Form 3922 Vs 3921

Form 3922 Vs 3921 - Web form 3921 is different from form 3922. Additionally, form 3921 requires reporting. Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. Your company transfers the legal title of a share of stock, and the option is exercised under an. Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. You are required to file a 3922 if: Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web january 11, 2022 it’s that time of year again.

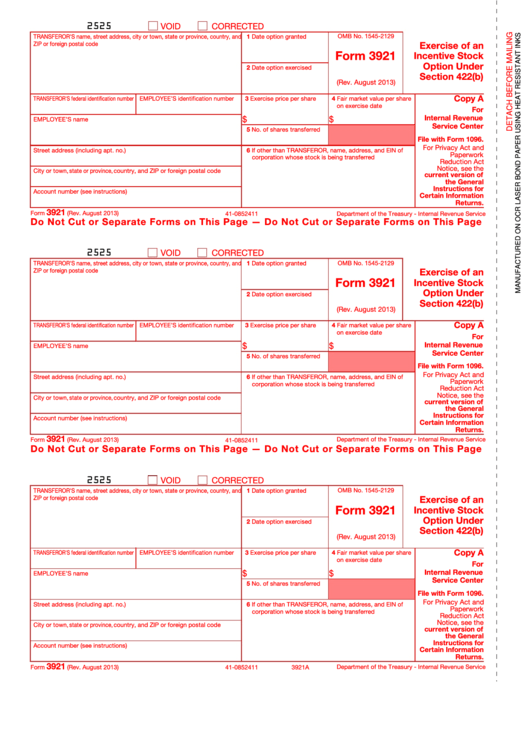

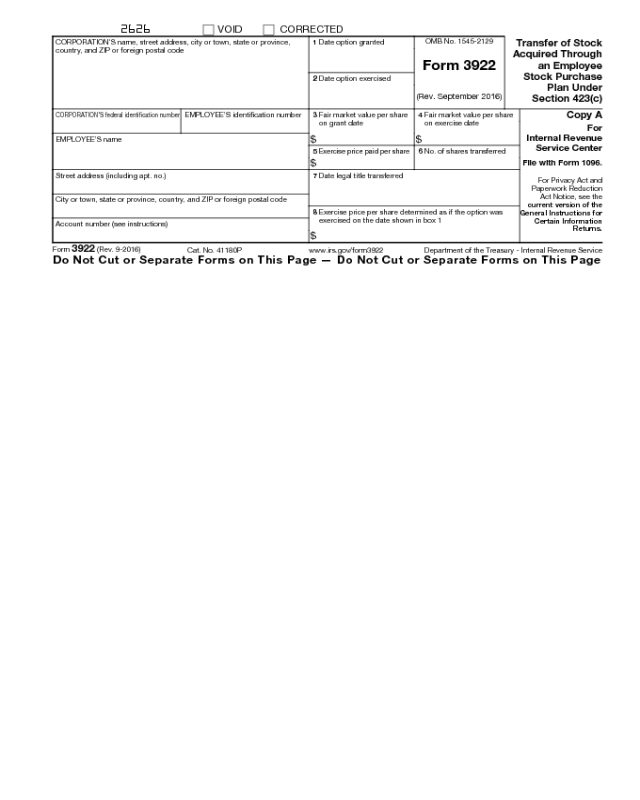

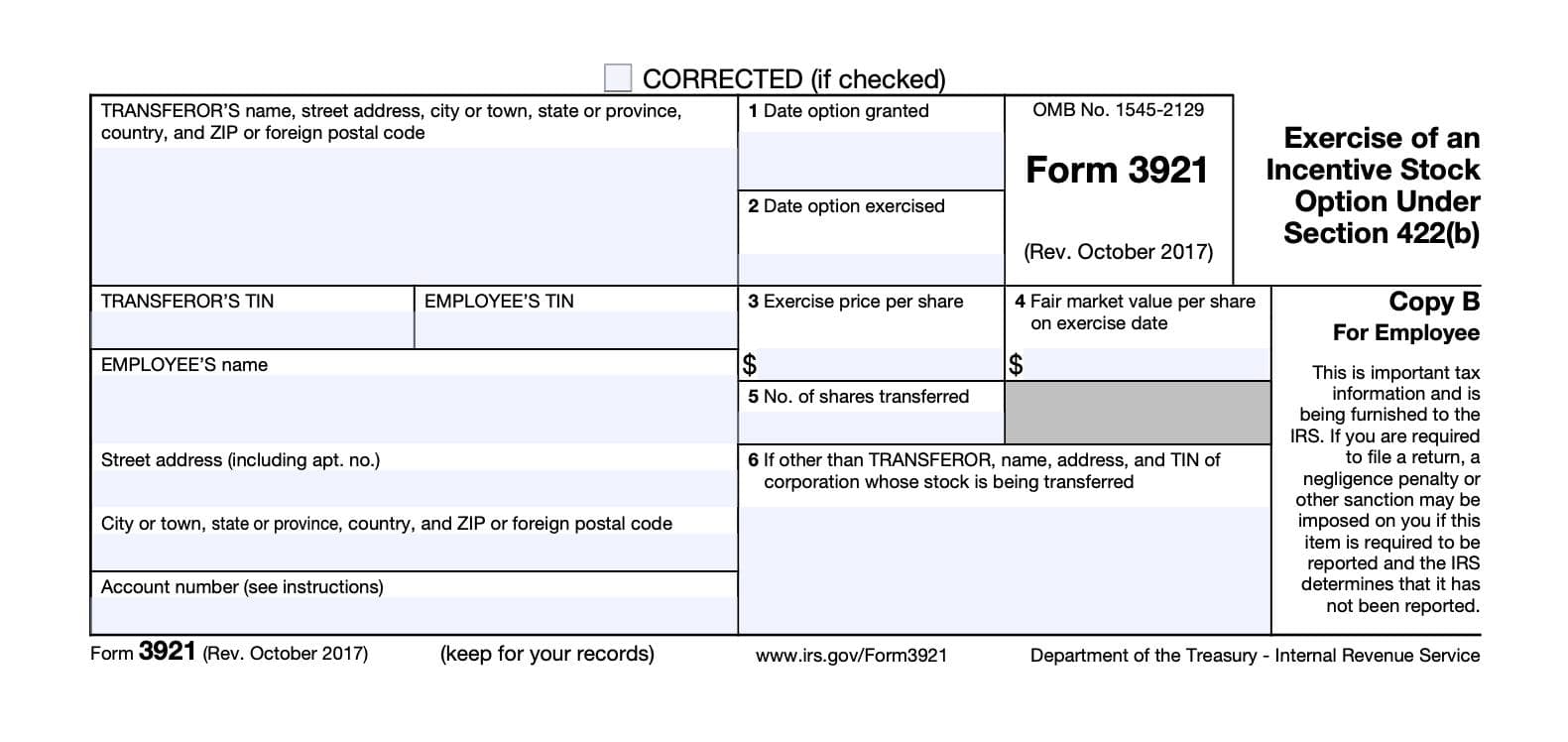

Web form 3921 exercise of an incentive stock option under section 422(b), is for informational purposes only and should be kept with your records. Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Web when you need to file form 3922. Web form 3921 is different from form 3922. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to. Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. I feel like i say that phrase a lot—usually when i’m reminding you to renew your naspp membership. Web form 3921 is used for transfers during the calendar year, while form 3922 is used for transfers during the prior year.

Web with form 3921 for isos, the irs now has the information it needs to confirm your calculation for triggering the alternative minimum tax (amt) when you exercise and hold. Additionally, form 3921 requires reporting. Web when you need to file form 3922. Web form 3921 exercise of an incentive stock option under section 422(b), is for informational purposes only and should be kept with your records. You are required to file a 3922 if: Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. Form 3921 is used by companies to report that a shareholder has just exercised the iso to the irs. For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to. Web january 11, 2022 it’s that time of year again. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock.

