Form 1120 H 2021

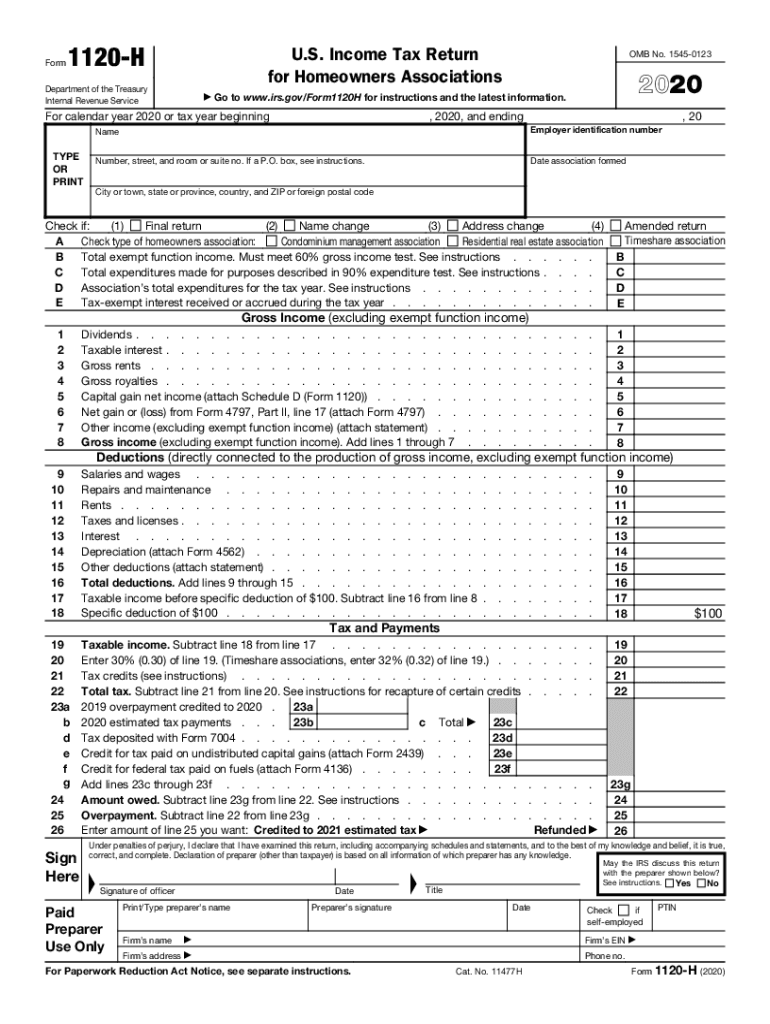

Form 1120 H 2021 - Compared to form 1120, this form allows for a more simplified hoa tax filing process. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Complete, edit or print tax forms instantly. Use fill to complete blank online irs pdf forms for free. These benefits, in effect, allow the association to exclude exempt function income from its. Web credited to 2021 estimated tax. Income tax return for homeowners associations keywords: Ad upload, modify or create forms.

Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Income tax return for homeowners associations. Use the following irs center address. Income tax return for homeowners associations keywords: A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits. Web credited to 2021 estimated tax. These benefits, in effect, allow the association to exclude exempt function income from its. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s business no private shareholder or individual should benefit from the association’s earnings Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania.

These benefits, in effect, allow the association to exclude exempt function income from its. Download this form print this form 03 export or print immediately. Income tax return for homeowners associations keywords: This form is specifically designated for “qualifying” homeowners’ associations. It also allows hoas to enjoy certain tax benefits that are outlined in section 528 of the internal revenue code. Web condominium association homeowners association timeshare association there are five requirements to qualify as an hoa: Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits. Compared to form 1120, this form allows for a more simplified hoa tax filing process. Income tax return for homeowners associations keywords:

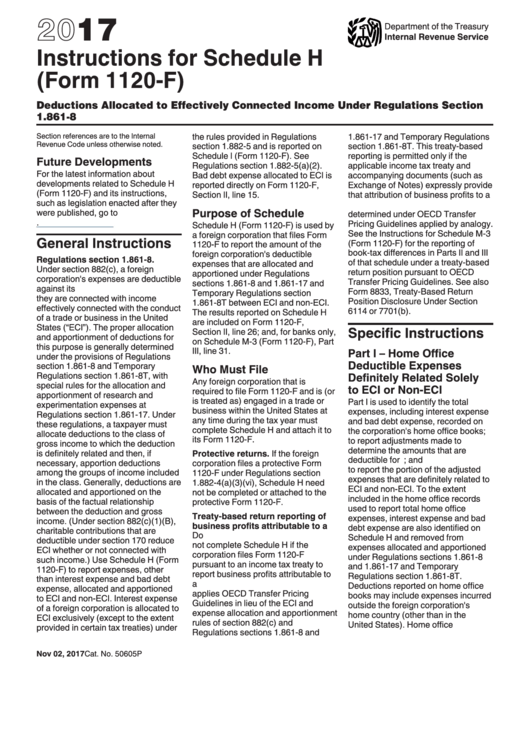

Instructions For Schedule H (Form 1120F) 2017 printable pdf download

The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Use the following irs center address. The tax rate for timeshare associations is 32%. If the association's principal business or office is located in. Web condominium association homeowners association timeshare association there are five requirements.

