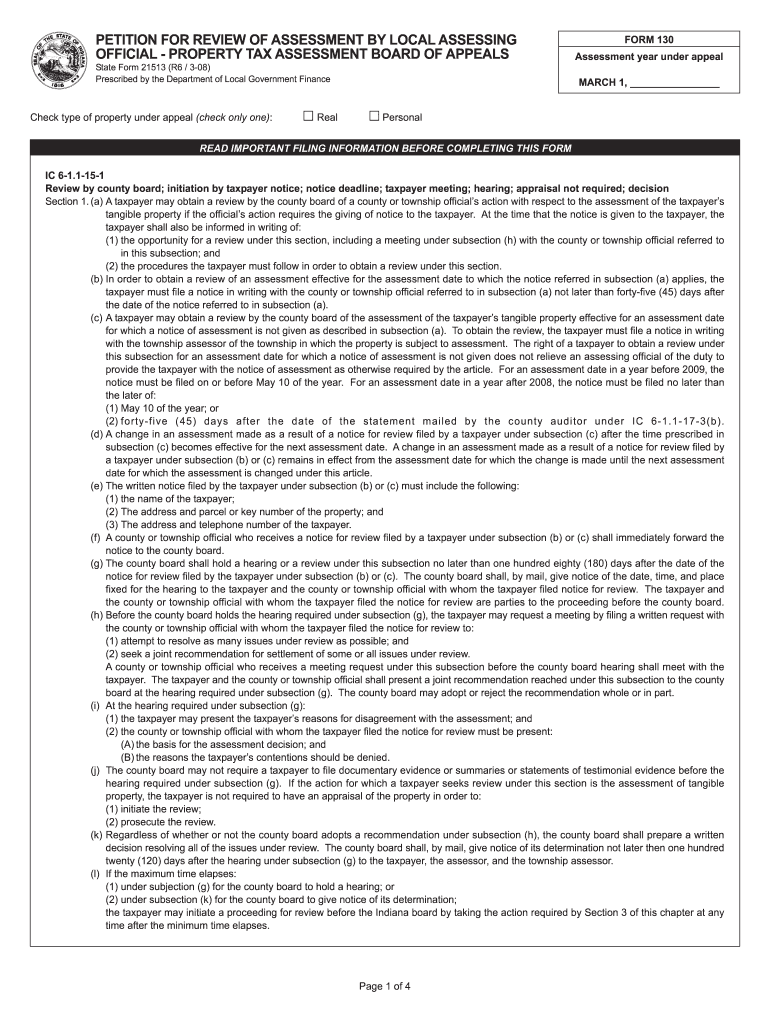

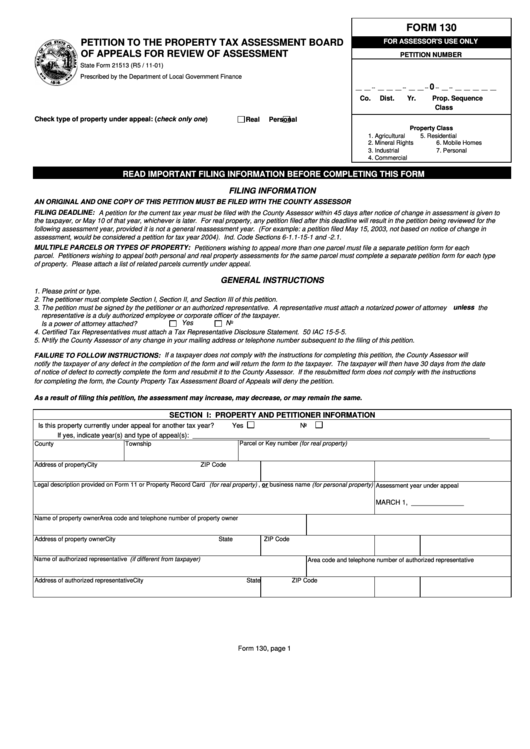

Form 130 Indiana

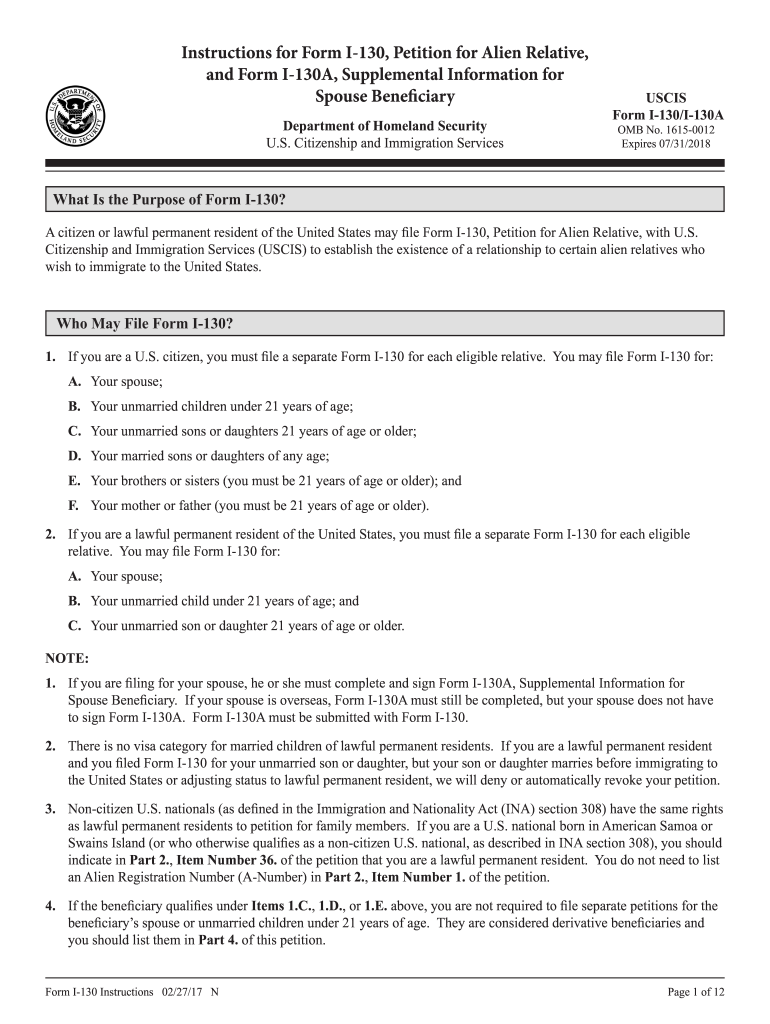

Form 130 Indiana - Web a taxpayer may appeal an assessment by filing a form (“form 130”) with the assessing official. Taxpayer’s notice to initiate an appeal/correction of error. Petition for review of assessment before the indiana board of tax. Web we last updated indiana form 130 in january 2023 from the indiana department of revenue. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Petition to the state board of tax commissioners for review of assessment (pdf) form 132 petition for. And 2) requires the assessing official. The deadline to file an appeal is june 15th, 2023. Web a blank form 130 can be accessed here blank 130; This form is for income earned in tax year 2022, with tax returns due in april.

The taxpayer must file a separate petition for each parcel. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Web taxpayer files a property tax appeal with assessing official. Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). Know when i will receive my tax refund. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web we last updated indiana form 130 in january 2023 from the indiana department of revenue. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Petition for review of assessment before the indiana board of tax.

Web a blank form 130 can be accessed here blank 130; Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web taxpayer files a property tax appeal with assessing official. Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). Web a taxpayer may appeal an assessment by filing a form (“form 130”) with the assessing official. The taxpayer must file a separate petition for each parcel. Appeals can be emailed to:. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Edit, sign and save in dlgf 130 form. Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel.

Company B, 38th Indiana Infantry in 2020 Infantry, Interesting

If you file a form 130, the. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Uslegalforms allows users to edit, sign, fill & share all type of documents online. And 2) requires the assessing official. The deadline to file an appeal is june 15th, 2023.

