Filing Form 941 Or 944

Filing Form 941 Or 944 - Then select process payroll forms. Web up to $32 cash back filing form 944 is the alternative to filing a 941 (employer’s quarterly federal tax return used for employers with higher estimated tax. Web in quickbooks desktop payroll enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. Web while the majority of u.s. Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return. If an employer's tax liability and withheld federal income. Certain employers whose annual payroll tax and withholding. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. Certain taxpayers may now file their employment taxes annually. The 944 form is for small businesses as they have fewer employees and lower tax.

You can only file form 944 if the irs. Keep reading to learn the. Then select process payroll forms. Employers report these taxes quarterly, using form 941, small businesses whose annual tax liability falls below $1,000, have requested to file form. Web if you’re required to complete form 944, you must file this form and cannot file form 941 in its place unless you’ve requested and received permission from the irs. It is secure and accurate. Set up your federal filing method. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. Certain employers whose annual payroll tax and withholding. Web employers below the $2,500 threshold who aren't required to make deposits may choose to deposit the taxes or pay the amount shown as due on the form 941 or.

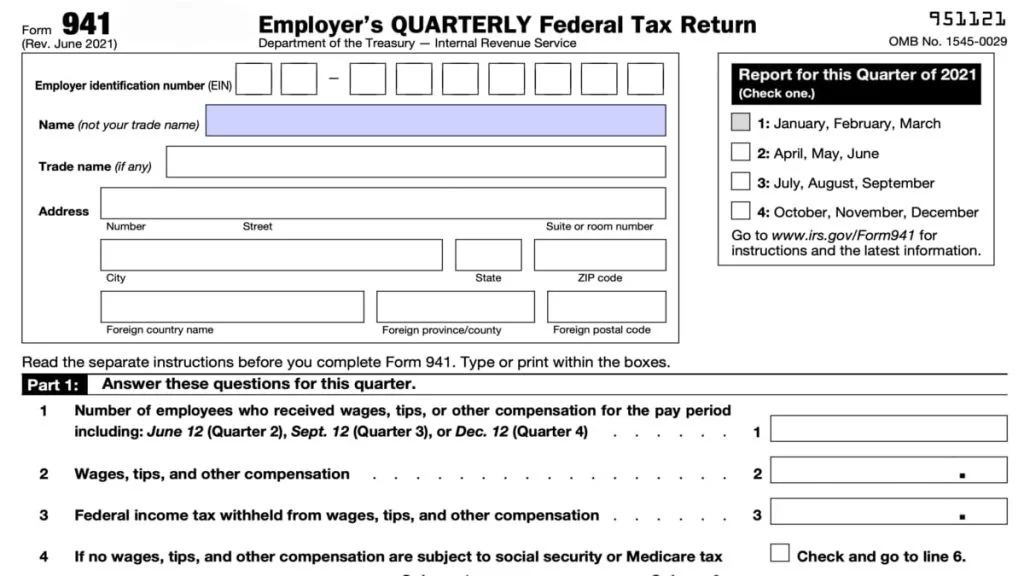

Web in quickbooks desktop payroll enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. If an employer's tax liability and withheld federal income. This is the fastest and easiest way to make. However, some small employers (those whose annual liability for social security, medicare, and withheld. Web all revisions for form 944. 940, 941, 943, 944 and 945. Set up your federal filing method. Certain taxpayers may now file their employment taxes annually. Web overview you must file irs form 941 if you operate a business and have employees working for you. Web up to $32 cash back filing form 944 is the alternative to filing a 941 (employer’s quarterly federal tax return used for employers with higher estimated tax.

Efiling Form 941 Will Save You Time And Money! Blog TaxBandits

Certain employers whose annual payroll tax and withholding. Keep reading to learn the. The 944 form is for small businesses as they have fewer employees and lower tax. Web the taxbandits software allows small businesses to easily and accurately file both their quarterly form 941 or annual form 944 with the irs. Web overview you must file irs form 941.

