Form 2441 Provider Ssn

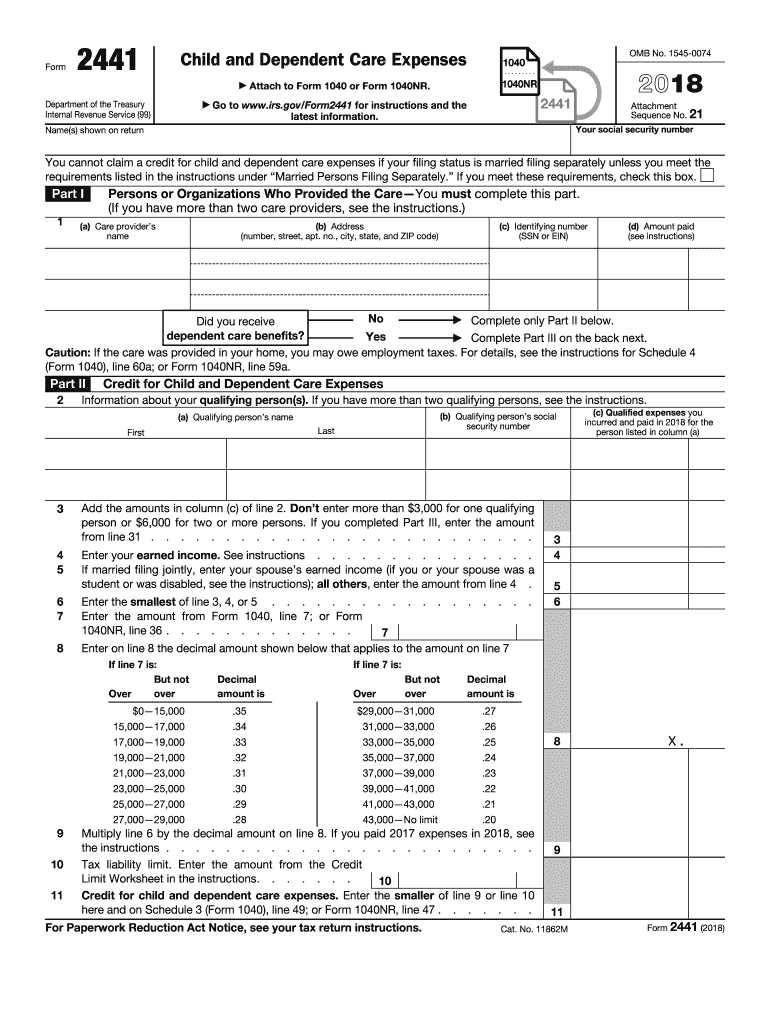

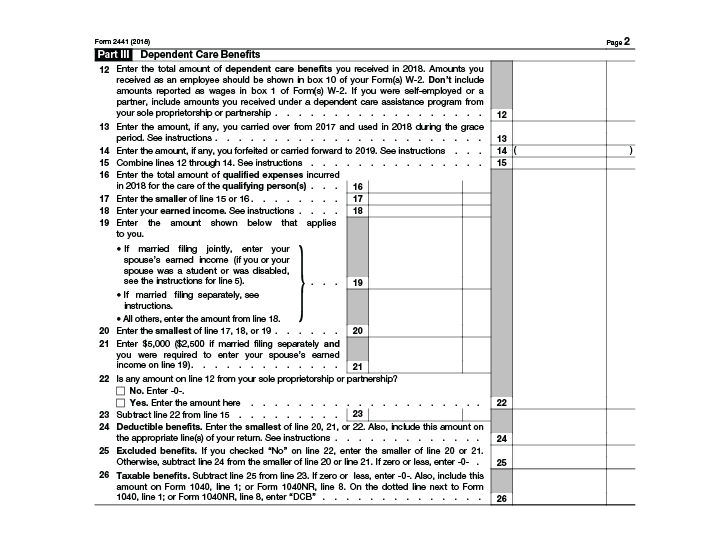

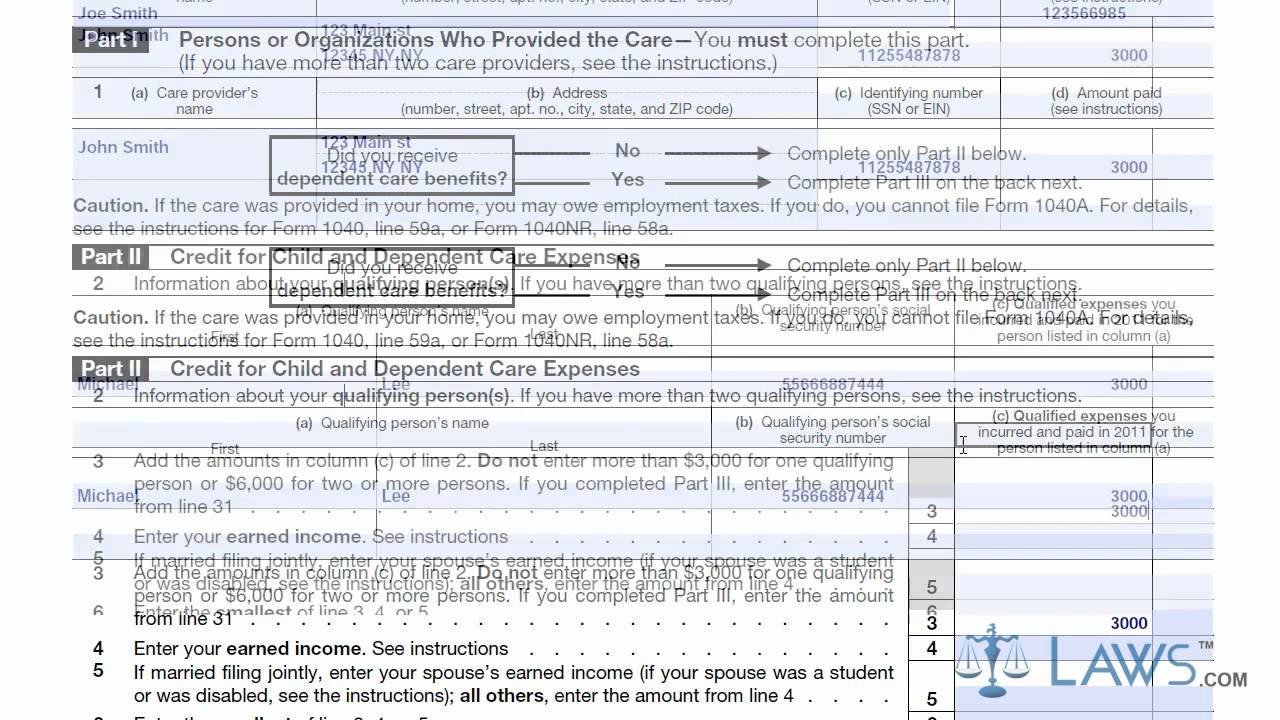

Form 2441 Provider Ssn - Web if you don’t have any care providers and you are filing form 2441 only to report taxable income in part iii, enter “none” in line 1, column (a). (updated august 24, 2021) q3. Next, enter the total amount of qualified expenses paid for each dependent. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. If your care provider is foreign and does not have or is not required to have a taxpayer identification. To claim the child and dependent care credit, you must identify the care provider on form 2441. You can usually find this amount on. How do i claim the credit? Web claim the childcare expenses on form 2441, child and dependent care expenses and provide the care provider's information you have available (such as name. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules.

Next, enter the total amount of qualified expenses paid for each dependent. Web identification number (ssn or ein). Web 11 14,033 reply bookmark icon cherylw level 3 turbo tax is asking for the amount that you paid to your child's care provider. (updated august 24, 2021) q3. Am i eligible to claim the credit? Fill out any other applicable information on this. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Web if you are living abroad, your care provider may not have, and may not be required to get, a u.s. Web form 2441 based on the income rules listed in the instructions under. No., city, state, and zip code) (c) identifying number (ssn or ein)

To claim the child and dependent care credit, you must identify the care provider on form 2441. Am i eligible to claim the credit? Enter the total amount paid to care provider in 2022 for all dependents. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Web 1 (a) care provider’s name (b) address care provider is your (number, street, apt. Taxpayer identification number (for example, an ssn or an ein). Web claim the childcare expenses on form 2441, child and dependent care expenses and provide the care provider's information you have available (such as name. Web add a child care provider. (updated august 24, 2021) q3. Web identification number (ssn or ein).

