Form 144 Filing Requirements

Form 144 Filing Requirements - Web form 144 must be filed with the sec when intending to resell restricted or control securities. Web on june 2, 2022, the sec adopted amendments that require certain forms 144 to be filed electronically with the sec. Proposed amendment to the rule 144 filing requirements the proposed amendment to rule 144 would: Filers have six months after the amendments’ effective date. The party filing form 144 must have a bona fide intention to sell the securities within a reasonable time frame after. Filing options for form 4 and form 144. Securities must be held for a minimum of 6 consecutive months prior to being sold (time may include the initial purchase date for any gifted securities 2 ). The electronic filing requirement pertains to forms 144 related to the sale of securities of an issuer subject to the reporting requirements under section 13 or 15 (d) of the securities exchange act of 1934. 17 cfr 230 17 cfr 232 17 cfr 239 17. Securities and exchange commission dates:

Proposed amendment to the rule 144 filing requirements the proposed amendment to rule 144 would: Securities must be held for a minimum of 6 consecutive months prior to being sold (time may include the initial purchase date for any gifted securities 2 ). The final rules are effective july 11, 2022. Filing options for form 4 and form 144. Filers have six months after the amendments’ effective date. The electronic filing requirement pertains to forms 144 related to the sale of securities of an issuer subject to the reporting requirements under section 13 or 15 (d) of the securities exchange act of 1934. Proposed amendment to the form 144 filing requirements. Web when are you required to file? If the sales of restricted or control securities exceed any of the following within three months of the sale: Web document details printed version:

Proposed amendment to the form 144 filing requirements. Web document details printed version: Proposed amendment to the rule 144 filing requirements the proposed amendment to rule 144 would: Since sales covered under form 144 are often. Filers have six months after the amendments’ effective date. Mandatory electronic filing of form 144. The party filing form 144 must have a bona fide intention to sell the securities within a reasonable time frame after. The requirement to file form 144s electronically will commence six months from the date of publication in the. Filing options for form 4 and form 144. Web form 144 must be filed with the sec when intending to resell restricted or control securities.

Sf 144 Fill Online, Printable, Fillable, Blank pdfFiller

Since sales covered under form 144 are often. The requirement to file form 144s electronically will commence six months from the date of publication in the. Securities must be held for a minimum of 6 consecutive months prior to being sold (time may include the initial purchase date for any gifted securities 2 ). Web document details printed version: 17.

Federal Register Rule 144 Holding Period and Form 144 Filings

Web form 144 must be filed with the sec when intending to resell restricted or control securities. Mandatory electronic filing of form 144. Proposed amendment to the form 144 filing requirements. Securities and exchange commission dates: Since sales covered under form 144 are often.

