Form 1045 Instructions

Form 1045 Instructions - Web form 1045 by fax. Form 1045, net operating loss worksheet. The carryback of a net operating loss (nol) the carryback of an unused general business credit. Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. Application for tentative refund is an internal revenue service (irs) form used by individuals, estates, and trusts to apply for a quick tax refund. Solved•by intuit•76•updated january 30, 2023. Don't include form 1045 in the same envelope as your 2022 income tax return. The carryback of a net section 1256 contracts loss. Click + next to the forms and schedules manila folder (if that section is not already expanded). The carryback of an nol.

The carryback of an nol. The carryback of a net section 1256 contracts loss. This tax form is often used to. The carryback of an unused general business credit. According to the instructions for. (don’t attach to tax return.) go to www.irs.gov/form1045 for instructions and the latest information. Click + next to the forms and schedules manila folder (if that section is not already expanded). Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. Solved•by intuit•76•updated january 30, 2023. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from:

The carryback of an nol. Form 1045, net operating loss worksheet. Web file form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2022 income tax return. You may only file by fax if you're filing form 1045 to apply for tentative refunds for changes in the nol rules under the cares act. Web form 1045 by fax. Click + next to the forms and schedules manila folder (if that section is not already expanded). The carryback of an unused general business credit. Web about form 1045, application for tentative refund. According to the instructions for. Application for tentative refund is an internal revenue service (irs) form used by individuals, estates, and trusts to apply for a quick tax refund.

form 1045 instructions 20202022 Fill Online, Printable, Fillable

This tax form is often used to. From within your taxact return ( online ), click the tools dropdown, then click forms assistant. File form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2019 income tax return. The carryback of a net operating loss (nol) the carryback of.

Instructions For Form 1045 (Rev. February 2006) 2005 printable pdf

File form 1045 with the internal revenue service center for the place where you live as shown in the instructions for your 2019 income tax return. Don't include form 1045 in the same envelope as your 2022 income tax return. Web form 1045 by fax. The carryback of a net section 1256 contracts loss. The carryback of an unused general.

Instructions For Form 1045 Application For Tentative Refund 2007

From within your taxact return ( online ), click the tools dropdown, then click forms assistant. The carryback of a net operating loss (nol) the carryback of an unused general business credit. Web irs form 1045 is a tax form that some individuals, estates, or trusts use to quickly receive a tax refund related to a previous tax filing rather.

Instructions For Form 1045 Application For Tentative Refund 2010

Web about form 1045, application for tentative refund. The carryback of a net section 1256 contracts loss. Form 1045, net operating loss worksheet. Application for tentative refund is an internal revenue service (irs) form used by individuals, estates, and trusts to apply for a quick tax refund. Web form 1045 by fax.

Instructions For Form 1045 Application For Tentative Refund 2017

Don't include form 1045 in the You may only file by fax if you're filing form 1045 to apply for tentative refunds for changes in the nol rules under the cares act. Click + next to the forms and schedules manila folder (if that section is not already expanded). Application for tentative refund is an internal revenue service (irs) form.

Form 1045 Application For Tentative Refund 1995 printable pdf download

The carryback of an nol. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The carryback of a net section 1256 contracts loss. Don't include form 1045 in the same envelope as your 2022 income tax return. Generally, you must file form 1045 on or after the date you file your tax.

