Florida Property Disclosure Form

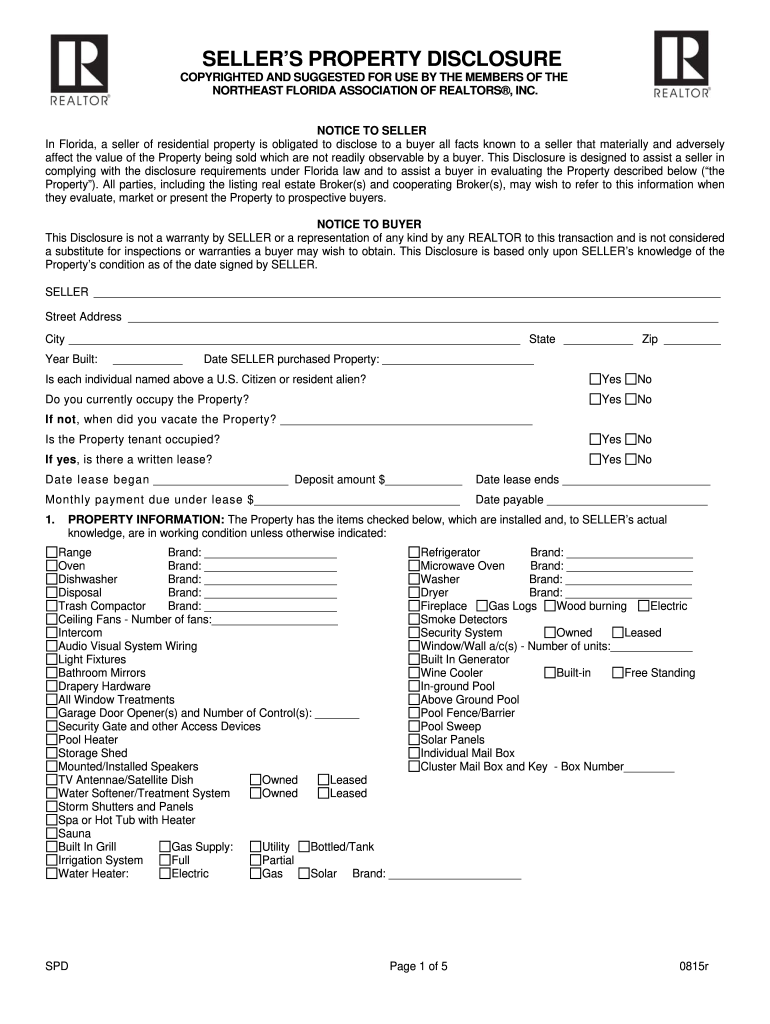

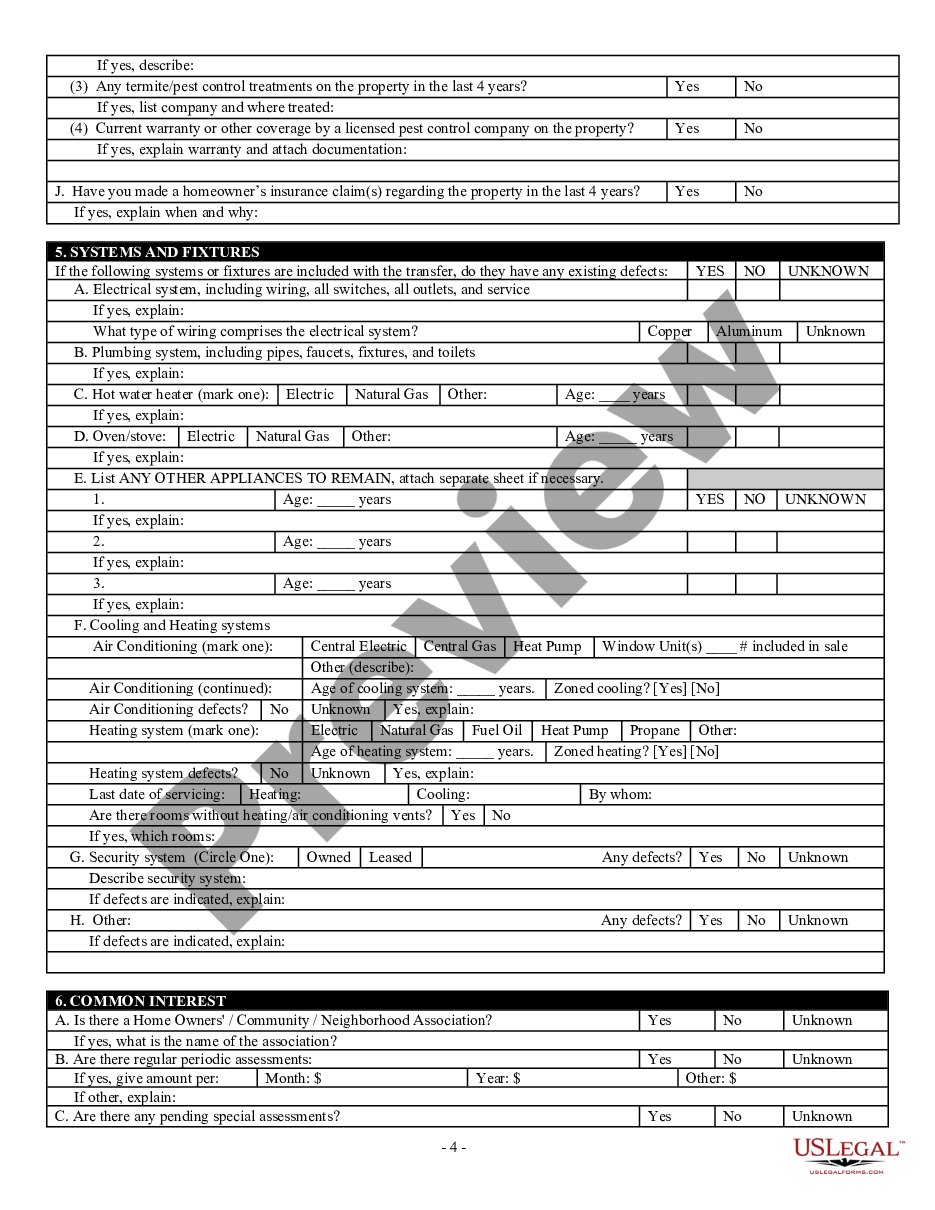

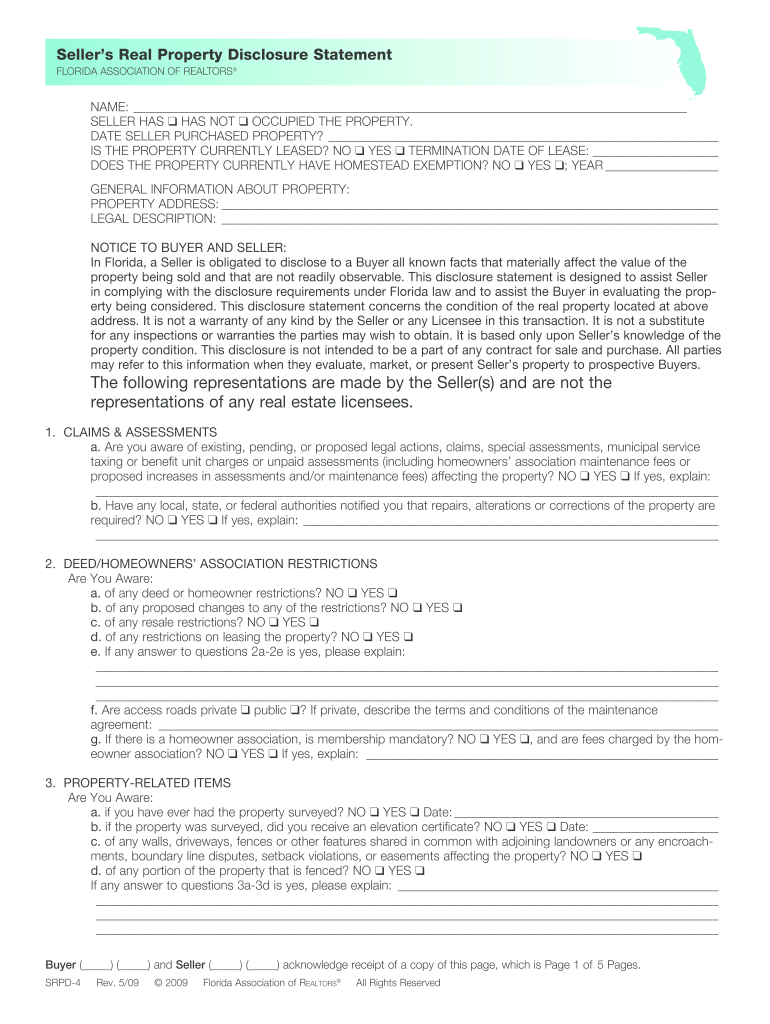

Florida Property Disclosure Form - Web the florida property disclosure form form is 4 pages long and contains: The amount of money on hand that can be obtained from real property. Web seller’s property disclosure in florida a seller of residential property is obligated to disclose to a buyer all facts known to a seller that materially and adversely affect the value of the property being sold which are not readily observable by a buyer. The form contains the name of the district and the amount of taxes and/or assessments due to the district. Pdf browse others forms related forms peel leadership framework for superintendents electrical subcontractor agreement t arlington. The florida seller’s disclosure form starts with a section that lists property features both basic and lavish — starting with simple features like your oven and dishwasher, and moving into less common household fixtures like saunas, smart home systems, and solar panels. Web the disclosure can be made in writing or verbally, although it is highly recommended to make the disclosure in writing in case any issue regarding disclosure pops up later. Notice to licensee and seller: The total amount of cash that a seller has on hand that is not tied up in real property. Web this form may be used when the property is subject to taxes and assessments imposed by a community development district that are in addition to other taxes/assessments provided by law.

