Form 2553 Fillable

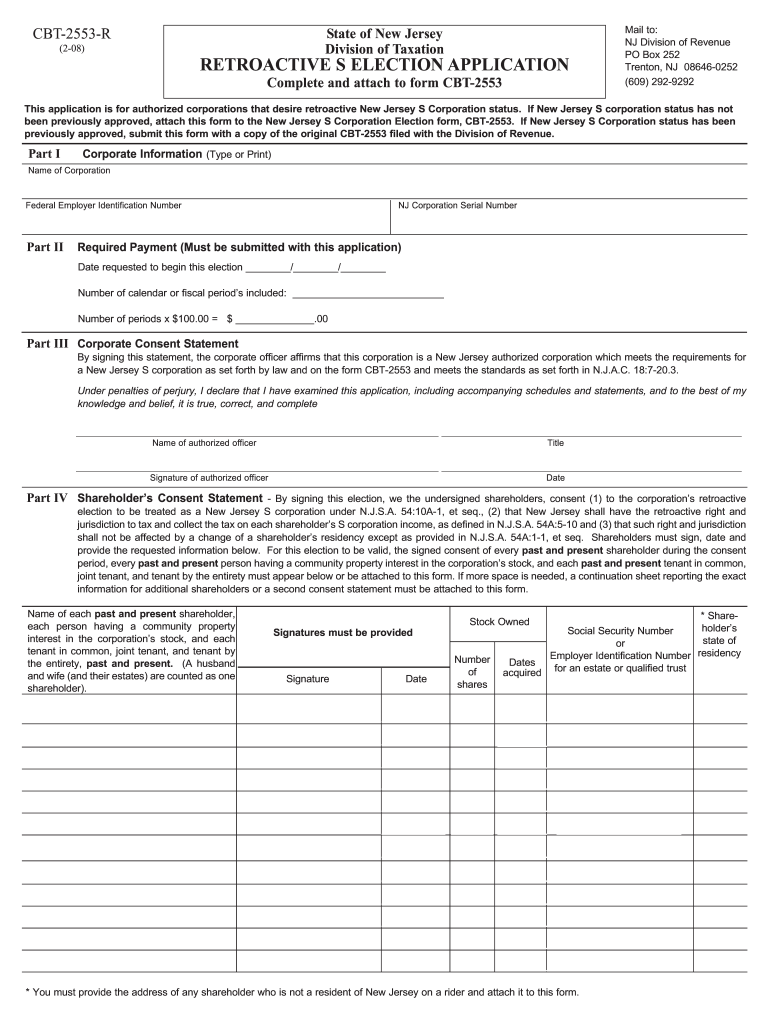

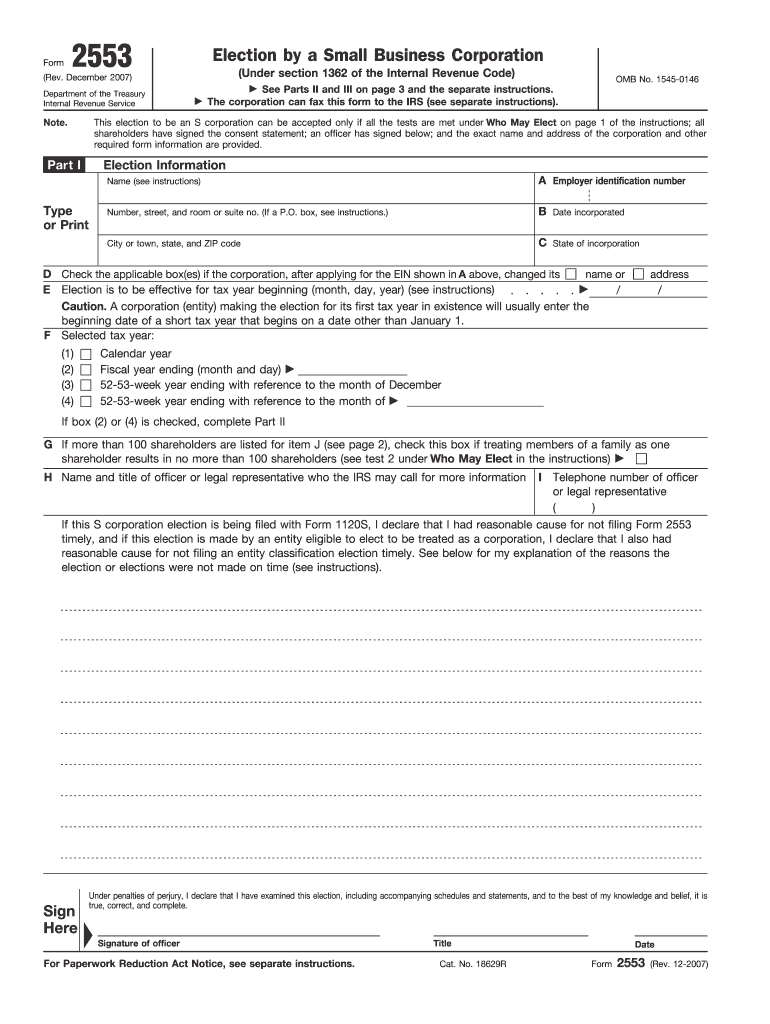

Form 2553 Fillable - Web all of the following conditions must be true in order to file form 2553: Web filling out irs 2553. The business is a domestic corporation or domestic entity (such as an llc) that is eligible to. Selection of fiscal tax year;. Ad complete irs tax forms online or print government tax documents. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Web what is form 2553? Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

The form should be filed before the 16th day of the third. The business is a domestic corporation or domestic entity (such as an llc) that is eligible to. Type text, add images, blackout confidential details, add comments, highlights and more. Web how to file the irs form 2553. Ad elect your company to s corporation with just a few clicks. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. Web how to fill out form 2553. Irs form 2553 can be filed with the irs by either mailing or faxing the form. To complete this form, you’ll need the following. Ad download, print or email irs 2553 tax form on pdffiller for free.