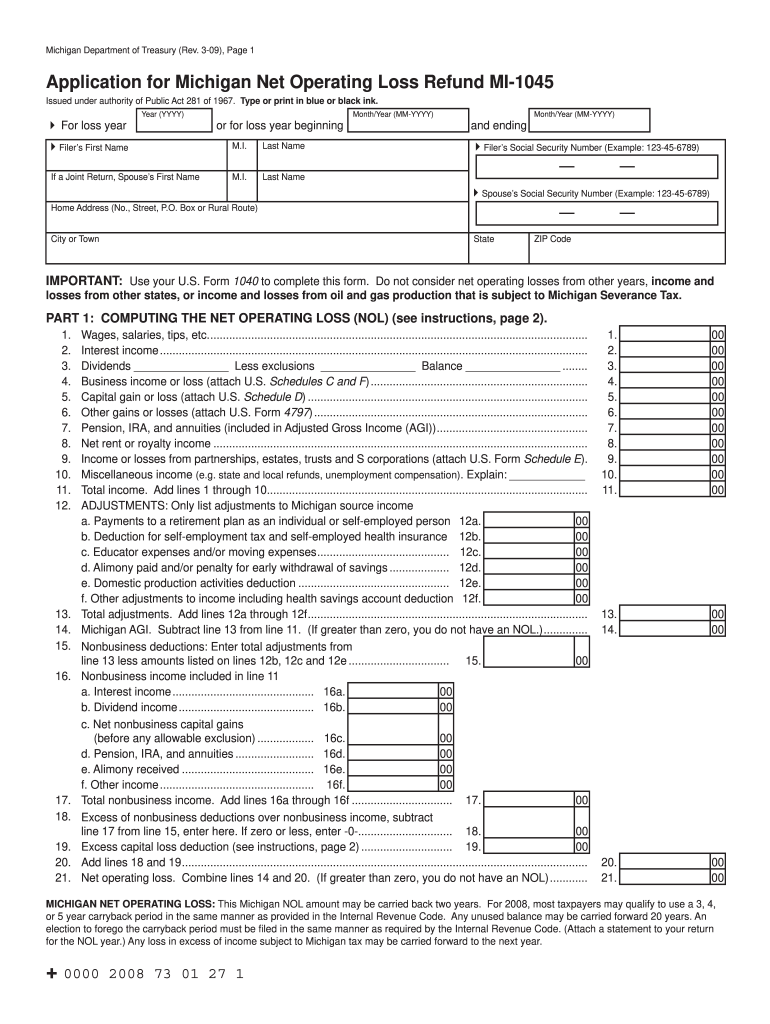

Mi 1045 Fill Online, Printable, Fillable, Blank pdfFiller

Web irs form 1045 is a tax form that some individuals, estates, or trusts use to quickly receive a tax refund related to a previous tax filing rather than receiving the refund by filing an amended tax return. The carryback of an nol. Solved•by intuit•76•updated january 30, 2023. Web about form 1045, application for tentative refund. The carryback of a.

