File Form 8832

File Form 8832 - Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Each person who is an owner of the business at the time of filing,. Who should file form 8832? Pursuant to the entity classification rules, a domestic entity that has. Web you can file irs form 8832 at any time. Upload, modify or create forms. According to your objectives, you can elect to have your llc taxed as a. Your new categorization cannot take effect. How to file the forms if you already have a business and want to change your business taxes, you may not have to create an entirely new business. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner.

Pursuant to the entity classification rules, a domestic entity that has. You might choose to file it at the same time you start your business, or you might decide to file at a later point. The filing date for form 8832 is within 75 days of the formation of your company. Each person who is an owner of the business at the time of filing,. Ad fill, sign, email irs 8832 & more fillable forms, try for free now! Web the filing date, on the other hand, is significant. Web you can file irs form 8832 at any time. How to file the forms if you already have a business and want to change your business taxes, you may not have to create an entirely new business. Who should file form 8832? Web to file form 8832, you must have an authorized signature from one or more of the following people:

When you file the form 8832, it will determine when your new tax iqq begins. Web what is irs form 8832? The filing date for form 8832 is within 75 days of the formation of your company. Who should file form 8832? Try it for free now! Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Ad fill, sign, email irs 8832 & more fillable forms, try for free now! Web updated july 8, 2020: December 2013) department of the treasury internal revenue service omb no. Web form 8832 an llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default.