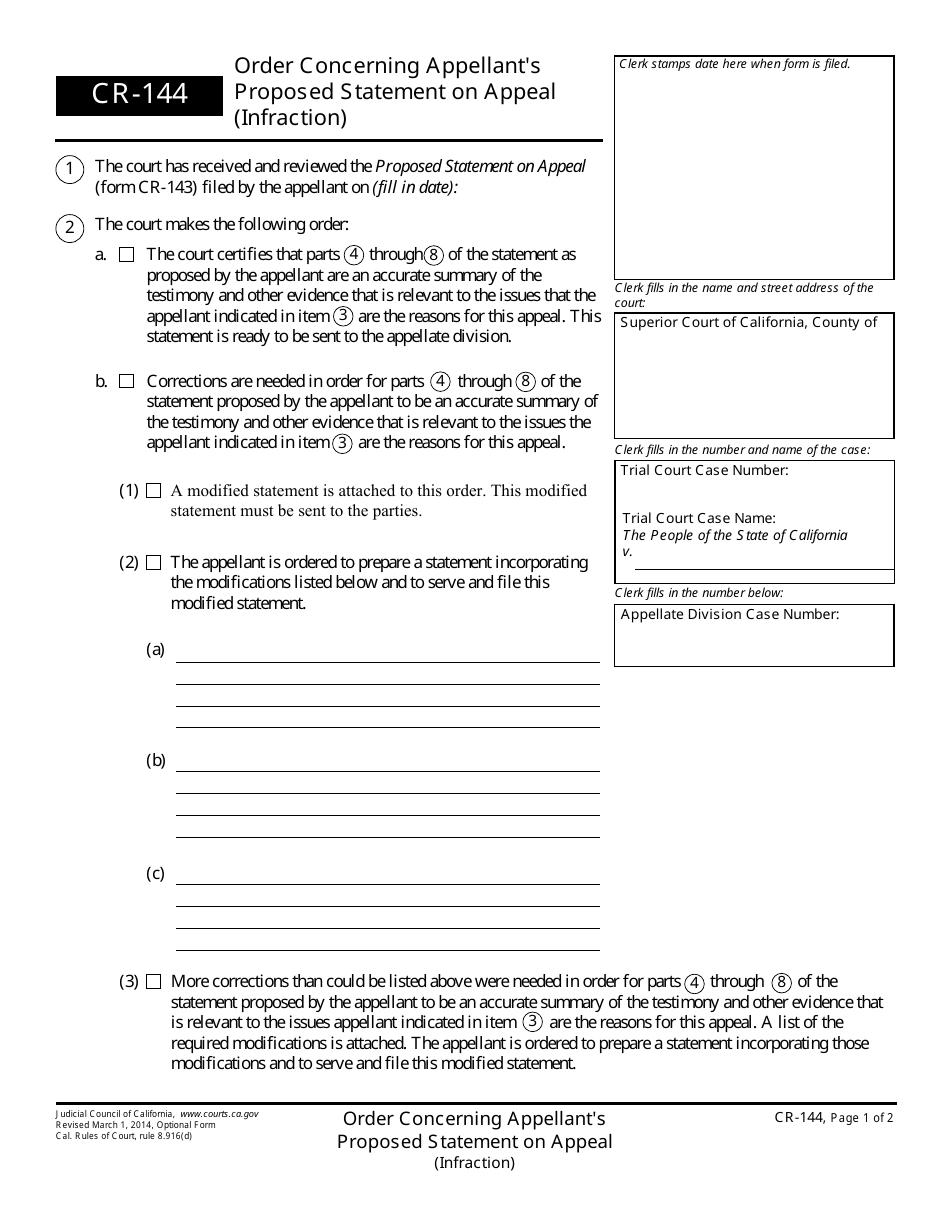

Form CR144 Download Fillable PDF or Fill Online Order Concerning

Mandatory electronic filing of form 144. Form 144 will be an online fillable document and will delete certain personally identifiable information in the form. 17 cfr 230 17 cfr 232 17 cfr 239 17. Web in addition, the amendments will require all forms 144 for the sale of securities of reporting companies to be filed electronically on edgar, rather than.

Section 144 Notice Notice u/s 143(2) for Scrutiny u/s 143(2

Since sales covered under form 144 are often. Securities must be held for a minimum of 6 consecutive months prior to being sold (time may include the initial purchase date for any gifted securities 2 ). Mandatory electronic filing of form 144. If the sales of restricted or control securities exceed any of the following within three months of the.

SEC proposes amendments to Rule 144 and Form 144

Filers have six months after the amendments’ effective date. The final rules are effective july 11, 2022. Web document details printed version: Web all documents newly required to be submitted electronically: Filing options for form 4 and form 144.

