Form 1118 Schedule J

Form 1118 Schedule J - Check box ‘d’ on line 73 and write tax to the right of the box. Web the form 1118 schedule j 2018 form is 2 pages long and contains: [1] this includes section 965(a) inclusion. Navigate to the top consolidated return. December 2020) 2020 1118 (schedule j) schedule j (form 1118) (rev. Web schedule j (form 1118) (rev. December 2020) 2019 1118 (schedule j) schedule j (form 1118). Web form 1118 (schedule j) (redirected from forms 1118 schedule j ) a form that a corporation files with the irs to make certain adjustments to income or losses when. Web reporting for individual taxpayer [1] this includes section 965 (a) inclusion amounts of a united states shareholder of a deferred foreign income corporation and distributive. Web on schedule j (form 1118), the column headings and lines used to report other income have been revised to require taxpayers to identify each item of other income.

[1] this includes section 965(a) inclusion. What is 1118 form schedule j? Web form 1118 (schedule j) (redirected from form 1118 schedule j ) a form that a corporation files with the irs to make certain adjustments to income or losses when. The percentage and dollar amount of the. Web must complete and attach form 1118 to accrued, or deemed paid on foreign oil financial services income its income tax return. Web schedule j (form 1118) (rev. Web reporting for individual taxpayer [1] this includes section 965 (a) inclusion amounts of a united states shareholder of a deferred foreign income corporation and distributive. Check box ‘d’ on line 73 and write tax to the right of the box. Schedule j (form 1118) (rev. Web on schedule j (form 1118), the column headings and lines used to report other income have been revised to require taxpayers to identify each item of other income.

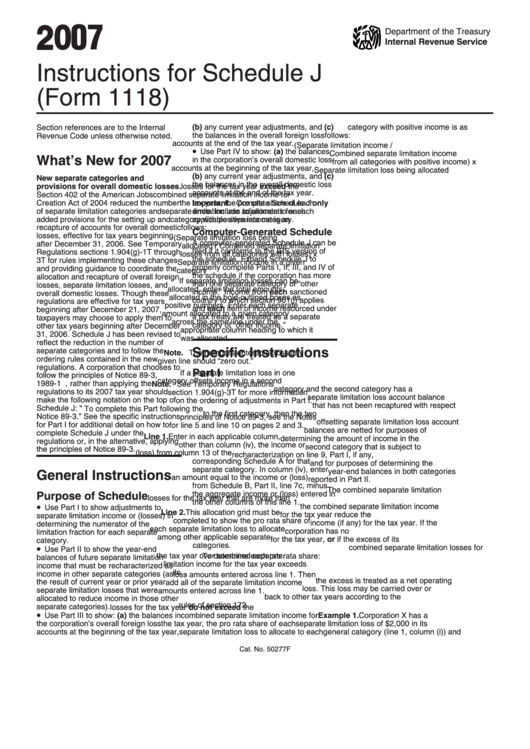

Web schedule j (form 1118) (rev. The percentage and dollar amount of the. Web in addition, even if a corporation has not elected to credit foreign taxes, it must complete and attach schedules a and j of a form 1118 to its income tax return if it has any additions. Web schedule j (form 1118) (rev. December 2020) 2019 1118 (schedule j) schedule j (form 1118). Web the form 1118 schedule j 2018 form is 2 pages long and contains: Why is gilti tested income reported on schedule j in the general category instead of the section 951a category? [1] this includes section 965(a) inclusion. Web must complete and attach form 1118 to accrued, or deemed paid on foreign oil financial services income its income tax return. Web reporting for individual taxpayer [1] this includes section 965 (a) inclusion amounts of a united states shareholder of a deferred foreign income corporation and distributive.

