Foreign Income Form

Foreign Income Form - United states gift (and generation skipping transfer) tax return. Get ready for tax season deadlines by completing any required tax forms today. For the purposes of form 1116, the irs identifies. Web you must pay u.s. Web the foreign earned income exclusion is designed to allow american citizens and legal residents who reside outside the country to exclude most or all of the income earned. Web here is a step by step guide to report foreign incomes in itr form. Web foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. We have decades of experience with holistic international tax strategies and planning. Expatriates use this form to reduce withholding on their us w2.

Web here is a step by step guide to report foreign incomes in itr form. Web after classifying your foreign income by category, you must complete a separate form for each of the seven types of income you may have: Web however, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2020, $108,700 for 2021,. Expatriates use this form to reduce withholding on their us w2. Ad our international tax services can be customized to fit your specific business needs. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Web the foreign earned income exclusion is designed to allow american citizens and legal residents who reside outside the country to exclude most or all of the income earned. You are not considered to have a tax home in a foreign country for any period during which your abode is in the united states unless, for tax years beginning after. Income tax on your foreign income regardless of where you reside if you are a u.s. Web schedule fa was introduced to combat tax evasion and money laundering.

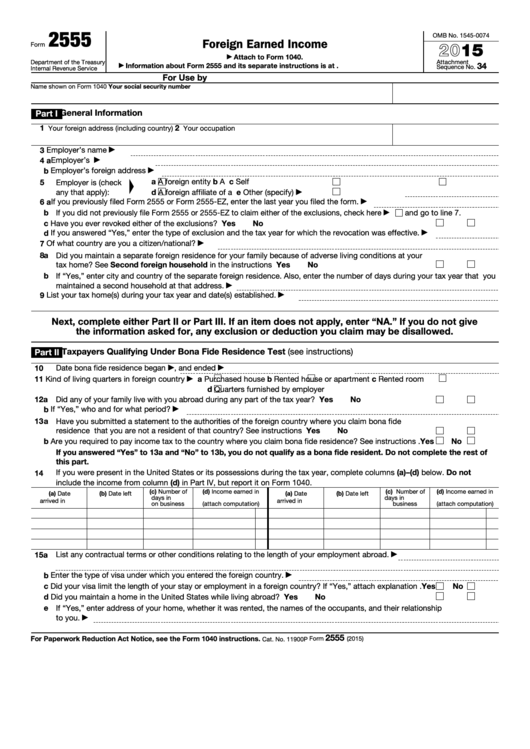

Web a corporation created or organized in the united states or under the law of the united states or of any state, or the district of columbia, any estate or trust other than a foreign. Web form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the. Web 2018 form 1040—line 11a foreign earned income tax worksheet—line 11a. Web the foreign earned income exclusion is designed to allow american citizens and legal residents who reside outside the country to exclude most or all of the income earned. Web of course, first, we need to identify exactly what the irs considers income when it’s earned in another country. Ad our international tax services can be customized to fit your specific business needs. Expatriates use this form to reduce withholding on their us w2. Web you must pay u.s. Web if you are a u.s. We have decades of experience with holistic international tax strategies and planning.

Undisclosed Foreign and Assets Enterslice

Complete, edit or print tax forms instantly. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Citizen or resident alien, you must report income from sources outside the united states (foreign income) on your tax return unless it is. Web however, you.

