Fake 1098 T Form

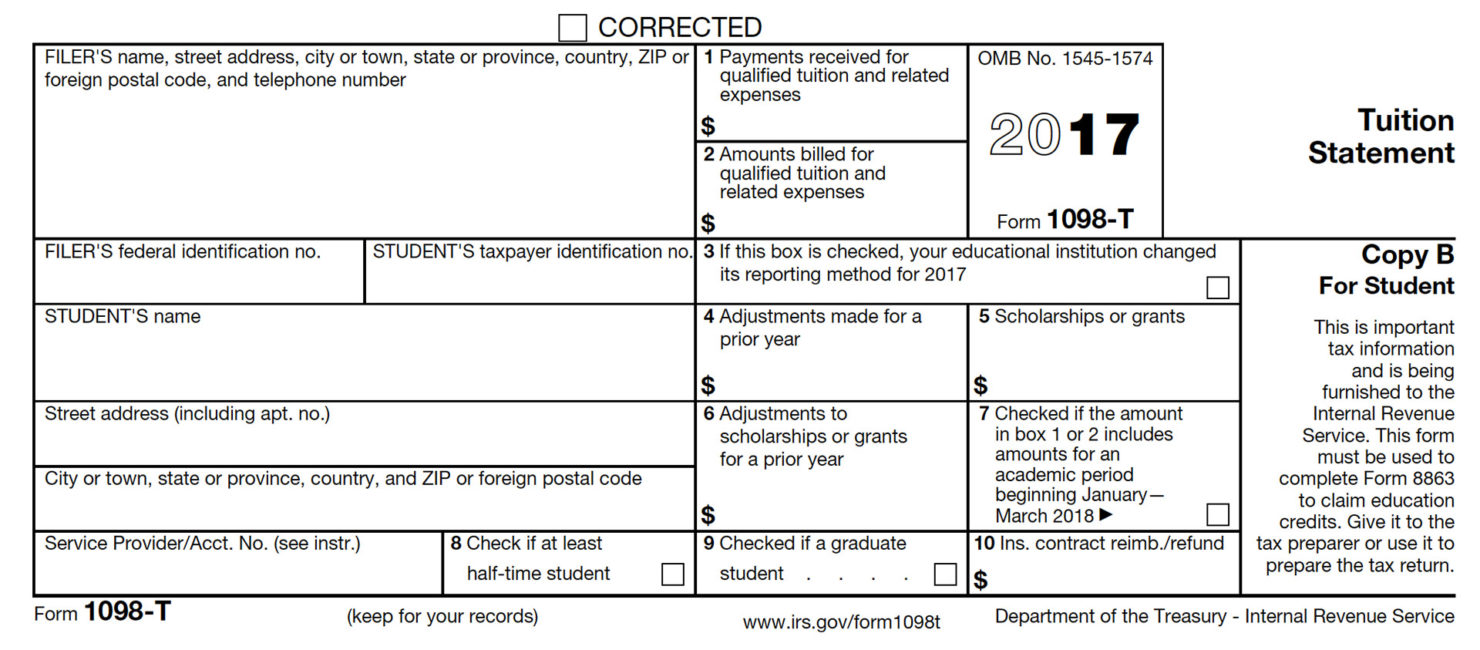

Fake 1098 T Form - In the program, you are allowed to make an adjustment under box 1. It is important to enter the actual amount of tuition expenses you paid. The institution has to report a form for every student that is currently enrolled and paying. This copy goes directly from the eligible educational institution to the irs. And tuition and scholarship information. If you land on your education expenses summary: Higher education emergency relief fund and emergency financial aid grants under the. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Web here are the seven types of 1098 forms and a brief description of what they’re for. What are these forms used for when filing your taxes?

You must file for each student you enroll and for whom a reportable transaction is made. And tuition and scholarship information. Web insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. The institution has to report a form for every student that is currently enrolled and paying. Higher education emergency relief fund and emergency financial aid grants under the. The educational institution generates this form and mails it to the students by january 31. Web here are the seven types of 1098 forms and a brief description of what they’re for. Therefore, if the total aid you received during the calendar year (reportable in box 5) exceeds the qualified tuition and related expenses (qtre) paid during the same calendar year,. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related expenses to you.

Contributions of motor vehicles, boats, or airplanes; This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related expenses to you. Contract reimb./refund this is important tax information and is being furnished to the irs. And tuition and scholarship information. Retain this statement for your records. Web instructions for student you, or the person who can claim you as a dependent, may be able to claim an education credit on form 1040. I photoshopped a fake one intending to retrieve it before he sent them in, but it looks like he got impatient and sent my paperwork in with the fake form included. This statement is required to support any claim for an education credit. You must file for each student you enroll and for whom a reportable transaction is made. It documents qualified tuition, fees, and other related course materials.

