Fill Out Form 2553 Online

Fill Out Form 2553 Online - How to file form 2553 online with the irs? Election information and employer identification number; If you want your business to be taxed as an s corp, you’ll have to fill form 2553 with the irs. Web find mailing addresses by state and date for filing form 2553. Input the business’s mailing address in the appropriate lines. We know the irs from the inside out. The irs has 2 different. Web how to file form 2553. You need to file form 2553, election by a small business corporation to be treated as an s corporation by the irs. Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation.

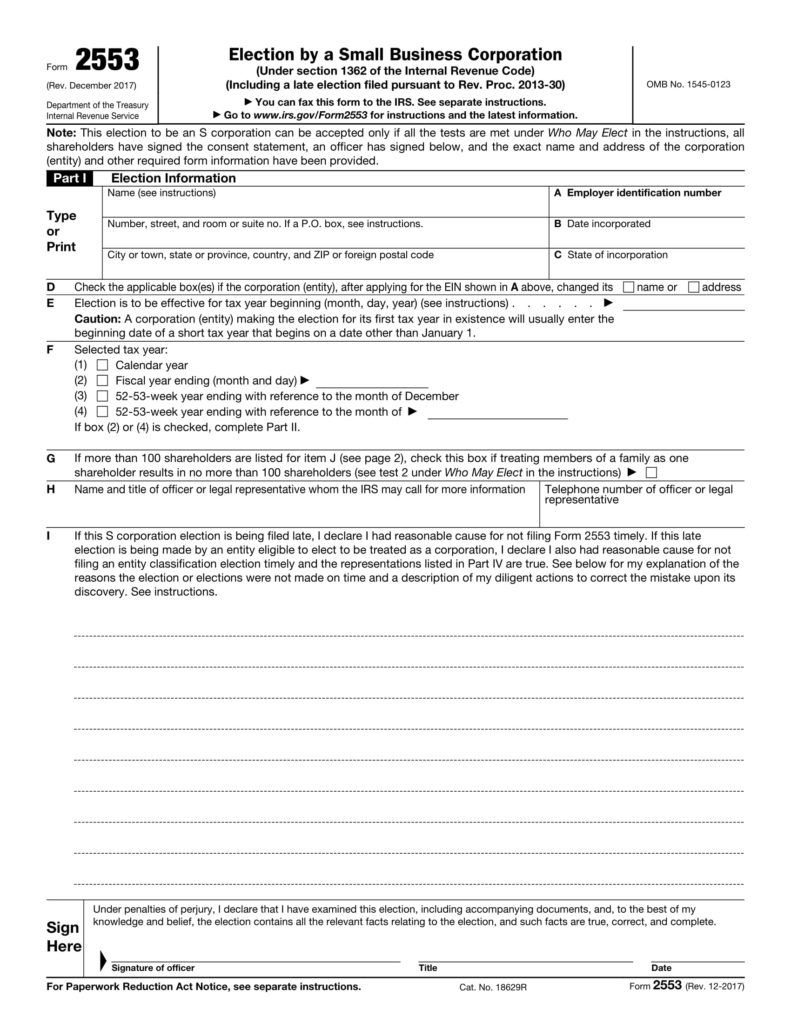

Input the business’s employer identification number (ein) obtained from the irs. How to file form 2553 online with the irs? Filling out your form 2553; Election information and employer identification number; Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service. Web how to fill out form 2553. Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Try it for free now! Election by a small business corporation (under section 1362 of the internal revenue.

A corporation or other entity eligible to be. Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. How to file form 2553 online with the irs? Web what is form 2553 used for? December 2017) department of the treasury internal revenue service. Filling out your form 2553; Try it for free now! Web how to fill out form 2553. Input the business’s mailing address in the appropriate lines. Instructions to complete form 2553;

Ssurvivor Form 2553 Sample

Web what is form 2553 used for? Web how to fill out form 2553. Try it for free now! Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Complete, edit or print tax forms instantly.

How Do You Fill Out Form 2553 Get Help Tax Remote Tax Accountants

Complete, edit or print tax forms instantly. Web form 2553 is an irs form. If you want your business to be taxed as an s corp, you’ll have to fill form 2553 with the irs. Ad get ready for tax season deadlines by completing any required tax forms today. Instructions to complete form 2553;

How to Fill Out Form 2553 Instructions, Deadlines [2023]

If the corporation's principal business, office, or agency is located in. Web how to fill out form 2553. Web filling out irs 2553. Top 13mm (1⁄ 2), center sides.prints: Upload, modify or create forms.

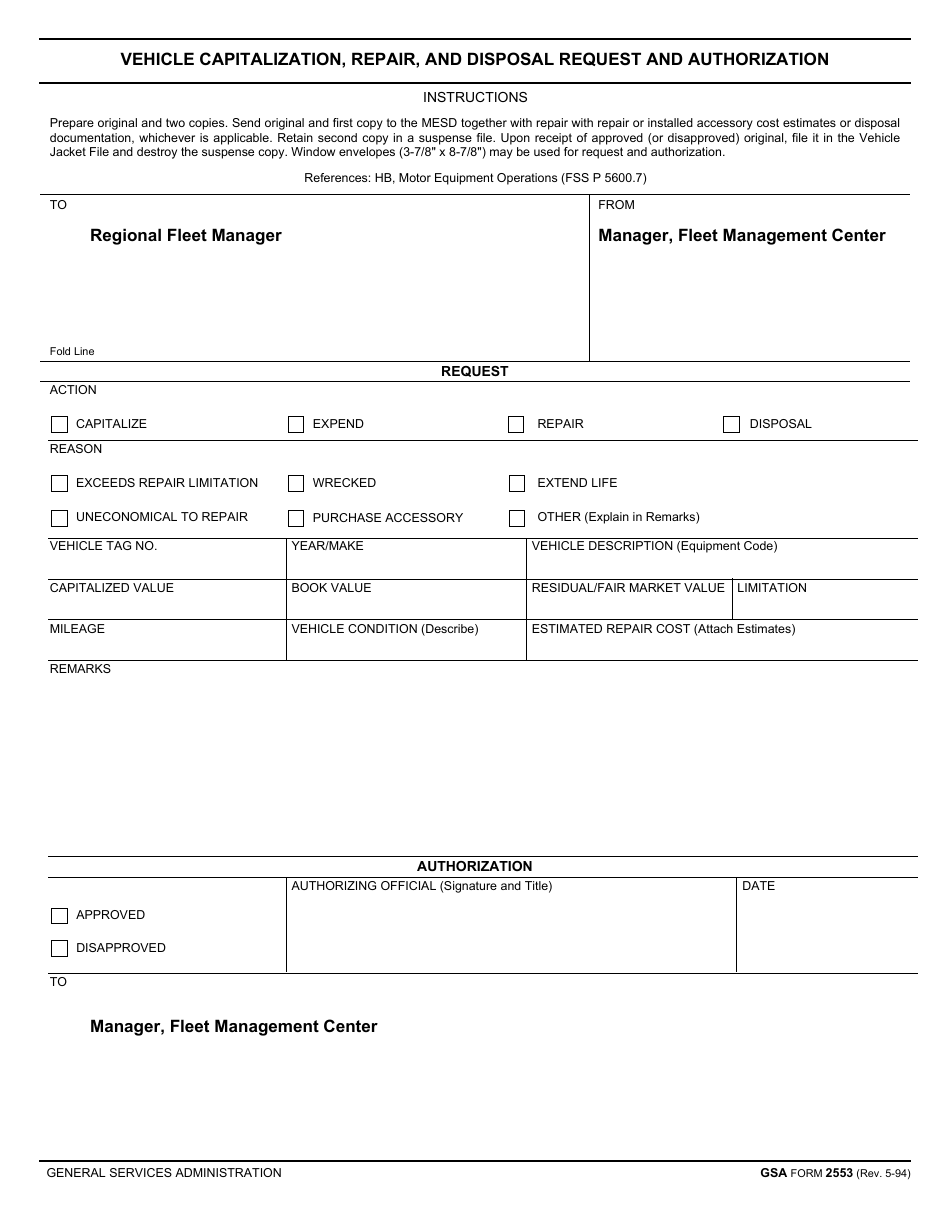

GSA Form 2553 Download Fillable PDF or Fill Online Vehicle

Business owners can fill it out by typing. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. How to file form 2553 online.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Upload, modify or create forms. Web how to fill out form 2553. Web form 2553, page 3 of 4 (page 4 blank) margins: Web how to fill out form 2553.

How To Fill Out Form 2553 Make it simple, Filling, Tax forms

Election information and employer identification number; Input the business’s mailing address in the appropriate lines. Selection of fiscal tax year;. How to file form 2553 online with the irs? Web form 2553 cannot be filed online.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. A corporation or other entity eligible to be. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Selection of fiscal tax year;. Election information and employer.

How to Fill Out IRS Form 2553

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web what is form 2553 used for? Election information and employer identification number; Check the entered data several times. If you are a new business owner, you may be wondering, “how to fill out form.

2002 Form IRS 2553 Fill Online, Printable, Fillable, Blank PDFfiller

Election by a small business corporation (under section 1362 of the internal revenue. Election information and employer identification number; A corporation or other entity eligible to be. Instructions to complete form 2553; Try it for free now!

2007 Form IRS 2553 Fill Online, Printable, Fillable, Blank PDFfiller

Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Election information and employer identification number; If necessary, use our form. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web form 2553.

Input The Business’s Employer Identification Number (Ein) Obtained From The Irs.

Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. You need to file form 2553, election by a small business corporation to be treated as an s corporation by the irs. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service. Web form 2553 is an irs form.

If You Want Your Business To Be Taxed As An S Corp, You’ll Have To Fill Form 2553 With The Irs.

The form consists of several parts requiring the following information: Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. A corporation or other entity eligible to be. The irs has 2 different.

Web Find Mailing Addresses By State And Date For Filing Form 2553.

Web how to fill out form 2553. 1) the entity itself is taxed on income at the. Complete, edit or print tax forms instantly. It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code.

Business Owners Can Fill It Out By Typing.

Ad get ready for tax season deadlines by completing any required tax forms today. Web form 2553, page 3 of 4 (page 4 blank) margins: Election information and employer identification number; If the corporation's principal business, office, or agency is located in.

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)