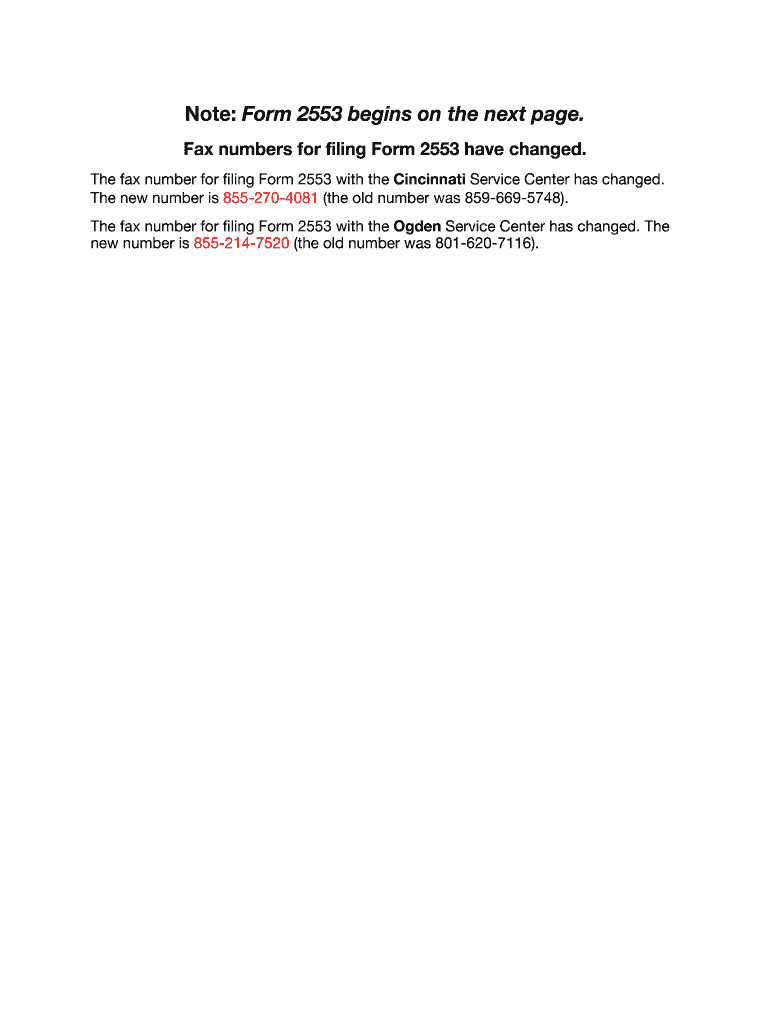

Web form 2553 is an irs form. (see, irc section 1362(a)) toggle navigation. Complete, edit or print tax forms instantly. A corporation or other entity. The form should be filed before the 16th day of the third. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. December 2017) department of the treasury internal revenue service. Ad elect your company to s corporation with just a few clicks. Ad download, print or email irs 2553 tax form on pdffiller for free. Web filling out irs 2553.

Fillable Form 2553 (2017) Edit, Sign & Download in PDF PDFRun

Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. (see, irc section 1362(a)) toggle navigation. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Form 2553, get ready for tax deadlines by filling.

2013 Form IRS 2553 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Web how to file the irs form 2553. Election by a small business corporation (under section 1362 of the internal revenue. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. Web like most irs forms, the first.

Fill Free fillable form 2553 election by a small business corporation

The business is a domestic corporation or domestic entity (such as an llc) that is eligible to. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. Election information and employer identification number; Type text, add images, blackout confidential details, add comments, highlights and more. A corporation or other entity.

IRS Form 2553 Download Fillable PDF or Fill Online Election by a Small

A corporation or other entity. (see, irc section 1362(a)) toggle navigation. Sign it in a few clicks. Election by a small business corporation (under section 1362 of the internal revenue. If necessary, use our form.

Ssurvivor Form 2553 Sample

(see, irc section 1362(a)) toggle navigation. Web all of the following conditions must be true in order to file form 2553: Web what is form 2553? Web how to fill out form 2553. Irs form 2553 can be filed with the irs by either mailing or faxing the form.