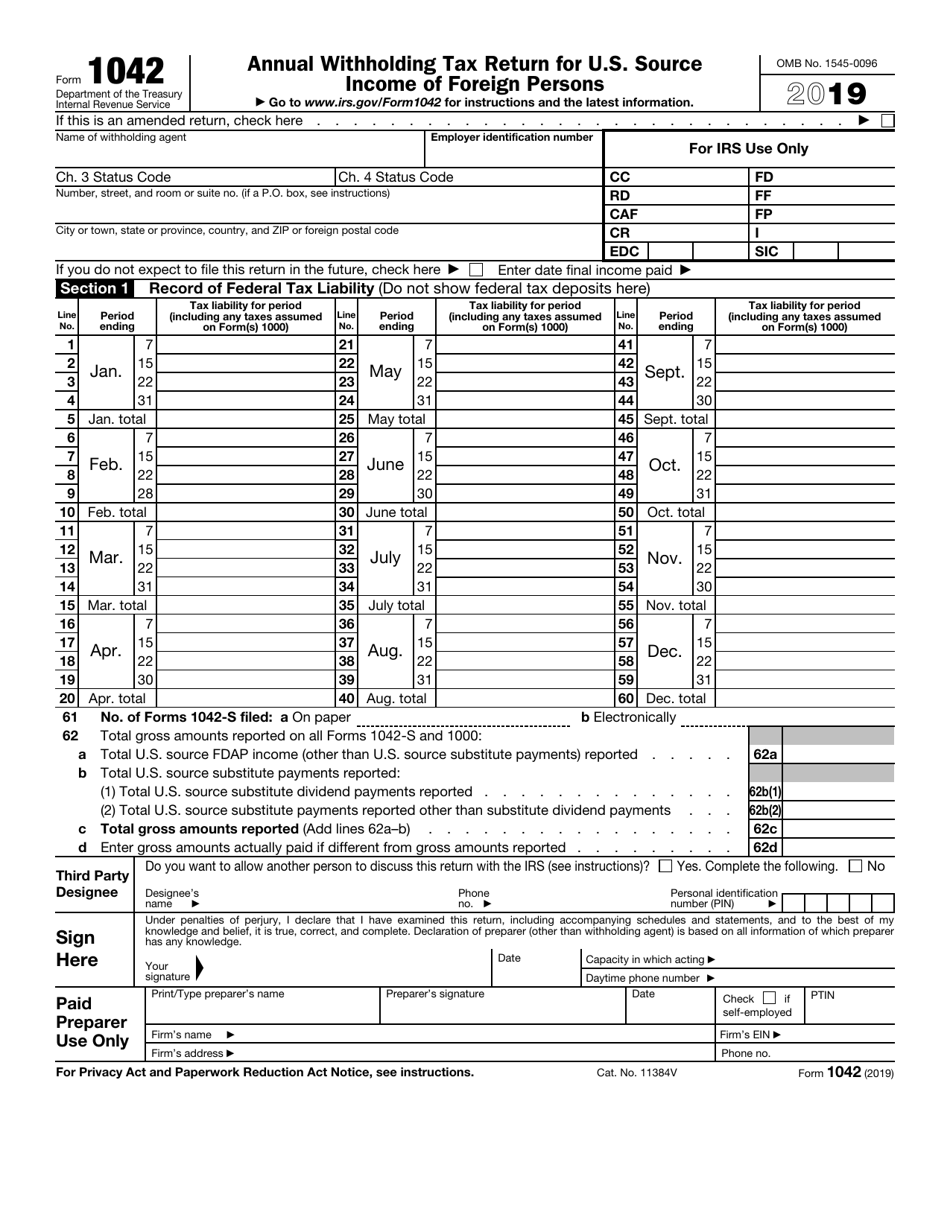

IRS Form 1042 Download Fillable PDF or Fill Online Annual Withholding

Complete, edit or print tax forms instantly. For the purposes of form 1116, the irs identifies. Web 2018 form 1040—line 11a foreign earned income tax worksheet—line 11a. Web a corporation created or organized in the united states or under the law of the united states or of any state, or the district of columbia, any estate or trust other than.

