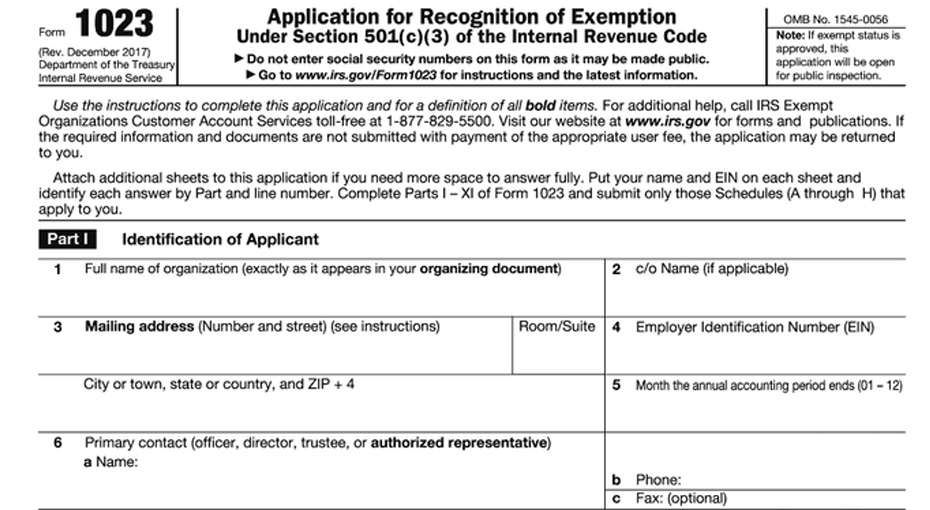

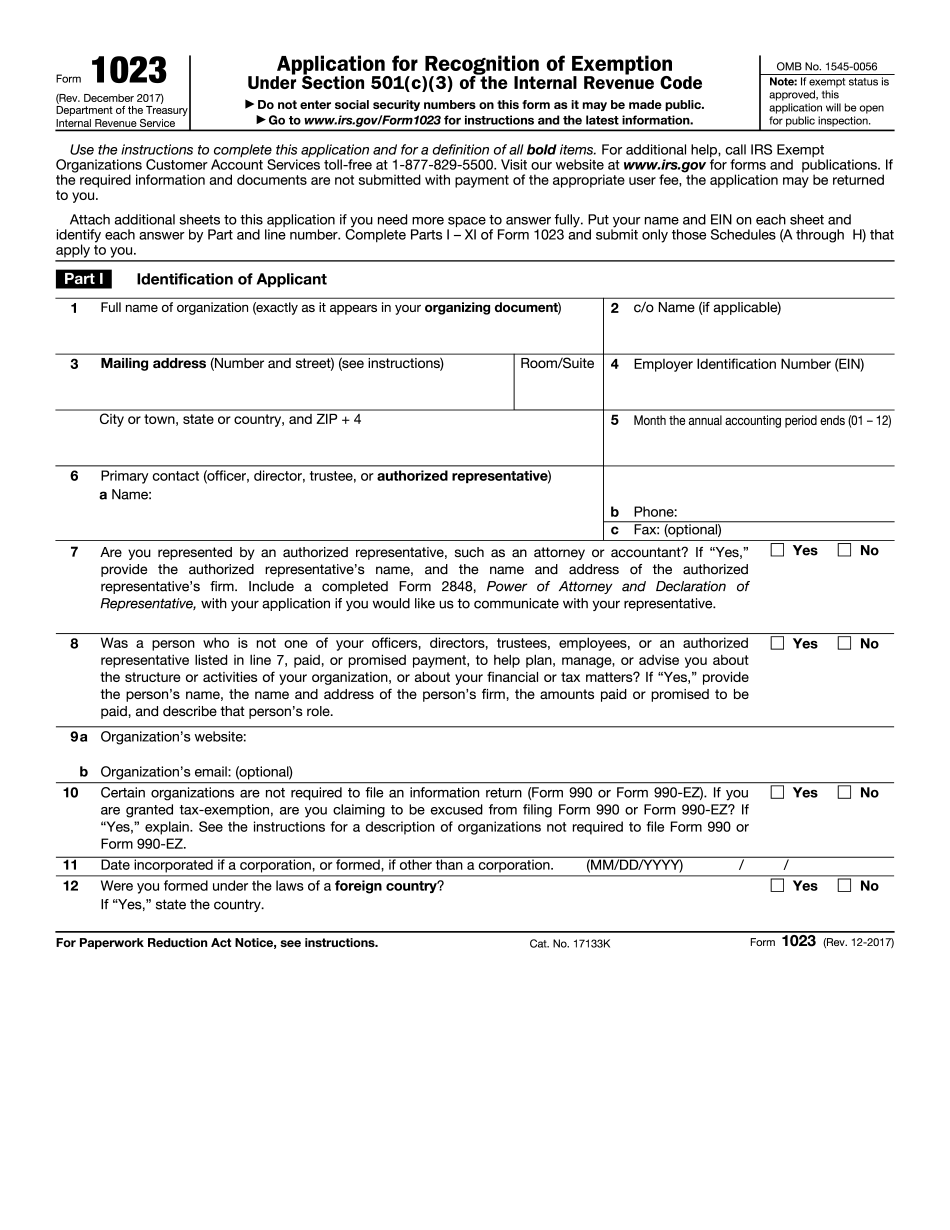

File Form 1023

File Form 1023 - Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Web form 1023 is used to apply for recognition as a tax exempt organization. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Go to www.irs.gov/form1023 for additional filing information. Republicans, though, have seized on the unverified material as part of their. About form 1023, application for recognition of exemption under section 501(c)(3) of the internal revenue code Reinstatement of 501c3 exemption status; December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Form 1023 part x, signature and upload;

Web form 1023 part ix, 990 filing requirements; Web form 1023 is filed electronically only on pay.gov. You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end of the application. About form 1023, application for recognition of exemption under section 501(c)(3) of the internal revenue code Irs form 1023 application review; Form 1023 part x, signature and upload; Expediting the irs form 1023 application; Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts. December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code

