Form 2848 Electronic Signature

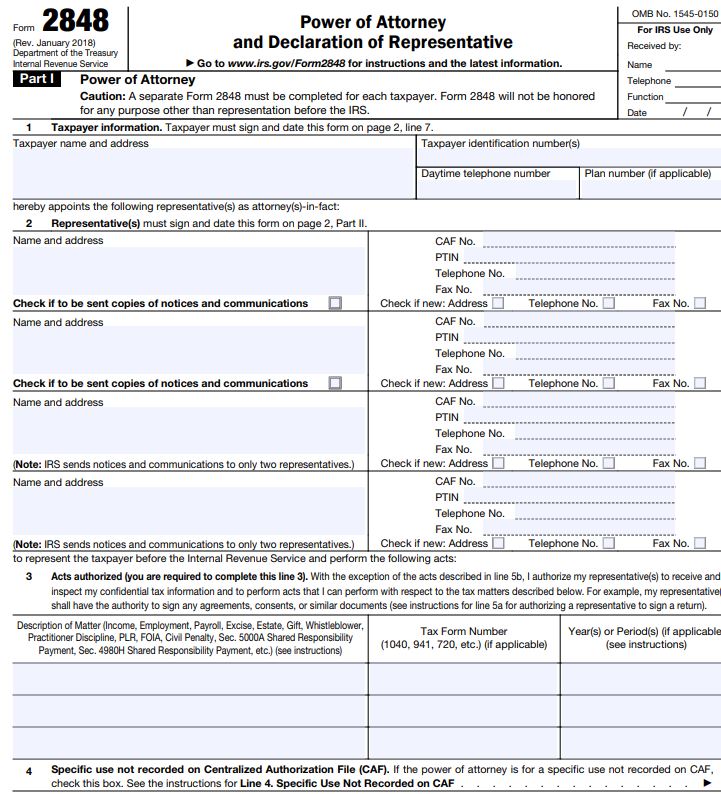

Form 2848 Electronic Signature - January 2021) department of the treasury internal revenue service. The form 2848 is submitted online to www.irs.gov/submit2848. For instructions and the latest information. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Web if you use an electronic signature (see electronic signatures below), you must submit your form 2848 online. Submit your form 2848 securely at irs.gov/submit2848. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. For more information on secure access, go to irs.gov/secureaccess. You will need to have a secure access account to submit your form 2848 online.

If you complete form 2848 for electronic signature authorization, do not file form 2848 with the irs. Web effective january, 2021, form 2848, power of attorney and declaration of representative may be executed electronically, provided: January 2021) department of the treasury internal revenue service. The form 2848 is submitted online to www.irs.gov/submit2848. Below is information to help you, as a tax professional, learn the basics about this new tool. For more information on secure access, go to irs.gov/secureaccess. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Instead, use form 2848 to authorize an individual to represent you before give it to your representative, who will retain the document. You will need to have a secure access account to submit your form 2848 online. The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity.

Web as long as you can create a secure access account and follow authentication procedures, you may submit a form 2848 or 8821 with an image of an electronic signature. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity. Power of attorney and declaration of representative. Tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. For more information on secure access, go to irs.gov/secureaccess. Below is information to help you, as a tax professional, learn the basics about this new tool. Web effective january, 2021, form 2848, power of attorney and declaration of representative may be executed electronically, provided: Web however, a representative of the irs has confirmed that that if the taxpayer signs the form 2848 poa and scans and emails tax counsel the scanned signature, that will constitute a “wet ink” signature. Instead, use form 2848 to authorize an individual to represent you before give it to your representative, who will retain the document.

