Form 2553 For Llc

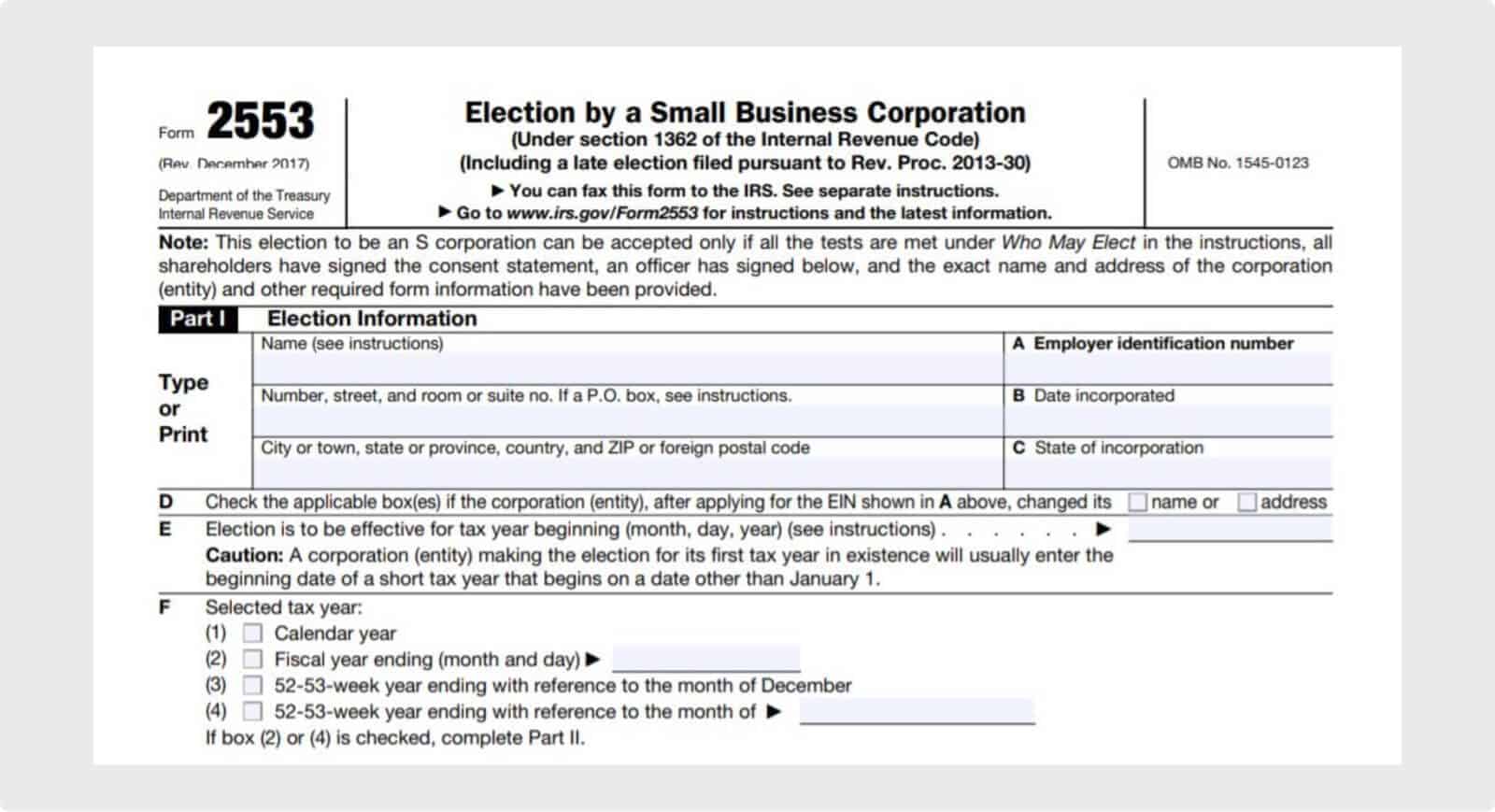

Form 2553 For Llc - Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c corporation business structure assigned by. Web rob watts editor updated: Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election to be taxed as a corporation (regs. Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes. Web 2553 form (under section 1362 of the internal revenue code) (rev. How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as provide other. These entities are not required to file form 8832, entity classification election. Commissions do not affect our editors' opinions or evaluations. Aug 21, 2022, 10:57pm editorial note: Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service (irs).