Reinstatement of 501c3 exemption status; Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Web form 1023 part ix, 990 filing requirements; December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Republicans, though, have seized on the unverified material as part of their. Web what kinds of organizations can file form 1023? Expediting the irs form 1023 application; Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Irs form 1023 application review;

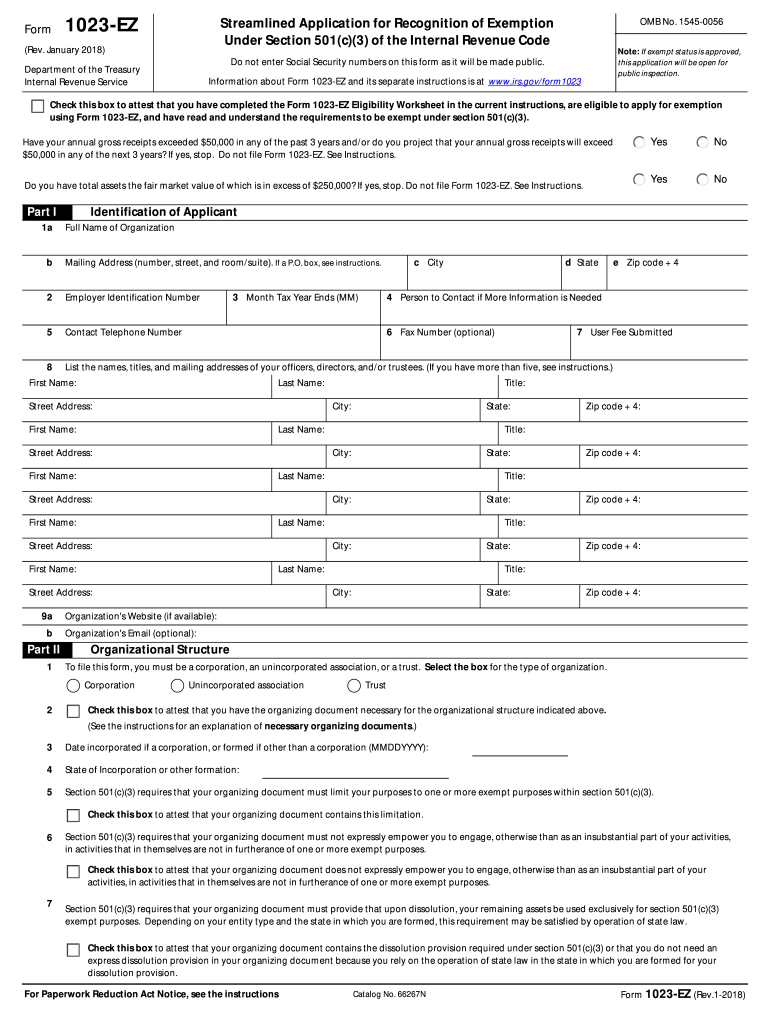

How to Fill Out Form 1023 & Form 1023EZ for Nonprofits Step by Step

December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Reinstatement of 501c3 exemption status; Web form 1023 part ix, 990 filing requirements; Web form 1023 is used to apply for recognition as a tax exempt organization. Go to www.irs.gov/form1023 for additional filing information.

Tips on filing the IRS Form 1023

Go to www.irs.gov/form1023 for additional filing information. Expediting the irs form 1023 application; You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end of the application. December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Web form 1023 is.