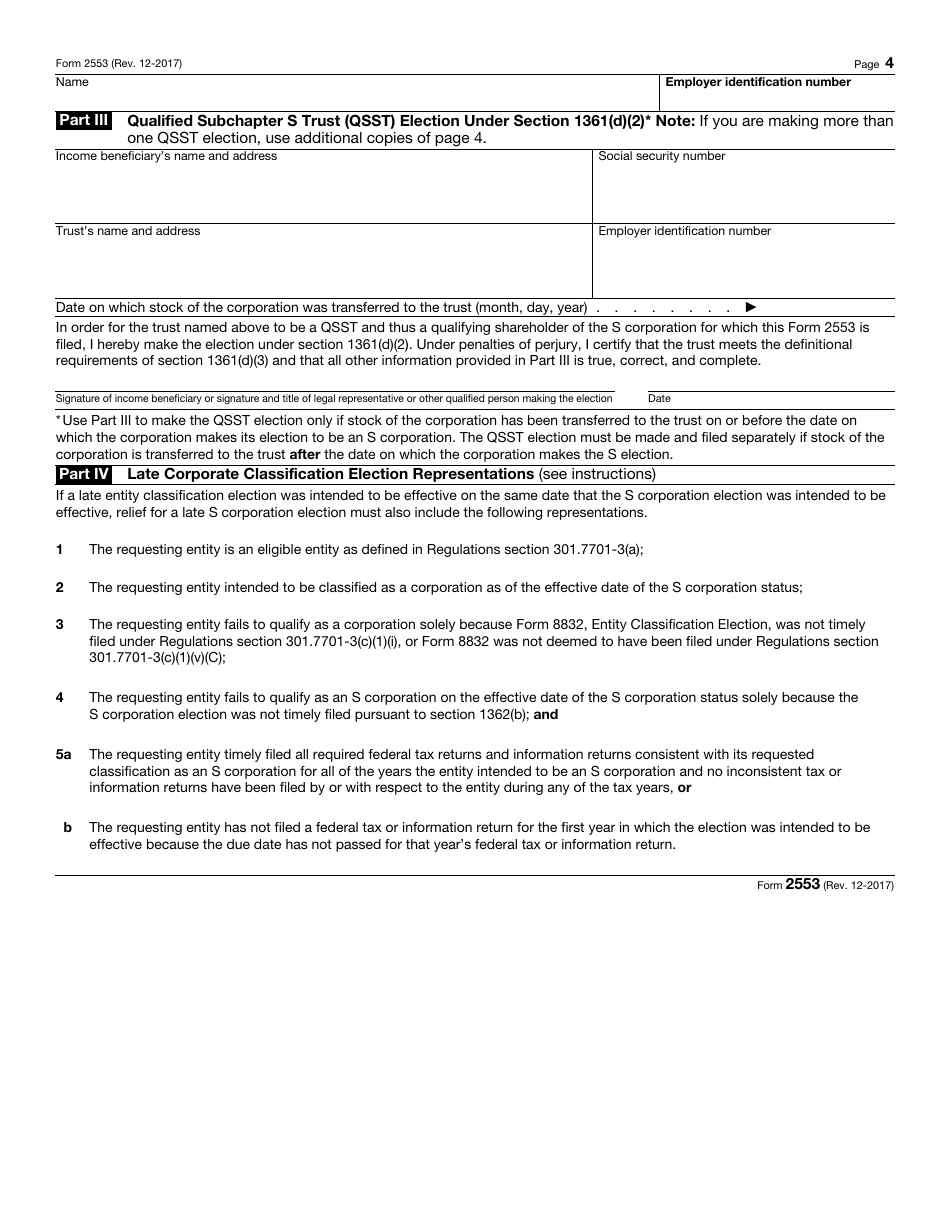

GSA Form 2553 Download Fillable PDF or Fill Online Vehicle

Irs form 2553 can be filed with the irs by either mailing or faxing the form. Election information and employer identification number; Ad complete irs tax forms online or print government tax documents. Edit your fillable form 2553 online. Web like most irs forms, the first fillable page of form 2553 is meant to identify and learn more about your.