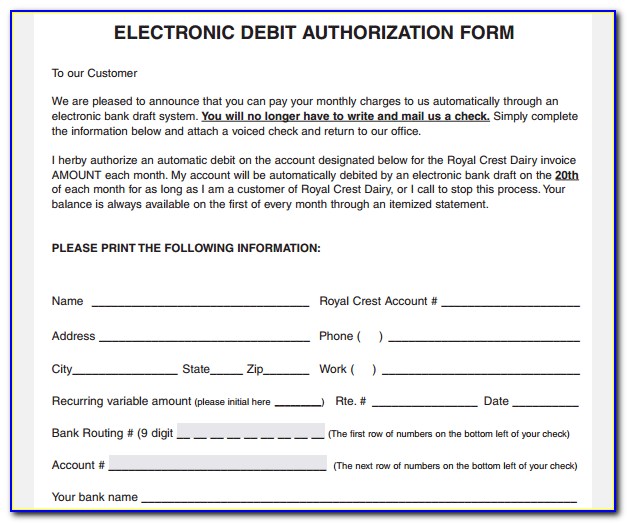

Electronic Signature Consent Form Form Resume Examples a15qwxakeQ

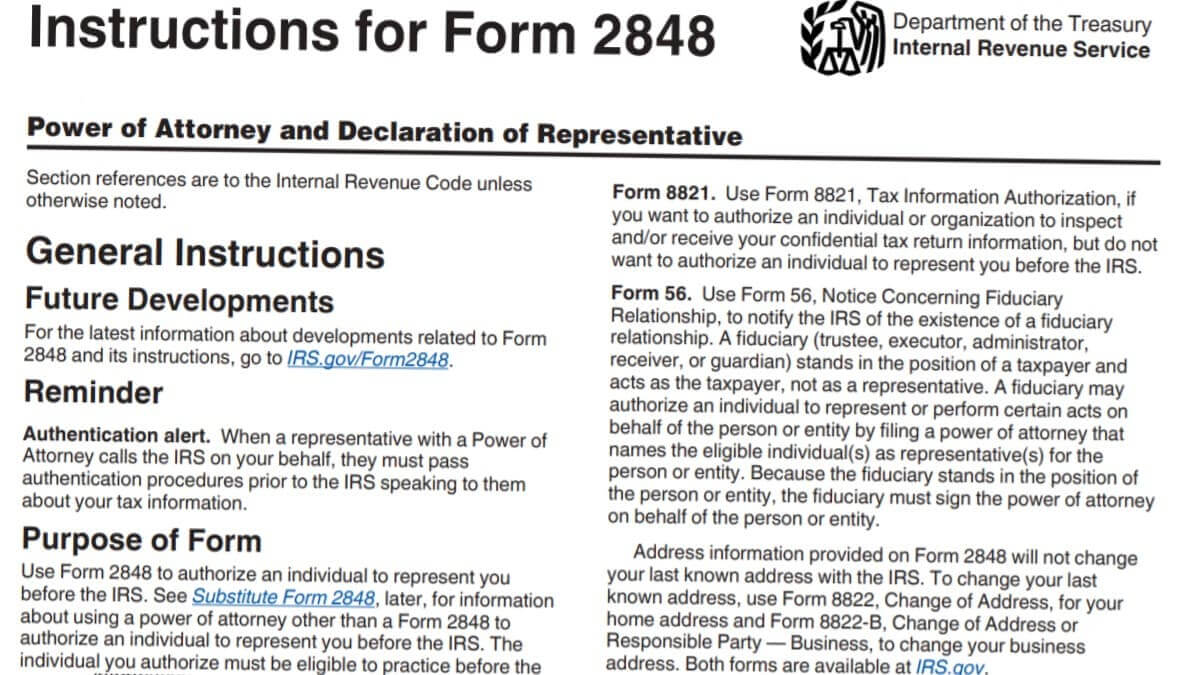

Tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. If.