Form 1120 Fill out & sign online DocHub

Complete, edit or print tax forms instantly. Use the following irs center address. It will often provide a lower audit risk than the alternative form 1120. The tax rate for timeshare associations is 32%. Try it for free now!

1120s schedule d instructions

Ad complete irs tax forms online or print government tax documents. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. These benefits, in effect, allow the association to exclude exempt function income from its. Complete, edit or print tax forms instantly. Income tax return for homeowners.

Irs Filing Tax Irs Filing

A homeowners association files this form as its income tax return to take advantage of certain tax benefits. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. All forms are printable and downloadable. Income tax return for homeowners associations go to www.irs.gov/form1120hfor instructions and.

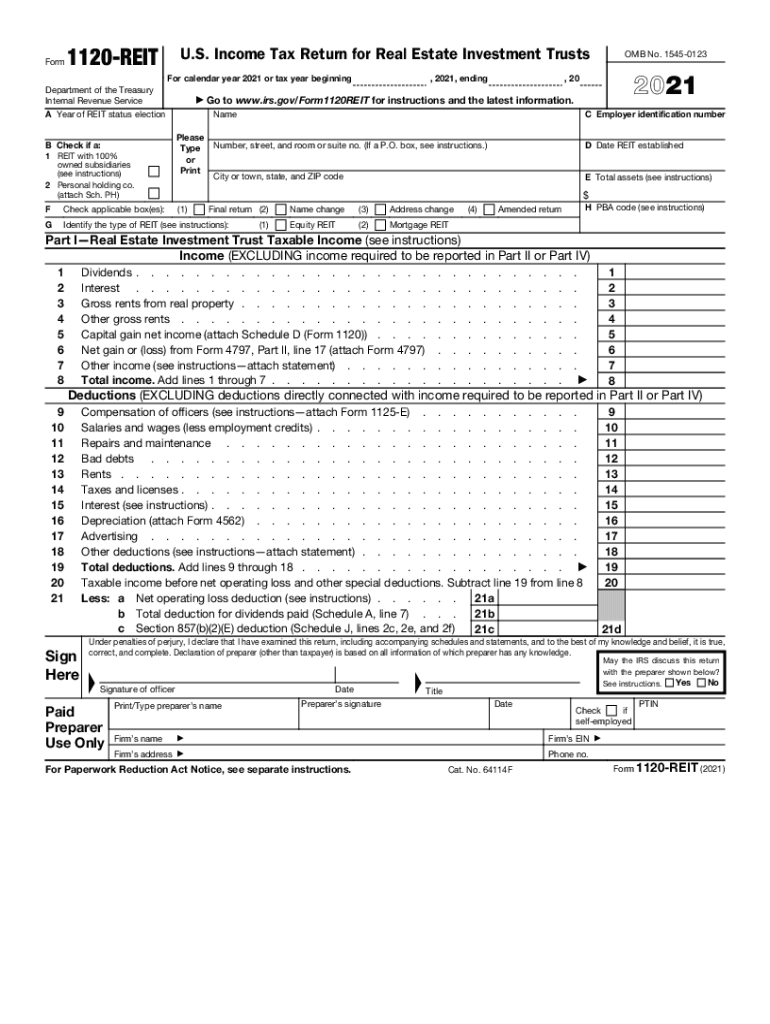

2021 Form IRS 1120REIT Fill Online, Printable, Fillable, Blank pdfFiller

The election is made separately for each tax year and must generally be made by the due date, including extensions, of the income tax return. Complete, edit or print tax forms instantly. Ad upload, modify or create forms. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s.

