Form 2210 Line 8

Form 2210 Line 8 - Show this amount on line 51 of form mo. Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. Subtract line 10 from line 9. Otherwise, enter 25% (0.25) of line 9, form 2210, in each column. Web complete lines 8 and 9 below. Web don’t file form 2210 7 8 maximum required annual payment based on prior year’s tax (see instructions). Multiply line 7 by.12.8 9 total tax. For many taxpayers, the irs. Is line 6 equal to or more than line 9? Web download this form print this form more about the federal form 2210 individual income tax estimated ty 2022 if you failed to pay or underpaid your previous year's estimated.

Add lines 4 and 8. Don’t file form 2210 (but if box e in part ii applies, you must file page 1 of form. Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. Show this amount on line 51 of form mo. For many taxpayers, the irs. Web line 25 for the number of days shown on line 27b. Multiply line 7 by.12.8 9 total tax. Otherwise, enter 25% (0.25) of line 9, form 2210, in each column. The irs will generally figure your penalty for you and you should not file form 2210. Web download this form print this form more about the federal form 2210 individual income tax estimated ty 2022 if you failed to pay or underpaid your previous year's estimated.

Web download this form print this form more about the federal form 2210 individual income tax estimated ty 2022 if you failed to pay or underpaid your previous year's estimated. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. The irs will generally figure your penalty for you and you should not file form 2210. 10 11 total tax after credits. Multiply line 7 by.12.8 9 total tax. Don’t file form 2210 (but if box e in part ii applies, you must file page 1 of form. For many taxpayers, the irs. Web 8 tax on amount in line 7. Web don’t file form 2210 7 8 maximum required annual payment based on prior year’s tax (see instructions). Web complete lines 8 and 9 below.

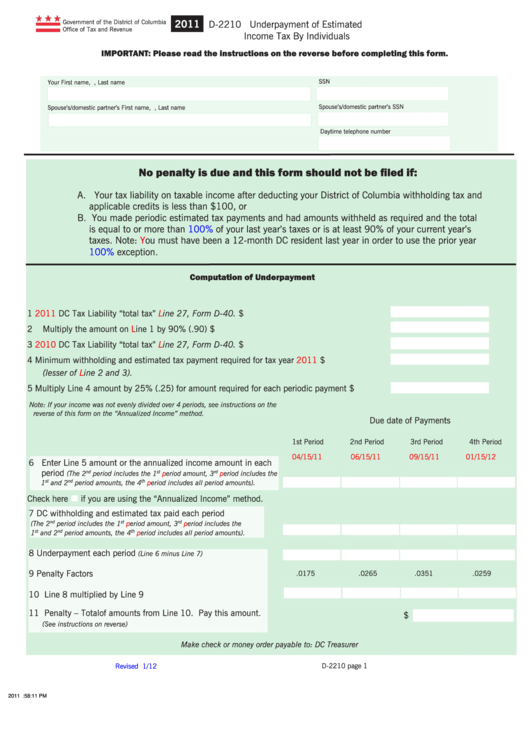

Form D2210 Underpayment Of Estimated Tax By Individuals

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. For many taxpayers, the irs. After completing lines 8 and 9 on irs form 2210, is the value on line 6 equal to or greater than the value on line 9? Enter the penalty on form 2210, line 27, and on.

IRS Form 2210Fill it with the Best Form Filler

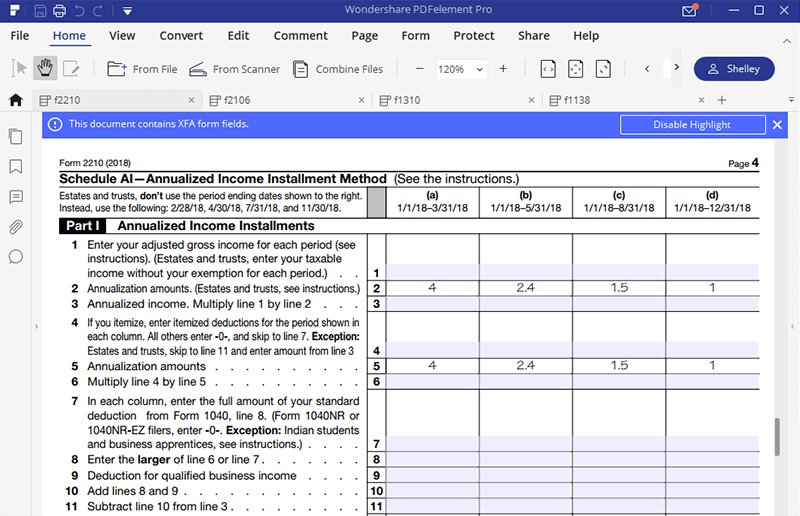

Enter the amount from each column of line 28 of schedule ai in each column of ia 2210, line 8. Don’t file form 2210 (but if box e in part ii applies, you must file page 1 of form. 10 11 total tax after credits. Show this amount on line 51 of form mo. Subtract line 10 from line 9.

Form 2210 Edit, Fill, Sign Online Handypdf

110% of prior year tax for taxpayers with prior year agi of more than $150,000 if. Web 8 tax on amount in line 7. Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. Web purpose of form use form.

