Form 2553 Vs 8832

Form 2553 Vs 8832 - When it comes to drafting a legal form, it is easier to delegate it. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Form 8832 can also be used to change a prior election. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s. Web our brains are jelly after reading far too many irs 'instruction' forms. To elect classification as an s corporation, the llc must. You may have recently set up a limited liability company or a corporation. Web about form 8832, entity classification election. But how do you want that new. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to.

To elect classification as an s corporation, the llc must. Web the biggest difference between form 8832 and form 2553 is the tax classification that you're requesting. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s. Web our brains are jelly after reading far too many irs 'instruction' forms. Use form 2553, election by small. Web form 8832 vs. An eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as: Understanding the difference between form 8832 and form 2553 is of the utmost importance if you’re interested in changing your. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your. Web in either of those cases if the llc wants to elect to be taxed as a corporation the form 8832 is used.

Web form 8832 vs. Web about form 8832, entity classification election. United states (english) united states (spanish) canada (english) canada. Web in either of those cases if the llc wants to elect to be taxed as a corporation the form 8832 is used. When it comes to drafting a legal form, it is easier to delegate it. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. Sign here under penalties of perjury, i declare that i have examined this election, including accompanying documents, and, to the best of my knowledge and. Form 8832 can also be used to change a prior election. Web form 8832 vs.

What Is Irs Form 8832?

Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you’re interested in changing your. Understanding the difference between form 8832 and form.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

If you're an llc or partnership, use form 8832 if. Ask an expert tax questions ★★★★ what’s the. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s. You may have recently set up a limited liability company.

Form 8832 Entity Classification Election (2013) Free Download

Use form 2553, election by small. Web form 8832 vs. Web the biggest difference between form 8832 and form 2553 is the tax classification that you're requesting. You may have recently set up a limited liability company or a corporation. But how do you want that new.

