Form 1065 For Rental Properties

Form 1065 For Rental Properties - The form allows you to record. Web up to 25% cash back these must file an annual tax form with the irs (form 1065, u.s. Web the fair market value of property or services received in lieu of monetary rental payments. Web form 1065 is a tax document used to report the profits, losses and deductions of business partnerships. Fill, sign, email irs 1065 & more fillable forms, register and subscribe now! Form 8825 rental real estate income and expenses of a partnership or an s corporation (one for each member) schedule k. Used by the fiduciary of a domestic decedent’s estate, trust,. And the total assets at the end of the tax year. Web the partnership will report your share of qualified rehabilitation expenditures and other information you need to complete form 3468 for property not related to rental. Web report the rental properties as 'converted to personal use' in the rental section ( property profile and assets/depreciation section).

However, if you and your. Web up to 25% cash back these must file an annual tax form with the irs (form 1065, u.s. Web form 1065 is a tax document used to report the profits, losses and deductions of business partnerships. Ad download or email irs 1065 & more fillable forms, register and subscribe now! Web filing 1065 for llc partnership that owns rental property i am currently in the process of filing the 1065 for my llc partnership which was formed this year for a. Web report the rental properties as 'converted to personal use' in the rental section ( property profile and assets/depreciation section). If the partnership's principal business, office, or agency is located in: Form 1065 is used to report partnership revenues, expenses,. Web the fair market value of property or services received in lieu of monetary rental payments. Web form 1065 2022 u.s.

Used by the fiduciary of a domestic decedent’s estate, trust,. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. Form 8825 rental real estate income and expenses of a partnership or an s corporation (one for each member) schedule k. The form allows you to record. Web filing 1065 for llc partnership that owns rental property i am currently in the process of filing the 1065 for my llc partnership which was formed this year for a. In addition to form 1065, partnerships must also. Web where to file your taxes for form 1065. Web form 1065 is a tax document used to report the profits, losses and deductions of business partnerships. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Web up to 25% cash back these must file an annual tax form with the irs (form 1065, u.s.