December 2017) (including a late election filed pursuant to rev. Aug 21, 2022, 10:57pm editorial note: Web form 2553 notifies the irs that you want to elect s corp status. Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a disregarded entity for federal income tax purposes, enter the owner's name and address. How to complete form 2553. How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as provide other. Web 2553 form (under section 1362 of the internal revenue code) (rev. The owner must be eligible to be an s. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election to be taxed as a corporation (regs. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c corporation business structure assigned by.

How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as provide other. December 2017) (including a late election filed pursuant to rev. How to complete form 2553. Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c corporation business structure assigned by. Aug 21, 2022, 10:57pm editorial note: We earn a commission from partner links on forbes advisor. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service (irs). Web rob watts editor updated: Web 2553 form (under section 1362 of the internal revenue code) (rev. Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a disregarded entity for federal income tax purposes, enter the owner's name and address.

Form 2553 An Overview of Who, When, and Why

Web 2553 form (under section 1362 of the internal revenue code) (rev. Commissions do not affect our editors' opinions or evaluations. Aug 21, 2022, 10:57pm editorial note: Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c corporation business structure assigned by. Web if a.

How to Fill Out Form 2553 Instructions, Deadlines [2023]

Our form 2553 instructions guide below covers: The owner must be eligible to be an s. How to complete form 2553. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. December 2017) (including a late election filed pursuant to rev.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Web 2553 form (under section 1362 of the internal revenue code) (rev. Where to file form 2553. These entities are not required to file form 8832, entity classification election. We earn a commission from partner links on forbes advisor. Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a.

67 FREE DOWNLOAD S CORP TAX FORM 2553 PDF DOC AND VIDEO TUTORIAL

Upon receipt and review, the irs will then send a letter to your corporation confirming its election for this tax treatment or denying your request. How to complete form 2553. How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as.

LLC Taxed as an S Corp Form 2553 LLC University Fill Out and Sign

A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes. The owner must be.

What is IRS Form 2553? Bench Accounting

Election by a small business corporation is used by small businesses that elect to be taxed as an s corporation, rather than the default c corporation business structure assigned by. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the.

LLC vs. SCorp (How to Choose) SimplifyLLC

Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes. Commissions do not affect our editors' opinions or evaluations. Web form 2553 notifies the irs that you want to elect s corp status. Aug 21, 2022, 10:57pm.

2553 Vorwahl

We earn a commission from partner links on forbes advisor. Web form 2553 is used by limited liability companies (llcs) and corporations to elect the s corporation (s corp) tax classification with the us internal revenue service (irs). Where to file form 2553. The owner must be eligible to be an s. Upon receipt and review, the irs will then.

Ssurvivor Form 2553 Sample

Web rob watts editor updated: Web form 2553 notifies the irs that you want to elect s corp status. Web an llc that is eligible to elect s status and timely files an s election (form 2553, election by a small business corporation) is considered to have made the election to be taxed as a corporation (regs. December 2017) (including.

Review Paystub News here Everything Paystubs All the time

Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a disregarded entity for federal income tax purposes, enter the owner's name and address. December 2017) (including a late election filed pursuant to rev. Upon receipt and review, the irs will then send a letter to your corporation confirming its.

Web Form 2553 Is Used By Qualifying Small Business Corporations And Limited Liability Companies To Make The Election Prescribed By Sec.

How form 2553 works for many business owners, electing for their business to be treated as an s corporation for tax purposes will save them on taxes as well as provide other. December 2017) (including a late election filed pursuant to rev. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Commissions do not affect our editors' opinions or evaluations.

Web An Llc That Is Eligible To Elect S Status And Timely Files An S Election (Form 2553, Election By A Small Business Corporation) Is Considered To Have Made The Election To Be Taxed As A Corporation (Regs.

Web form 2553 is a tax form on which owners of an llc or corporation can elect for their business entity to be taxed as an s corporation for federal income tax purposes. These entities are not required to file form 8832, entity classification election. Web form 2553 notifies the irs that you want to elect s corp status. Upon receipt and review, the irs will then send a letter to your corporation confirming its election for this tax treatment or denying your request.

Web Form 2553 Is Used By Limited Liability Companies (Llcs) And Corporations To Elect The S Corporation (S Corp) Tax Classification With The Us Internal Revenue Service (Irs).

Web rob watts editor updated: Web 2553 form (under section 1362 of the internal revenue code) (rev. How to complete form 2553. We earn a commission from partner links on forbes advisor.

Aug 21, 2022, 10:57Pm Editorial Note:

The owner must be eligible to be an s. Web if a single member limited liability company (llc) owns stock in the corporation, and the llc is treated as a disregarded entity for federal income tax purposes, enter the owner's name and address. Our form 2553 instructions guide below covers: Where to file form 2553.

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)