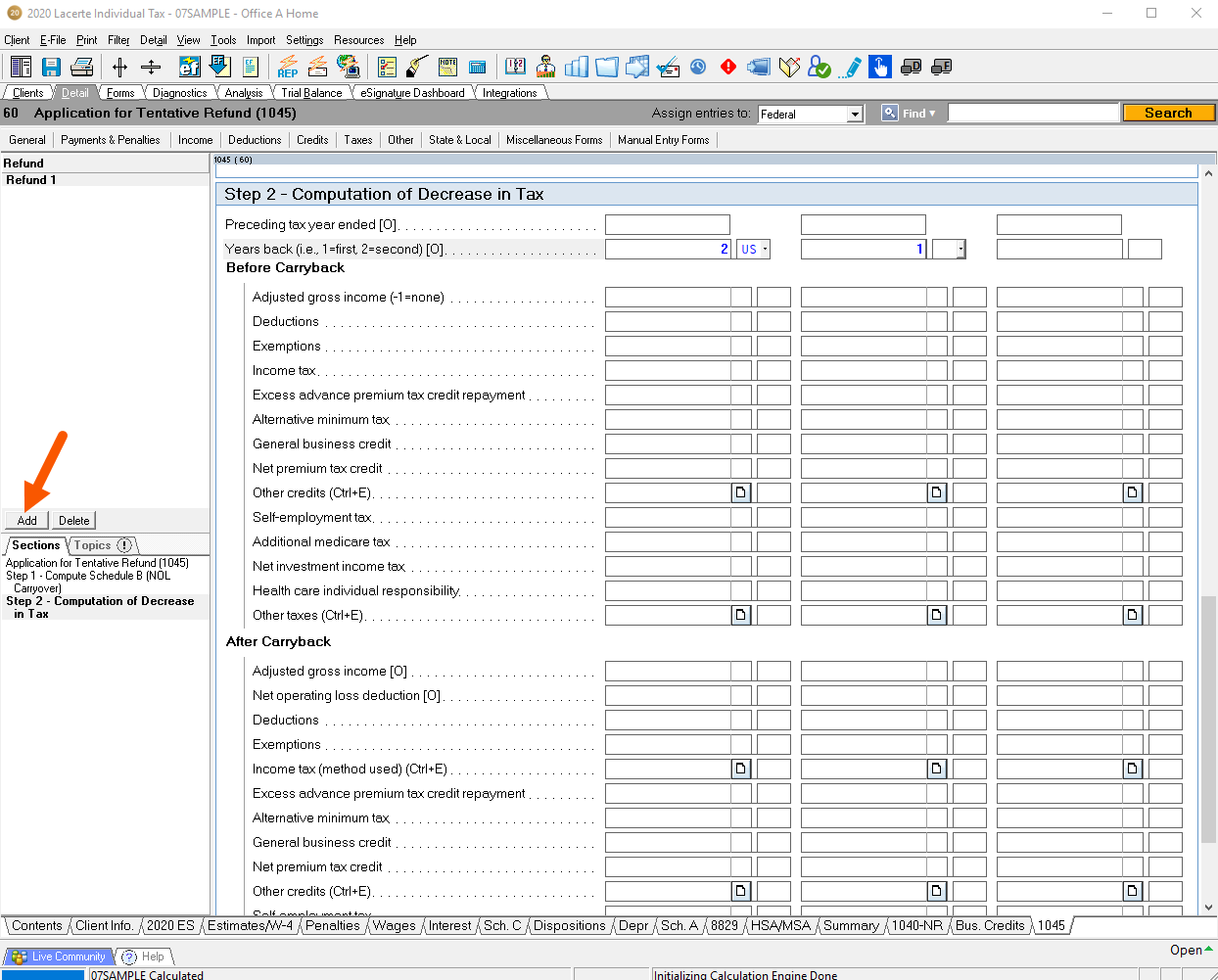

Generating Form 1045 Application for Tentative Refund

The carryback of a net operating loss (nol) the carryback of an unused general business credit. (don’t attach to tax return.) go to www.irs.gov/form1045 for instructions and the latest information. Click + next to the forms and schedules manila folder (if that section is not already expanded). If the last day of the nol year falls on a saturday, sunday,.

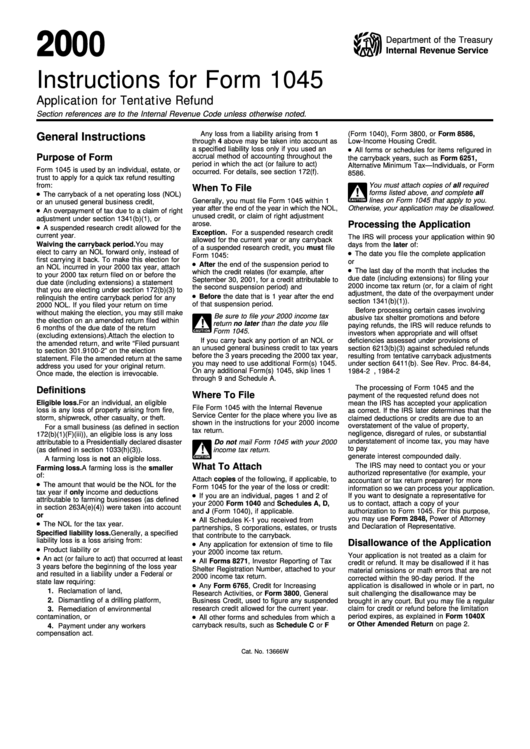

Instructions For Form 1045 Application For Tentative Refund 2000

Web form 1045 2022 application for tentative refund department of the treasury internal revenue service for individuals, estates, or trusts. From within your taxact return ( online ), click the tools dropdown, then click forms assistant. According to the instructions for. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Form 1045,.

