Fincen Form 114 Sample

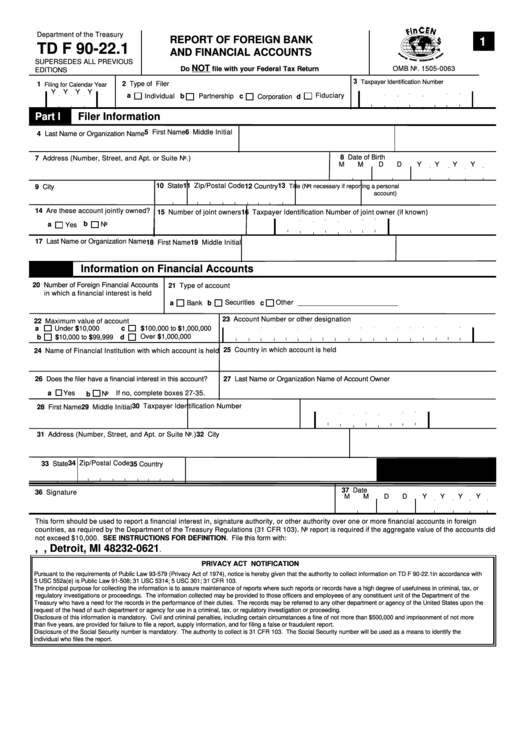

Fincen Form 114 Sample - Web under the bank secrecy act, each united states person must file a foreign bank accounts report (fbar), or fincen form 114 if the combined total of your foreign financial accounts is at least $10k or reaches this threshold at any point during the calendar year. Filing an fbar is the same process as submitting fincen form 114, so don’t worry about filing two separate forms. Web fill it out completely, even fields that don't need correction. Best company rating of not less than “a” which are qualified to do business in the state of michigan. Fbar (foreign bank account report) 114. Web who must file the fbar? Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Often times, you will hear that you need to file an fbar. Web policy form (a) all policies of insurance required by the foregoing section shall be issued by reputable and financially sound insurance companies reasonably satisfactory to landlord having an a.m. Web in a nutshell, form 114 is used by u.s.

The fincen report 114 documents a taxpayer’s foreign financial accounts when the aggregate value in those accounts exceeds $10,000. Fbar (foreign bank account report) 114. Have not already been contacted by the irs about the delinquent fbars. Web fincen form 114 is used to file a “report of foreign bank and financial accounts”, which is also known as fbar. Web policy form (a) all policies of insurance required by the foregoing section shall be issued by reputable and financially sound insurance companies reasonably satisfactory to landlord having an a.m. Citizens, residents, and entities to report foreign financial accounts. Web under the bank secrecy act, each united states person must file a foreign bank accounts report (fbar), or fincen form 114 if the combined total of your foreign financial accounts is at least $10k or reaches this threshold at any point during the calendar year. Best company rating of not less than “a” which are qualified to do business in the state of michigan. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. To file an fbar report.

Filing an fbar is the same process as submitting fincen form 114, so don’t worry about filing two separate forms. Web under the bank secrecy act, each united states person must file a foreign bank accounts report (fbar), or fincen form 114 if the combined total of your foreign financial accounts is at least $10k or reaches this threshold at any point during the calendar year. Web if fincen approves your request, fincen will send you the paper fbar form to complete and mail to the irs at the address in the form’s instructions. Web fincen form 114 is used to file a “report of foreign bank and financial accounts”, which is also known as fbar. Line item instructions for completing the fbar (form 114) (08/2021) Citizens, residents, and entities to report foreign financial accounts. The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the foreign financial accounts exceeds $10,000 at. Web fill it out completely, even fields that don't need correction. The fincen report 114 documents a taxpayer’s foreign financial accounts when the aggregate value in those accounts exceeds $10,000.

Top 5 Fincen Form 114 Templates free to download in PDF format

To file an fbar report. Web fill it out completely, even fields that don't need correction. Web under the bank secrecy act, each united states person must file a foreign bank accounts report (fbar), or fincen form 114 if the combined total of your foreign financial accounts is at least $10k or reaches this threshold at any point during the.

FBAR And Filing FinCEN Form 114 Step By Step Instructions For

Web under the bank secrecy act, each united states person must file a foreign bank accounts report (fbar), or fincen form 114 if the combined total of your foreign financial accounts is at least $10k or reaches this threshold at any point during the calendar year. Fbar (foreign bank account report) 114. Web complete fincen form 114 sample online with.

