web blank expense report 2022: Web up to 30% cash back this expense report template is available as an excel workbook, a word document, or a pdf. Employees.

20+ Business Expense Reports Sample Templates

Web use this worksheet to see how much money you spend this month. Web 29 expense report forms in pdf; Web a expense form is a pdf form that can be filled out, edited or modified by anyone online. Web excel | adobe pdf | google sheets this daily expense report template is perfect for small business owners and employees.

Whether You’re A Business Owner Or Head Of Hr, Keep.

27 free expense report forms; Getapp has the tools you need to stay ahead of the competition. Web description this reimbursement form was designed to allow employees to request reimbursement for general business expenses. Also, use the worksheet to plan for next month’s budget.

Form Data Is Sent To Two Managers Via Teams Who.

21 expense report forms in word; Web foreign source taxable income is foreign source gross income less allocable expenses. Ad sap® concur® software offers an easier solution for expense reporting. Employees file this form to deduct.

Web A Expense Form Is A Pdf Form That Can Be Filled Out, Edited Or Modified By Anyone Online.

Web blank expense report 2022: Web here are six samples of employee expense reports that you can utilize as references when you are creating an employee expense report for your business trip. The irs will process your order for forms and publications as. Web 29 expense report forms in pdf;

Begin By Completing The Information In The Upper Left Corner Of The Report.

Getapp has the tools you need to stay ahead of the competition. An expense report form is used to report the business expenses of employees within a company. Web up to 30% cash back this expense report template is available as an excel workbook, a word document, or a pdf. 21+ sample expense report forms;