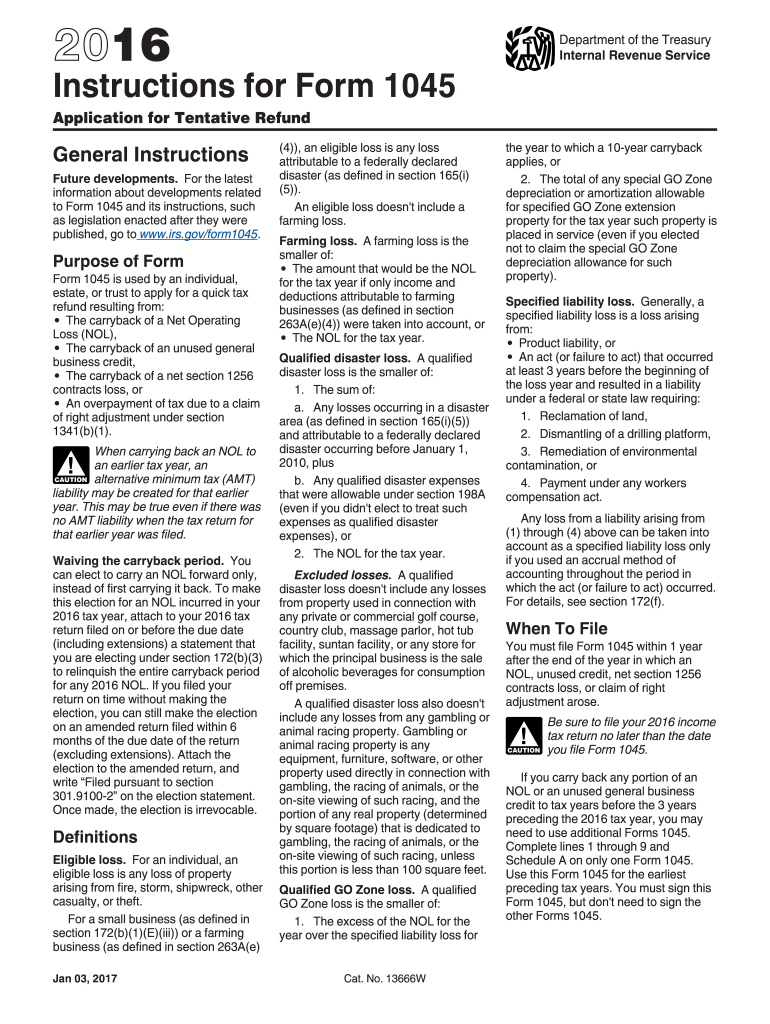

Form 1045 Instruction 2016 Fill Out and Sign Printable PDF Template

Form 1045, net operating loss worksheet. (don’t attach to tax return.) go to www.irs.gov/form1045 for instructions and the latest information. The carryback of a net operating loss (nol) the carryback of an unused general business credit. The carryback of an unused general business credit. The carryback of a net section 1256 contracts loss.

(Don’t Attach To Tax Return.) Go To Www.irs.gov/Form1045 For Instructions And The Latest Information.

Web form 1045 2022 application for tentative refund department of the treasury internal revenue service for individuals, estates, or trusts. The carryback of an unused general business credit. Form 1045 is used by an individual, estate, or trust to apply for a quick tax refund resulting from: From within your taxact return ( online ), click the tools dropdown, then click forms assistant.

File Form 1045 With The Internal Revenue Service Center For The Place Where You Live As Shown In The Instructions For Your 2019 Income Tax Return.

Solved•by intuit•76•updated january 30, 2023. This tax form is often used to. Don't include form 1045 in the Click + next to the forms and schedules manila folder (if that section is not already expanded).

An Individual, Estate, Or Trust Files Form 1045 To Apply For A Quick Tax Refund Resulting From:

You may only file by fax if you're filing form 1045 to apply for tentative refunds for changes in the nol rules under the cares act. Don't include form 1045 in the same envelope as your 2022 income tax return. Application for tentative refund is an internal revenue service (irs) form used by individuals, estates, and trusts to apply for a quick tax refund. The carryback of an unused general business credit.

According To The Instructions For.

Web generating form 1045 application for tentative refund. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Form 1045, net operating loss worksheet. The carryback of an nol.