Form 1099-Nec Due Date 2023

Form 1099-Nec Due Date 2023 - Web 4th quarter 2022 estimated tax payment due: Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer. The deadline to send the. Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal. Copy a & copy b should be filed by january 31. Takes 5 minutes or less to complete. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Furnishing due date for information returns payers must. But, with the right preparation and understanding, you can keep your business compliant and off of.

Do not miss the deadline. Copy a & copy b should be filed by january 31. Furnishing due date for information returns payers must. The deadline to send the. Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing). Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Get ready for tax season deadlines by completing any required tax forms today. Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Takes 5 minutes or less to complete.

Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing). But, with the right preparation and understanding, you can keep your business compliant and off of. Copy a & copy b should be filed by january 31. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web 1099 due dates for 2022: Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Get ready for tax season deadlines by completing any required tax forms today. Takes 5 minutes or less to complete. The deadline to send the. Simply answer a few question to instantly download, print & share your form.

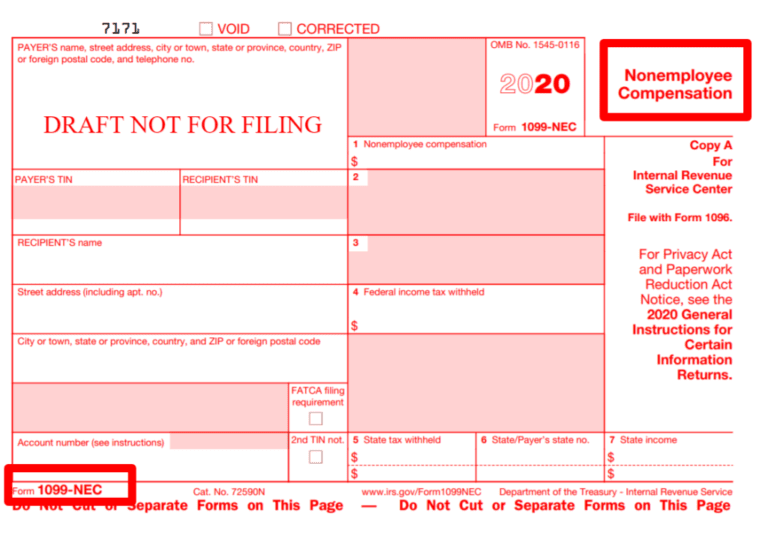

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Furnishing due date for information returns payers must. Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? The deadline to send the. Takes 5 minutes or less to complete.

How to File Your Taxes if You Received a Form 1099NEC

Tax payers submit payments in box eight or box 10 of the tax form; Furnishing due date for information returns payers must. Do not miss the deadline. But, with the right preparation and understanding, you can keep your business compliant and off of. Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it.