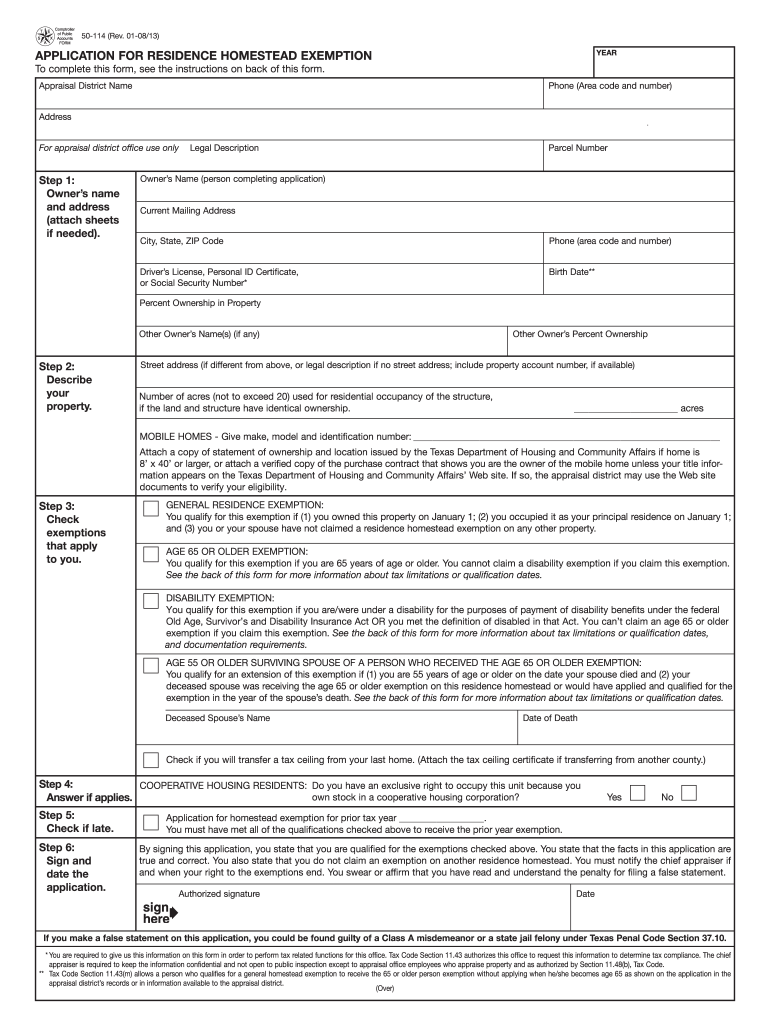

Form 50 Fill Out and Sign Printable PDF Template signNow

Web fincen form 114 is used to file a “report of foreign bank and financial accounts”, which is also known as fbar. The fincen report 114 documents a taxpayer’s foreign financial accounts when the aggregate value in those accounts exceeds $10,000. Web money services business (msb) registration. Line item instructions for completing the fbar (form 114) (08/2021) Web if fincen.

FinCEN Form 114 2023 Banking

Easily fill out pdf blank, edit, and sign them. Web who must file the fbar? Filing an fbar is the same process as submitting fincen form 114, so don’t worry about filing two separate forms. Fbar (foreign bank account report) 114. Line item instructions for completing the fbar (form 114) (08/2021)

Fc112ctr Fill Online, Printable, Fillable, Blank pdfFiller

Save or instantly send your ready documents. Web fincen form 114 is used to file a “report of foreign bank and financial accounts”, which is also known as fbar. Filing an fbar is the same process as submitting fincen form 114, so don’t worry about filing two separate forms. Fbar (foreign bank account report) 114. Web complete fincen form 114.