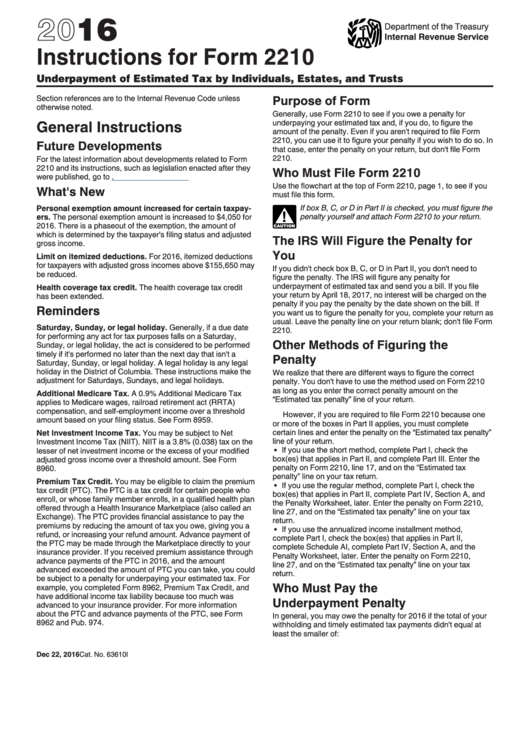

Instructions For Form 2210 Underpayment Of Estimated Tax By

10 11 total tax after credits. Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above. Total penalty (line 28a plus line 28b). The irs will generally figure your penalty for you and you should not file form 2210. Web.

Fill Free fillable F2210 2019 Form 2210 PDF form

If yes, the taxpayer does not owe a penalty and will not. Subtract line 10 from line 9. Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. After completing lines 8 and 9 on irs form 2210, is the value on line 6 equal to or greater than the value on line 9? Web complete lines.

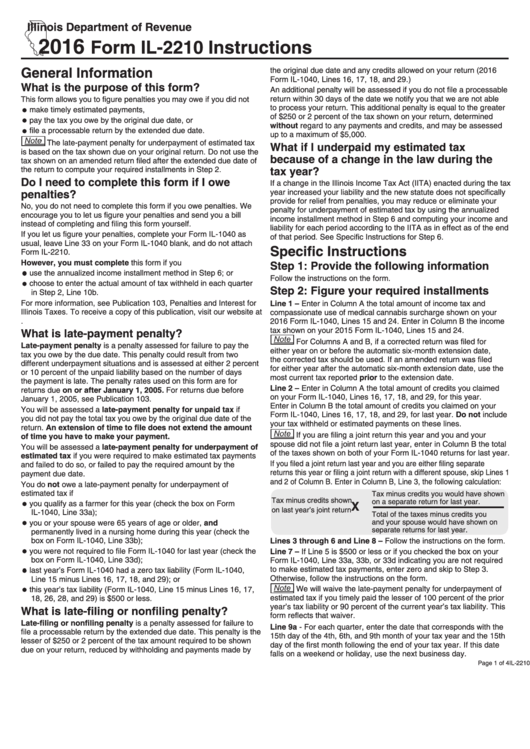

Form Il2210 Instructions 2016 printable pdf download

Web line 8 enter the taxes withheld shown on the following. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web line 25 for the number of days shown on line 27b. Web e you filed or are filing a joint return for either 2020 or 2021, but not for.

Ssurvivor Form 2210 Line 8 2018

Show this amount on line 51 of form mo. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Multiply line 7 by.12.8 9 total tax. Web you filed a joint return in one, but not both, of the past two years, and the amount.

Form 2210Underpayment of Estimated Tax

Web download this form print this form more about the federal form 2210 individual income tax estimated ty 2022 if you failed to pay or underpaid your previous year's estimated. If yes, the taxpayer does not owe a penalty and will not. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as.

Fillable Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

Show this amount on line 51 of form mo. 10 11 total tax after credits. For many taxpayers, the irs. Enter the amount from each column of line 28 of schedule ai in each column of ia 2210, line 8. Web you filed a joint return in one, but not both, of the past two years, and the amount in.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Show this amount on line 51 of form mo. 10 11 total tax after credits. • check the box on the ia 1040, line 71. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax. After completing lines 8 and 9 on irs form 2210, is the value on line 6 equal.

Add Lines 4 And 8.

Web don’t file form 2210 7 8 maximum required annual payment based on prior year’s tax (see instructions). Web you filed a joint return in one, but not both, of the past two years, and the amount in line 8 is smaller than the amount in line 5. Web 8 tax on amount in line 7. Web e you filed or are filing a joint return for either 2020 or 2021, but not for both years, and line 8 above is smaller than line 5 above.

Is Line 6 Equal To Or More Than Line 9?

After completing lines 8 and 9 on irs form 2210, is the value on line 6 equal to or greater than the value on line 9? 110% of prior year tax for taxpayers with prior year agi of more than $150,000 if. • check the box on the ia 1040, line 71. Web complete lines 8 and 9 below.

Multiply Line 7 By.12.8 9 Total Tax.

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web download this form print this form more about the federal form 2210 individual income tax estimated ty 2022 if you failed to pay or underpaid your previous year's estimated. Don’t file form 2210 (but if box e in part ii applies, you must file page 1 of form. Enter the penalty on form 2210, line 27, and on the “estimated tax penalty” line on your tax.

You Must File Page 1 Of Form 2210, But You Aren’t.

Web worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. For many taxpayers, the irs. The irs will generally figure your penalty for you and you should not file form 2210. Web line 25 for the number of days shown on line 27b.