Llc Tax Form 1065 Universal Network

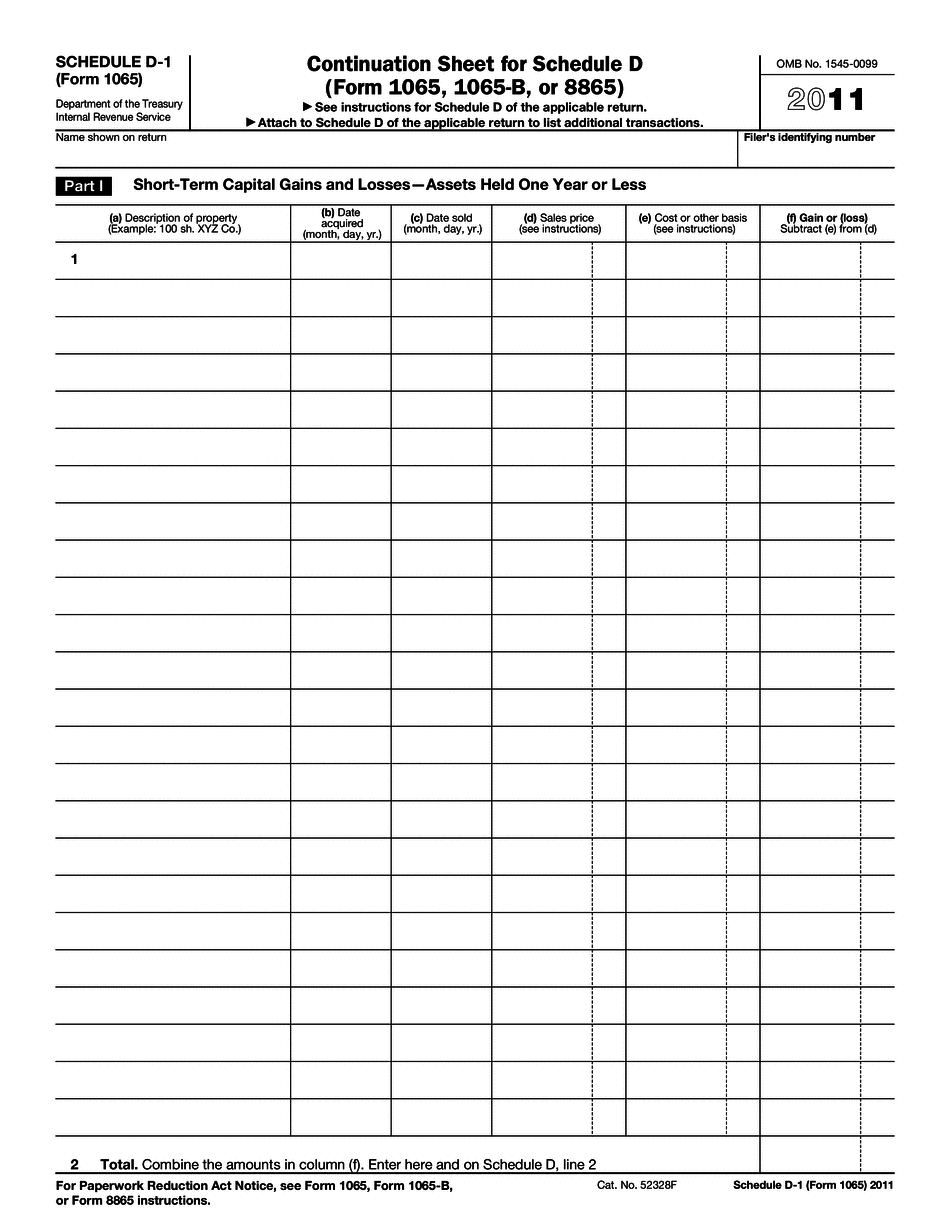

Web use schedule d (form 1065) to report the following. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. In addition to form 1065, partnerships must also. Web the partnership will report your share of qualified rehabilitation expenditures and other information you need to complete form.

Form 1065x Editable Fill out and Edit Online PDF Template

In addition to form 1065, partnerships must also. And the total assets at the end of the tax year. The form allows you to record. Web the purpose of this form is to address rental property issues to promote greater compliance with health and safety standards and preserve the quality of kansas city. Return of partnership income department of the.

Form 1065 Corporate

Form 1065 is used to report partnership revenues, expenses,. Complete, edit or print tax forms instantly. Web report the rental properties as 'converted to personal use' in the rental section ( property profile and assets/depreciation section). Web the fair market value of property or services received in lieu of monetary rental payments. However, if you and your.

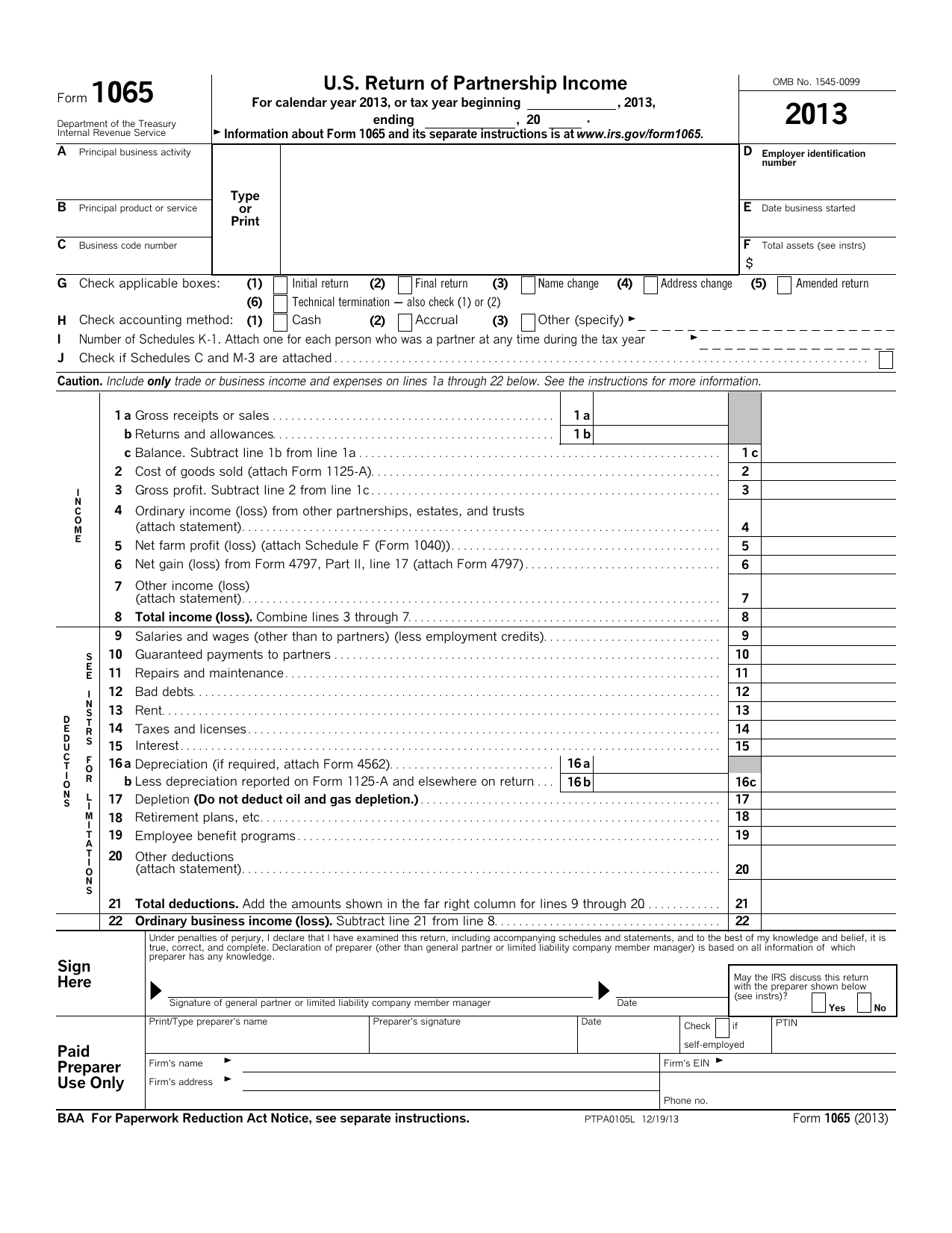

Form 1065 (2013)