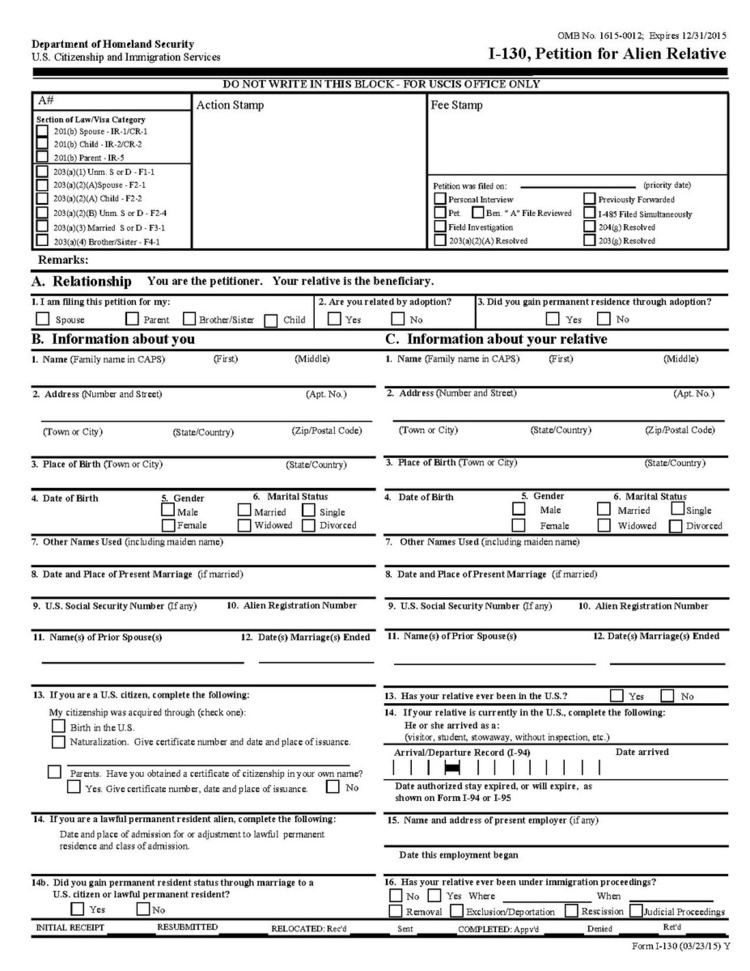

2015 Form USCIS I130 Instructions Fill Online, Printable, Fillable

Appeals can be emailed to:. Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). Web to access all department of local government finance forms please visit the state forms online catalog available here. Ad download or email 2008 130 & more fillable forms,.

Form 130 Indiana Fill Out and Sign Printable PDF Template signNow

Petition to the state board of tax commissioners for review of assessment (pdf) form 132 petition for. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Taxpayer's notice to initiate an appeal (pdf) form.

Enterline and Partners Consulting What is a Form I130?

Edit, sign and save in dlgf 130 form. Web we last updated indiana form 130 in january 2023 from the indiana department of revenue. Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel. Web a blank form 130 can be accessed here blank.

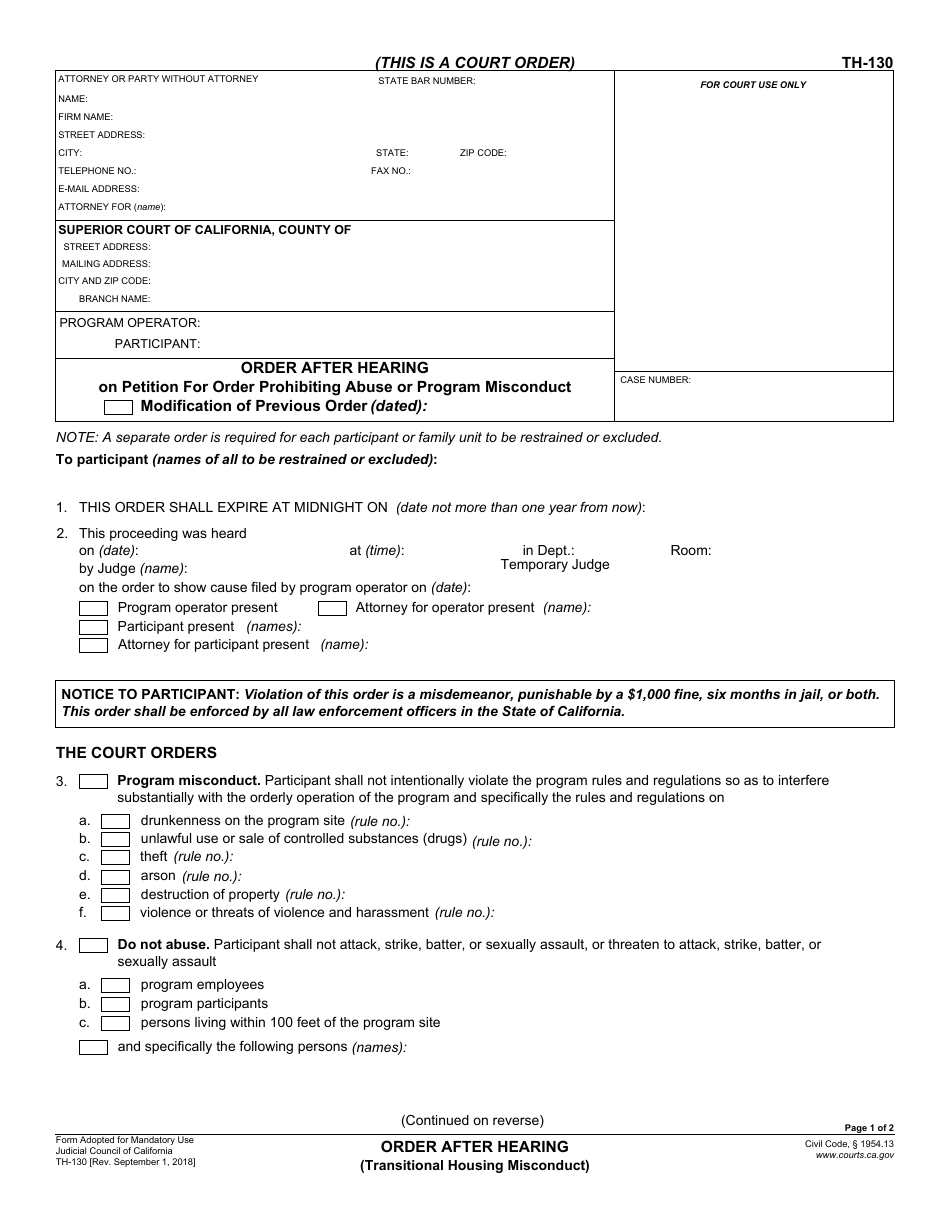

Form TH130 Download Fillable PDF or Fill Online Order After Hearing

Appeals can be emailed to:. And requires the assessing official to. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. Know when i will receive my tax refund.