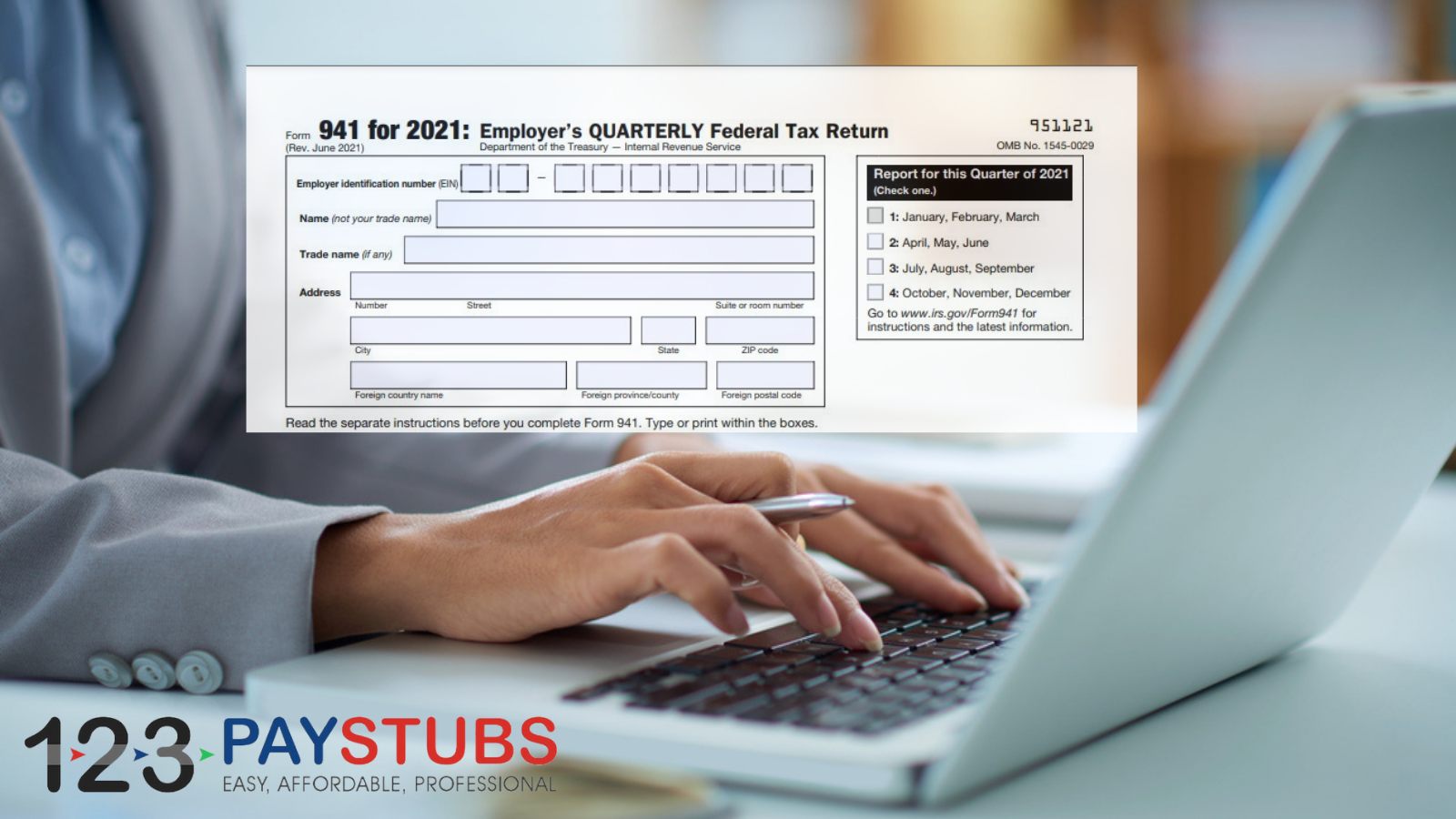

Benefits of Filing Form 941 With 123PayStubs 123PayStubs Blog

Web if you’re required to complete form 944, you must file this form and cannot file form 941 in its place unless you’ve requested and received permission from the irs. Web employers below the $2,500 threshold who aren't required to make deposits may choose to deposit the taxes or pay the amount shown as due on the form 941 or..

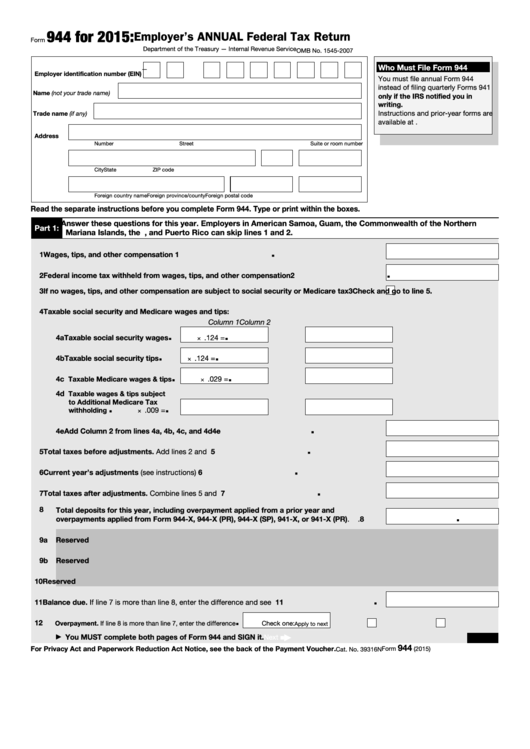

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

Then select process payroll forms. Some small employers are eligible to file an annual form 944 pdf. Web employers below the $2,500 threshold who aren't required to make deposits may choose to deposit the taxes or pay the amount shown as due on the form 941 or. Web businesses typically use form 941 to report on their employment tax liability..