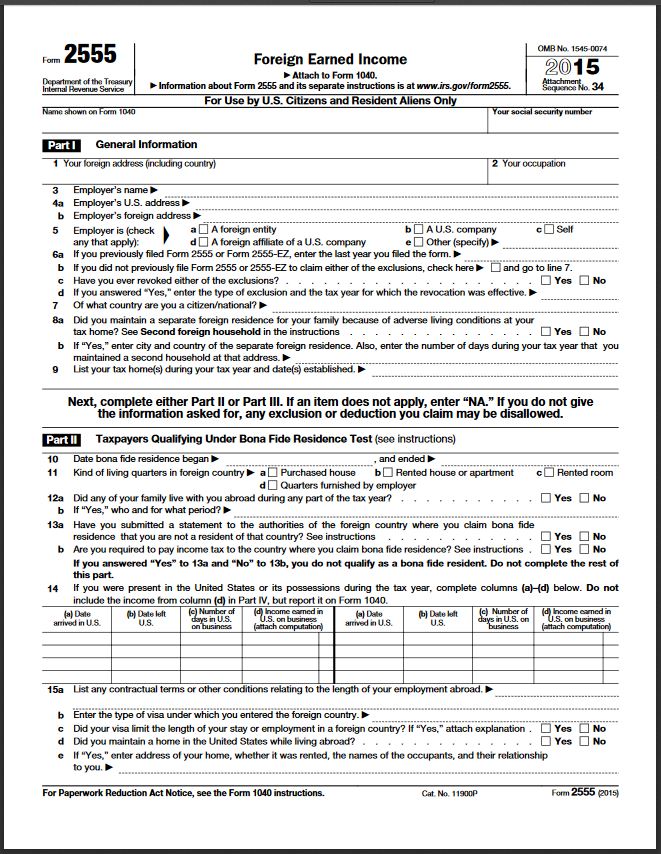

Foreign Earned Exclusion Form 2555 Verni Tax Law

Web form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the. Web for this purpose, foreign earned income is income you receive for services you perform in a foreign country in a period during which your tax home is in a foreign..

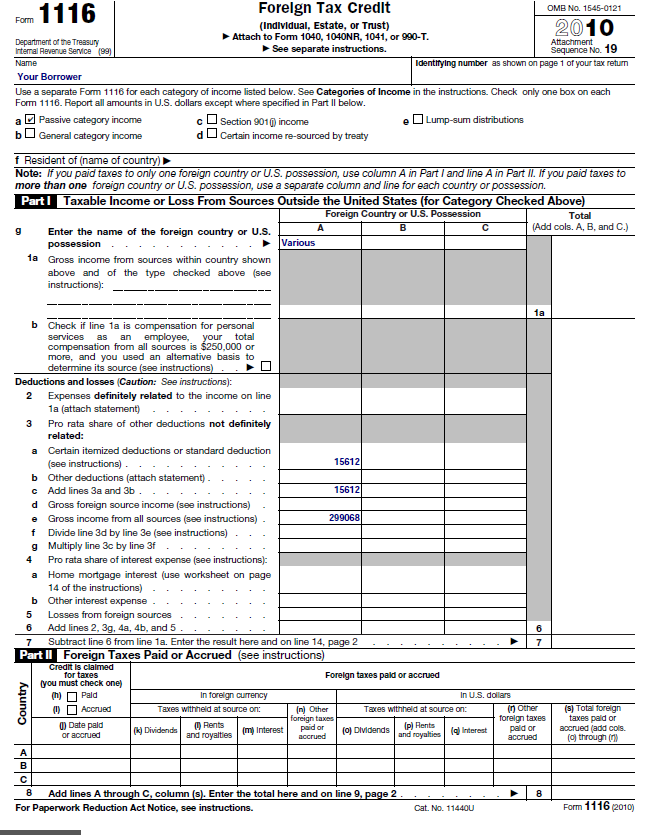

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

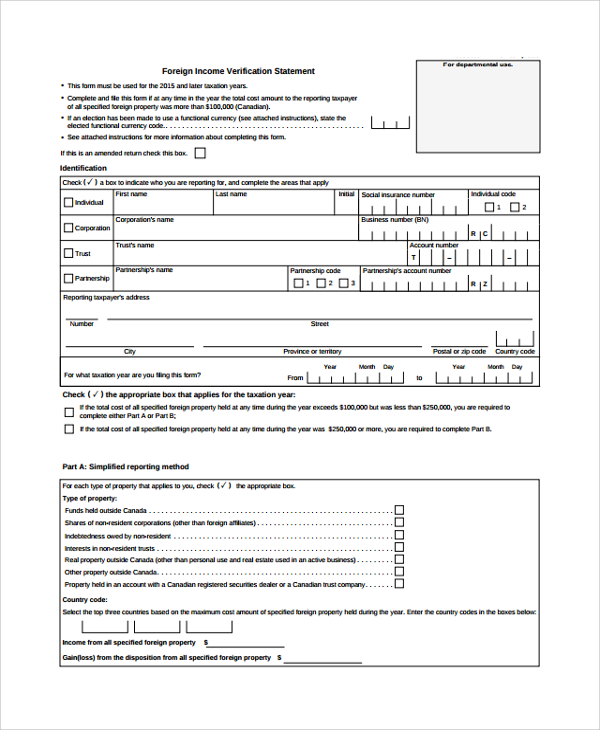

See general information for details. This section of the program contains information for part iii of the schedule k. We have decades of experience with holistic international tax strategies and planning. Web t1135 foreign income verification statement. If form 1040, line 10, is zero, don’t complete this worksheet.

