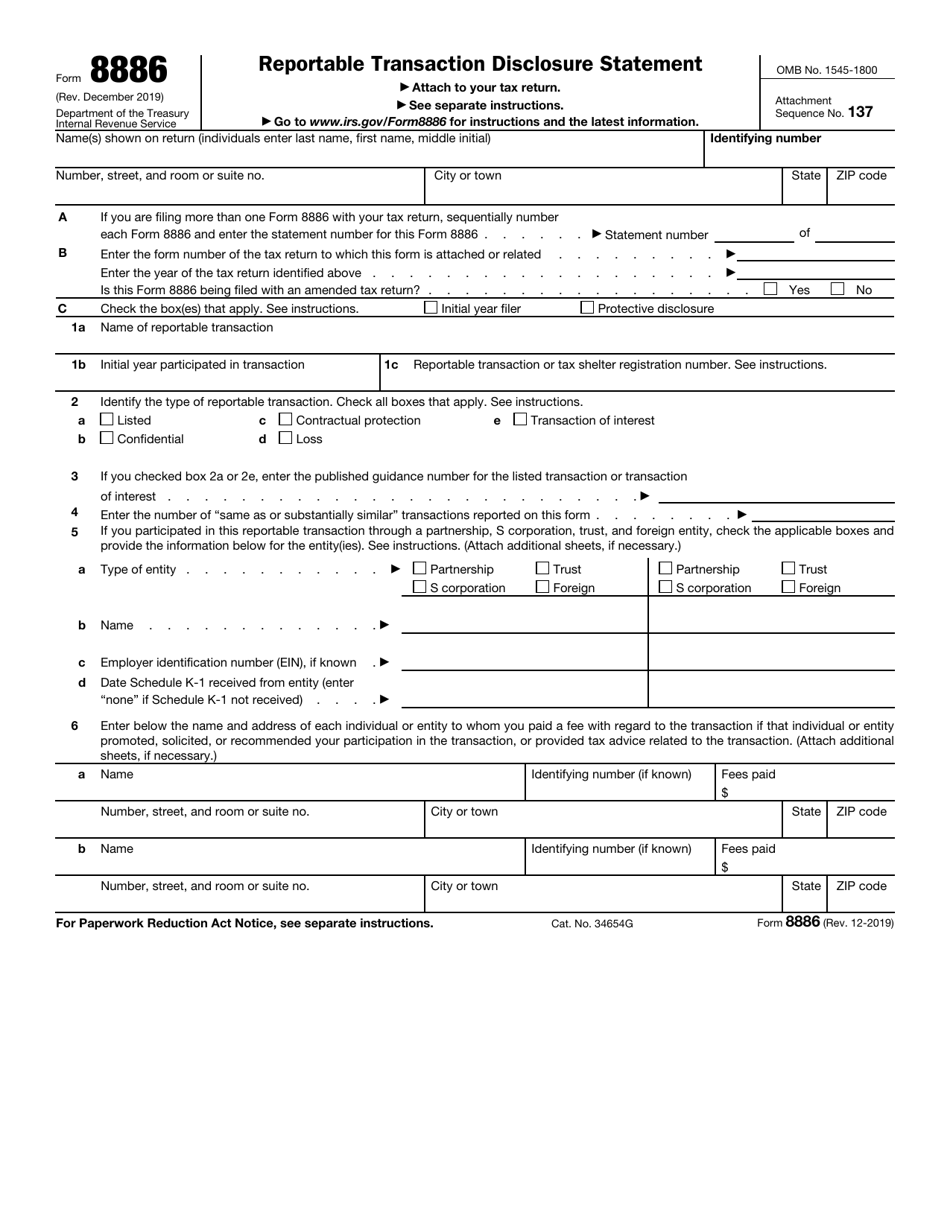

Federal Form 8886

Federal Form 8886 - The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. A reportable transaction is generally a transaction of a type that the irs has determined as having a potential for tax avoidance or evasion. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. Web to file a federal tax return or information return must file form 8886. December 2019) department of the treasury internal revenue service. Web if you claim a deduction, credit, or other tax benefit related to a reportable transaction and are required to submit federal form 8886, reportable transaction disclosure statement. If this is the first time the. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the partnership has claimed or reported income from, or a deduction,. Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules.

The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. Name, address, ssn, and residency; A reportable transaction is generally a transaction of a type that the irs has determined as having a potential for tax avoidance or evasion. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web federal form 8886, reportable transaction disclosure statement, must be attached to any return on which the partnership has claimed or reported income from, or a deduction,. When it comes to international tax planning and avo. Attach to your tax return. Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. December 2019) department of the treasury internal revenue service. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation.

Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. If this is the first time the. Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. State tax refund included on federal return; Attach to your tax return. Web if you were required to file form 8886 (or a similar form prescribed by the irs) with your federal income tax return and did not include the form in the supporting. December 2019) department of the treasury internal revenue service. When it comes to international tax planning and avo.

IRS Form 8886 Download Fillable PDF or Fill Online Reportable

Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. When it comes to international tax planning and avo. December 2019) department of the treasury internal revenue.

Form CT8886 Download Printable PDF or Fill Online Connecticut Listed

Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. The instructions to form 8886 (available at irs.gov) provide a specific explanation of what. Web to file a federal tax return or information return must file form 8886. Web we last updated the reportable transaction disclosure statement in february.

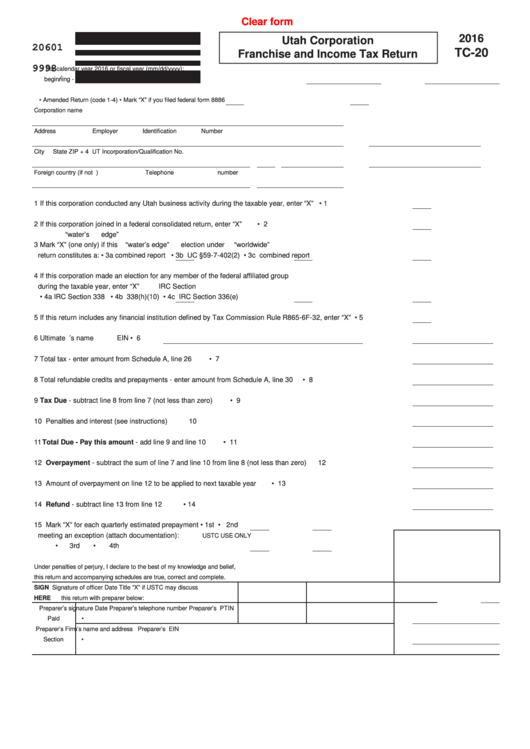

Fillable Form Tc20 Utah Corporation Franchise And Tax Return

Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. December 2019) department of the treasury internal revenue service. Web if you were required.

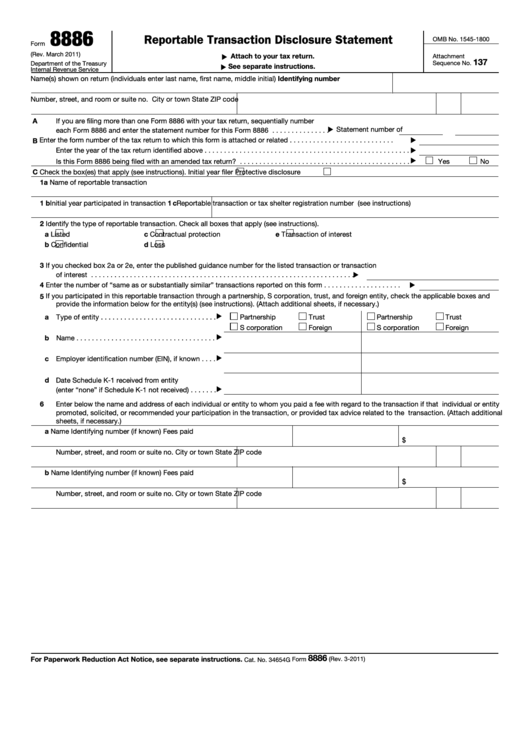

Form 8886 Reportable Transaction Disclosure Statement (2011) Free

Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. Web federal form 8886 is required to be attached to any return.

Fillable Form 8886 Reportable Transaction Disclosure Statement

Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. Web federal form 8886 is.

Form 8886 Reportable Transaction Disclosure Statement (2011) Free

When it comes to international tax planning and avo. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation. If this is the first time the. Web if you were required to file form 8886 (or.

Form 1116 part 1 instructions

Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. When it comes to international tax planning and avo. Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. State tax refund included on federal return; A.