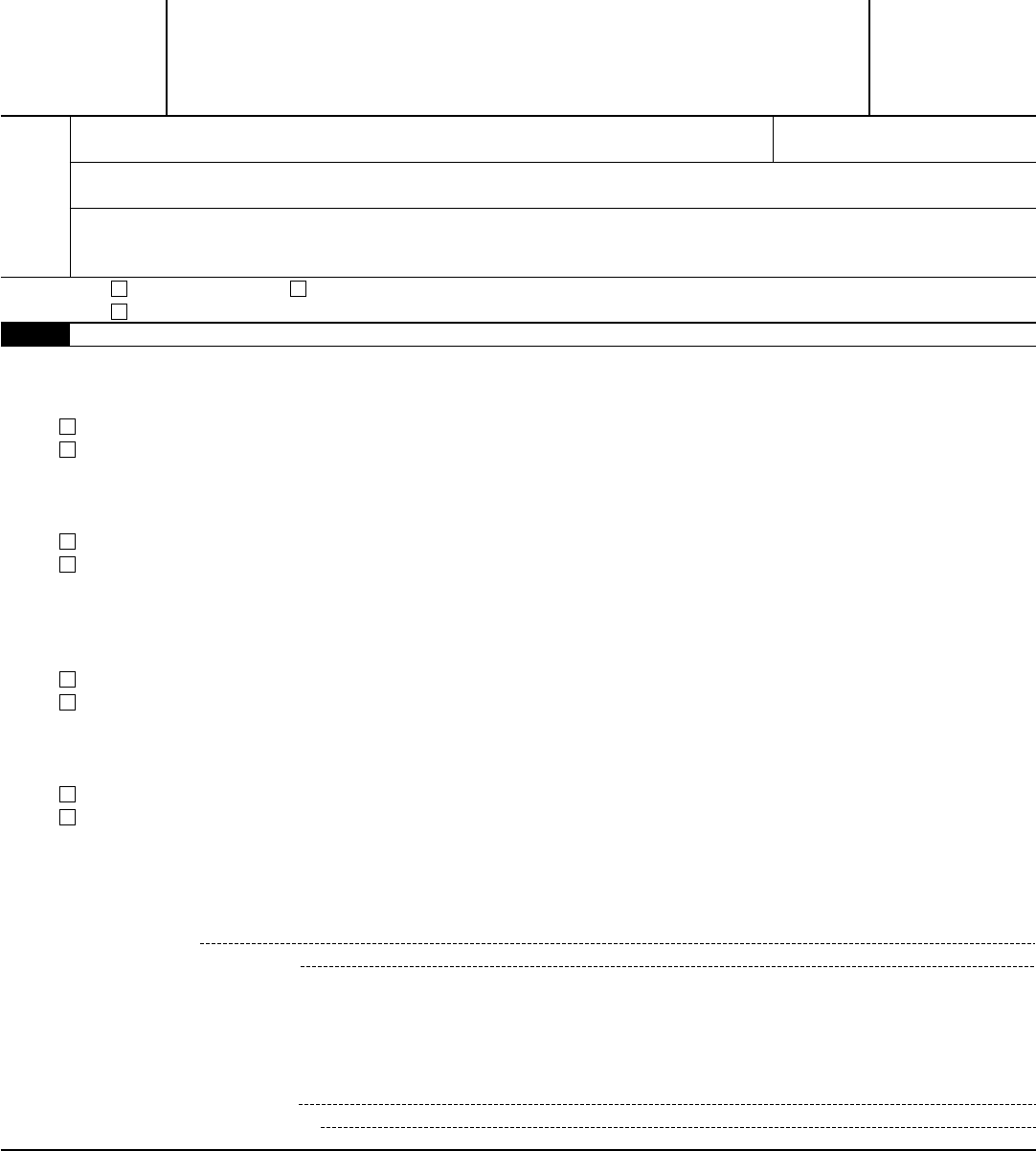

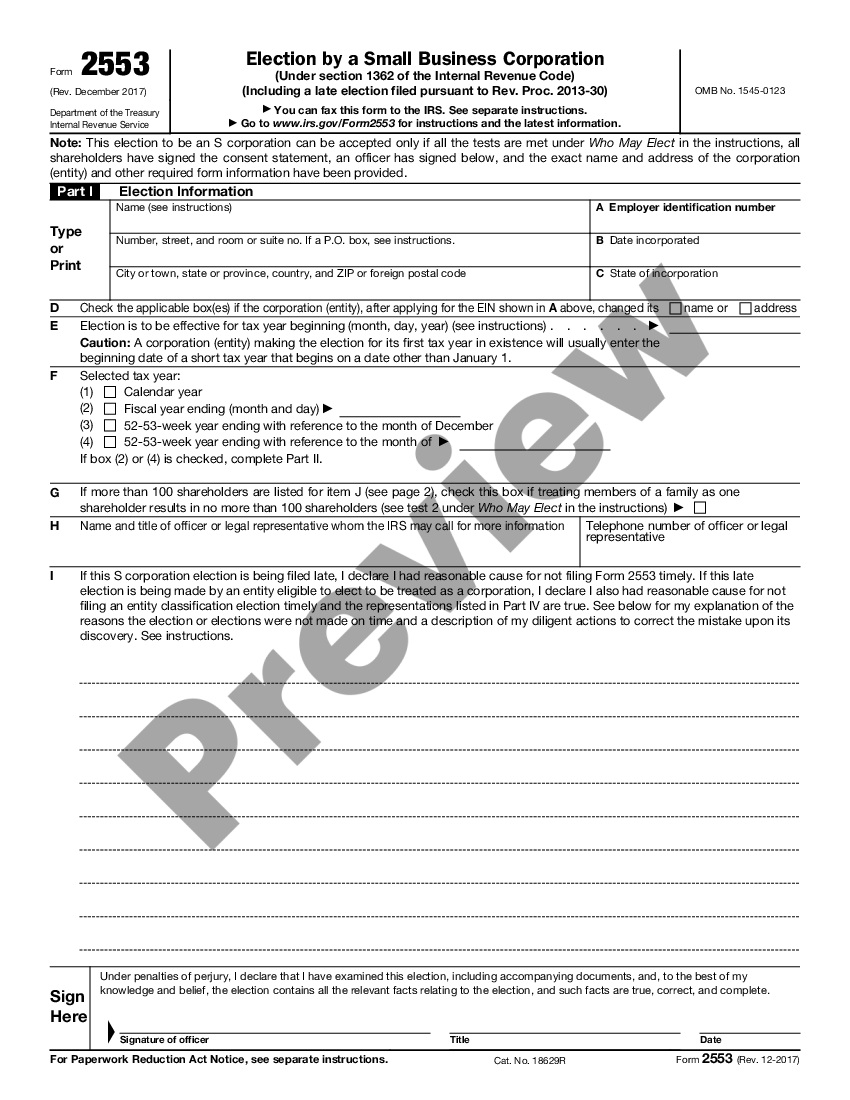

Election of 'S' Corporation Status and Instructions Form 2553 S Corp

Web the biggest difference between form 8832 and form 2553 is the tax classification that you're requesting. Web the corrected form 8832, with the box checked entitled: Use form 2553, election by small. You may have recently set up a limited liability company or a corporation. When it comes to drafting a legal form, it is easier to delegate it.

What is IRS Form 2553? Bench Accounting

If you're an llc or partnership, use form 8832 if. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you’re interested in changing your. Web in either of those cases if the llc wants to elect to be taxed as a corporation the form 8832 is used. An eligible entity uses form 8832 to.

Como usar el Formulario 8832 para cambiar la clasificación fiscal de su

Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your. To elect classification as an s corporation, the llc must. The information you provide impacts whether the irs will. Web form 8832 vs. Web selected as best answer.

Form 2553 How To Qualify And An S Corporation Silver Tax Group

Web about form 8832, entity classification election. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s. United states (english) united states (spanish) canada (english) canada. Ask an expert tax questions ★★★★ what’s the. You may have recently.

(PDF) Form 8832 Shane Dorn Academia.edu

If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. United states (english) united states (spanish) canada (english) canada. If you're an llc or partnership, use form 8832 if. Web about form 8832, entity classification election. Web our brains are jelly after reading far.

What is Form 8832 and How Do I File it?

Use form 2553, election by small. Web about form 8832, entity classification election. Sign here under penalties of perjury, i declare that i have examined this election, including accompanying documents, and, to the best of my knowledge and. To elect classification as an s corporation, the llc must. Web the biggest difference between form 8832 and form 2553 is the.