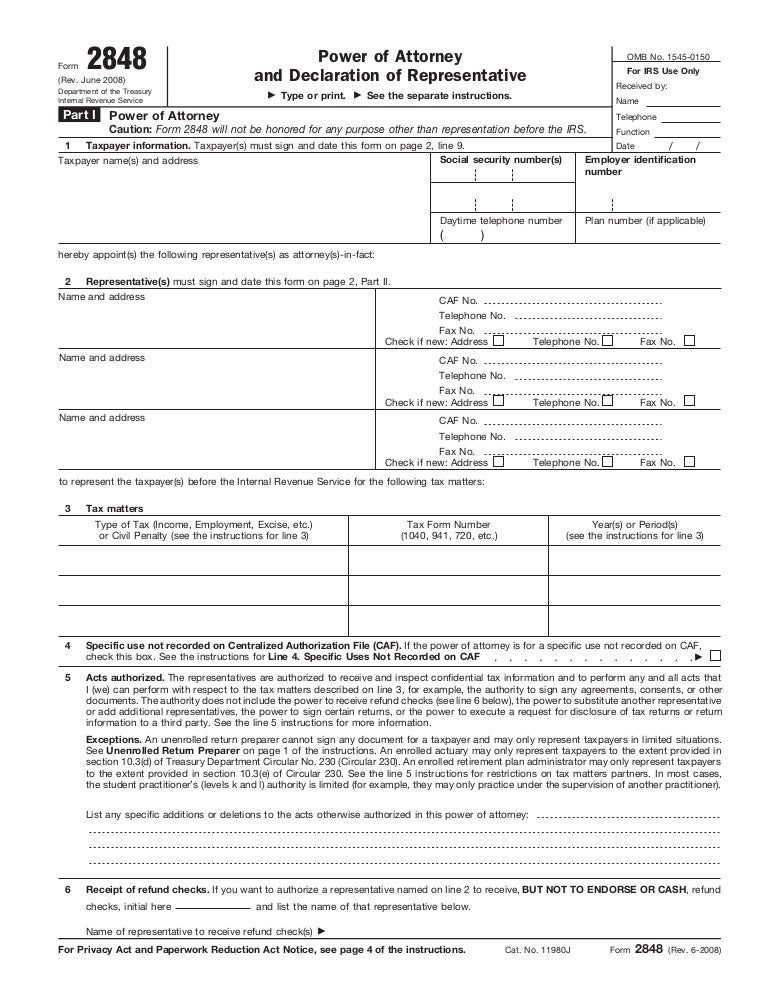

The Fastest Way To Convert PDF To Fillable IRS Form 2848

The form 2848 is submitted online to www.irs.gov/submit2848. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity. Tax professionals can find the.

Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. For more information on secure access, go to irs.gov/secureaccess. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. The form 2848 is submitted online to www.irs.gov/submit2848..

Form 2848 Edit, Fill, Sign Online Handypdf

Date / / part i power of attorney. January 2021) department of the treasury internal revenue service. Instead, use form 2848 to authorize an individual to represent you before give it to your representative, who will retain the document. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. Below is information to help.

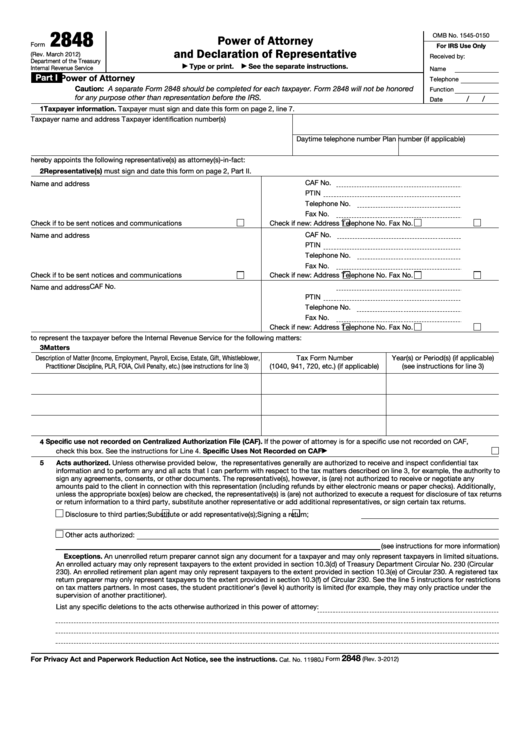

2018 Form IRS 2848 Fill Online, Printable, Fillable, Blank pdfFiller

If you complete form 2848 for electronic signature authorization, do not file form 2848 with the irs. Web as long as you can create a secure access account and follow authentication procedures, you may submit a form 2848 or 8821 with an image of an electronic signature. Submit your form 2848 securely at irs.gov/submit2848. Power of attorney and declaration of.