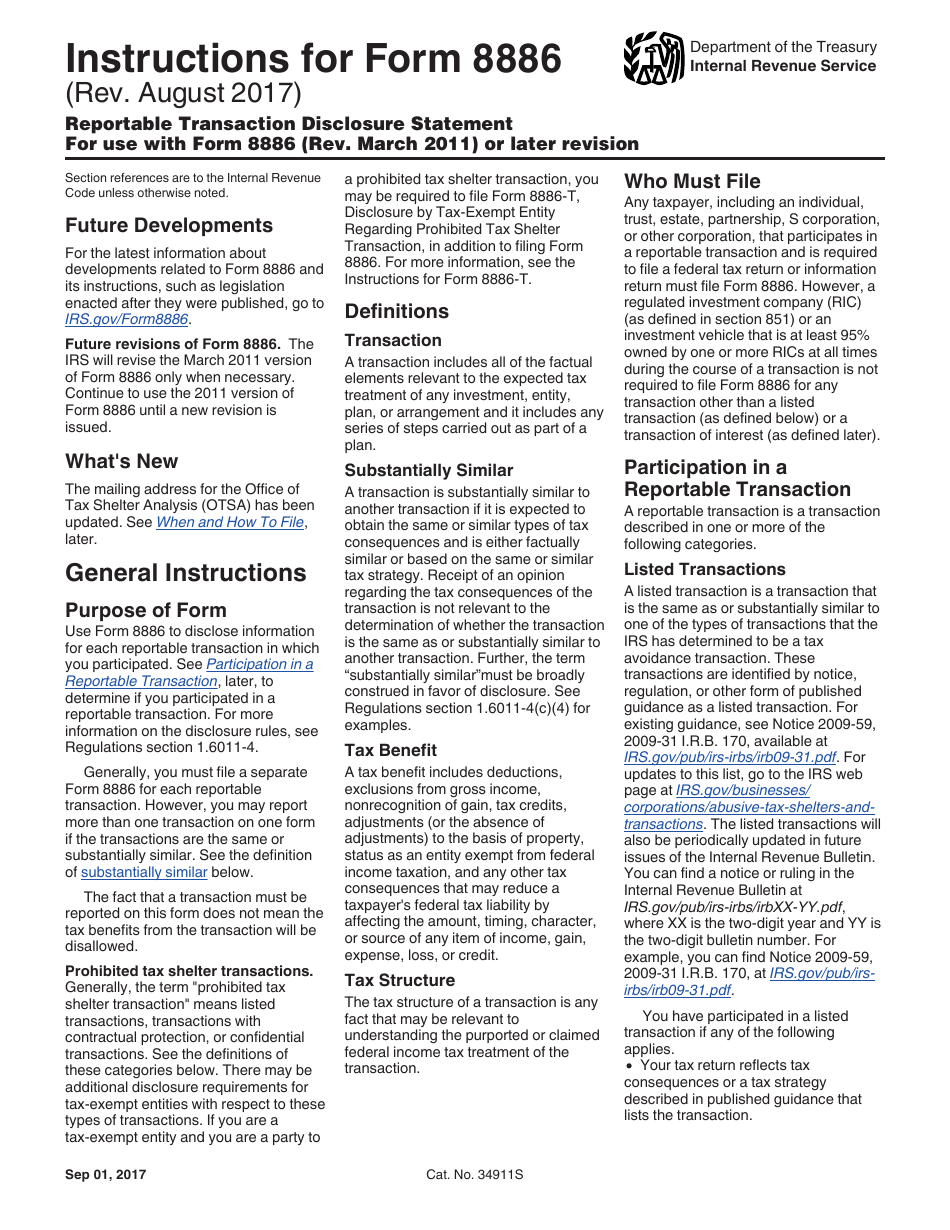

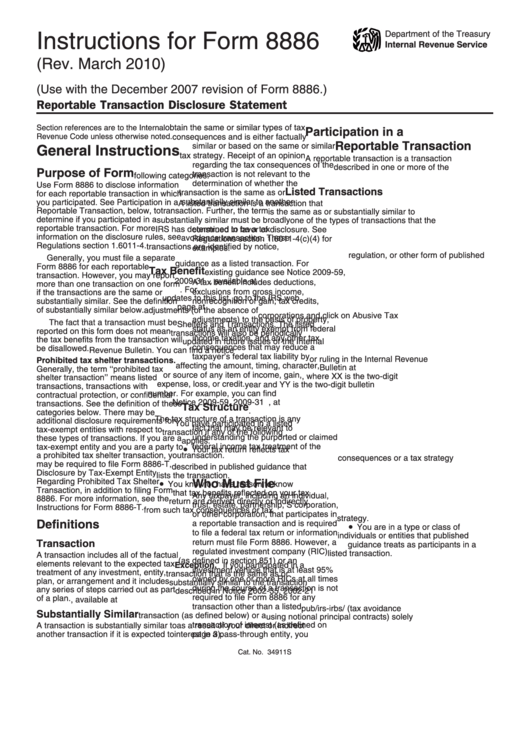

Download Instructions for IRS Form 8886 Reportable Transaction

However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at. Web if you claim a deduction, credit, or other tax benefit related to a reportable transaction and are required to submit federal form 8886, reportable transaction disclosure statement. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that.