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web form 1065 us partnership return. Web use schedule d (form 1065) to report the following. Web up to 25% cash back these must file an annual.

Form 1065 Tax Software Universal Network

Complete, edit or print tax forms instantly. Web the purpose of this form is to address rental property issues to promote greater compliance with health and safety standards and preserve the quality of kansas city. Web the fair market value of property or services received in lieu of monetary rental payments. Web where to file your taxes for form 1065..

Form 1065B U.S. Return of for Electing Large Partnerships

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. Form 8825 rental real estate income and expenses of a partnership or an s corporation (one for each member) schedule k. Web where to file your taxes for form 1065. In addition to form 1065, partnerships must also. Web irs form.

Form 1065B U.S. Return of for Electing Large Partnerships

The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets. Web form 1065 is a tax document used to report the profits, losses and deductions of business partnerships. Get ready for tax season deadlines by completing any required tax forms today. Web the fair market value of property or services received.

Form 1065 2022 Fill out and Edit Online PDF Template

If the partnership's principal business, office, or agency is located in: Used by the fiduciary of a domestic decedent’s estate, trust,. Web the application automatically calculates the net gain or loss from the sale of rental property included as ordinary income on form 4797, enter an amount, including 0 (zero) to. Fill, sign, email irs 1065 & more fillable forms,.

Form 1065 StepbyStep Instructions (+Free Checklist)

Web the purpose of this form is to address rental property issues to promote greater compliance with health and safety standards and preserve the quality of kansas city. Get ready for tax season deadlines by completing any required tax forms today. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities,.

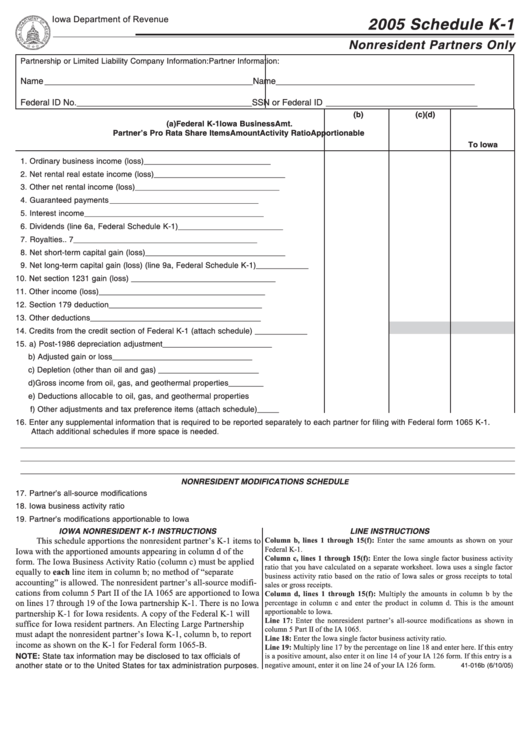

Fillable Form Ia 1065 Schedule K1 Nonresident Partners Only 2005

Web rental businesses must be registered and licensed to do business in kansas city, missouri. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Form 8825 rental real estate income and.

Web The Purpose Of This Form Is To Address Rental Property Issues To Promote Greater Compliance With Health And Safety Standards And Preserve The Quality Of Kansas City.

And the total assets at the end of the tax year. Web irs form 8825 is a special tax form specifically for reporting the rental income and expenses of a partnership or s corporation. Complete, edit or print tax forms instantly. The total capital gains and losses from transactions reported on form 8949, sales and other dispositions of capital assets.

Web Up To 25% Cash Back These Must File An Annual Tax Form With The Irs (Form 1065, U.s.

Form 1065 is used to report partnership revenues, expenses,. Web use schedule d (form 1065) to report the following. Fill, sign, email irs 1065 & more fillable forms, register and subscribe now! The form allows you to record.

Web Form 1065 Is A Tax Document Used To Report The Profits, Losses And Deductions Of Business Partnerships.

Form 8825 rental real estate income and expenses of a partnership or an s corporation (one for each member) schedule k. Used by the fiduciary of a domestic decedent’s estate, trust,. If the partnership's principal business, office, or agency is located in: Web the partnership will report your share of qualified rehabilitation expenditures and other information you need to complete form 3468 for property not related to rental.

Web Where To File Your Taxes For Form 1065.

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest. In addition to form 1065, partnerships must also. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from.