What Is IRS Form 8832? Definition, Deadline, & More

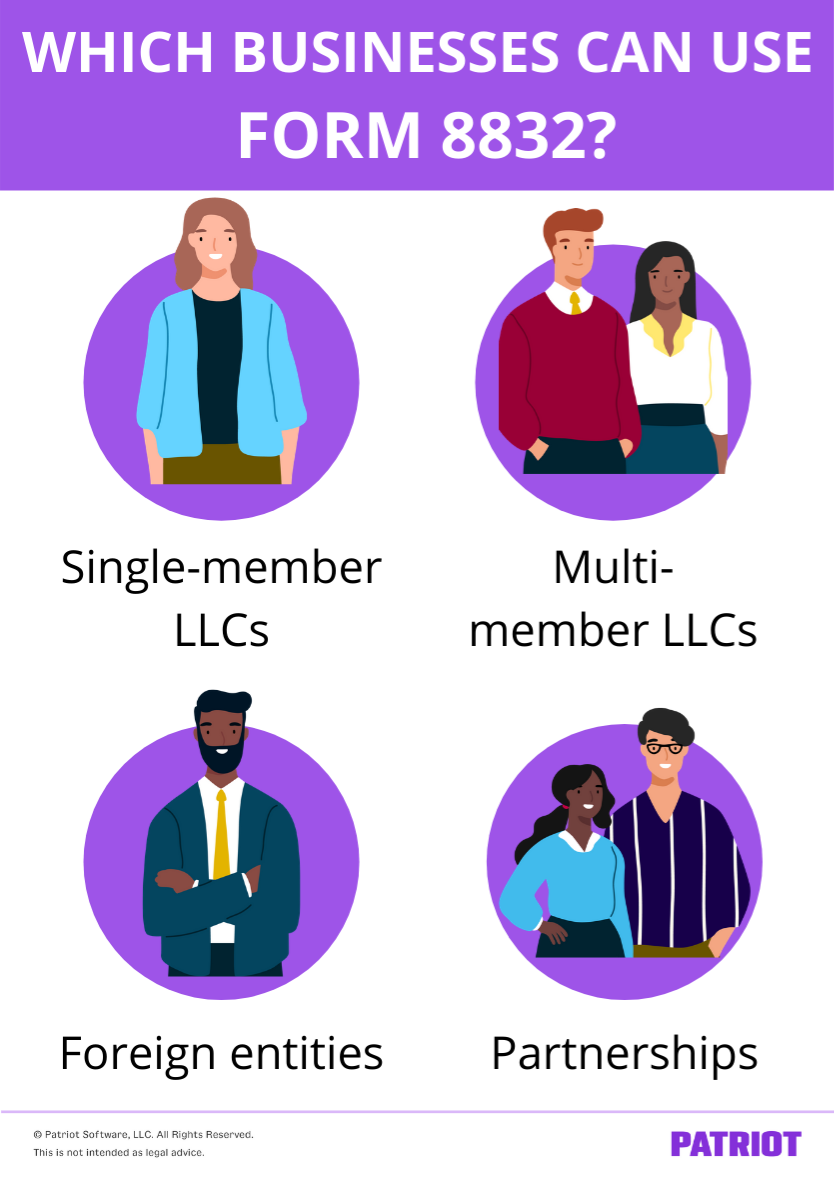

Ad fill, sign, email irs 8832 & more fillable forms, try for free now! Upload, modify or create forms. Web when to file form 8832? Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Form 8832 can be filed with the irs for partnerships and.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

You might choose to file it at the same time you start your business, or you might decide to file at a later point. Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Form 8832 can be filed with the irs for partnerships and limited.

Form 8832 All About It and How to File It?

Information to have before filling out irs form 8832; Web the filing date, on the other hand, is significant. Who should file form 8832? Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Ad access irs tax.

Do I Need to File IRS Form 8832 for My Business? The Handy Tax Guy

December 2013) department of the treasury internal revenue service omb no. You might choose to file it at the same time you start your business, or you might decide to file at a later point. When you file the form 8832, it will determine when your new tax iqq begins. Web when to file form 8832? What happens if i.

What is Form 8832 and How Do I File it?

Web llcs can file form 8832, entity classification election to elect their business entity classification. Web when to file form 8832? You might choose to file it at the same time you start your business, or you might decide to file at a later point. Upload, modify or create forms. How to file the forms if you already have a.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Web form 8832, entity classification election, is a tax form that allows certain businesses to select whether they want to be taxed under c corporation/ partnership or disregarded. Information to have before filling out irs form 8832; December 2013) department of the treasury internal revenue service omb no. Who should file form 8832? Web you can file irs form 8832.

Form 8832 and Changing Your LLC Tax Status Bench Accounting

Fill out your basic information just as you would on any tax document, fill in your business’s name, address, and employer identification number (ein). Web the filing date, on the other hand, is significant. What happens if i don't file form 8832? Ad access irs tax forms. Web to file form 8832, you must have an authorized signature from one.

Form 8832 All About It and How to File It?

Web llcs can file form 8832, entity classification election to elect their business entity classification. Pursuant to the entity classification rules, a domestic entity that has. Web updated july 8, 2020: Ad access irs tax forms. If you miss this timeframe, the irs allows it to be filed in.

IRS Form 8832 Instructions and FAQs for Business Owners

Pursuant to the entity classification rules, a domestic entity that has. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Information to have before filling out irs form 8832; Web the filing date, on the other hand,.

Using Form 8832 to Change Your LLC’s Tax Classification

If you miss this timeframe, the irs allows it to be filed in. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web to file form 8832, you must have an authorized signature from one or more.

Ad Fill, Sign, Email Irs 8832 & More Fillable Forms, Try For Free Now!

The filing date for form 8832 is within 75 days of the formation of your company. Pursuant to the entity classification rules, a domestic entity that has. When you file the form 8832, it will determine when your new tax iqq begins. Who should file form 8832?

Web By Filing Form 8832 With The Irs, You Can Choose A Tax Status For Your Entity Besides The Default Status.

Web the filing date, on the other hand, is significant. Web you can file irs form 8832 at any time. Your new categorization cannot take effect. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner.

Web What Is Irs Form 8832?

Web form 8832 an llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default. Web to file form 8832, you must have an authorized signature from one or more of the following people: What happens if i don't file form 8832? Web llcs can file form 8832, entity classification election to elect their business entity classification.

Each Person Who Is An Owner Of The Business At The Time Of Filing,.

Web updated july 8, 2020: Web when to file form 8832? Web form 8832, entity classification election, is a tax form that allows certain businesses to select whether they want to be taxed under c corporation/ partnership or disregarded. Form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of.