Instructions For Form 8886 Reportable Transaction Disclosure

Web to file a federal tax return or information return must file form 8886. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022. State tax refund included on federal return; When it comes to international tax planning and avo. Web form ct‑8886,.

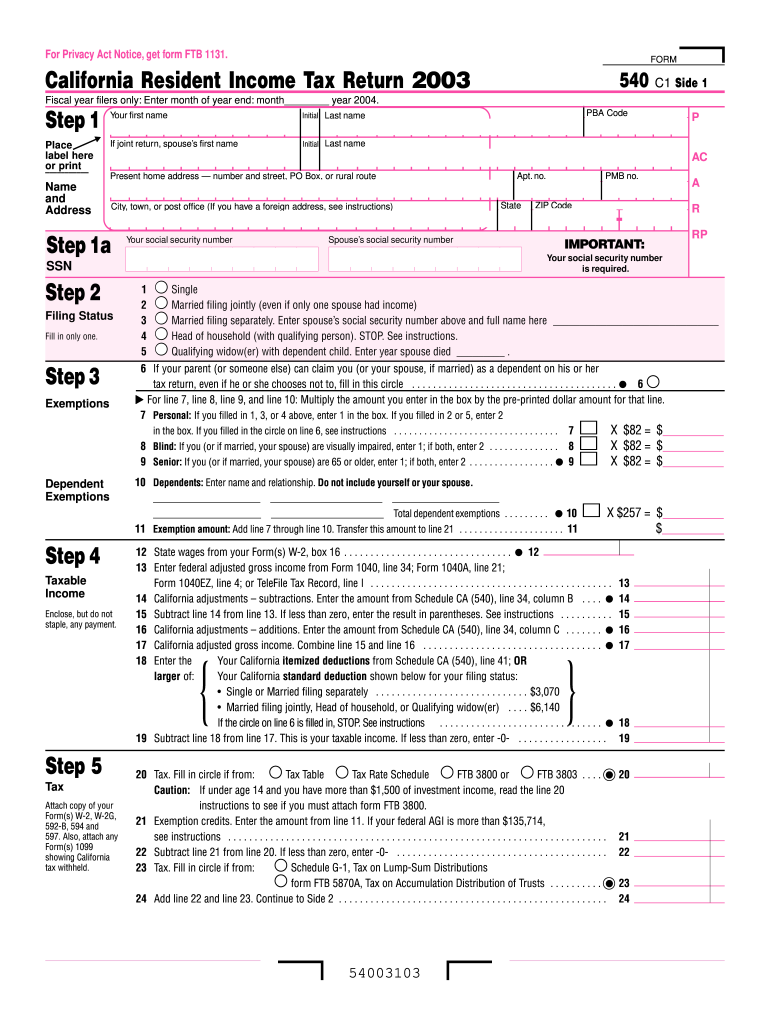

2003 Form CA FTB 540 Fill Online, Printable, Fillable, Blank PDFfiller

Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule. Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation. Web federal form 8886, reportable.

Web If You Were Required To File Form 8886 (Or A Similar Form Prescribed By The Irs) With Your Federal Income Tax Return And Did Not Include The Form In The Supporting.

Web attach federal form 8886, reportable transaction disclosure statement, to the back of the california return along with any other supporting schedules. December 2019) department of the treasury internal revenue service. Web to file a federal tax return or information return must file form 8886. Web we last updated the reportable transaction disclosure statement in february 2023, so this is the latest version of form 8886, fully updated for tax year 2022.

Attach To Your Tax Return.

Web federal form 8886 is required to be attached to any return on which a deduction, loss, credit, or any other tax benefit is claimed or is reported, or any income the s corporation. Name, address, ssn, and residency; A reportable transaction is generally a transaction of a type that the irs has determined as having a potential for tax avoidance or evasion. Web form ct‑8886, along with federal form 8886, reportable transaction disclosure statement, including all supplemental statements and any required federal schedule.

Web Federal Form 8886, Reportable Transaction Disclosure Statement, Must Be Attached To Any Return On Which The Partnership Has Claimed Or Reported Income From, Or A Deduction,.

State tax refund included on federal return; Web 3671223 form 568 2022 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. When it comes to international tax planning and avo. If this is the first time the.

Web If You Claim A Deduction, Credit, Or Other Tax Benefit Related To A Reportable Transaction And Are Required To Submit Federal Form 8886, Reportable Transaction Disclosure Statement.

Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. Web the instructions to form 8886, reportable transaction disclosure statement. Any taxpayer, including an individual, trust, estate, partnership, s corporation, or other corporation, that participates in a reportable transaction and is. However, a regulated investment company (ric) (as defined in section 851) or an investment vehicle that is at.