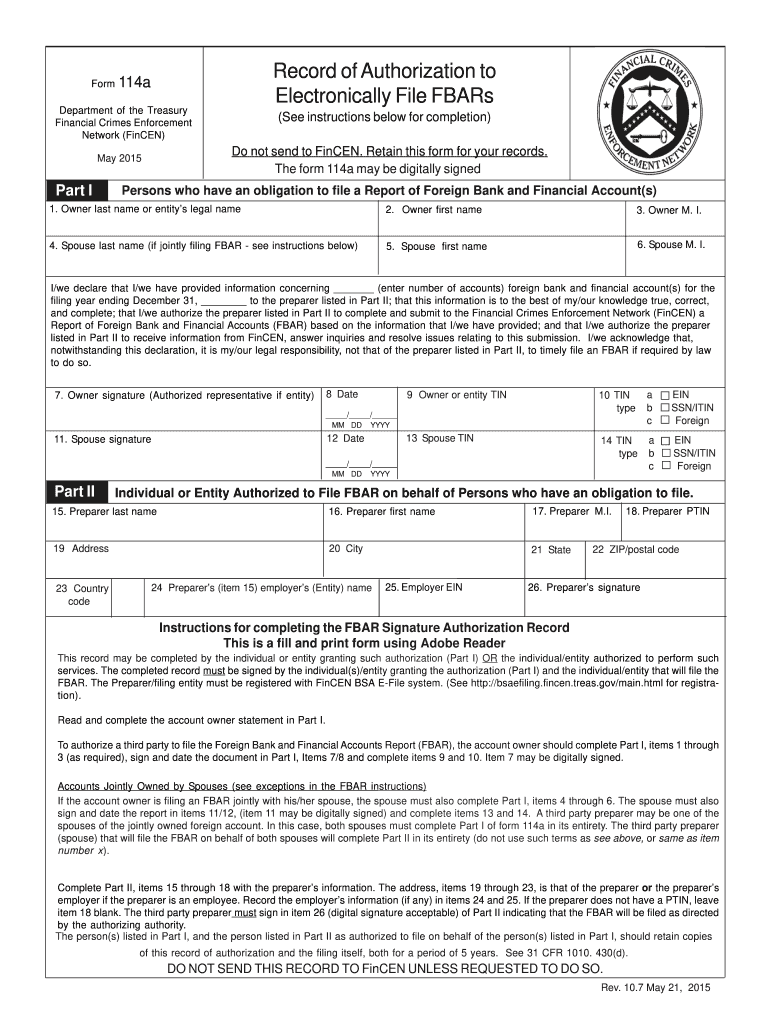

Form 114a Fill out & sign online DocHub

Citizens, residents, and entities to report foreign financial accounts. Web in a nutshell, form 114 is used by u.s. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the foreign financial accounts exceeds $10,000 at. Fbar (foreign bank account report) 114. Best company.

FINCEN FORM 109 PDF

Line item instructions for completing the fbar (form 114) (08/2021) Often times, you will hear that you need to file an fbar. To file an fbar report. Web fincen form 114 is used to file a “report of foreign bank and financial accounts”, which is also known as fbar. The electronic version of the fbar is currently available and must.

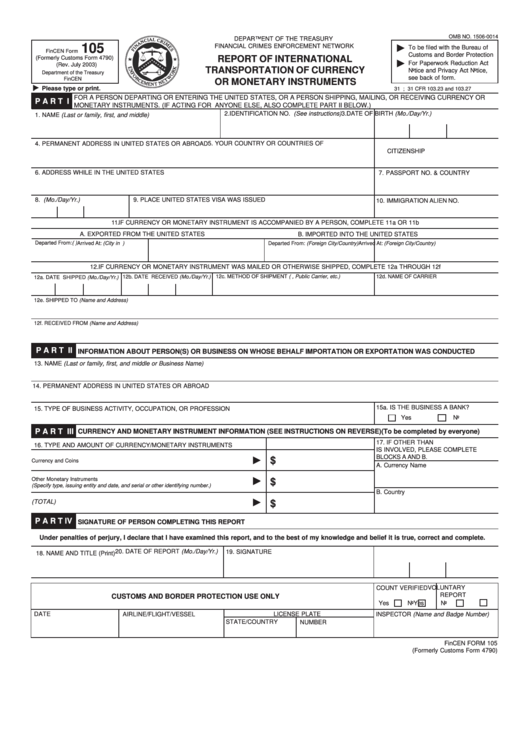

Fincen Form 105 Report Of International Transportation Of Currency Or

Filing an fbar is the same process as submitting fincen form 114, so don’t worry about filing two separate forms. Best company rating of not less than “a” which are qualified to do business in the state of michigan. Citizens, residents, and entities to report foreign financial accounts. The electronic version of the fbar is currently available and must be.

Fincen Form 114 Sample

Web who must file the fbar? The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. To file an fbar report. Web fincen form 114 is used to file a “report of foreign bank and financial accounts”, which is also known as fbar. A united states person that has a financial interest.

FinCEN Form 114, FBAR Foreign Bank Account Report YouTube

The fincen report 114 documents a taxpayer’s foreign financial accounts when the aggregate value in those accounts exceeds $10,000. Citizens, residents, and entities to report foreign financial accounts. Easily fill out pdf blank, edit, and sign them. Web who must file the fbar? Often times, you will hear that you need to file an fbar.

Web Complete Fincen Form 114 Sample Online With Us Legal Forms.

Fbar (foreign bank account report) 114. Web fill it out completely, even fields that don't need correction. Web under the bank secrecy act, each united states person must file a foreign bank accounts report (fbar), or fincen form 114 if the combined total of your foreign financial accounts is at least $10k or reaches this threshold at any point during the calendar year. The fincen report 114 documents a taxpayer’s foreign financial accounts when the aggregate value in those accounts exceeds $10,000.

Web If Fincen Approves Your Request, Fincen Will Send You The Paper Fbar Form To Complete And Mail To The Irs At The Address In The Form’s Instructions.

Filing an fbar is the same process as submitting fincen form 114, so don’t worry about filing two separate forms. Have not already been contacted by the irs about the delinquent fbars. Best company rating of not less than “a” which are qualified to do business in the state of michigan. Line item instructions for completing the fbar (form 114) (08/2021)

Web Policy Form (A) All Policies Of Insurance Required By The Foregoing Section Shall Be Issued By Reputable And Financially Sound Insurance Companies Reasonably Satisfactory To Landlord Having An A.m.

To file an fbar report. Save or instantly send your ready documents. The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Web money services business (msb) registration.

Citizens, Residents, And Entities To Report Foreign Financial Accounts.

Web fincen form 114 is used to file a “report of foreign bank and financial accounts”, which is also known as fbar. Web in a nutshell, form 114 is used by u.s. A united states person that has a financial interest in or signature authority over foreign financial accounts must file an fbar if the aggregate value of the foreign financial accounts exceeds $10,000 at. Web who must file the fbar?