Notice to licensee and seller: Web the florida property disclosure form form is 4 pages long and contains: The florida seller’s disclosure form starts with a section that lists property features both basic and lavish — starting with simple features like your oven and dishwasher, and moving into less common household fixtures like saunas, smart home systems, and solar panels. Web seller’s property disclosure in florida a seller of residential property is obligated to disclose to a buyer all facts known to a seller that materially and adversely affect the value of the property being sold which are not readily observable by a buyer. Web this form may be used when the property is subject to taxes and assessments imposed by a community development district that are in addition to other taxes/assessments provided by law. Web the florida seller disclosure form contains the following information: Web a florida property disclosure statement is a form provided to a home buyer that reveals the seller’s knowledge of material damage affecting the value and desirability of the property. The form identifies defects with the home itself and any legal issues or restrictions the property is subject to. Even if a home is being sold “as is,” the seller has an obligation to. The amount of money on hand that can be obtained from real property.

Web seller’s property disclosure in florida a seller of residential property is obligated to disclose to a buyer all facts known to a seller that materially and adversely affect the value of the property being sold which are not readily observable by a buyer. Web the florida seller disclosure form contains the following information: The form contains the name of the district and the amount of taxes and/or assessments due to the district. Web seller's property disclosure ─ residential. Pdf browse others forms related forms peel leadership framework for superintendents electrical subcontractor agreement t arlington. Notice to licensee and seller: Web the disclosure can be made in writing or verbally, although it is highly recommended to make the disclosure in writing in case any issue regarding disclosure pops up later. Florida law1 requires a seller of a home to disclose to the buyer all known facts that materially affect the value of the property being sold and that are not readily observable or known by the buyer. Web this form may be used when the property is subject to taxes and assessments imposed by a community development district that are in addition to other taxes/assessments provided by law. The total amount of cash that a seller has on hand that is not tied up in real property.