The child care tax credit is a good claim on 2020 taxes, even better

How do i claim the credit? Fill out any other applicable information on this. Web 11 14,033 reply bookmark icon cherylw level 3 turbo tax is asking for the amount that you paid to your child's care provider. Web add a child care provider. Web for the latest information about developments related to form 2441 and its instructions, such as.

All About IRS Form 2441 SmartAsset

To claim the child and dependent care credit, you must identify the care provider on form 2441. Next, enter the total amount of qualified expenses paid for each dependent. Select edit next to the appropriate dependent. Column (c) if the care provider is an individual, enter his or her ssn. Web 1 min read it depends.

Learn How to Fill the Form 2441 Dependent Care Expenses YouTube

(updated august 24, 2021) q3. Web if you are living abroad, your care provider may not have, and may not be required to get, a u.s. Web 1 (a) care provider’s name (b) address care provider is your (number, street, apt. Web if you don’t have any care providers and you are filing form 2441 only to report taxable income.

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out (2023)

Web per irs instructions for form 2441 child and dependent care expenses, page 3: Web if you are living abroad, your care provider may not have, and may not be required to get, a u.s. Part i persons or organizations. Column (c) if the care provider is an individual, enter his or her ssn. Web claiming the credit q1.

Form 2441 Definition

Web add a child care provider. Next, enter the total amount of qualified expenses paid for each dependent. Fill out any other applicable information on this. How do i claim the credit? Web identification number (ssn or ein).

2020 Tax Form 2441 Create A Digital Sample in PDF

Web if you are living abroad, your care provider may not have, and may not be required to get, a u.s. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Next, enter the total amount of qualified expenses paid.

2018 Form IRS 2441 Fill Online, Printable, Fillable, Blank PDFfiller

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web 11 14,033 reply bookmark icon cherylw level 3 turbo tax is asking for the amount that you paid to your child's care provider. Web for the.

Tax Form 2441 Filing Child and Dependent Care Expenses Top Daycare

(updated august 24, 2021) q2. Web form 2441 based on the income rules listed in the instructions under. Enter the total amount paid to care provider in 2022 for all dependents. Fill out any other applicable information on this. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for.

Ssurvivor Form 2441 Child And Dependent Care Expenses

No., city, state, and zip code) (c) identifying number (ssn or ein) How do i claim the credit? Web if you don’t have any care providers and you are filing form 2441 only to report taxable income in part iii, enter “none” in line 1, column (a). Am i eligible to claim the credit? Web if you or your spouse.

Form 2441 YouTube

Enter the total amount paid to care provider in 2022 for all dependents. You cannot claim a deduction for childcare expenses. Web if you don’t have any care providers and you are filing form 2441 only to report taxable income in part iii, enter “none” in line 1, column (a). (updated august 24, 2021) q2. Taxpayer identification number (for example,.

Web 1 Min Read It Depends.

Part i persons or organizations. Enter the total amount paid to care provider in 2022 for all dependents. Next, enter the total amount of qualified expenses paid for each dependent. To claim the child and dependent care credit, you must identify the care provider on form 2441.

No., City, State, And Zip Code) (C) Identifying Number (Ssn Or Ein)

Web claim the childcare expenses on form 2441, child and dependent care expenses and provide the care provider's information you have available (such as name. Web form 2441 based on the income rules listed in the instructions under. Select edit next to the appropriate dependent. Web add a child care provider.

Web For The Latest Information About Developments Related To Form 2441 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/ Form2441.

If you or your spouse was a student or disabled, check this box. You can usually find this amount on. (updated august 24, 2021) q3. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying.

Web 1 (A) Care Provider’s Name (B) Address Care Provider Is Your (Number, Street, Apt.

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web identification number (ssn or ein). If your care provider is foreign and does not have or is not required to have a taxpayer identification. Column (c) if the care provider is an individual, enter his or her ssn.

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)