Claim your Educational Tax Refund with IRS Form 1098T

Contributions of motor vehicles, boats, or airplanes; Therefore, if the total aid you received during the calendar year (reportable in box 5) exceeds the qualified tuition and related expenses (qtre) paid during the same calendar year,. And tuition and scholarship information. Web here are the seven types of 1098 forms and a brief description of what they’re for. You can.

1098 T Calendar Year Month Calendar Printable

If you land on your education expenses summary: I photoshopped a fake one intending to retrieve it before he sent them in, but it looks like he got impatient and sent my paperwork in with the fake form included. It allows the irs to confirm information entered by students on their tax returns against this information. The information on the.

Irs Form 1098 T Box 4 Universal Network

I photoshopped a fake one intending to retrieve it before he sent them in, but it looks like he got impatient and sent my paperwork in with the fake form included. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition.

1098 T Calendar Year Month Calendar Printable

It documents qualified tuition, fees, and other related course materials. Higher education emergency relief fund and emergency financial aid grants under the. This statement is required to support any claim for an education credit. Web insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses. Web this statement has been.

Form 1098T Information Student Portal

It is important to enter the actual amount of tuition expenses you paid. The institution has to report a form for every student that is currently enrolled and paying. Contributions of motor vehicles, boats, or airplanes; There are two education credits (discussed below) that can be worth thousands of dollars. In particular, they cover mortgage interest payments;

1098 T Form Printable Blank PDF Online

Web instructions for student you, or the person who can claim you as a dependent, may be able to claim an education credit on form 1040. Web insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related expenses. Retain this statement for your records. What are these forms used for when.

Form 1098T Everything you need to know Go TJC

You can complete these copies online for furnishing statements to recipients and for retaining in your own files. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related expenses to you. It allows the irs to confirm information entered.

Form 1098T, Tuition Statement, Student Copy B

What are these forms used for when filing your taxes? It is important to enter the actual amount of tuition expenses you paid. It allows the irs to confirm information entered by students on their tax returns against this information. Higher education emergency relief fund and emergency financial aid grants under the. And tuition and scholarship information.

Form 1098T Federal Copy A Mines Press

Form 1098 (mortgage interest statement) — if you paid at least $600 in mortgage interest, your mortgage company is required to provide you with this form, which may help you deduct mortgage interest. Contributions of motor vehicles, boats, or airplanes; In the program, you are allowed to make an adjustment under box 1. Web instructions for student you, or the.

IRS Form 1098T Tuition Statement

Higher education emergency relief fund and emergency financial aid grants under the. This copy goes directly from the eligible educational institution to the irs. You should report the actual amount of tuition you paid in 2020. If you land on your education expenses summary: In particular, they cover mortgage interest payments;

Form 1098 (Mortgage Interest Statement) — If You Paid At Least $600 In Mortgage Interest, Your Mortgage Company Is Required To Provide You With This Form, Which May Help You Deduct Mortgage Interest.

This copy goes directly from the eligible educational institution to the irs. Web instructions for student you, or the person who can claim you as a dependent, may be able to claim an education credit on form 1040. The educational institution generates this form and mails it to the students by january 31. This statement is required to support any claim for an education credit.

Web This Statement Has Been Furnished To You By An Eligible Educational Institution In Which You Are Enrolled, Or By An Insurer Who Makes Reimbursements Or Refunds Of Qualified Tuition And Related Expenses To You.

This form must be used to complete form 8863 to claim education credits. Contributions of motor vehicles, boats, or airplanes; In particular, they cover mortgage interest payments; The information on the form is required to be reported and needed for you to claim education credits or tuition and fees deduction on your tax return.

And Tuition And Scholarship Information.

You can complete these copies online for furnishing statements to recipients and for retaining in your own files. This statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition and related expenses to you. Contract reimb./refund this is important tax information and is being furnished to the irs. You must file for each student you enroll and for whom a reportable transaction is made.

I Photoshopped A Fake One Intending To Retrieve It Before He Sent Them In, But It Looks Like He Got Impatient And Sent My Paperwork In With The Fake Form Included.

Web here are the seven types of 1098 forms and a brief description of what they’re for. It is important to enter the actual amount of tuition expenses you paid. It documents qualified tuition, fees, and other related course materials. There are two education credits (discussed below) that can be worth thousands of dollars.