Form 3514 Turbotax

Form 3514 Turbotax - You do not need a child to qualify, but must file a california income tax return to. You can download or print. I looked it up and it doesn’t even apply to me. If you don't have a sein or business license number, then you should be able to leave. For windows go to to find form 3514. After reviewing this, lacerte currently does not have a way to force form 3514 for ca when the taxpayer does not qualify for eic. Web i am being asked a question about form 3514, and i have no idea what the form is. Web california form 3514 want business code, etc. Sign it in a few. Just deleting the form fixed it.

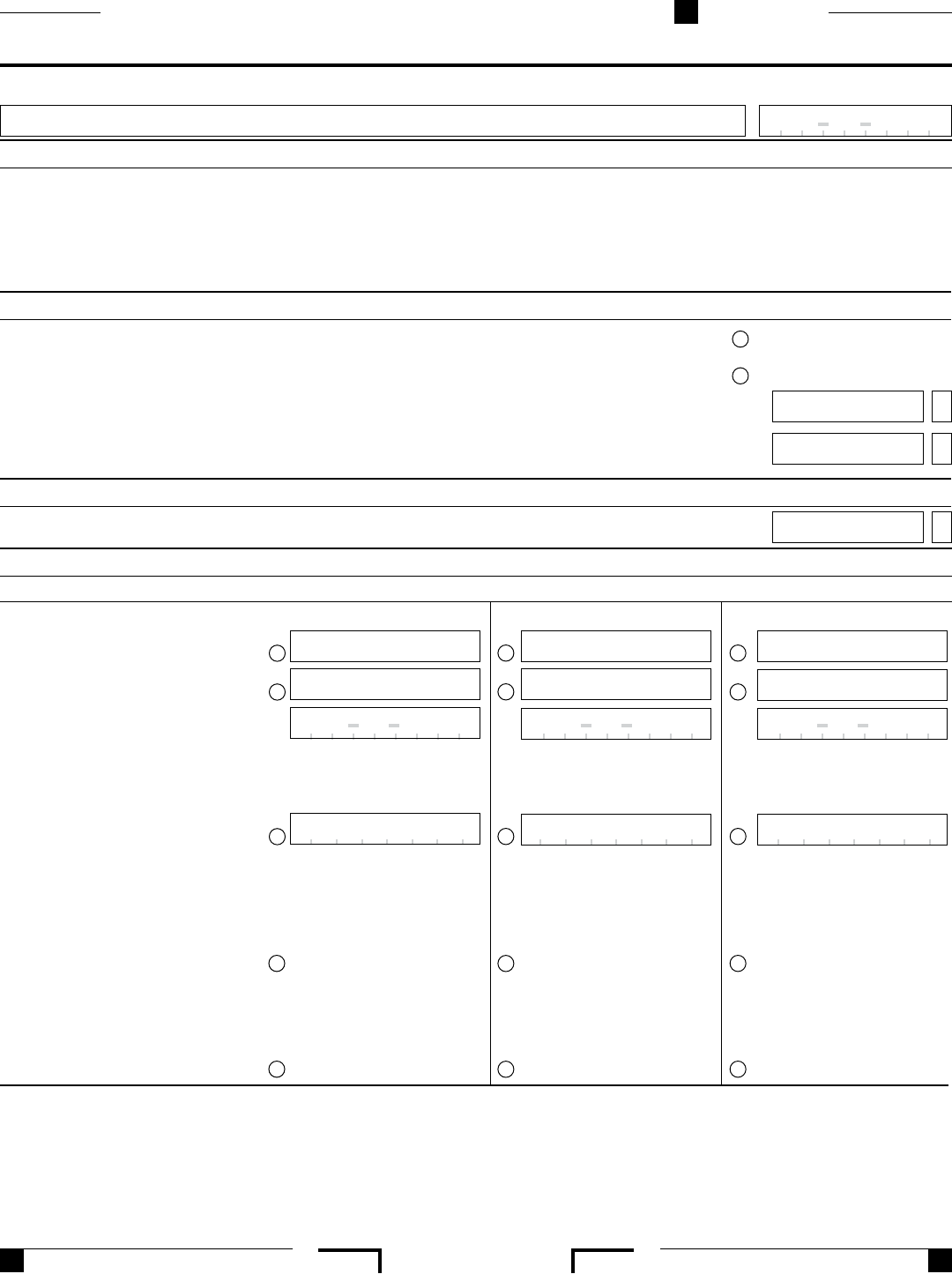

Ca exemption credit percentage from form 540nr, line. You can download or print. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. Web i ran into this problem with turbo tax premier 2019. Sign it in a few. If you claim the eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. Sign it in a few clicks. How do we get rid of that form? Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. On a previous return i had some business income that might have.

