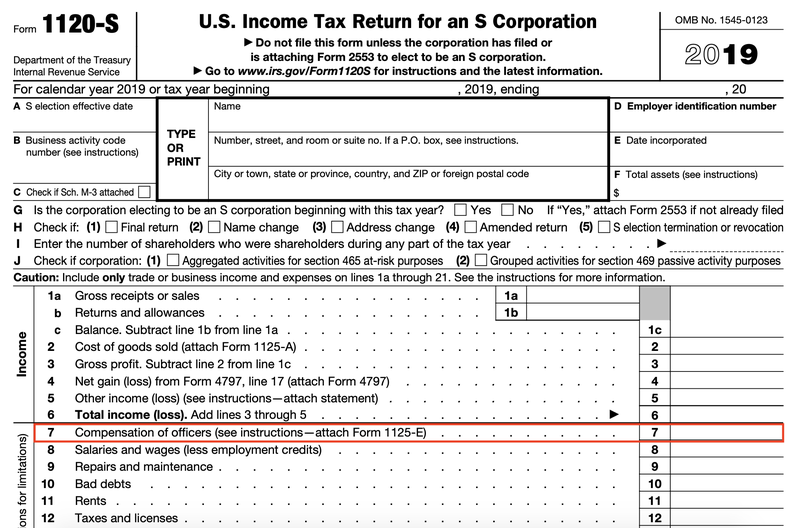

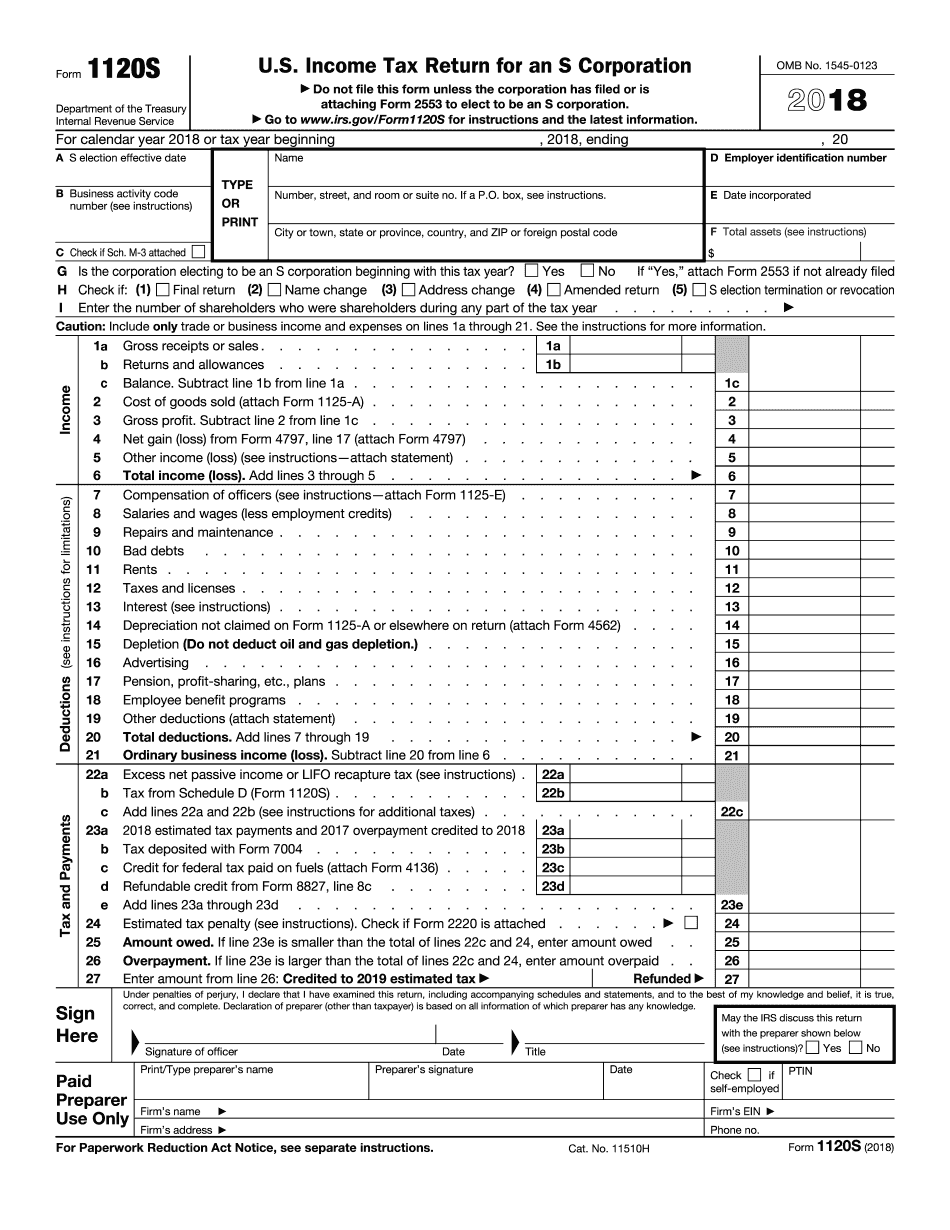

Form 1120-S Extension

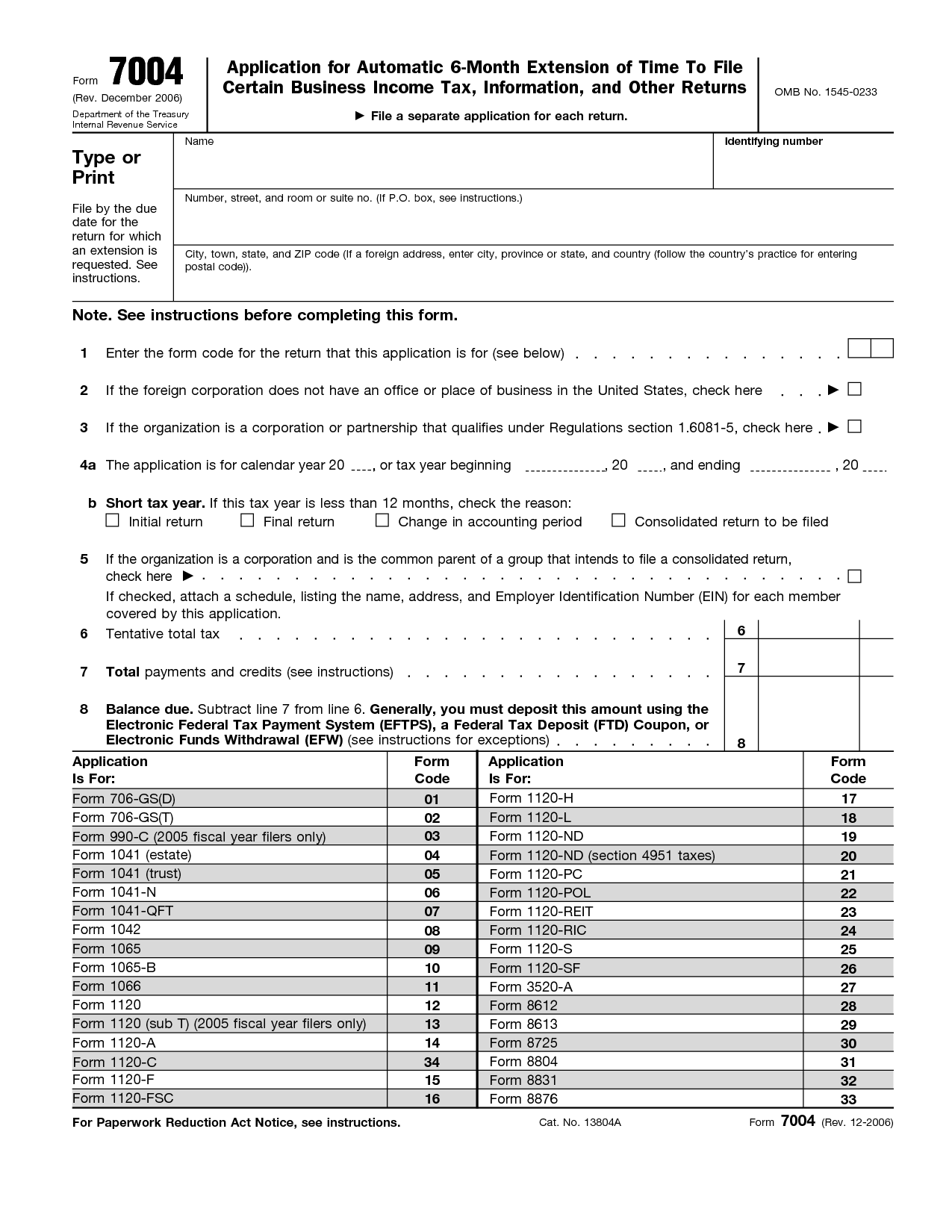

Form 1120-S Extension - Complete, edit or print tax forms instantly. Here is how to file your. Complete, edit or print tax forms instantly. You can obtain the extension by. Even if you file an extension, you must still pay the tax you owe by. The deadline to file form the 1120s is march 15 th of the tax year. Ad easy guidance & tools for c corporation tax returns. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Choose form 1120 and enter the tax year.

Ad easy guidance & tools for c corporation tax returns. You can obtain the extension by. Most corporations operate on the calendar tax year. An s corporation can request an extension to get. Web enter code 25 in the box on form 7004, line 1. Even if you file an extension, you must still pay the tax you owe by. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Enter tentative taxes if any and choose efw or eftps to make payments. The deadline to file form the 1120s is march 15 th of the tax year. Web add business details.

Complete, edit or print tax forms instantly. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Choose form 1120 and enter the tax year. Here is how to file your. Ad easy guidance & tools for c corporation tax returns. The deadline to file form the 1120s is march 15 th of the tax year. You can obtain the extension by. Even if you file an extension, you must still pay the tax you owe by. Enter tentative taxes if any and choose efw or eftps to make payments. Most corporations operate on the calendar tax year.