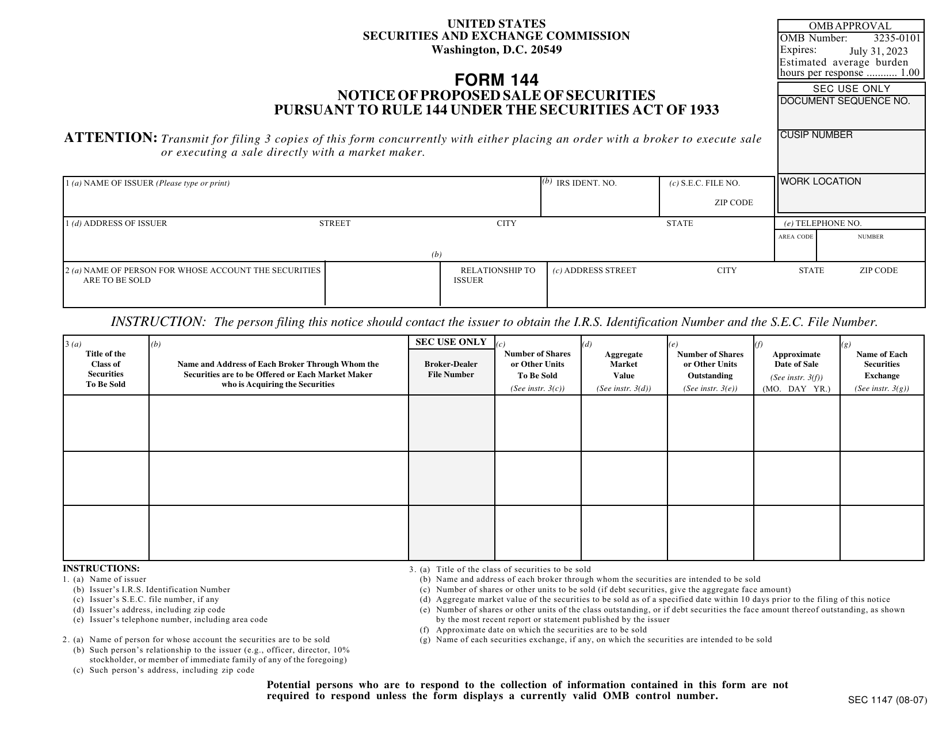

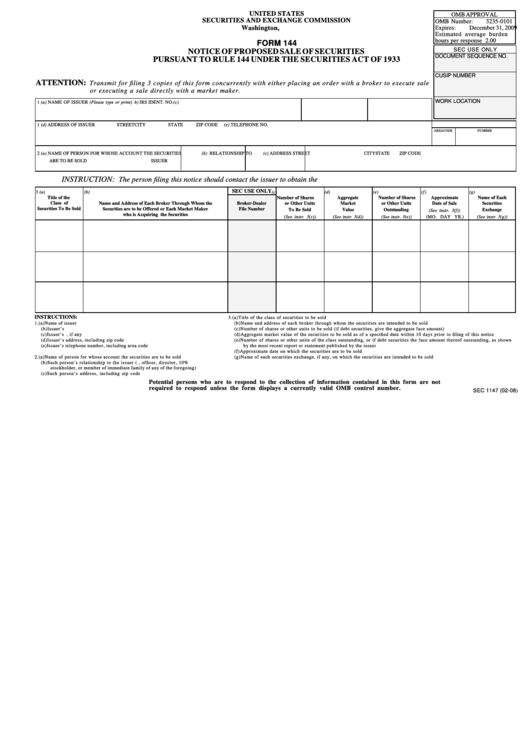

Form 144 (SEC Form 1147) Download Printable PDF or Fill Online Notice

Securities must be held for a minimum of 6 consecutive months prior to being sold (time may include the initial purchase date for any gifted securities 2 ). The electronic filing requirement pertains to forms 144 related to the sale of securities of an issuer subject to the reporting requirements under section 13 or 15 (d) of the securities exchange.