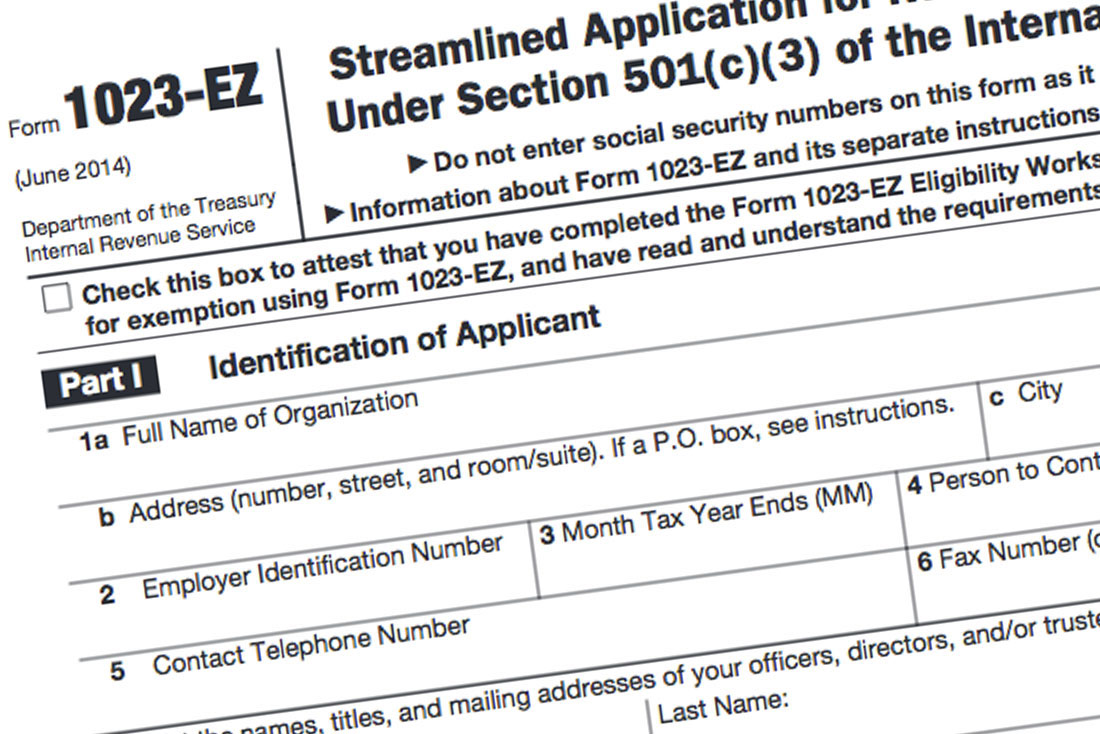

What Is Form 1023EZ? Foundation Group®

Go to www.irs.gov/form1023 for additional filing information. Reinstatement of 501c3 exemption status; Web form 1023 is used to apply for recognition as a tax exempt organization. Irs form 1023 application review; Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3).

1023 ez form Fill out & sign online DocHub

Irs form 1023 application review; Web form 1023 part ix, 990 filing requirements; How you can make a difference Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Web form 1023 is used to apply for recognition as a tax exempt organization.

Form 1023 and Form 1023EZ FAQs Wegner CPAs

Web how can i get a copy of form 1023? Reinstatement of 501c3 exemption status; Expediting the irs form 1023 application; Web form 1023 part ix, 990 filing requirements; About form 1023, application for recognition of exemption under section 501(c)(3) of the internal revenue code

Form 1023 Tax Exempt Form 1023

Expediting the irs form 1023 application; Web what kinds of organizations can file form 1023? You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end of the application. Form 1023 part x, signature and upload; Organizations must electronically file this form to apply for recognition of exemption from federal income tax under.

How to File Form 1023EZ 501c3 Application TRUiC

Reinstatement of 501c3 exemption status; Expediting the irs form 1023 application; Go to www.irs.gov/form1023 for additional filing information. Web form 1023 is used to apply for recognition as a tax exempt organization. About form 1023, application for recognition of exemption under section 501(c)(3) of the internal revenue code

Form 1023EZ Edit, Fill, Sign Online Handypdf

December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code About form 1023, application for recognition of exemption under section 501(c)(3) of the internal revenue code Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Organizations must electronically file.

ICANN Application for Tax Exemption (U.S.) Page 1

Web form 1023 is used to apply for recognition as a tax exempt organization. Form 1023 part x, signature and upload; Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Reinstatement of 501c3 exemption status; Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy.

2017 2019 IRS Form 1023 Fill Out Online PDF Template

Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Republicans, though, have seized on the unverified material as part of their. Expediting the irs form 1023 application; Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Go to www.irs.gov/form1023 for additional.

Reinstatement Of 501C3 Exemption Status;

Irs form 1023 application review; Expediting the irs form 1023 application; December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Republicans, though, have seized on the unverified material as part of their.

Web What Kinds Of Organizations Can File Form 1023?

Web form 1023 is used to apply for recognition as a tax exempt organization. Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Web form 1023 part ix, 990 filing requirements; Web form 1023 is filed electronically only on pay.gov.

Web The 1023 Form Memorializes Claims From An Fbi Informant, But It Doesn’t Provide Proof That The Allegations Are True.

Web how can i get a copy of form 1023? Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts. You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end of the application. About form 1023, application for recognition of exemption under section 501(c)(3) of the internal revenue code

Form 1023 Part X, Signature And Upload;

Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Go to www.irs.gov/form1023 for additional filing information. How you can make a difference