Form 2848 Instructions

January 2021) department of the treasury internal revenue service. Date / / part i power of attorney. The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. Instead, use form 2848 to authorize an individual.

Breanna Form 2848 Power Of Attorney And Declaration Of Representative

Web however, a representative of the irs has confirmed that that if the taxpayer signs the form 2848 poa and scans and emails tax counsel the scanned signature, that will constitute a “wet ink” signature. Date / / part i power of attorney. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for.

Breanna Form 2848 Fax Number Irs

Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. For more information on secure access, go to irs.gov/secureaccess. Power of attorney and declaration of representative. Submit your form 2848 securely at irs.gov/submit2848. January 2021) department of the treasury internal revenue service.

Top 12 Form 2848 Templates free to download in PDF format

January 2021) department of the treasury internal revenue service. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. The third party submitting the form 2848 on behalf of the taxpayer attests that s/he authenticated the taxpayer’s identity. Instead, use form 2848 to authorize an individual to represent you before give it to your.

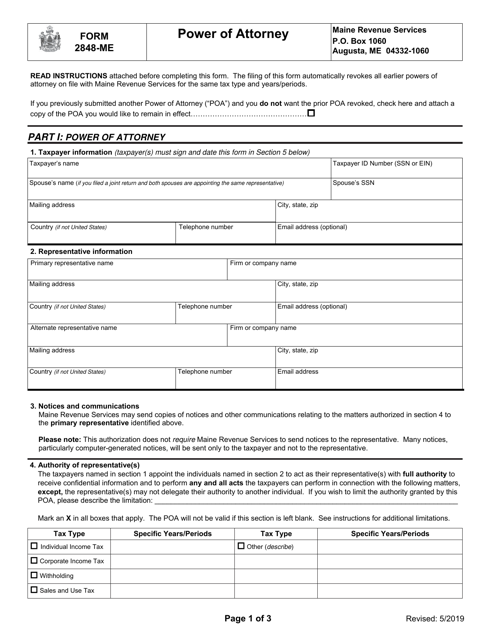

Form 2848ME Download Fillable PDF or Fill Online Power of Attorney

For more information on secure access, go to irs.gov/secureaccess. Web effective january, 2021, form 2848, power of attorney and declaration of representative may be executed electronically, provided: Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. Electronic signatures may be uploaded.

Web As Long As You Can Create A Secure Access Account And Follow Authentication Procedures, You May Submit A Form 2848 Or 8821 With An Image Of An Electronic Signature.

Below is information to help you, as a tax professional, learn the basics about this new tool. Web however, a representative of the irs has confirmed that that if the taxpayer signs the form 2848 poa and scans and emails tax counsel the scanned signature, that will constitute a “wet ink” signature. Web if you use an electronic signature (see electronic signatures below), you must submit your form 2848 online. For instructions and the latest information.

Web The Taxpayer First Act (Tfa) Of 2019 Requires The Irs To Provide Digital Signature Options For Form 2848, Power Of Attorney, And Form 8821, Tax Information Authorization.

January 2021) department of the treasury internal revenue service. Tax professionals can find the new submit forms 2848 and 8821 online on the irs.gov/taxpros page. Instead, use form 2848 to authorize an individual to represent you before give it to your representative, who will retain the document. Web effective january, 2021, form 2848, power of attorney and declaration of representative may be executed electronically, provided:

The Third Party Submitting The Form 2848 On Behalf Of The Taxpayer Attests That S/He Authenticated The Taxpayer’s Identity.

For more information on secure access, go to irs.gov/secureaccess. Electronic signatures may be uploaded to the irs’s website provided the electronic signature has been authenticated. Power of attorney and declaration of representative. The form 2848 is submitted online to www.irs.gov/submit2848.

Date / / Part I Power Of Attorney.

Submit your form 2848 securely at irs.gov/submit2848. These improvements will help individual taxpayers, business taxpayers, and the tax professionals who serve them. Web the taxpayer first act (tfa) of 2019 requires the irs to provide digital signature options for form 2848, power of attorney, and form 8821, tax information authorization. You will need to have a secure access account to submit your form 2848 online.