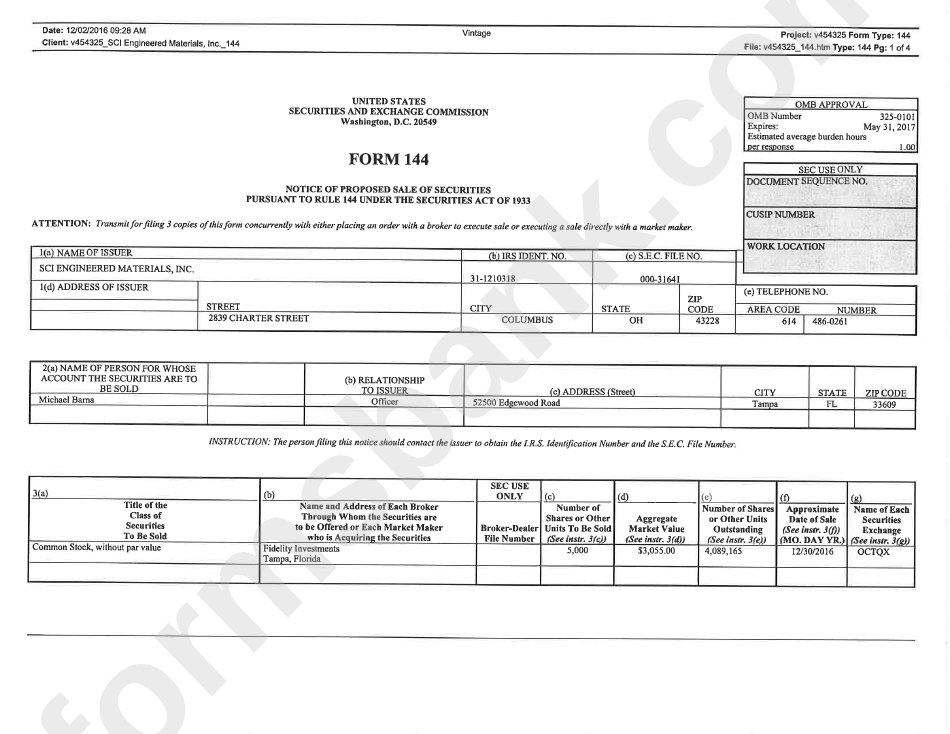

(FORM 144)

Form 144 will be an online fillable document and will delete certain personally identifiable information in the form. Proposed amendment to the rule 144 filing requirements the proposed amendment to rule 144 would: The electronic filing requirement pertains to forms 144 related to the sale of securities of an issuer subject to the reporting requirements under section 13 or 15.