Web i am being asked a question about form 3514, and i have no idea what the form is. Web california form 3514 want business code, etc. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? If you claim the eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. Web 3514 ssn before you begin: Just deleting the form fixed it.

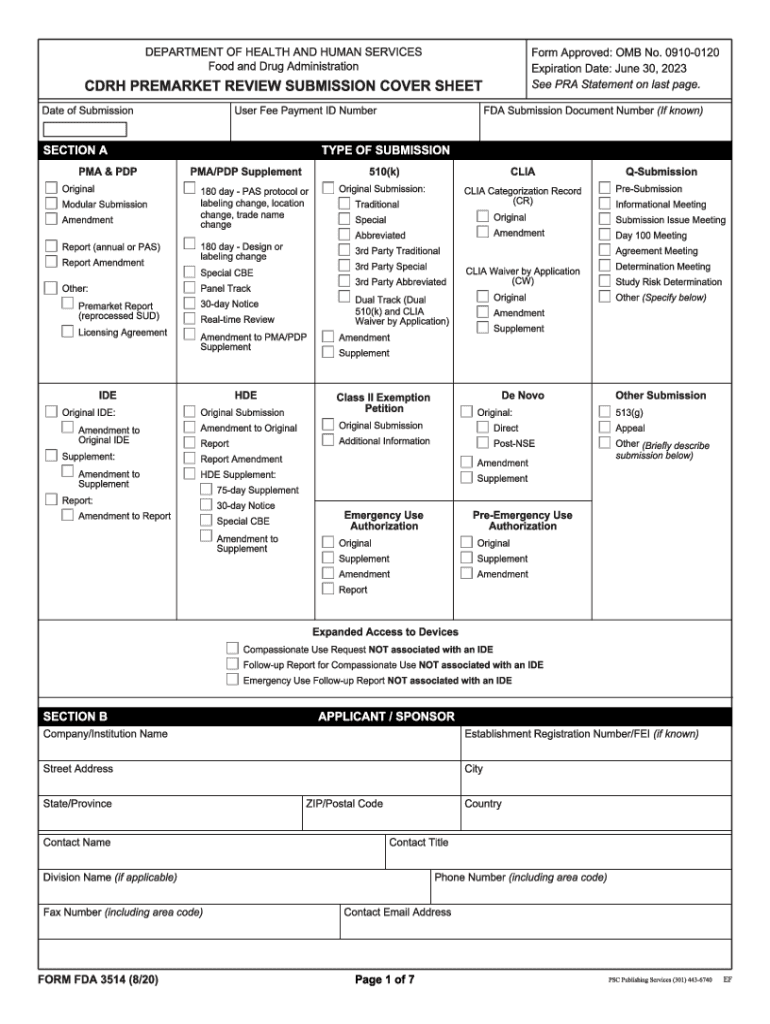

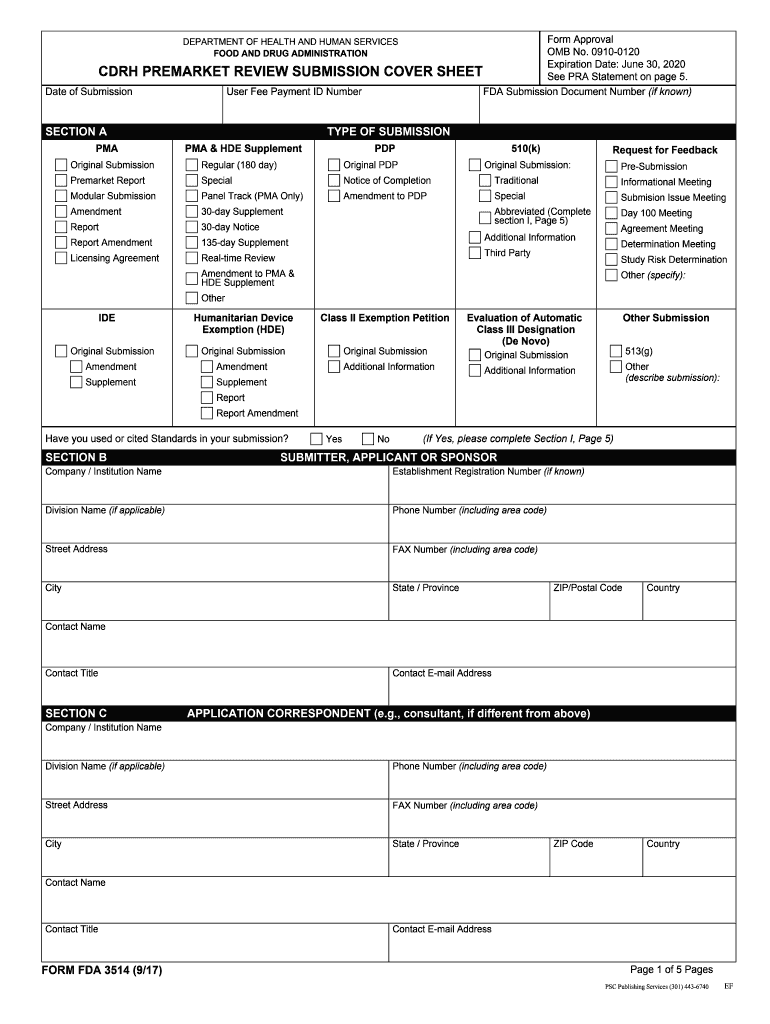

FDA Form 3514 PDF Food And Drug Administration Federal Food

Web 3514 ssn before you begin: Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. The california review part keeps. Web california form 3514 want business code, etc. Web i am being asked a question about form 3514, and.

20202022 Form FDA 3514 Fill Online, Printable, Fillable, Blank pdfFiller