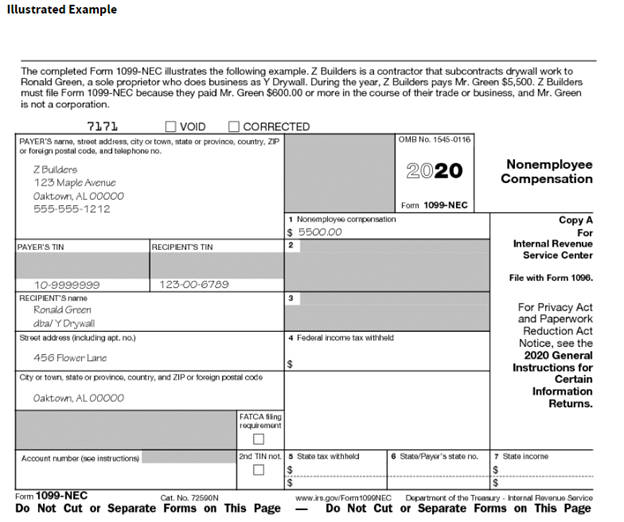

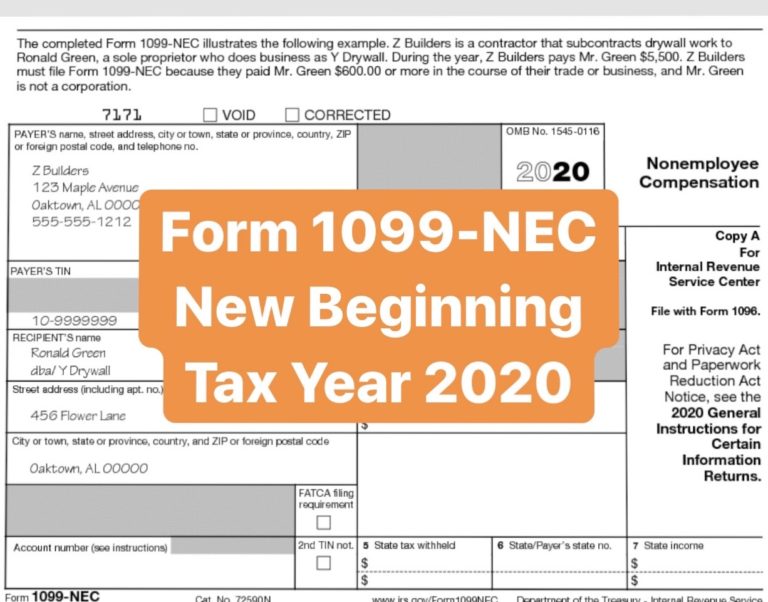

1099NEC or 1099MISC? What has changed and why it matters! IssueWire

Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer. Do not miss the deadline. Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal. Web the irs filing season 2023 deadlines for tax year 2022 are as follows:.

How do I Access 1099NEC form Files for Use with Sage Checks & Forms?

Get ready for tax season deadlines by completing any required tax forms today. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal. Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Web 4th quarter.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Copy a & copy b should be filed by january 31. Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? Furnishing due date for information returns payers must. Web 4th quarter 2022 estimated tax payment due: Web the due date for the 1099 tax form’s electronic filing is 31 st march.

Should An Llc Get A 1099 Nec Armando Friend's Template

But, with the right preparation and understanding, you can keep your business compliant and off of. Simply answer a few question to instantly download, print & share your form. Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing). Takes 5 minutes or less to.

What is Form 1099NEC for Nonemployee Compensation

Web 4th quarter 2022 estimated tax payment due: But, with the right preparation and understanding, you can keep your business compliant and off of. Web 1099 due dates for 2022: Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Furnishing due date for information returns payers must.

Beware The 1099NEC Due Date How To Avoid Late Fees

Web 4th quarter 2022 estimated tax payment due: Web 1099 due dates for 2022: Takes 5 minutes or less to complete. Get ready for tax season deadlines by completing any required tax forms today. Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Takes 5 minutes or less to complete. Get ready for tax season deadlines by completing any required tax forms today. Do not miss the deadline. The deadline to send the.