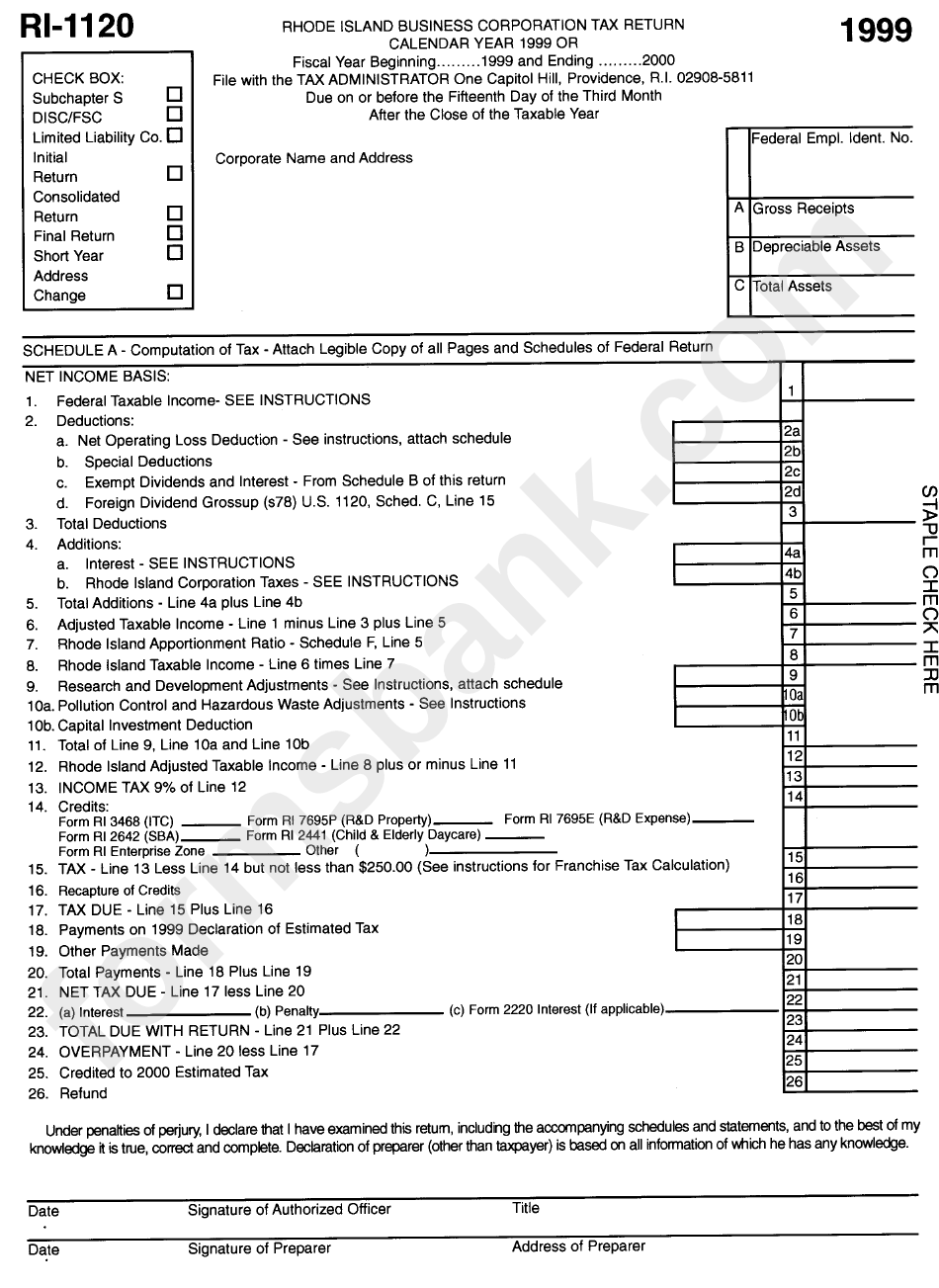

1120 tax table

An s corporation can request an extension to get. Here is how to file your. Web enter code 25 in the box on form 7004, line 1. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. File form 7004, application for automatic extension of time to file certain business.

File 1120 Extension Online Corporate Tax Extension Form for 2020

Choose form 1120 and enter the tax year. Web extension of time to file. An s corporation can request an extension to get. Ad easy guidance & tools for c corporation tax returns. The deadline to file form the 1120s is march 15 th of the tax year.

A Beginner's Guide to S Corporation Taxes The Blueprint

Most corporations operate on the calendar tax year. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. An s corporation can request an extension to get. Enter tentative taxes if any and choose efw or eftps to make payments. File form 7004, application for automatic extension of time to.

Form Ri1120 Rhode Island Business Corporation Tax Return printable

Web add business details. The deadline to file form the 1120s is march 15 th of the tax year. An s corporation can request an extension to get. Web enter code 25 in the box on form 7004, line 1. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching.

How to File an Extension for Your SubChapter S Corporation

An s corporation can request an extension to get. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. Web extension of time to file. Enter tentative taxes if any and choose efw or eftps to make payments. Here is how to file your.

Form 1120S (Schedule B1) Information on Certain Shareholders of an

File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. You can obtain the extension by. Complete, edit or print tax forms instantly. Choose form 1120 and enter the tax year. Web enter code 25 in the box on form 7004, line 1.

IRS 1120S 2022 Form Printable Blank PDF Online

Here is how to file your. Web add business details. You can obtain the extension by. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an. The deadline to file form the 1120s is march 15 th of the tax year.

Form 1120S Tax Return for an S Corporation (2013) Free Download

Here is how to file your. Web enter code 25 in the box on form 7004, line 1. Choose form 1120 and enter the tax year. Complete, edit or print tax forms instantly. An s corporation can request an extension to get.