Fill Free fillable Florida Property Disclosure Form PDF form

The amount of money on hand that can be obtained from real property. The total amount of cash that a seller has on hand that is not tied up in real property. The florida seller’s disclosure form starts with a section that lists property features both basic and lavish — starting with simple features like your oven and dishwasher, and.

Ohio Residential Property Disclosure Form Pdf RAELST

Web a florida property disclosure statement is a form provided to a home buyer that reveals the seller’s knowledge of material damage affecting the value and desirability of the property. Pdf browse others forms related forms peel leadership framework for superintendents electrical subcontractor agreement t arlington. Web the florida property disclosure form form is 4 pages long and contains: Web.

Residential Property Disclosure Form Ohio Free Download

Web the disclosure can be made in writing or verbally, although it is highly recommended to make the disclosure in writing in case any issue regarding disclosure pops up later. Web the florida seller disclosure form contains the following information: Florida law1 requires a seller of a home to disclose to the buyer all known facts that materially affect the.

Fillable Online Residential Seller's Property Disclosure Statement

The florida seller’s disclosure form starts with a section that lists property features both basic and lavish — starting with simple features like your oven and dishwasher, and moving into less common household fixtures like saunas, smart home systems, and solar panels. Web the disclosure can be made in writing or verbally, although it is highly recommended to make the.

Florida Residential Real Estate Sales Disclosure Statement US Legal Forms

Web seller's property disclosure ─ residential. The form contains the name of the district and the amount of taxes and/or assessments due to the district. Notice to licensee and seller: Web seller’s property disclosure in florida a seller of residential property is obligated to disclose to a buyer all facts known to a seller that materially and adversely affect the.