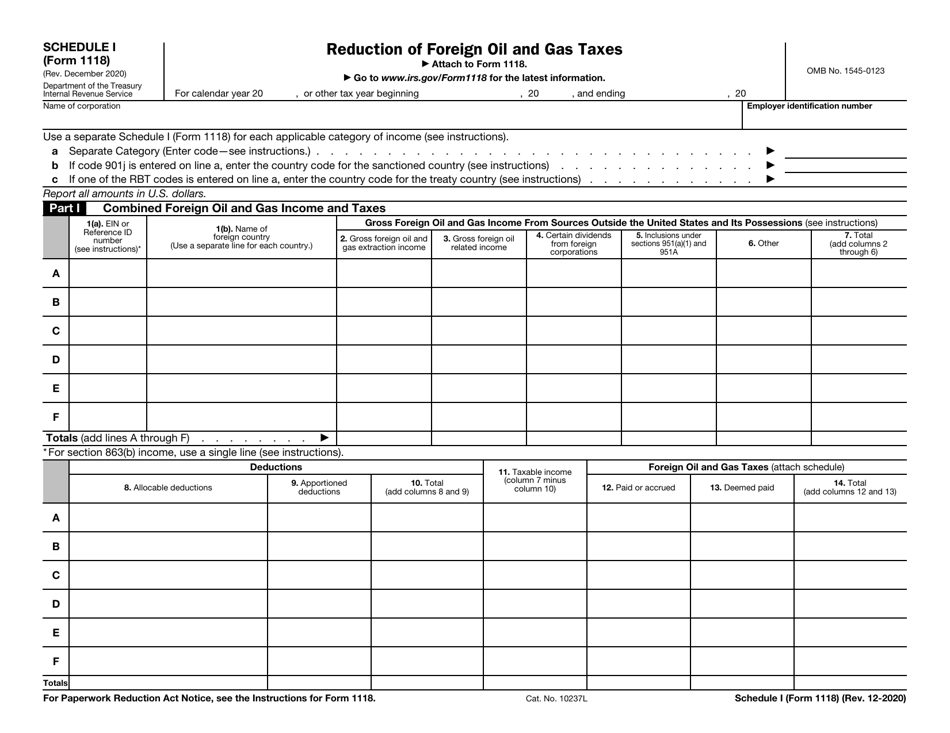

IRS Form 1118 Schedule I Download Fillable PDF or Fill Online Reduction

Web must complete and attach form 1118 to accrued, or deemed paid on foreign oil financial services income its income tax return. Web reporting for individual taxpayer [1] this includes section 965 (a) inclusion amounts of a united states shareholder of a deferred foreign income corporation and distributive. Navigate to the top consolidated return. The percentage and dollar amount of.

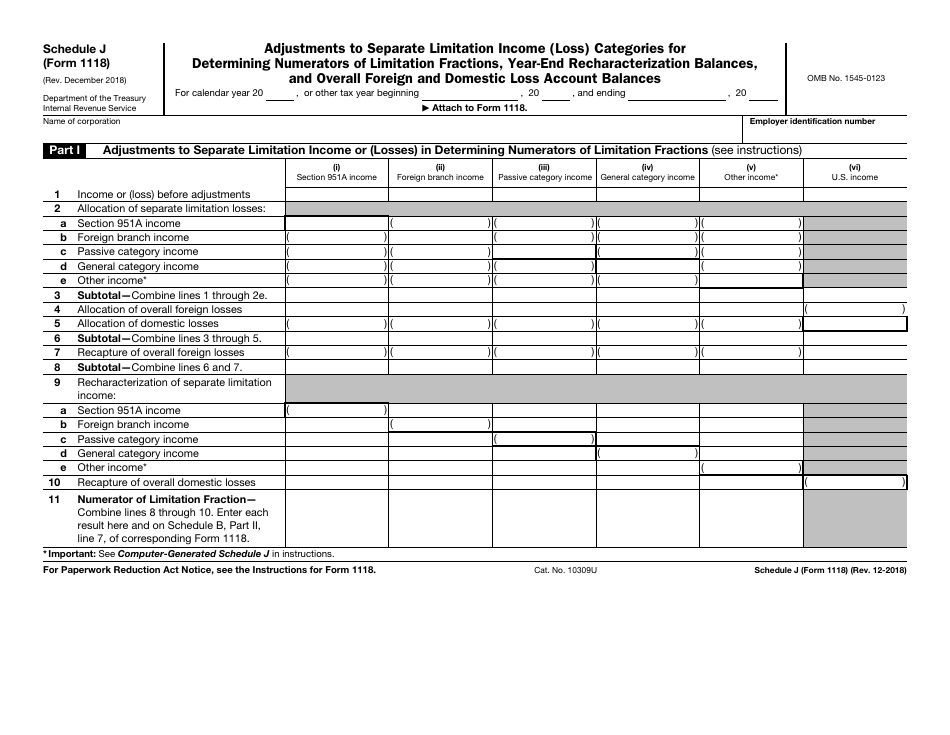

IRS Form 1118 Schedule J Download Fillable PDF or Fill Online

Check box ‘d’ on line 73 and write tax to the right of the box. Schedule j (form 1118) (rev. Web on schedule j (form 1118), the column headings and lines used to report other income have been revised to require taxpayers to identify each item of other income. Web schedule j (form 1118) (rev. December 2020) 2019 1118 (schedule.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Navigate to the top consolidated return. December 2020) 2019 1118 (schedule j) schedule j (form 1118). Web form 1118 (schedule j) (redirected from form 1118 schedule j ) a form that a corporation files with the irs to make certain adjustments to income or losses when. What is 1118 form (schedule j)? Web to produce form 1118, schedule j in.

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

[1] this includes section 965(a) inclusion. Web reporting for individual taxpayer [1] this includes section 965 (a) inclusion amounts of a united states shareholder of a deferred foreign income corporation and distributive. The percentage and dollar amount of the. Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the.

