Form 2290 Amendment

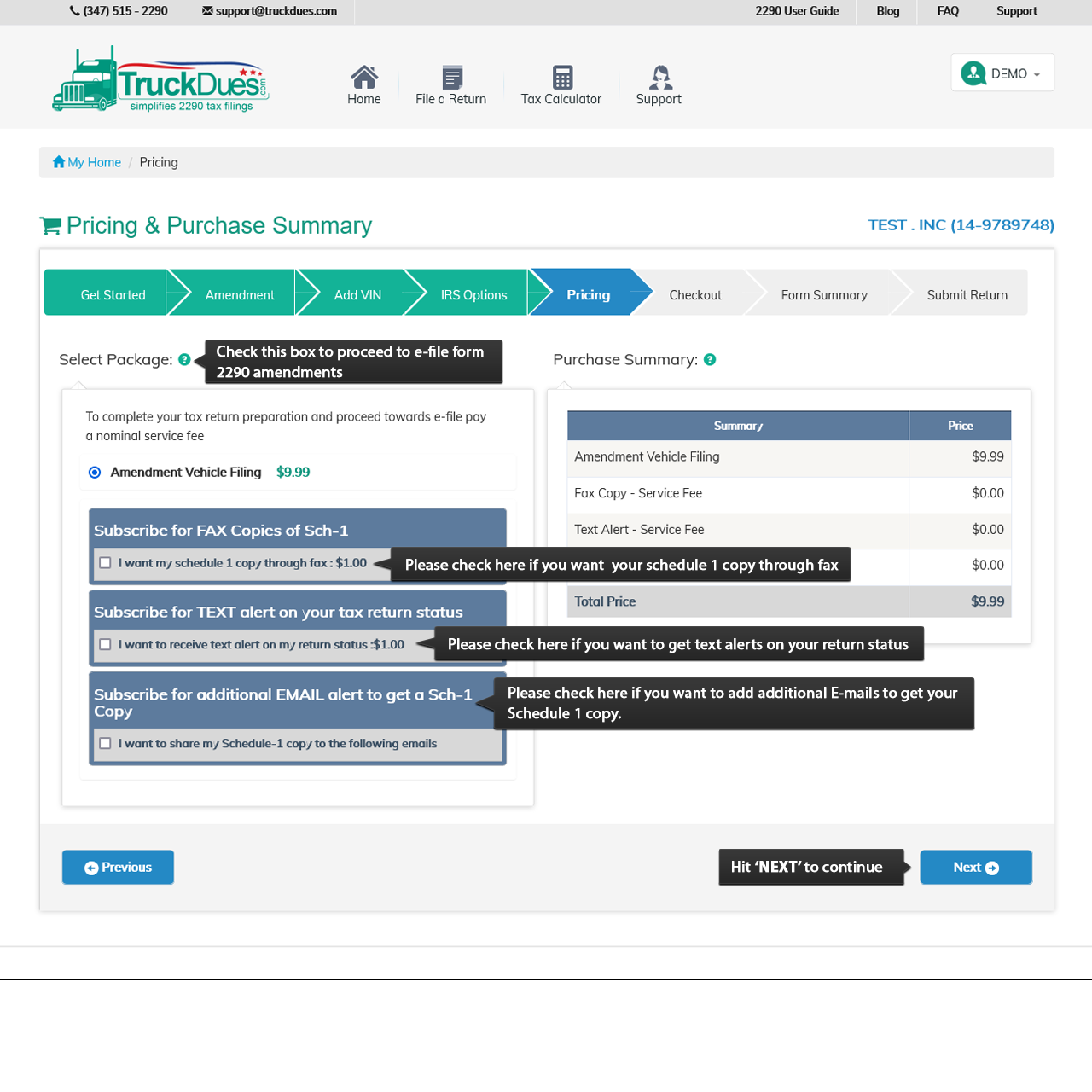

Form 2290 Amendment - Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2022, through june 30, 2023, were not subject to the tax for that period except for any. For example, if the vehicle exceeded the mileage use. On your dashboard, select “start new return”. Complete, edit or print tax forms instantly. File form 2290 easily with eform2290.com. Ad get ready for tax season deadlines by completing any required tax forms today. November 23, 2020 what is taxable gross weight? Web amendment for vin correction: Web what is form 2290 amendment? In any of the following scenarios, you have the option to do amendment for your previously accepted form 2290 returns:

On your dashboard, select “start new return”. Web an amendment is a fast and easy way to correct an error on a 2290 return that has already been accepted by the irs. Web what is form 2290 amendment? Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Web amendment for vin correction: Web instantly complete your form 2290 amendment online! Web what is form 2290 amendment? File form 2290 easily with eform2290.com. Form 2290 amendment is a way for trucking business owners to make changes to their initial form 2290 filing with the irs. Correcting a vehicle identification number.

Correcting a vehicle identification number. Web what is form 2290 amendment? It is important to note that the 2290 amendment is not a separate form. There are three types of form 2290. Web amendment for vin correction: Ad upload, modify or create forms. Complete, edit or print tax forms instantly. Web what is form 2290 amendment? Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Web form 2290 amendment is used for amending certain vehicle information.

How to File the Form 2290 Weight Increase Amendment YouTube

Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties. Web amendment for vin correction: File form 2290 easily with eform2290.com. Web you can amend your irs tax form 2290 online at yourtrucktax.com. Web form 2290 amendment must be filed by the last date of the month following.

Form 2290 Amendments What Are They And How Do You File? Blog

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web what is the form 2290 amendment? Click “form 2290 amendments” and. On your dashboard, select “start new return”. Web an amendment is a fast and easy way to correct an error on a 2290 return that has.

2290 Fill Out and Sign Printable PDF Template signNow

There are three types of form 2290. Web what is the form 2290 amendment? Click “form 2290 amendments” and. Details such as the increase in the gross taxable weight of the vehicle and the vehicle’s. On your dashboard, select “start new return”.

Form 2290 e file Amendment Increase in Gross Weight

Log in to your expresstrucktax account. Form 2290 amendment is a way for trucking business owners to make changes to their initial form 2290 filing with the irs. Web the process of filing form 2290 can be amended for a number of reasons. Ad get ready for tax season deadlines by completing any required tax forms today. Web heavy highway.

When To File A Form 2290 Amendment INSTANT 2290

Log in to your expresstrucktax account. The 2290 form has a checkbox that must be. For example, if the vehicle exceeded the mileage use. Web what is form 2290 amendment? Web you can amend your irs tax form 2290 online at yourtrucktax.com.

Form 2290 Amendment e File Step by Step Instructions

File form 2290 easily with eform2290.com. Web i declare that the vehicles listed as suspended on the form 2290 filed for the period july 1, 2022, through june 30, 2023, were not subject to the tax for that period except for any. November 23, 2020 what is taxable gross weight? Web form 2290 amendment is used for amending certain vehicle.

Ssurvivor Form 2290 Irs Pdf

Use coupon code get20b & get 20% off. Complete, edit or print tax forms instantly. Web amendment for vin correction: On your dashboard, select “start new return”. Complete, edit or print tax forms instantly.