2012 IN State Form 53958 Fill Online, Printable, Fillable, Blank

The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel. Taxpayer's notice to initiate an appeal (pdf) form 131: Web the taxpayer must use the form prescribed.

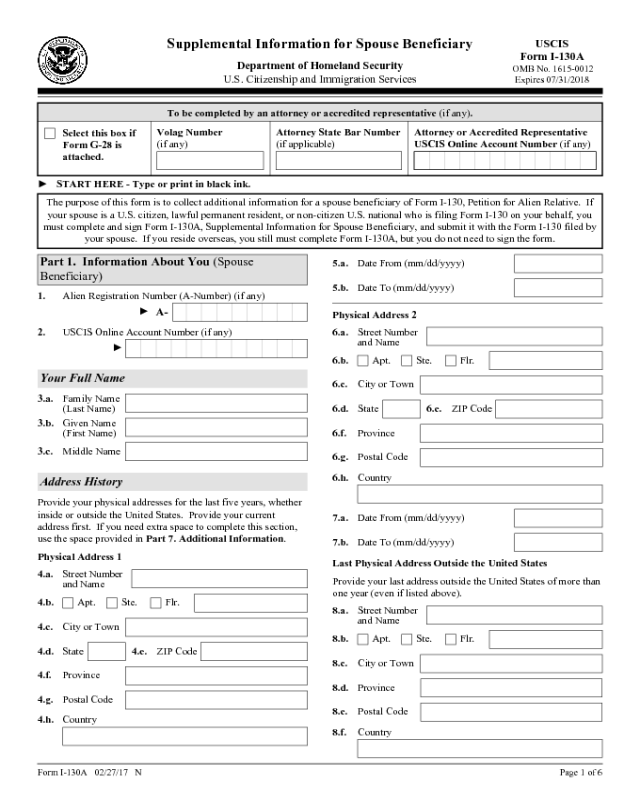

Form I130A Edit, Fill, Sign Online Handypdf

File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. Web taxpayer files a property tax appeal with assessing official. Web the boone county assessor’s office mailed the 2023 form 11’s on april 28th. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel.

Form I 130 Alchetron, The Free Social Encyclopedia

The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Petition to the state board of tax commissioners for review of assessment (pdf) form 132 petition for. The taxpayer must file a separate petition for each parcel. Taxpayer's notice to initiate an appeal (pdf) form 131: Web taxpayer files a property tax appeal.

Guardsmen come home

And requires the assessing official to. Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). Web to access all department of local government finance forms please visit the state forms online catalog available here. And 2) requires the assessing official. This form is.

Fillable Form 130 Petition To The Property Tax Assessment Board Of

Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel. Taxpayer's notice to initiate an appeal (pdf) form 131: Uslegalforms allows users to edit, sign, fill & share all type of documents online. The taxpayer must use the form prescribed by the dlgf (form.

Web The Taxpayer Must Use The Form Prescribed By The Dlgf (Form 130) For Each Parcel Being Appealed.

Petition for review of assessment before the indiana board of tax. Ad download or email 2008 130 & more fillable forms, register and subscribe now! Web to access all department of local government finance forms please visit the state forms online catalog available here. Taxpayer's notice to initiate an appeal (pdf) form 131:

Taxpayer’s Notice To Initiate An Appeal/Correction Of Error.

Know when i will receive my tax refund. Edit, sign and save in dlgf 130 form. The deadline to file an appeal is june 15th, 2023. Web a blank form 130 can be accessed here blank 130;

Appeals Can Be Emailed To:.

Ad download or email 2008 130 & more fillable forms, register and subscribe now! Web to initiate an appeal of your assessment, you must file a form 130 taxpayer's notice to initiate an appeal (state form 53958) for each parcel. Web find indiana tax forms. Web the taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed.

If You File A Form 130, The.

Web the form 130, taxpayer's notice to initiate an appeal, and the power of attorney form are prescribed by the department of local government finance (dlgf). And requires the assessing official to. The taxpayer must use the form prescribed by the dlgf (form 130) for each parcel being appealed. Web taxpayer files a property tax appeal with assessing official.