First Time Abatement Form 5472

First Time Abatement Form 5472 - Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Web the penalty under irc § 6038a begins at $25,000, and the continuation penalty, which commences 90 days after notication of assessment, is $25,000 for each. The penalty also applies for failure to. Web form 5472 delinquency procedures. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign. Persons with respect to certain foreign corporations, and/or form 5472,. Web the annual deadline for filing both form 5471 and form 5472 is the due date of a taxpayer’s income tax return (including extensions). Get ready for tax season deadlines by completing any required tax forms today. Form 5471 must be filed by certain. Web penalties systematically assessed when a form 5471, information return of u.s.

Extension of time to file. Web the annual deadline for filing both form 5471 and form 5472 is the due date of a taxpayer’s income tax return (including extensions). Web the penalty under irc § 6038a begins at $25,000, and the continuation penalty, which commences 90 days after notication of assessment, is $25,000 for each. To qualify, taxpayers must meet the conditions set forth in i.r.m. Generally, an fta can provide penalty relief if the taxpayer has not previously been required to file a return or has no prior penalties (except. De required to file form 5472 can request an extension of time to file by filing form 7004. I also swear and affirm all. Web the instructions for form 1120. Persons with respect to certain foreign corporations, and/or form 5472,. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the failure, with no maximum.

Persons with respect to certain foreign corporations, and/or form 5472,. I also swear and affirm all. Web in order to obtain an abatement of the penalties associated with a form 5472 penalty, it must be established that the individual that was assessed a penalty did not only act with. Get ready for tax season deadlines by completing any required tax forms today. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Extension of time to file. To qualify, taxpayers must meet the conditions set forth in i.r.m. The irm clarifies that relief. Web form 5472, when filed with form 11202, information return of 25% foreign owned u.s. Web the instructions for form 1120.

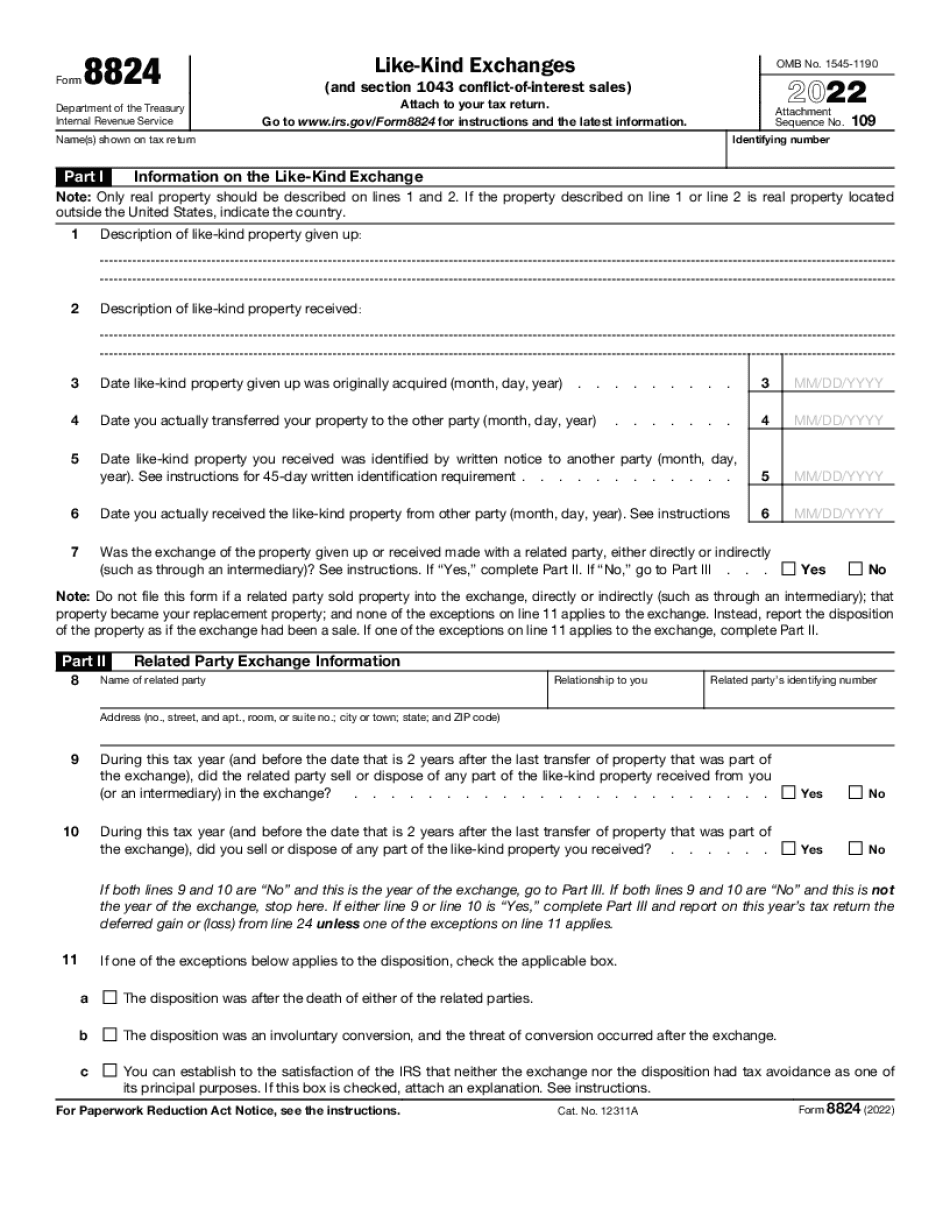

Form 843, Claim for Refund and Request for Abatement IRS Fill

The irm clarifies that relief. Web in order to obtain an abatement of the penalties associated with a form 5472 penalty, it must be established that the individual that was assessed a penalty did not only act with. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of.

50 Irs Penalty Abatement Reasonable Cause Letter Ls3p Irs penalties

Web form 5472, when filed with form 11202, information return of 25% foreign owned u.s. The irm clarifies that relief. Generally, an fta can provide penalty relief if the taxpayer has not previously been required to file a return or has no prior penalties (except. Corporation or a foreign corporation engaged in a u.s. Web a failure to timely file.

Using The IRS First Time Abatement Strategically To Reduce Penalties

The irm clarifies that relief. Corporation or a foreign corporation engaged in a u.s. Web the annual deadline for filing both form 5471 and form 5472 is the due date of a taxpayer’s income tax return (including extensions). Extension of time to file. Web the penalty under irc § 6038a begins at $25,000, and the continuation penalty, which commences 90.