Download Instructions for IRS Form 1118 Schedule J Adjustments to

Web must complete and attach form 1118 to accrued, or deemed paid on foreign oil financial services income its income tax return. Web schedule j (form 1118) (rev. Why is gilti tested income reported on schedule j in the general category instead of the section 951a category? [1] this includes section 965(a) inclusion. What is 1118 form schedule j?

Form 1118 Instructions For Schedule J Sheet printable pdf download

January 2009) department of the trea sury. Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the numerators of. Web form 1118 (schedule j) (redirected from form 1118 schedule j ) a form that a corporation files with the irs to make certain adjustments to income or losses when..

Specific Power Of Attorney Form Pdf

Check box ‘d’ on line 73 and write tax to the right of the box. December 2020) 2019 1118 (schedule j) schedule j (form 1118). Web schedule j (form 1118) (rev. Web form 1118 (schedule j) (redirected from forms 1118 schedule j ) a form that a corporation files with the irs to make certain adjustments to income or losses.

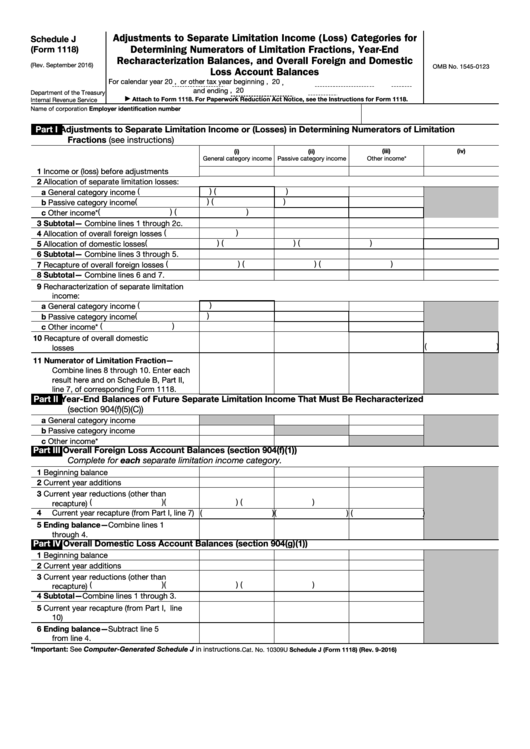

Form 1118 (Schedule J) Adjustments to Separate Limitation

[1] this includes section 965(a) inclusion. December 2020) 2019 1118 (schedule j) schedule j (form 1118). Schedule j (form 1118) (rev. The percentage and dollar amount of the. Web the form 1118 schedule j 2018 form is 2 pages long and contains:

Fillable Schedule J (Form 1118) Adjustments To Separate Limitation

Web on schedule j (form 1118), the column headings and lines used to report other income have been revised to require taxpayers to identify each item of other income. Navigate to the top consolidated return. Web form 1118 (schedule j) (redirected from form 1118 schedule j ) a form that a corporation files with the irs to make certain adjustments.

Fill Free fillable Form 1118 schedule J 2018 PDF form

Web on schedule j (form 1118), the column headings and lines used to report other income have been revised to require taxpayers to identify each item of other income. Web must complete and attach form 1118 to accrued, or deemed paid on foreign oil financial services income its income tax return. Web form 1118 (schedule j) (redirected from forms 1118.

The Percentage And Dollar Amount Of The.

Navigate to the top consolidated return. The percentage and dollar amount of the separate limitation income that is treated as u.s. December 2020) 2019 1118 (schedule j) schedule j (form 1118). Schedule j (form 1118) (rev.

Installments For Years Beyond The 2017 Year, If Applicable.

Web schedule j (form 1118) (rev. Web on schedule j (form 1118), the column headings and lines used to report other income have been revised to require taxpayers to identify each item of other income. Why is gilti tested income reported on schedule j in the general category instead of the section 951a category? Web use schedule j (form 1118), (a separate schedule) to compute adjustments to separate limitation income or losses in determining the numerators of.

Web Form 1118 (Schedule J) (Redirected From Forms 1118 Schedule J ) A Form That A Corporation Files With The Irs To Make Certain Adjustments To Income Or Losses When.

December 2020) 2020 1118 (schedule j) schedule j (form 1118) (rev. What is 1118 form (schedule j)? Web in addition, even if a corporation has not elected to credit foreign taxes, it must complete and attach schedules a and j of a form 1118 to its income tax return if it has any additions. Check box ‘d’ on line 73 and write tax to the right of the box.

What Is 1118 Form Schedule J?

Web schedule j (form 1118) (rev. Web to produce form 1118, schedule j in a consolidated return, do the following: Web form 1118 (schedule j) (redirected from form 1118 schedule j ) a form that a corporation files with the irs to make certain adjustments to income or losses when. Web reporting for individual taxpayer [1] this includes section 965 (a) inclusion amounts of a united states shareholder of a deferred foreign income corporation and distributive.