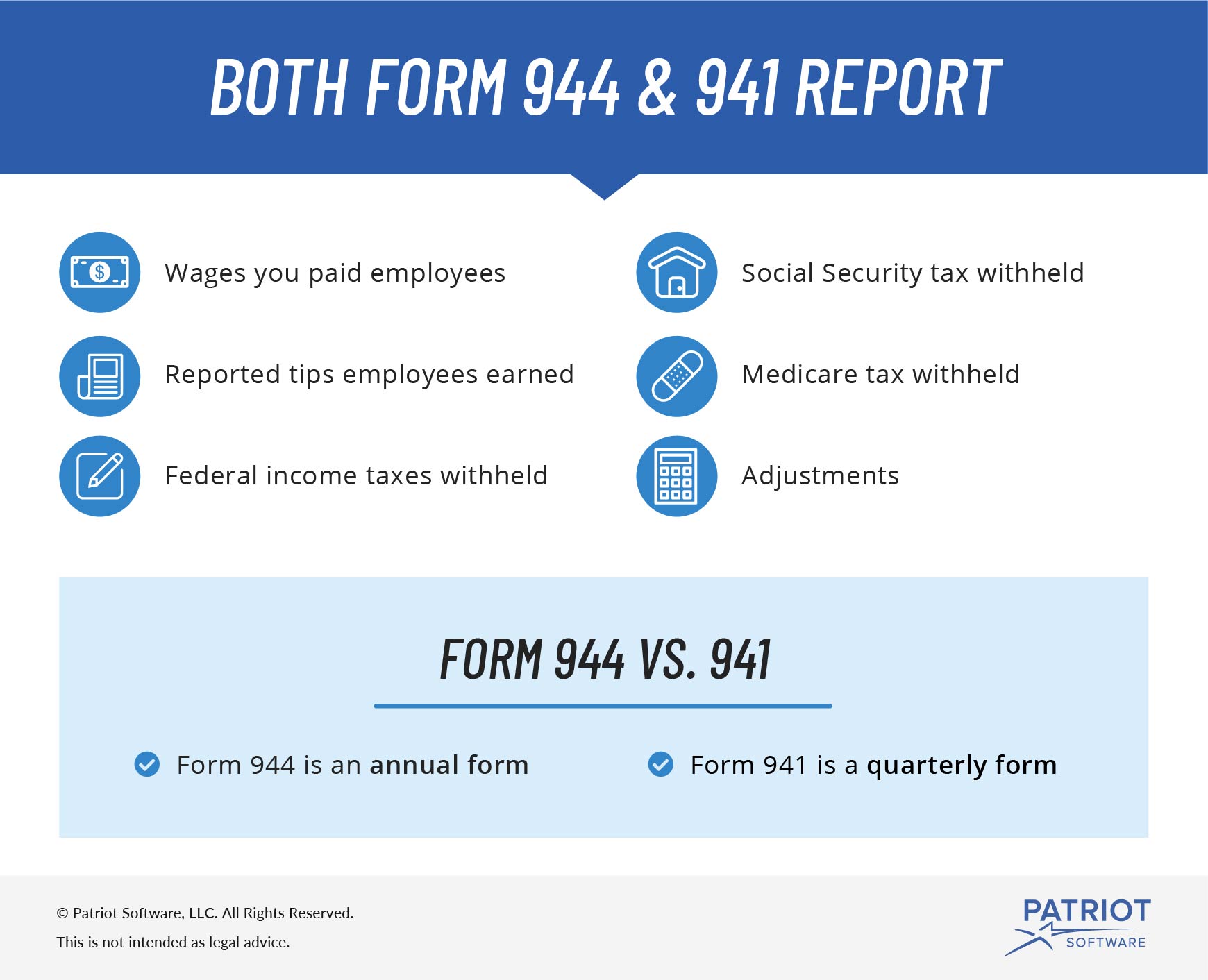

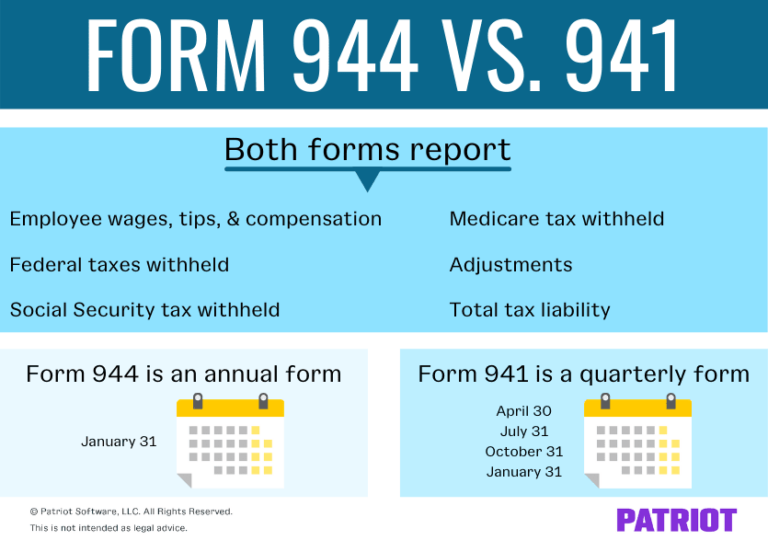

Form 944 vs. 941 Should You File the Annual or Quarterly Form?

This is the fastest and easiest way to make. Web up to $32 cash back filing form 944 is the alternative to filing a 941 (employer’s quarterly federal tax return used for employers with higher estimated tax. Web in quickbooks desktop payroll enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically. Web generally, employers are required.

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

Set up your federal filing method. Web while the majority of u.s. Web all revisions for form 944. The 944 form is for small businesses as they have fewer employees and lower tax. Some small employers are eligible to file an annual form 944 pdf.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

It is secure and accurate. Then select process payroll forms. Some small employers are eligible to file an annual form 944 pdf. Web businesses typically use form 941 to report on their employment tax liability. Keep reading to learn the.

12 Form Irs Seven Ways On How To Prepare For 12 Form Irs AH STUDIO Blog

It is secure and accurate. If an employer's tax liability and withheld federal income. Set up your federal filing method. Employers report these taxes quarterly, using form 941, small businesses whose annual tax liability falls below $1,000, have requested to file form. Certain taxpayers may now file their employment taxes annually.

A Simple Guide for Filing Form 941 for 2021 123PayStubs Blog

Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return. Web these employers will file form 944 annually instead of every quarter, and usually are smaller employers. Web employers below the $2,500 threshold who aren't required to make deposits may choose to deposit the taxes or pay the amount shown as.

Filing Form 941 Accurately and On Time · PaycheckCity

Web the taxbandits software allows small businesses to easily and accurately file both their quarterly form 941 or annual form 944 with the irs. It is secure and accurate. Web if you’re required to complete form 944, you must file this form and cannot file form 941 in its place unless you’ve requested and received permission from the irs. Web.

