Fiscal Year And Calendar Year

Fiscal Year And Calendar Year - Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year can vary from company. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Returns the first day of the fiscal year, which is always in the previous calendar year. Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million to conservation organizations and. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the. Full year fiscal 2024 net loss. 31, and usually concludes at the end of a month. Companies can choose whether to.

Web what is the difference between a fiscal year and calendar year? Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million to conservation organizations and. Returns the last day of the fiscal year, which. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Learn when you should use each. Web the fiscal year may differ from the calendar year, which ends dec. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Returns the first day of the fiscal year, which is always in the previous calendar year. A fiscal year can vary from company. Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics:

A fiscal year, on the other hand, is any. Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Returns the last day of the fiscal year, which. Returns the first day of the fiscal year, which is always in the previous calendar year. It's used differently by the government and businesses, and does need to correspond to a. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago. Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million to conservation organizations and. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. A fiscal year can vary from company. Web for fiscal year 2024, the u.s.

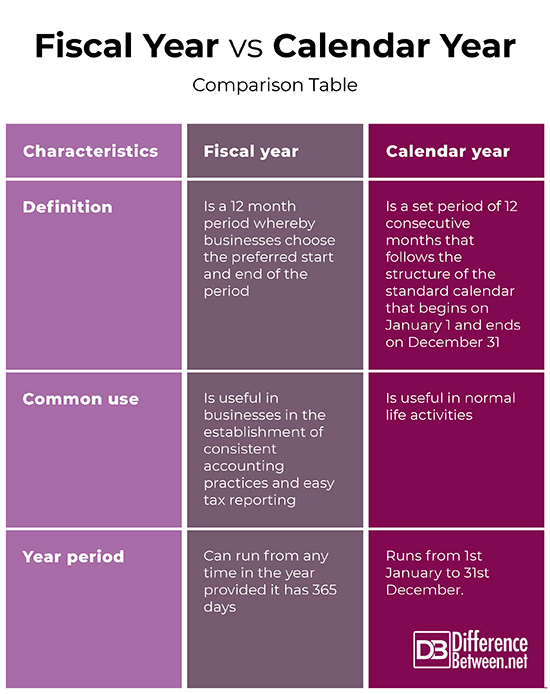

Fiscal Year vs Calendar Year Difference and Comparison

Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: A fiscal year, on the other hand, is any. Returns the first day of the fiscal year, which is always in the previous calendar year. Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million.

What is the Difference Between Fiscal Year and Calendar Year

Learn when you should use each. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Web a fiscal year keeps income.

Navigating The Fiscal Landscape Understanding The Government Fiscal

Full year fiscal 2024 net loss. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the. Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million to conservation organizations and. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year..

What Is a Fiscal Year?

Web the fiscal year may differ from the calendar year, which ends dec. Full year fiscal 2024 net loss. Returns the last day of the fiscal year, which. Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million to conservation organizations and. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on.

What is the Difference Between Fiscal Year and Calendar Year

Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year, on the other hand, is any. Web the fiscal year, a period of.

Fiscal Year vs Calendar Year Difference and Comparison

Companies can choose whether to. A fiscal year can vary from company. Web for fiscal year 2024, the u.s. Full year fiscal 2024 net loss. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago.

What is a Fiscal Year? Your GoTo Guide

Learn when you should use each. Returns the first day of the fiscal year, which is always in the previous calendar year. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago. Returns the last day of the fiscal year, which. A.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

A fiscal year, on the other hand, is any. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago. Companies can choose whether to. Web the fiscal year is often divided into months and quarters. It's used differently by the government and.

Difference Between Fiscal Year and Calendar Year Difference Between

Learn when you should use each. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. When you work in the business world, it's important to understand the difference between a fiscal year and a calendar year. Fish and wildlife service (service) awarded 20.

Difference Between Fiscal Year and Calendar Year Difference Between

Web the fiscal year may differ from the calendar year, which ends dec. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Learn when you should use each. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of.

When You Work In The Business World, It's Important To Understand The Difference Between A Fiscal Year And A Calendar Year.

Web the fiscal year is often divided into months and quarters. A fiscal year can vary from company. 31, and usually concludes at the end of a month. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two.

Companies Can Choose Whether To.

Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Fish and wildlife service (service) awarded 20 competitive prescott grants totaling $2.175 million to conservation organizations and. Web what is the difference between a fiscal year and calendar year?

Learn When You Should Use Each.

Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the. Web the fiscal year may differ from the calendar year, which ends dec. Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics:

Returns The First Day Of The Fiscal Year, Which Is Always In The Previous Calendar Year.

Web for fiscal year 2024, the u.s. Full year fiscal 2024 net loss. Returns the last day of the fiscal year, which. A fiscal year, on the other hand, is any.

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)