Linda Keith CPA » Do I include Foreign Source in Tax Return Cash

Expatriates use this form to reduce withholding on their us w2. Web the foreign earned income exclusion is designed to allow american citizens and legal residents who reside outside the country to exclude most or all of the income earned. Web however, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually.

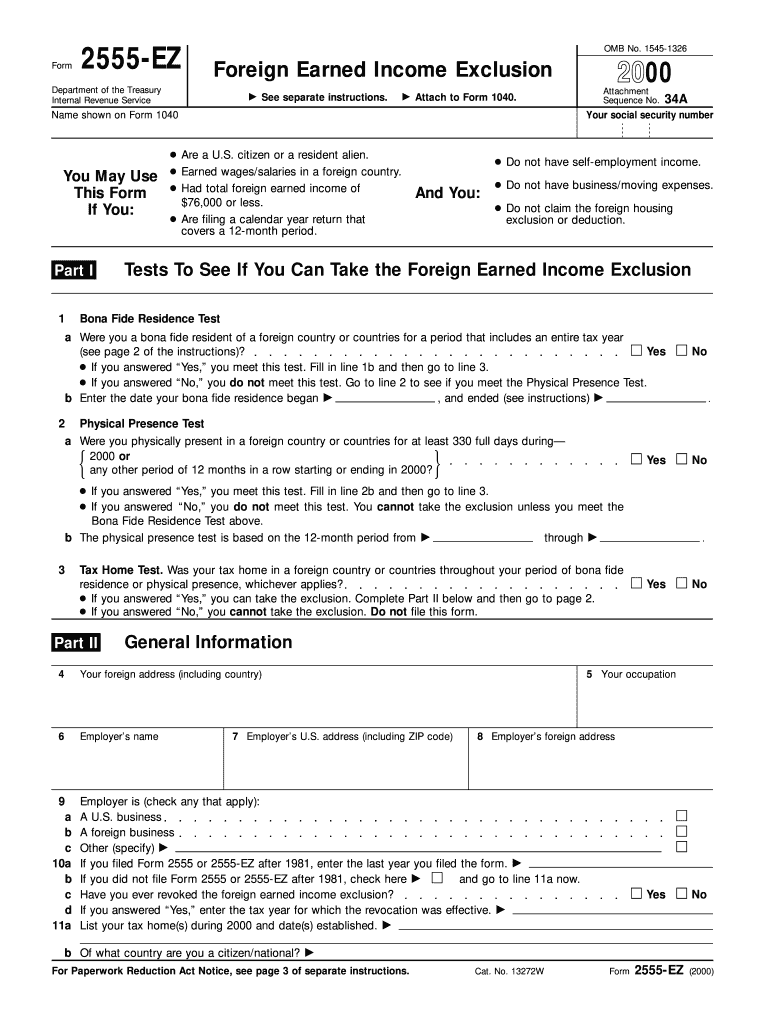

Form 2555 EZ Foreign Earned Exclusion Irs Fill Out and Sign

Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. For the purposes of form 1116, the irs identifies. Web 2018 form 1040—line 11a foreign earned income tax worksheet—line 11a. Expatriates use this form to reduce withholding on their us w2. This section.

Paying Tax on Foreign Roy A McDonald

Expatriates use this form to reduce withholding on their us w2. See general information for details. Complete, edit or print tax forms instantly. Ad our international tax services can be customized to fit your specific business needs. For best results, download and open this form in adobe reader.

Fillable Form 2555 Foreign Earned 2015 printable pdf download

Web in year 1, a pays $2,000 of foreign income taxes on passive category income other than capital gains which was reported to a on a qualified payee statement. Citizen or resident alien, you must report income from sources outside the united states (foreign income) on your tax return unless it is. Web however, you may qualify to exclude your.

FREE 9+ Sample Verification Forms in PDF MS Word

Web of course, first, we need to identify exactly what the irs considers income when it’s earned in another country. This section of the program contains information for part iii of the schedule k. Web after classifying your foreign income by category, you must complete a separate form for each of the seven types of income you may have: Ad.