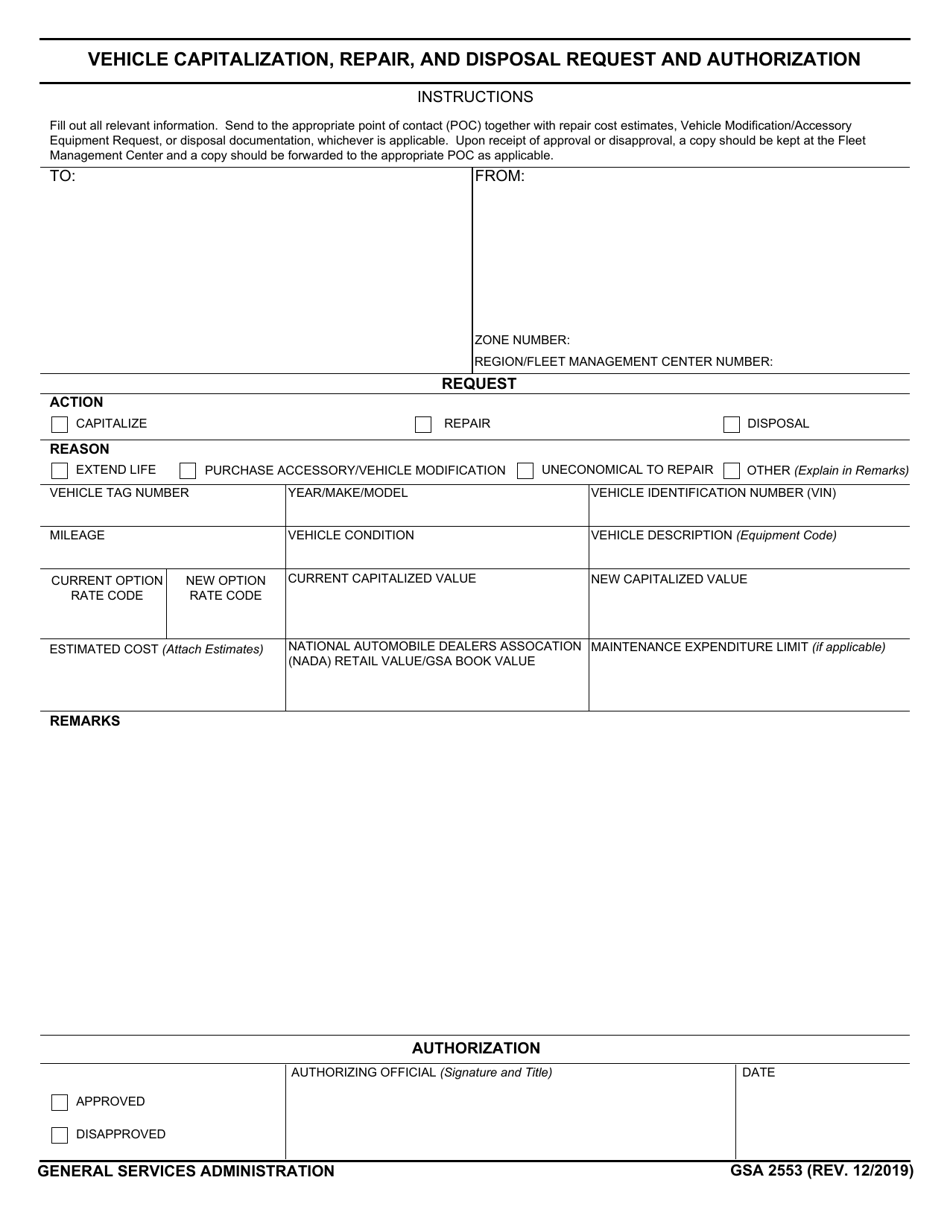

Cbt 2553 Fill Out and Sign Printable PDF Template signNow

Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15. Web all of the following conditions must be true in order to file form 2553: The form consists of several parts requiring the following information: To.

Form 2553 Fill Out and Sign Printable PDF Template signNow

Irs form 2553 can be filed with the irs by either mailing or faxing the form. The form should be filed before the 16th day of the third. Selection of fiscal tax year;. Complete, edit or print tax forms instantly. Sign it in a few clicks.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Election by a small business corporation (under section 1362 of the internal revenue. Web all of the following conditions must be true in order to file form 2553: The form consists of several parts requiring the following information: Web how to fill out form 2553. A corporation or other entity.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c. The form consists of several parts requiring the following information: Check the entered data several times. For example, if you want. Web form 2553 must be filed either during the tax year that precedes the.

Election Information And Employer Identification Number;

The form consists of several parts requiring the following information: Currently, an online filing option does not exist for this form. A corporation or other entity. Ad complete irs tax forms online or print government tax documents.

Complete, Edit Or Print Tax Forms Instantly.

Irs form 2553 can be filed with the irs by either mailing or faxing the form. Web all of the following conditions must be true in order to file form 2553: Form 2553, get ready for tax deadlines by filling online any tax form for free. Web form 2553 must be filed either during the tax year that precedes the tax year for which you want the s corporation to take effect or no more than two months and 15.

The Form Should Be Filed Before The 16Th Day Of The Third.

Web it is (a) a domestic corporation, or (b) a domestic entity eligible to elect to be treated as a corporation, that timely files form 2553 and meets all the other tests listed. Check the entered data several times. Selection of fiscal tax year;. Sign it in a few clicks.

Web Form 2553 Is An Irs Form.

This means that all income and. Web you must file form 2553 within two months and 15 days of the beginning of the tax year that you want your s corp tax treatment to start. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. For example, if you want.