How to File A 2290 Amendment Online? Eform 2290 Blog

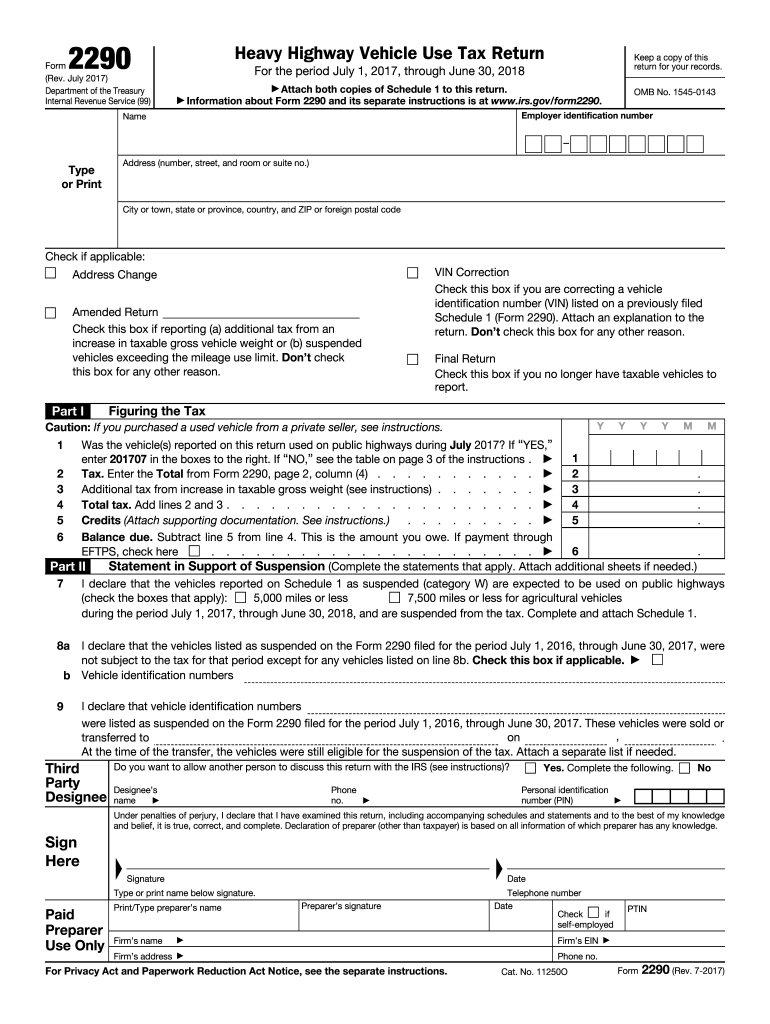

Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Web amendment for vin correction: Web filing a form 2290 amendment. Complete, edit or print tax forms instantly. Web what is form 2290 amendment?

How To Make Amendments To Your Form 2290

Correcting a vehicle identification number. Log in to your expresstrucktax account. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Web instantly complete your form 2290 amendment online! It is important to note that the 2290 amendment is not a.

Irs amendments 2290

The 2290 form has a checkbox that must be. Web you can amend your irs tax form 2290 online at yourtrucktax.com. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Both the tax return and the heavy highway vehicle use tax must be paid by the deadline in order to avoid penalties.

There Are Three Types Of Form 2290.

Details such as the increase in the gross taxable weight of the vehicle and the vehicle’s. Web you filed tax suspension for your vehicle in its form 2290 truck tax based on the estimated mileage less than 5,000 miles (75,000 miles for agricultural vehicles) for the current tax. Correcting a vehicle identification number. Click “form 2290 amendments” and.

Both The Tax Return And The Heavy Highway Vehicle Use Tax Must Be Paid By The Deadline In Order To Avoid Penalties.

Complete, edit or print tax forms instantly. Web the process of filing form 2290 can be amended for a number of reasons. For example, if the vehicle exceeded the mileage use. Web filing a form 2290 amendment.

Web I Declare That The Vehicles Listed As Suspended On The Form 2290 Filed For The Period July 1, 2022, Through June 30, 2023, Were Not Subject To The Tax For That Period Except For Any.

Web what is form 2290 amendment? Web the 2290 form is due annually between july 1 and august 31. Web an amendment is a fast and easy way to correct an error on a 2290 return that has already been accepted by the irs. File form 2290 easily with eform2290.com.

Web What Is The Form 2290 Amendment?

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 attach both copies of. Web you can amend your irs tax form 2290 online at yourtrucktax.com. Form 2290 amendment is a way for trucking business owners to make changes to their initial form 2290 filing with the irs.