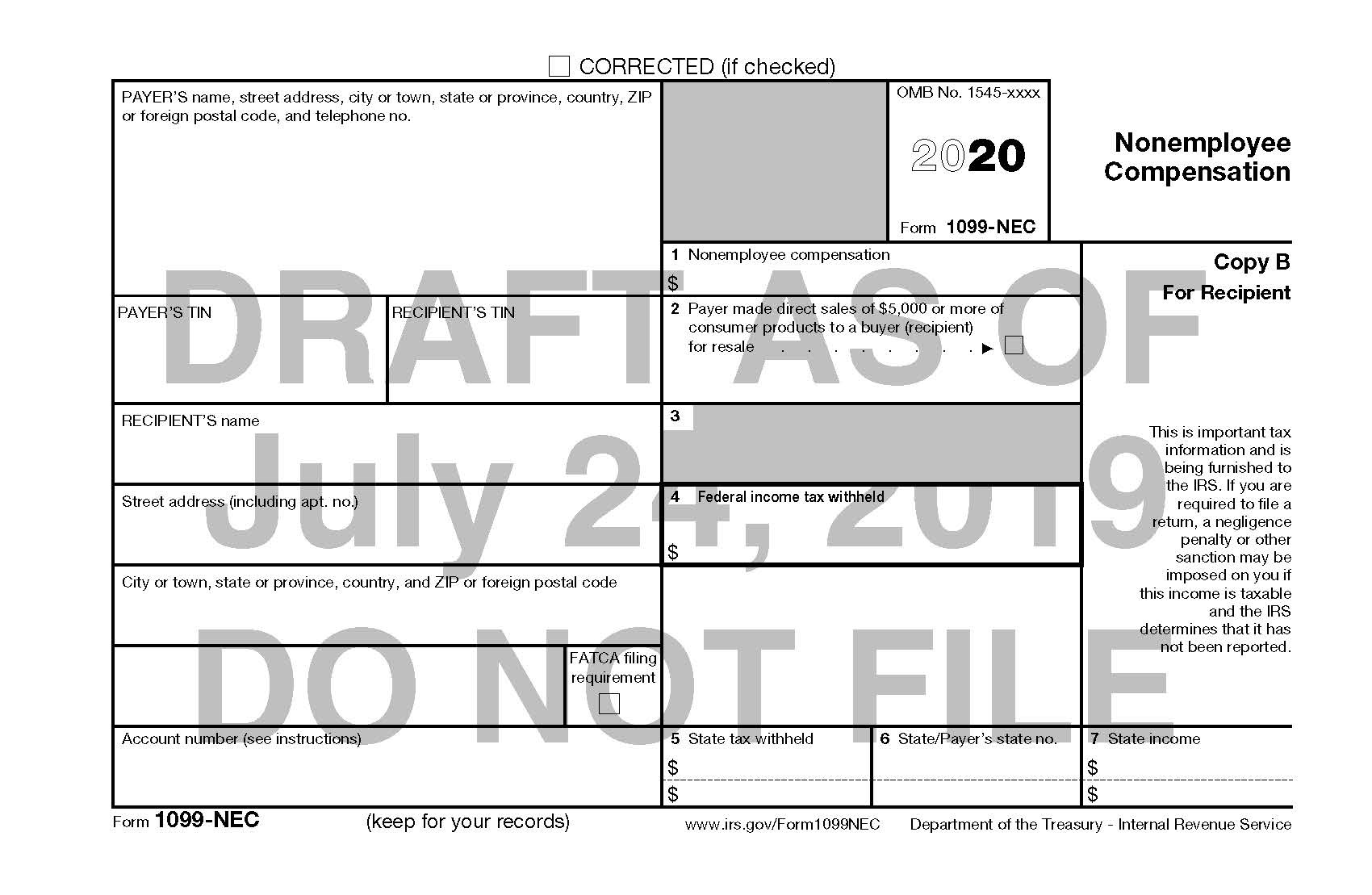

IRS to Bring Back Form 1099NEC, Last Used in 1982 — Current Federal

Do not miss the deadline. But, with the right preparation and understanding, you can keep your business compliant and off of. Furnishing due date for information returns payers must. Copy a & copy b should be filed by january 31. Web 1099 due dates for 2022:

Ad Register And Subscribe Now To Work On Irs Nonemployee Compensation & More Fillable Forms.

Web the due date for the 1099 tax form’s electronic filing is 31 st march of the 2022 tax year. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Get ready for tax season deadlines by completing any required tax forms today. Copy a & copy b should be filed by january 31.

Tax Payers Submit Payments In Box Eight Or Box 10 Of The Tax Form;

But, with the right preparation and understanding, you can keep your business compliant and off of. Filing season 2023 form 1099 deadlines (ty2022) please note that these are just the federal. Furnishing due date for information returns payers must. Do not miss the deadline.

The Deadline To Send The.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web 1099 due dates for 2022: Web form 1099 rules for employers in 2023 hat is a 1099 form, and how is it used? Web with the 2023 filing season deadline drawing near, be aware that the deadline for businesses to file information returns for hired workers is even closer.

Simply Answer A Few Question To Instantly Download, Print & Share Your Form.

Web the irs filing season 2023 deadlines for tax year 2022 are as follows: Web form 1099 nec must be filed by january 31, 2023, for the tax year 2022 irrespective of filing methods ( paper or electronic filing). Takes 5 minutes or less to complete. Web 4th quarter 2022 estimated tax payment due:

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)