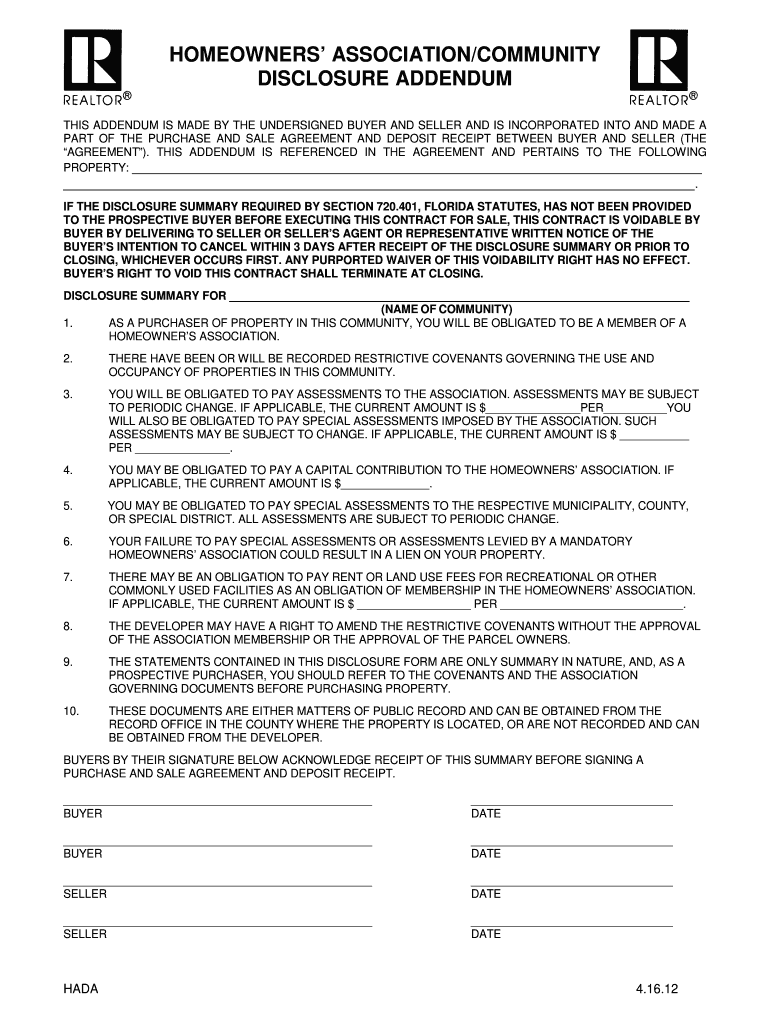

Hoa Addendum Florida Fill Online, Printable, Fillable, Blank pdfFiller

Web the florida seller disclosure form contains the following information: Web the disclosure can be made in writing or verbally, although it is highly recommended to make the disclosure in writing in case any issue regarding disclosure pops up later. Web seller’s property disclosure in florida a seller of residential property is obligated to disclose to a buyer all facts.

Florida Residential Real Estate Sales Disclosure Statement US Legal Forms

Notice to licensee and seller: Web seller's property disclosure ─ residential. The amount of money on hand that can be obtained from real property. Web the florida seller disclosure form contains the following information: The total amount of cash that a seller has on hand that is not tied up in real property.

Florida Sellers Disclosure Form 2022 Fill Online, Printable, Fillable

Web a florida property disclosure statement is a form provided to a home buyer that reveals the seller’s knowledge of material damage affecting the value and desirability of the property. The form contains the name of the district and the amount of taxes and/or assessments due to the district. Web the florida seller disclosure form contains the following information: The.

Florida Residential Real Estate Sales Disclosure Statement Florida

Even if a home is being sold “as is,” the seller has an obligation to. Web this form may be used when the property is subject to taxes and assessments imposed by a community development district that are in addition to other taxes/assessments provided by law. The florida seller’s disclosure form starts with a section that lists property features both.

Florida Sellers Disclosure Form 2022 Fill Out and Sign Printable PDF

Web the florida property disclosure form form is 4 pages long and contains: The form contains the name of the district and the amount of taxes and/or assessments due to the district. Florida law1 requires a seller of a home to disclose to the buyer all known facts that materially affect the value of the property being sold and that.

Florida Law1 Requires A Seller Of A Home To Disclose To The Buyer All Known Facts That Materially Affect The Value Of The Property Being Sold And That Are Not Readily Observable Or Known By The Buyer.

Notice to licensee and seller: Web seller's property disclosure ─ residential. Web seller’s property disclosure in florida a seller of residential property is obligated to disclose to a buyer all facts known to a seller that materially and adversely affect the value of the property being sold which are not readily observable by a buyer. Web the florida property disclosure form form is 4 pages long and contains:

The Form Identifies Defects With The Home Itself And Any Legal Issues Or Restrictions The Property Is Subject To.

The amount of money on hand that can be obtained from real property. Pdf browse others forms related forms peel leadership framework for superintendents electrical subcontractor agreement t arlington. Web the disclosure can be made in writing or verbally, although it is highly recommended to make the disclosure in writing in case any issue regarding disclosure pops up later. Web the florida seller disclosure form contains the following information:

The Total Amount Of Cash That A Seller Has On Hand That Is Not Tied Up In Real Property.

The florida seller’s disclosure form starts with a section that lists property features both basic and lavish — starting with simple features like your oven and dishwasher, and moving into less common household fixtures like saunas, smart home systems, and solar panels. Web a florida property disclosure statement is a form provided to a home buyer that reveals the seller’s knowledge of material damage affecting the value and desirability of the property. The form contains the name of the district and the amount of taxes and/or assessments due to the district. Web this form may be used when the property is subject to taxes and assessments imposed by a community development district that are in addition to other taxes/assessments provided by law.