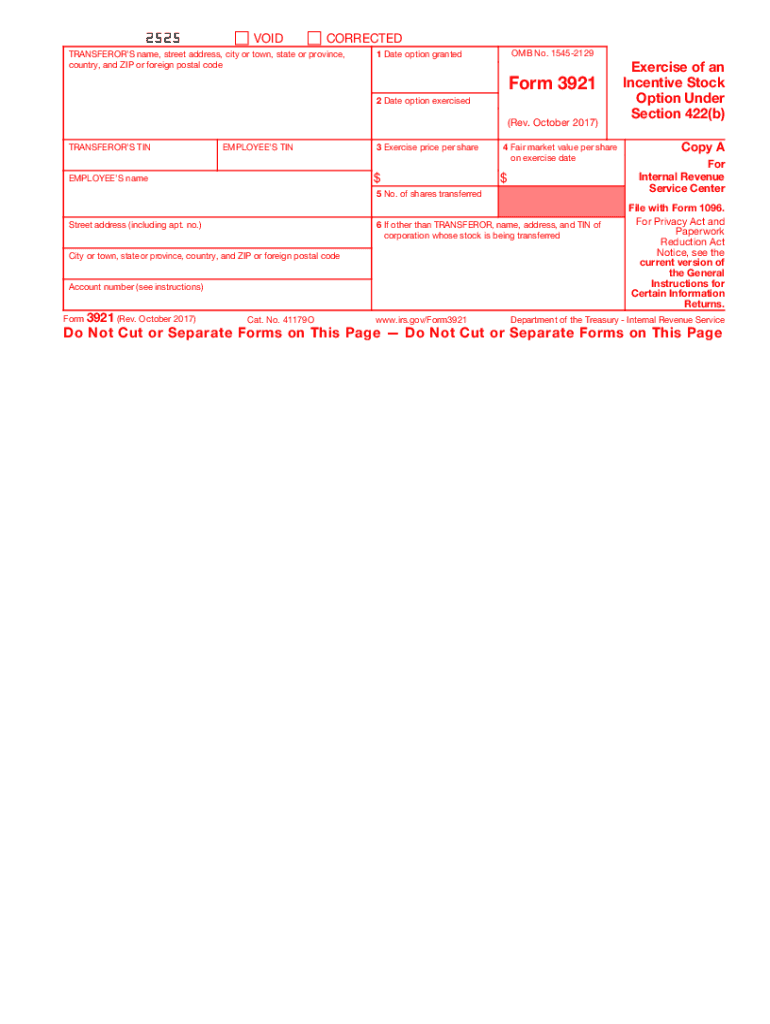

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Your company transfers the legal title of a share of stock, and the option is exercised under an. Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. Web form 3921 is used for transfers during the calendar year, while form 3922 is used for transfers during the prior year. Web information about form 3922,.

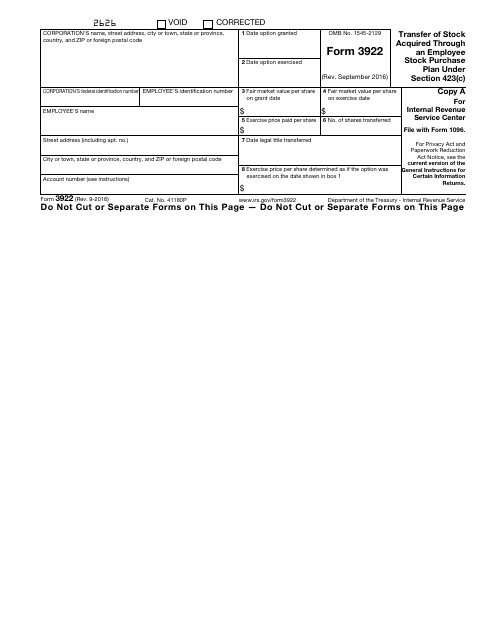

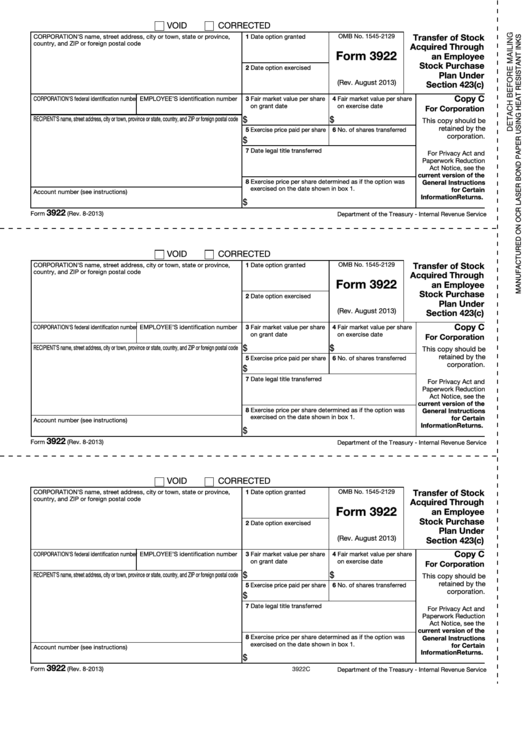

Form 3922 Edit, Fill, Sign Online Handypdf

Web irs sec 6039 form 3921, 3922 compliance as amended by section 403 of the tax relief and health care act of 2006, section 6039 requires corporations to file an information. Your company transfers the legal title of a share of stock, and the option is exercised under an. Web january 11, 2022 it’s that time of year again. Web.