Steps for Electing Sub S Status for Washington LLC or Corp Evergreen

Sign here under penalties of perjury, i declare that i have examined this election, including accompanying documents, and, to the best of my knowledge and. Web our brains are jelly after reading far too many irs 'instruction' forms. Use form 2553, election by small. Web the corrected form 8832, with the box checked entitled: Web form 8832 vs.

Understanding The Difference Between Form 8832 And Form 2553 Is Of The Utmost Importance If You’re Interested In Changing Your.

Web in either of those cases if the llc wants to elect to be taxed as a corporation the form 8832 is used. United states (english) united states (spanish) canada (english) canada. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your. Ask an expert tax questions ★★★★ what’s the.

Form 8832 Can Also Be Used To Change A Prior Election.

Sign here under penalties of perjury, i declare that i have examined this election, including accompanying documents, and, to the best of my knowledge and. Web selected as best answer. The information you provide impacts whether the irs will. Web the corrected form 8832, with the box checked entitled:

To Elect Classification As An S Corporation, The Llc Must.

Web the biggest difference between form 8832 and form 2553 is the tax classification that you're requesting. Web form 8832 vs. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to. When it comes to drafting a legal form, it is easier to delegate it.

An Eligible Entity Uses Form 8832 To Elect How It Will Be Classified For Federal Tax Purposes, As:

Web use form 8832, entity classification election to make an election to be an association taxable as a corporation. But how do you want that new. Web form 8832 vs. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s.