Sign it in a few clicks. Web california individual form availability. California earned income tax credit. Sign it in a few. After reviewing this, lacerte currently does not have a way to force form 3514 for ca when the taxpayer does not qualify for eic.

Form FDA 3511c Processing in Steam in Continuous Agitating Retorts

Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. California earned income tax credit. I looked it up and it doesn’t even apply to me. Sign it in a few. You can download or print.

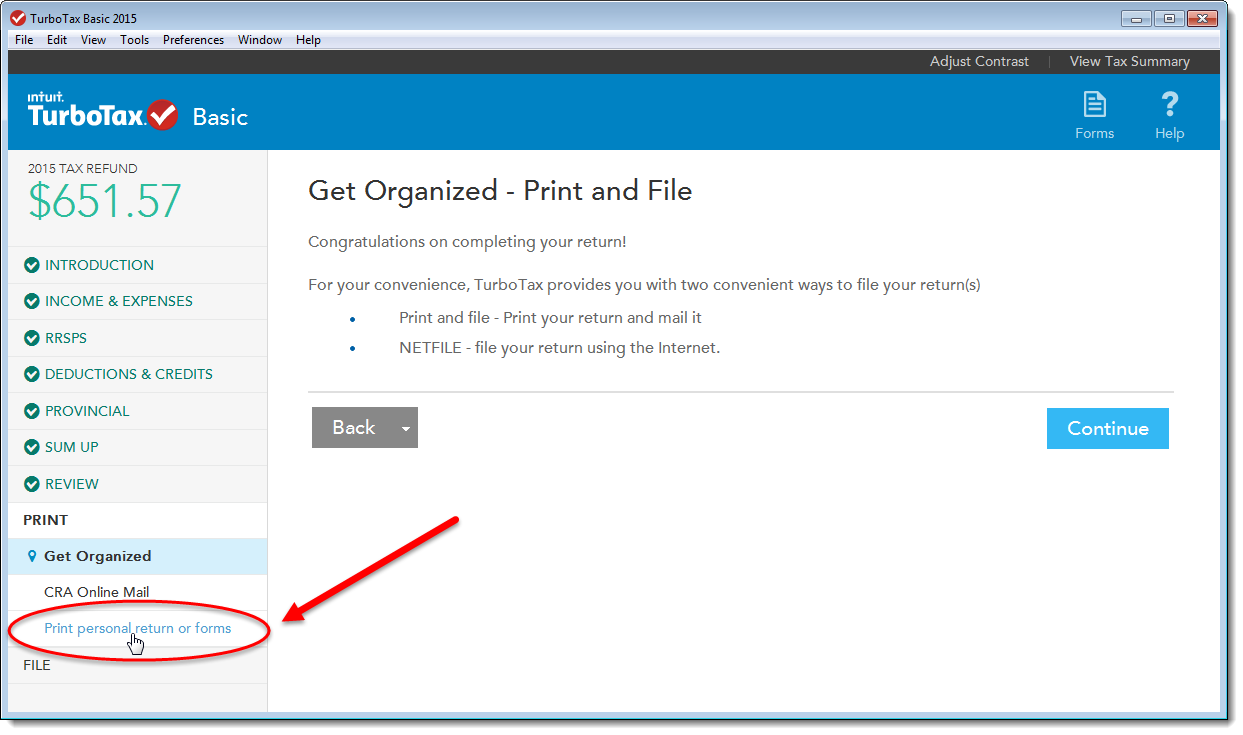

How do I save a PDF copy of my tax return in TurboTax AnswerXchange

You can download or print. I looked it up and it doesn’t even apply to me. How do we get rid of that form? This form is for income earned in tax year 2022, with tax returns due in april. Form 3536, estimated fee for llcs.