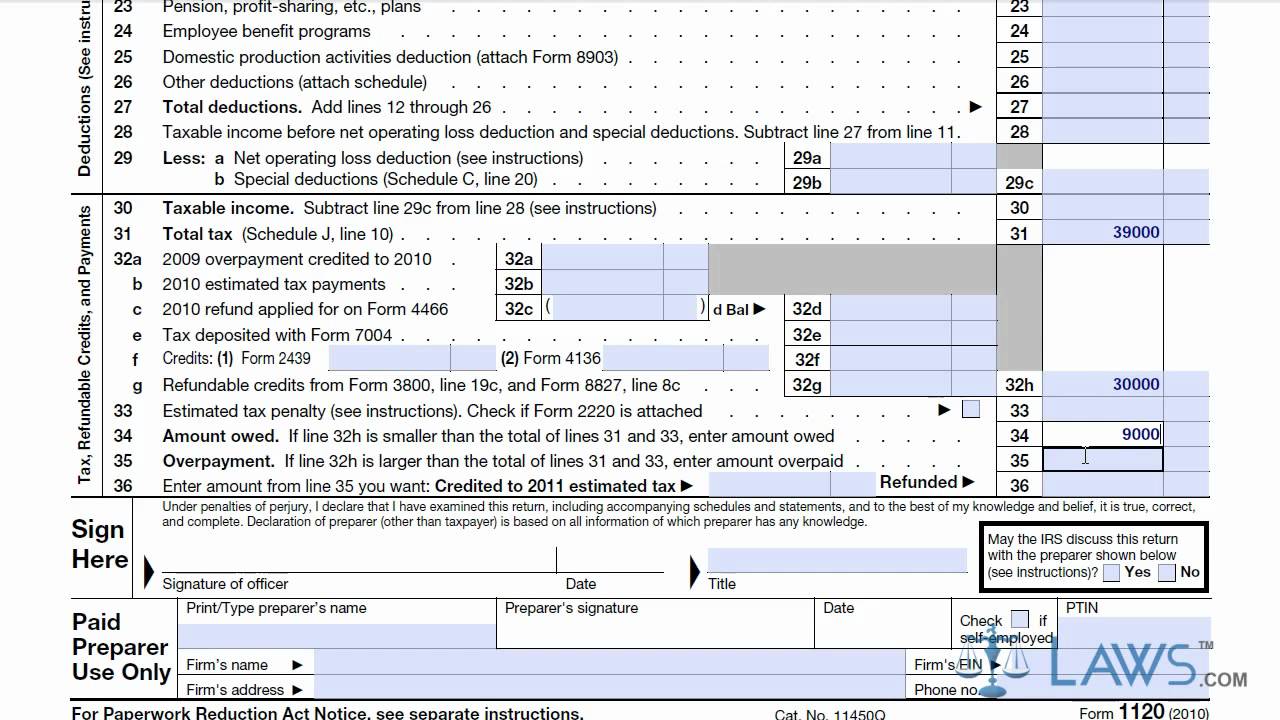

Learn How to Fill the Form 1120 U.S. Corporation Tax Return

Ad complete irs tax forms online or print government tax documents. This form is specifically designated for “qualifying” homeowners’ associations. If the association's principal business or office is located in. Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits. Download this form print this form

Form 1120H Tips & Tricks to Keep You Out of Trouble [Template]

Income tax return for homeowners associations keywords: Use the following irs center address. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Web condominium association homeowners association timeshare association there are five requirements to qualify as an hoa: The tax rate for timeshare associations is 32%.

Irs Instructions Form 1120s Fillable and Editable PDF Template

Download this form print this form Once completed you can sign your fillable form or send for signing. Income tax return for homeowners associations keywords: Use fill to complete blank online irs pdf forms for free. These benefits, in effect, allow the association to exclude exempt function income from its.

File 1120 Extension Online Corporate Tax Extension Form for 2020

03 export or print immediately. It will often provide a lower audit risk than the alternative form 1120. This form is for income earned in tax year 2022, with tax returns due in april 2023. Download this form print this form Complete, edit or print tax forms instantly.

Try It For Free Now!

Income tax return for homeowners associations keywords: Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits. Income tax return for homeowners associations. These benefits, in effect, allow the association to exclude exempt function income from its.

It Will Often Provide A Lower Audit Risk Than The Alternative Form 1120.

Complete, edit or print tax forms instantly. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. The tax rate for timeshare associations is 32%.

At Least 60% Of Gross Income Should Be Exempt Function Income At Least 90% Of Annual Expenses Should Be For The Association’s Business No Private Shareholder Or Individual Should Benefit From The Association’s Earnings

Web condominium association homeowners association timeshare association there are five requirements to qualify as an hoa: Ad complete irs tax forms online or print government tax documents. Download this form print this form This form is for income earned in tax year 2022, with tax returns due in april 2023.

Use Fill To Complete Blank Online Irs Pdf Forms For Free.

Web credited to 2021 estimated tax. Once completed you can sign your fillable form or send for signing. Income tax return for homeowners associations 1120 (schedule h) pdf form content report error it appears you don't have a pdf plugin for this browser. Income tax return for homeowners associations go to www.irs.gov/form1120hfor instructions and the latest information.

![Form 1120H Tips & Tricks to Keep You Out of Trouble [Template]](https://hoatax.com/wp-content/uploads/2017/07/05-1024x712.jpg)