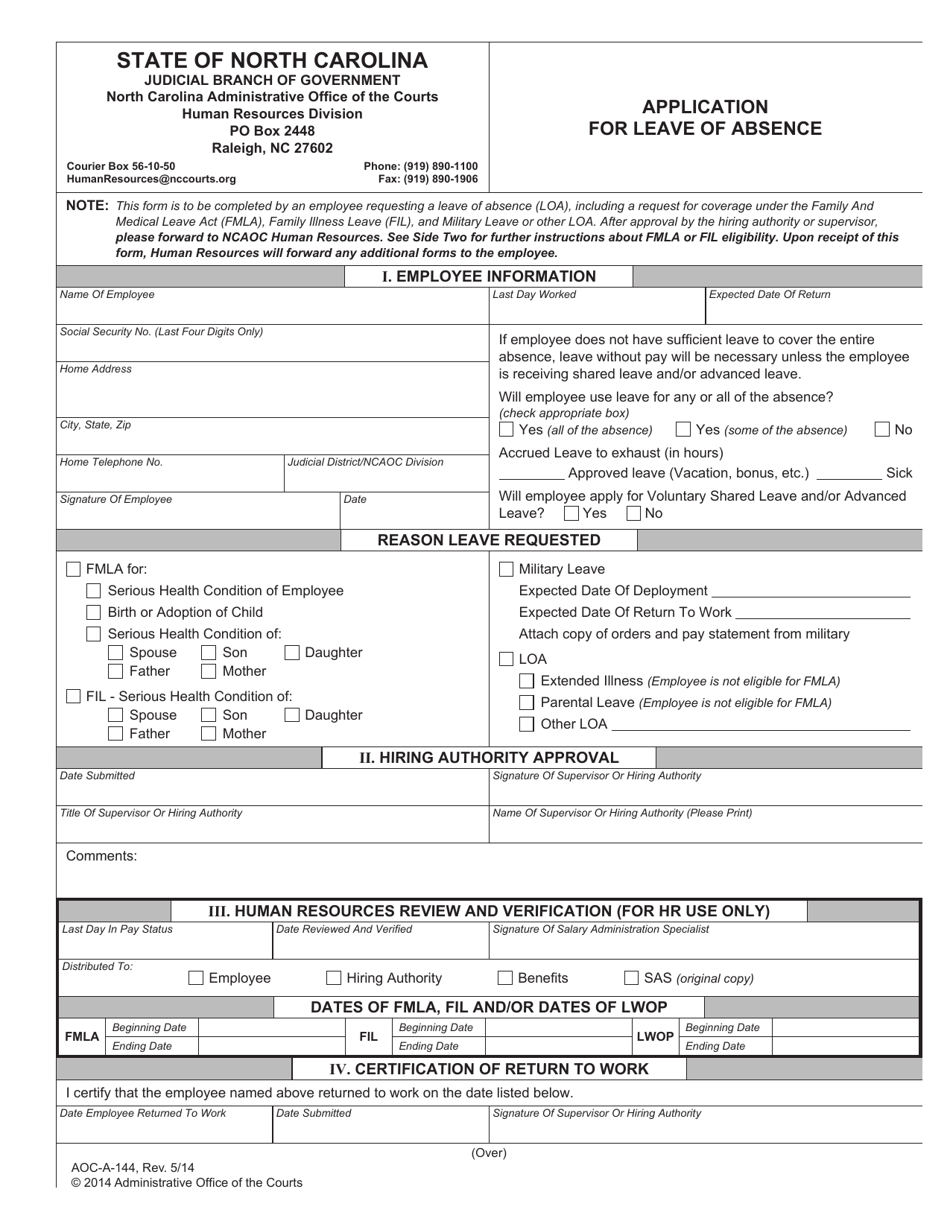

Form AOCA144 Download Fillable PDF or Fill Online Application for

The electronic filing requirement pertains to forms 144 related to the sale of securities of an issuer subject to the reporting requirements under section 13 or 15 (d) of the securities exchange act of 1934. Web in addition, the amendments will require all forms 144 for the sale of securities of reporting companies to be filed electronically on edgar, rather.

Fillable Form 144 Sec, Notice Of Proposed Sale Of Securities

Since sales covered under form 144 are often. Securities and exchange commission dates: Web document details printed version: Web in addition, the amendments will require all forms 144 for the sale of securities of reporting companies to be filed electronically on edgar, rather than through a paper filing. Web form 144 must be filed with the sec when intending to.

(Form 144)

Filing options for form 4 and form 144. Securities must be held for a minimum of 6 consecutive months prior to being sold (time may include the initial purchase date for any gifted securities 2 ). Proposed amendment to the rule 144 filing requirements the proposed amendment to rule 144 would: Web on june 2, 2022, the sec adopted amendments.

Securities Must Be Held For A Minimum Of 6 Consecutive Months Prior To Being Sold (Time May Include The Initial Purchase Date For Any Gifted Securities 2 ).

The requirement to file form 144s electronically will commence six months from the date of publication in the. The electronic filing requirement pertains to forms 144 related to the sale of securities of an issuer subject to the reporting requirements under section 13 or 15 (d) of the securities exchange act of 1934. Securities and exchange commission dates: If the sales of restricted or control securities exceed any of the following within three months of the sale:

Proposed Amendment To The Rule 144 Filing Requirements The Proposed Amendment To Rule 144 Would:

Since sales covered under form 144 are often. Web in addition, the amendments will require all forms 144 for the sale of securities of reporting companies to be filed electronically on edgar, rather than through a paper filing. Web when are you required to file? Proposed amendment to the form 144 filing requirements.

Web Form 144 Must Be Filed With The Sec When Intending To Resell Restricted Or Control Securities.

Web all documents newly required to be submitted electronically: Filers have six months after the amendments’ effective date. Mandatory electronic filing of form 144. Web on june 2, 2022, the sec adopted amendments that require certain forms 144 to be filed electronically with the sec.

Filing Options For Form 4 And Form 144.

Form 144 will be an online fillable document and will delete certain personally identifiable information in the form. 17 cfr 230 17 cfr 232 17 cfr 239 17. Web document details printed version: The party filing form 144 must have a bona fide intention to sell the securities within a reasonable time frame after.