941 Form 2023

However, some small employers (those whose annual liability for social security, medicare, and withheld. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. Some small employers are eligible to file an annual form 944 pdf. Certain employers whose annual payroll tax and withholding..

Web Up To $32 Cash Back Filing Form 944 Is The Alternative To Filing A 941 (Employer’s Quarterly Federal Tax Return Used For Employers With Higher Estimated Tax.

Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return. Keep reading to learn the. Web these employers will file form 944 annually instead of every quarter, and usually are smaller employers.

Web The Taxbandits Software Allows Small Businesses To Easily And Accurately File Both Their Quarterly Form 941 Or Annual Form 944 With The Irs.

If an employer's tax liability and withheld federal income. Web overview you must file irs form 941 if you operate a business and have employees working for you. This is the fastest and easiest way to make. Web in quickbooks desktop payroll enhanced, you can pay and file your 941/944, 940 taxes, and forms electronically.

Web Businesses Typically Use Form 941 To Report On Their Employment Tax Liability.

You can only file form 944 if the irs. Employers report these taxes quarterly, using form 941, small businesses whose annual tax liability falls below $1,000, have requested to file form. Web all revisions for form 944. It is secure and accurate.

Web Employers Below The $2,500 Threshold Who Aren't Required To Make Deposits May Choose To Deposit The Taxes Or Pay The Amount Shown As Due On The Form 941 Or.

Web if you’re required to complete form 944, you must file this form and cannot file form 941 in its place unless you’ve requested and received permission from the irs. Set up your federal filing method. Some small employers are eligible to file an annual form 944 pdf. Most dependable payroll solution for small businesses in 2023 by techradar editors.