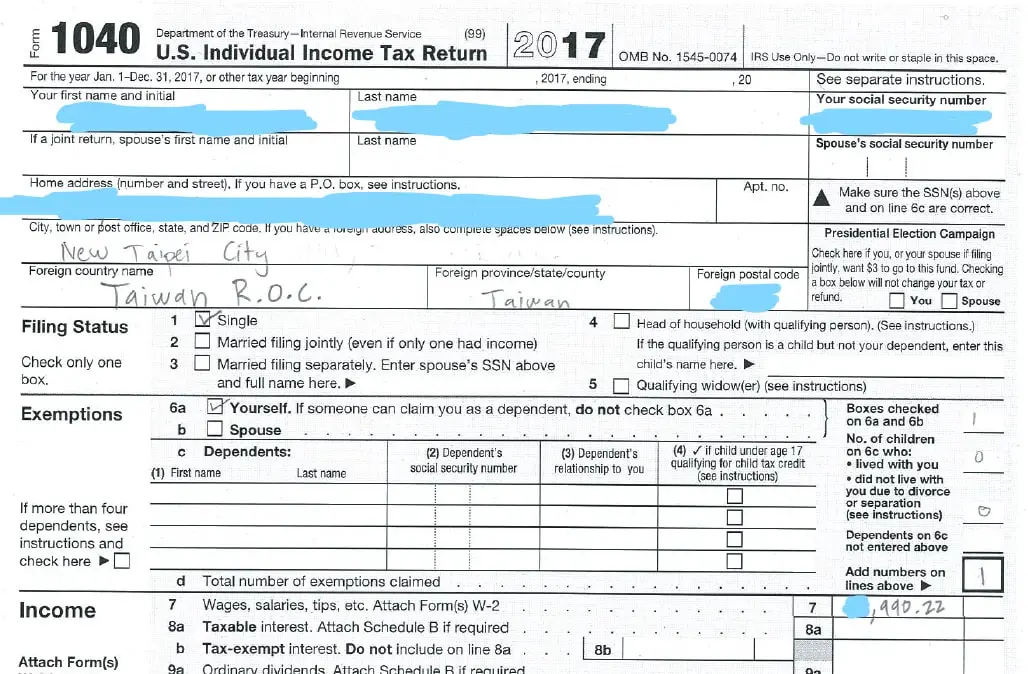

Tax Filing Guide for American Expats Abroad Foreigners in

We have decades of experience with holistic international tax strategies and planning. See general information for details. Web however, you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation ($107,600 for 2020, $108,700 for 2021,. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of.

Web The Foreign Earned Income Exclusion Is Designed To Allow American Citizens And Legal Residents Who Reside Outside The Country To Exclude Most Or All Of The Income Earned.

Web a corporation created or organized in the united states or under the law of the united states or of any state, or the district of columbia, any estate or trust other than a foreign. Web 2018 form 1040—line 11a foreign earned income tax worksheet—line 11a. For best results, download and open this form in adobe reader. For the purposes of form 1116, the irs identifies.

Complete, Edit Or Print Tax Forms Instantly.

We have decades of experience with holistic international tax strategies and planning. Web schedule fa was introduced to combat tax evasion and money laundering. Web section 43 of the black money (undisclosed foreign income & assets) & imposition of tax act 2015 has a provision for imposing a penalty of rs. Getty images naveen wadhwa ca naveen wadhwa, dgm, r&d, taxmann manila mehta.

United States Gift (And Generation Skipping Transfer) Tax Return.

You are not considered to have a tax home in a foreign country for any period during which your abode is in the united states unless, for tax years beginning after. Web here is a step by step guide to report foreign incomes in itr form. Web foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. If form 1040, line 10, is zero, don’t complete this worksheet.

Web After Classifying Your Foreign Income By Category, You Must Complete A Separate Form For Each Of The Seven Types Of Income You May Have:

Citizen or resident alien, you must report income from sources outside the united states (foreign income) on your tax return unless it is. Income tax on your foreign income regardless of where you reside if you are a u.s. Web t1135 foreign income verification statement. This section of the program contains information for part iii of the schedule k.