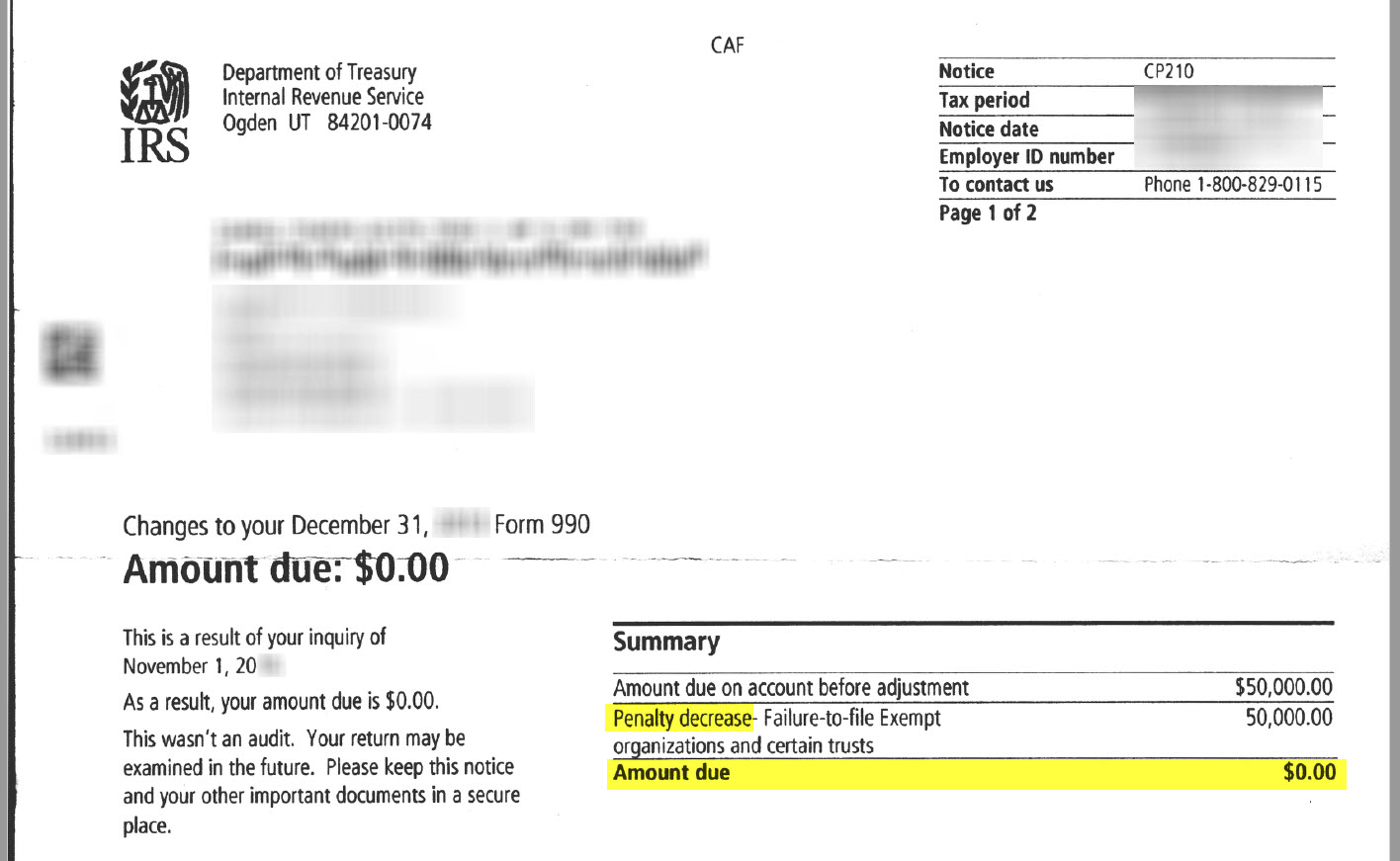

How to Write a Form 990 Late Filing Penalty Abatement Letter 50,000

Web form 5472 delinquency procedures. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the failure, with no maximum. Web form 5472, when filed with form 11202, information return of 25%.

Fill Free fillable IRS PDF forms

When taxpayers have no unreported income and the only missed requirement was an international reporting form, it used to be the penalties. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of.

Irs form 5472 Penalty Abatement Fresh Penalty Abatement Sample Letter

Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the failure, with no maximum. Web the penalty under irc § 6038a begins at $25,000, and the continuation penalty, which commences 90.

Form 5471 and Form 5472 Possible FirstTime Penalty Abatement Hone

Web the irm revisions also address whether first time penalty abatement (fta) will take precedence over relief provided under the notice. Persons with respect to certain foreign corporations, and/or form 5472,. De required to file form 5472 can request an extension of time to file by filing form 7004. Extension of time to file. Get ready for tax season deadlines.

Asking For Waiver Of Penalty Sample Letter To Irs Requesting Them To

I also swear and affirm all. Web form 5472, when filed with form 11202, information return of 25% foreign owned u.s. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,. Generally, an fta can provide penalty relief if the taxpayer has.

Tax Offshore Citizen

Web the irm revisions also address whether first time penalty abatement (fta) will take precedence over relief provided under the notice. Extension of time to file. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs.

FirstTime Abatement in IRS Tax Relief Billings, MT How to Use It

The irm clarifies that relief. To qualify, taxpayers must meet the conditions set forth in i.r.m. Web the annual deadline for filing both form 5471 and form 5472 is the due date of a taxpayer’s income tax return (including extensions). Corporation (i.e., a corporation with at least one direct or indirect 25% foreign shareholder. Edit, sign and save irs 5472.

Web Form 5472, When Filed With Form 11202, Information Return Of 25% Foreign Owned U.s.

The irm clarifies that relief. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign. Form 5471 must be filed by certain. Web the irm revisions also address whether first time penalty abatement (fta) will take precedence over relief provided under the notice.

Web A Failure To Timely File A Form 5472 Is Subject To A $25,000 Penalty Per Information Return, Plus An Additional $25,000 For Each Month The Failure Continues,.

I also swear and affirm all. Extension of time to file. Web penalties systematically assessed when a form 5471, information return of u.s. Web form 5472 delinquency procedures.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web the annual deadline for filing both form 5471 and form 5472 is the due date of a taxpayer’s income tax return (including extensions). Generally, an fta can provide penalty relief if the taxpayer has not previously been required to file a return or has no prior penalties (except. To qualify, taxpayers must meet the conditions set forth in i.r.m. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the failure, with no maximum.

Edit, Sign And Save Irs 5472 Form.

Web the penalty under irc § 6038a begins at $25,000, and the continuation penalty, which commences 90 days after notication of assessment, is $25,000 for each. Web the instructions for form 1120. Web in order to obtain an abatement of the penalties associated with a form 5472 penalty, it must be established that the individual that was assessed a penalty did not only act with. De required to file form 5472 can request an extension of time to file by filing form 7004.

/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)