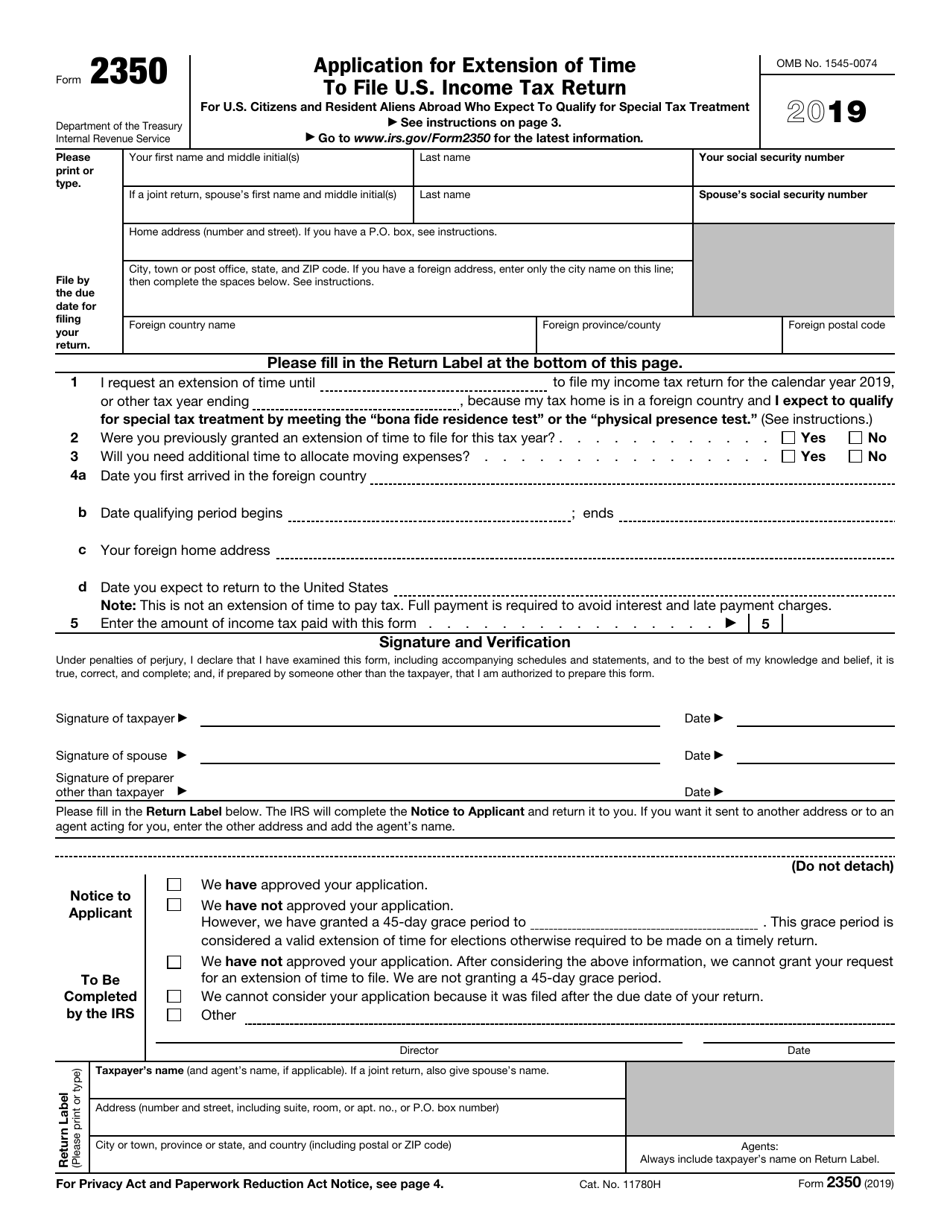

IRS Form 2350 Download Fillable PDF or Fill Online Application for

You can obtain the extension by. Complete, edit or print tax forms instantly. Web enter code 25 in the box on form 7004, line 1. Enter tentative taxes if any and choose efw or eftps to make payments. Even if you file an extension, you must still pay the tax you owe by.

1120S Extensions

Even if you file an extension, you must still pay the tax you owe by. Web extension of time to file. Web enter code 25 in the box on form 7004, line 1. Web add business details. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an.

Even If You File An Extension, You Must Still Pay The Tax You Owe By.

Here is how to file your. Web extension of time to file. Web add business details. Choose form 1120 and enter the tax year.

You Can Obtain The Extension By.

The deadline to file form the 1120s is march 15 th of the tax year. Complete, edit or print tax forms instantly. Enter tentative taxes if any and choose efw or eftps to make payments. File form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an.

Web Enter Code 25 In The Box On Form 7004, Line 1.

Complete, edit or print tax forms instantly. Most corporations operate on the calendar tax year. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. An s corporation can request an extension to get.