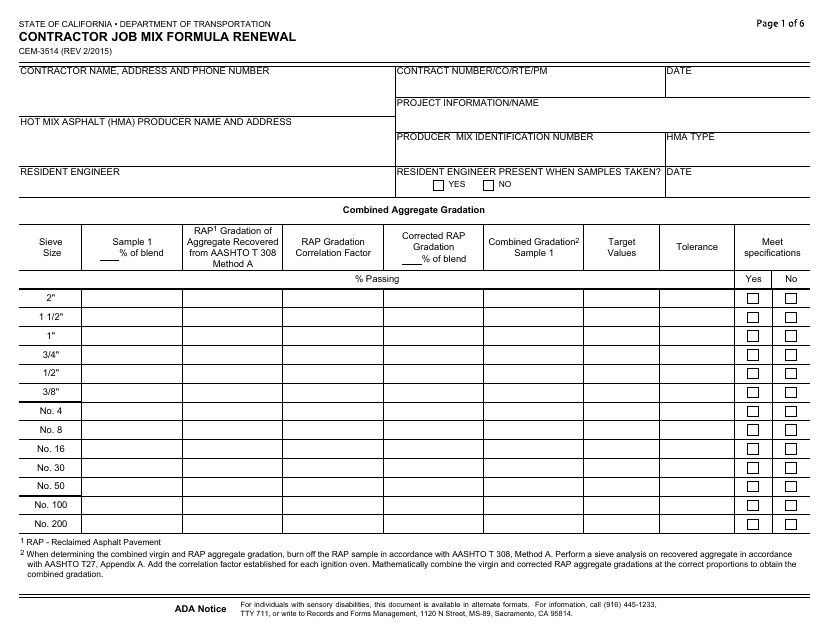

Form CEM3514 Download Fillable PDF or Fill Online Contractor Job Mix

Web i am being asked a question about form 3514, and i have no idea what the form is. Just deleting the form fixed it. Web 3514 ssn before you begin: After reviewing this, lacerte currently does not have a way to force form 3514 for ca when the taxpayer does not qualify for eic. Web california form 3514 want.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

You do not need a child to qualify, but must file a california income tax return to. Web 603 rows 2020 instructions for form ftb 3514 california earned income tax credit revised: Web we last updated california form 3514 in january 2023 from the california franchise tax board. Populated, but we don't have any of that and don't qualify for.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. Sign it in a few. Web we last updated california form 3514 in january 2023 from the california franchise tax board. Ca exemption credit percentage from form 540nr, line. For.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be eligible. Web i ran into this problem with turbo tax premier 2019. You can download or print. Sign it in a few clicks.

Fda Form 3514 Fill Out and Sign Printable PDF Template signNow

Web 603 rows 2020 instructions for form ftb 3514 california earned income tax credit revised: Sign it in a few clicks. For windows go to to find form 3514. Web the form 3514 requests a business code, business license number and sein. Populated, but we don't have any of that and don't qualify for eic.

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

If you claim the eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. On a previous return i had some business income that might have. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your.

If You Don't Have A Sein Or Business License Number, Then You Should Be Able To Leave.

Web we last updated california form 3514 in january 2023 from the california franchise tax board. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be eligible. Web 3514 ssn before you begin: You can download or print.

Web California Form 3514 Want Business Code, Etc.

On a previous return i had some business income that might have. Sign it in a few clicks. For windows go to to find form 3514. Just deleting the form fixed it.

Web 603 Rows 2020 Instructions For Form Ftb 3514 California Earned Income Tax Credit Revised:

I looked it up and it doesn’t even apply to me. Web i am being asked a question about form 3514, and i have no idea what the form is. You do not need a child to qualify, but must file a california income tax return to. Form 3536, estimated fee for llcs.

California Earned Income Tax Credit.

The california review part keeps. Populated, but we don't have any of that and don't qualify for eic. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. After reviewing this, lacerte currently does not have a way to force form 3514 for ca when the taxpayer does not qualify for eic.