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Web form 3921 exercise of an incentive stock option under section 422(b), is for informational purposes only and should be kept with your records. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web every corporation which in any calendar year transfers.

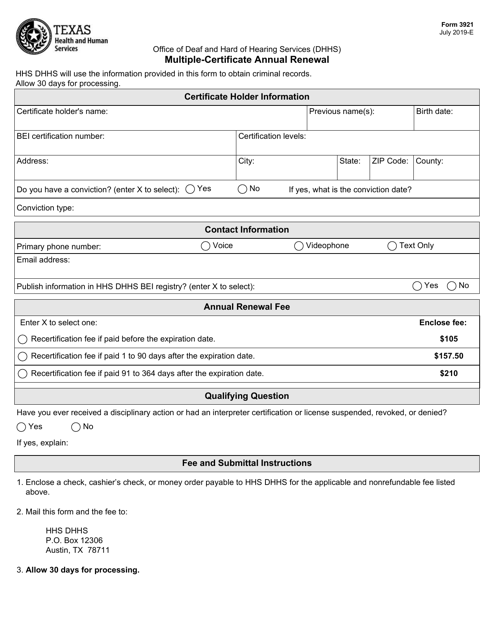

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Additionally, form 3921 requires reporting. Web when you need to file form 3922. It does not need to be entered into. For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to. I feel like i say that phrase a lot—usually when i’m reminding you to renew your.

20172022 Form IRS 3921 Fill Online, Printable, Fillable, Blank pdfFiller

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web form 3921 is used for transfers during the calendar year, while form 3922 is used for transfers during the prior year. Web form 3921 is different from form 3922. Additionally, form 3921.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web with form 3921 for isos, the irs now has the information it needs to confirm your calculation for triggering the alternative minimum tax (amt) when you exercise and hold. Additionally, form 3921 requires reporting. Web home forms and instructions about form 3921, exercise of an incentive stock option under section 422 (b) about form 3921, exercise of an incentive.

IRS Form 3922

Web form 3921 is different from form 3922. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates,. Additionally, form 3921 requires reporting. I feel like i say that phrase a lot—usually when i’m reminding you to renew your naspp membership. Your company transfers the legal title of a.

IRS Form 3922 Software 289 eFile 3922 Software

Web january 11, 2022 it’s that time of year again. Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Web information about form 3922, transfer of stock.

Form 3922 Transfer Of Stock Acquired Through An Employee Stock

I feel like i say that phrase a lot—usually when i’m reminding you to renew your naspp membership. Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. It does not need to be entered into. You are required to file a 3922 if: Web your employer will send you form 3922, transfer.

Form 3921 Everything you need to know

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web form 3921 is used for transfers during the calendar year, while form 3922 is used for transfers during the prior year. It does not need to be entered into. Companies.

It Does Not Need To Be Entered Into.

Web form 3921 is different from form 3922. I feel like i say that phrase a lot—usually when i’m reminding you to renew your naspp membership. Web order 3921 and 3922 tax forms for employee stock purchase or exercise of incentive stock options. Form 3921 is used by companies to report that a shareholder has just exercised the iso to the irs.

Web With Form 3921 For Isos, The Irs Now Has The Information It Needs To Confirm Your Calculation For Triggering The Alternative Minimum Tax (Amt) When You Exercise And Hold.

Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2020, corporations must file completed forms 3921 and forms 3922 with. Companies utilize form 3921 to notify the irs that a shareholder has just exercised the. You are required to file a 3922 if: Your company transfers the legal title of a share of stock, and the option is exercised under an.

Web Home Forms And Instructions About Form 3921, Exercise Of An Incentive Stock Option Under Section 422 (B) About Form 3921, Exercise Of An Incentive Stock.

Web when you need to file form 3922. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web january 11, 2022 it’s that time of year again. Web irs sec 6039 form 3921, 3922 compliance as amended by section 403 of the tax relief and health care act of 2006, section 6039 requires corporations to file an information.

Web Information About Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C), Including Recent Updates,.

Web form 3921 exercise of an incentive stock option under section 422(b), is for informational purposes only and should be kept with your records. For the latest information about developments related to form 3921 and its instructions, such as legislation enacted after they were published, go to. Web form 3921 is used for transfers during the calendar year, while form 3922 is used for transfers during the prior year. Additionally, form 3921 requires reporting.