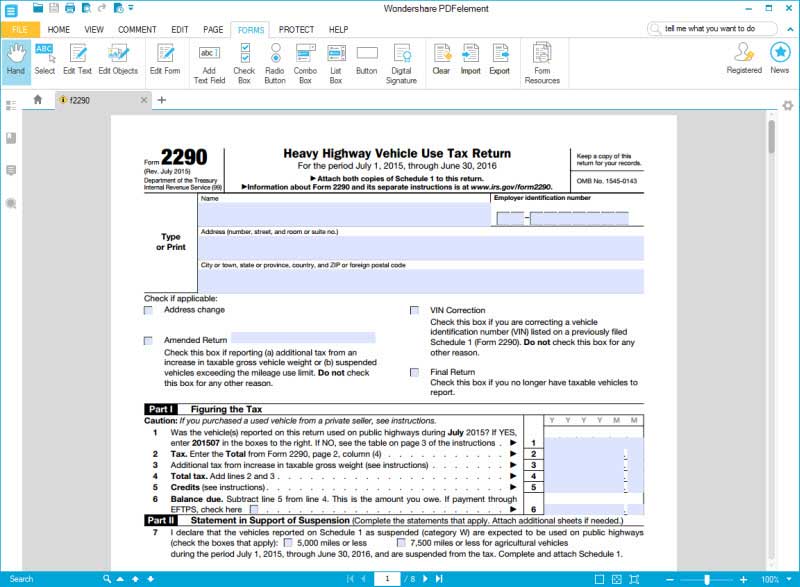

Fillable Form 2290

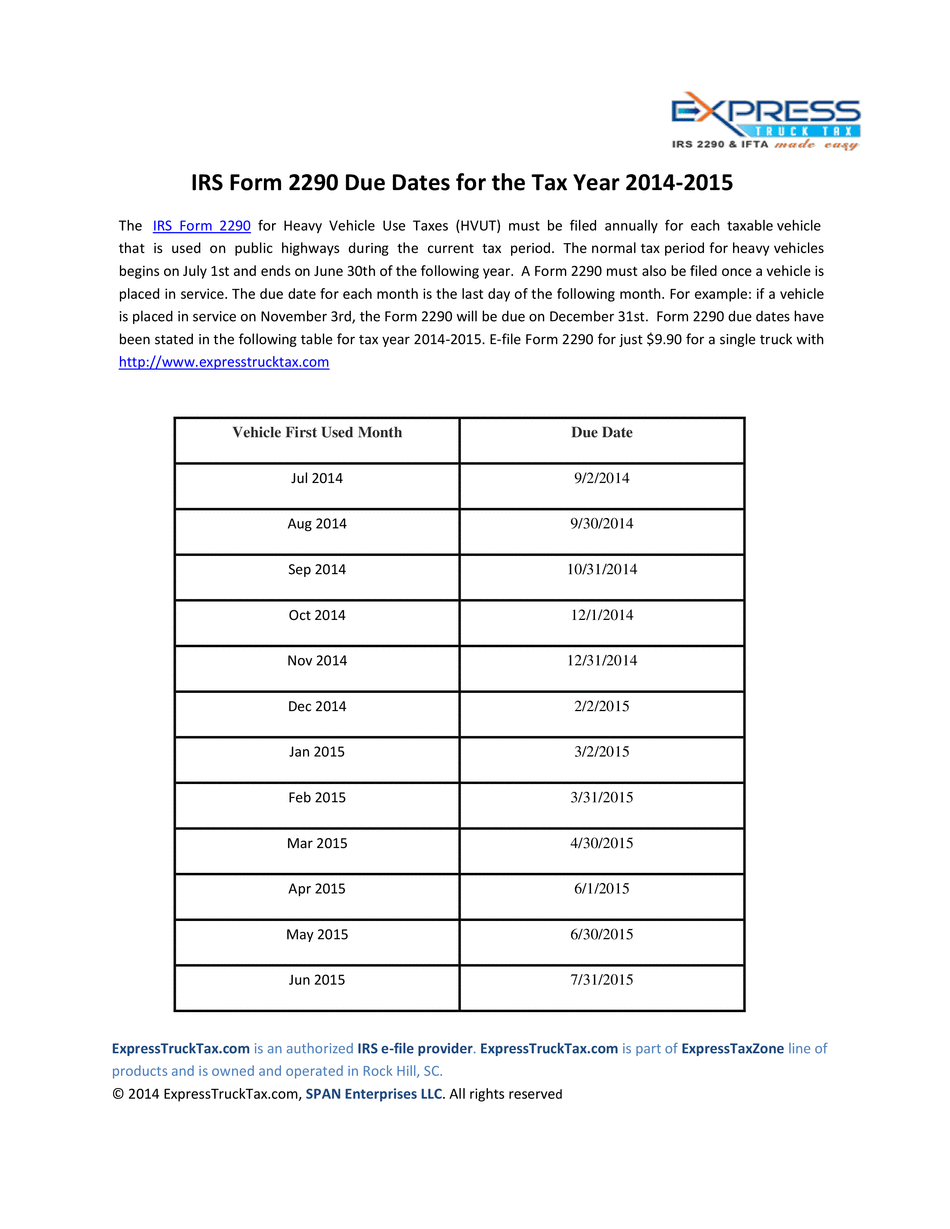

Fillable Form 2290 - Web use form 2290 to: Web the form 2290 will allow the filer to calculate and pay any taxes due on highway motor vehicles with a gross weight of 55,000 pounds or more. Web you must file this form 2290 (rev. Web the 2290 form is due annually between july 1 and august 31. The fundamentals basically, filing this return is a must for any individual, llc, cooperation, or any other type of entity with heavy vehicles registered. This revision if you need to file a return for a tax. Web what is a 2290 form? Web when form 2290 taxes are due. Get ready for tax season deadlines by completing any required tax forms today. Easy, fast, secure & free to try.

Web how to fill out a 2290 form: Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web use form 2290 to: Month new vehicle is first used. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august. July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. As an alternative to filling out and signing your report online, you can choose to get a printable tax form 2290 from the web and print it out. Like all tax forms, this form. Complete, edit or print tax forms instantly.

Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Easy, fast, secure & free to try. Web you must file this form 2290 (rev. Web form 2290 due dates for vehicles placed into service during reporting period. Free vin checker & correction. Ad access irs tax forms. Upload, modify or create forms. Like all tax forms, this form. Use coupon code get20b & get 20% off. Get schedule 1 or your money back.

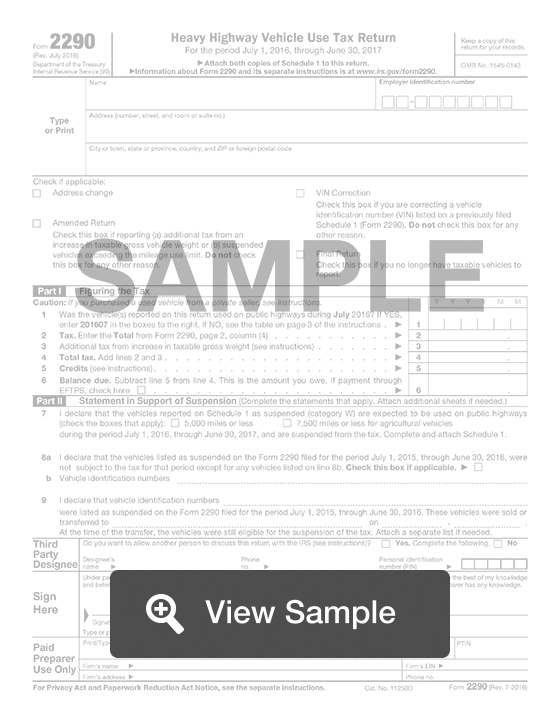

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

The fundamentals basically, filing this return is a must for any individual, llc, cooperation, or any other type of entity with heavy vehicles registered. Easy, fast, secure & free to try. Web the 2290 form is due annually between july 1 and august 31. Web how to fill out a 2290 form: Ad access irs tax forms.

IRS Form 2290 Fill it Without Stress

The fundamentals basically, filing this return is a must for any individual, llc, cooperation, or any other type of entity with heavy vehicles registered. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Web form 2290 due dates for vehicles placed into service during reporting.

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Web how to fill out a 2290 form: The irs mandates that everyone who owns a heavy vehicle. This revision if you need to file a return for a tax. Get ready for tax season deadlines by completing any required tax forms today. Web irs form 2290 online filing starts at $14.90.

Fill Free fillable Heavy Highway Vehicle Use Tax Return 2017 Form

Web the 2290 form is due annually between july 1 and august 31. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august. The irs mandates that everyone who owns a heavy vehicle. Ad access irs tax forms. Both the tax return and the.

IRS Form 2290 Fill it Without Stress

Web the fillable form 2290 (heavy highway vehicle use tax return) lets you calculate and pay the tax if you have a highway motor vehicle that weighs 55,000 pounds or more. Try it for free now! Free vin checker & correction. The irs mandates that everyone who owns a heavy vehicle. Web when form 2290 taxes are due.

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

Month new vehicle is first used. For vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august. Upload, modify or create forms. Complete, edit or print tax forms instantly. Web you must file this form 2290 (rev.

Fillable Form 2290 20232024 Create, Fill & Download 2290

This revision if you need to file a return for a tax. Month new vehicle is first used. The irs mandates that everyone who owns a heavy vehicle. Complete, edit or print tax forms instantly. You don’t have to rush to the irs office and wait in a long queue to file form 2290.

File IRS 2290 Form Online for 20222023 Tax Period

July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. Web fillable version of irs form 2290. Web how to fill out a 2290 form: Month form 2290 must be filed. Complete, edit or print tax forms instantly.

form 2290 20182022 Fill Online, Printable, Fillable Blank

Free vin checker & correction. Get ready for tax season deadlines by completing any required tax forms today. Web you must file this form 2290 (rev. Web the fillable form 2290 (heavy highway vehicle use tax return) lets you calculate and pay the tax if you have a highway motor vehicle that weighs 55,000 pounds or more. Web when form.

fillable form 2290 2018 Fill Online, Printable, Fillable Blank form

Easy, fast, secure & free to try. The current period begins july 1, 2023, and ends june 30,. July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. Web use form 2290 to: Web you must file this form 2290 (rev.

The Fillable Form 2290 (2023) (Heavy Highway Vehicle Use Tax Return) Lets You Calculate And Pay The Tax If You Have A Highway Motor Vehicle That.

Web you must file this form 2290 (rev. Web the form 2290 will allow the filer to calculate and pay any taxes due on highway motor vehicles with a gross weight of 55,000 pounds or more. Month form 2290 must be filed. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more.

For Vehicles First Used On A Public Highway During The Month Of July, File Form 2290 And Pay The Appropriate Tax Between July 1 And August.

Do your truck tax online & have it efiled to the irs! Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more; Web irs form 2290 online filing starts at $14.90. Don't use this revision if you need to file a return for a tax.

Try It For Free Now!

Free vin checker & correction. Upload, modify or create forms. Use coupon code get20b & get 20% off. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period.

This Revision If You Need To File A Return For A Tax.

July 2017) for the tax period beginning on july 1, 2017, and ending on june 30, 2018. Web the 2290 form is due annually between july 1 and august 31. Month new vehicle is first used. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties.