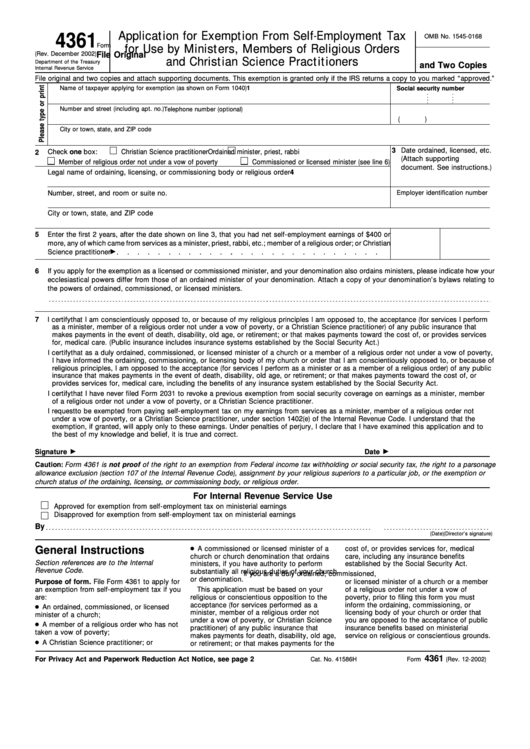

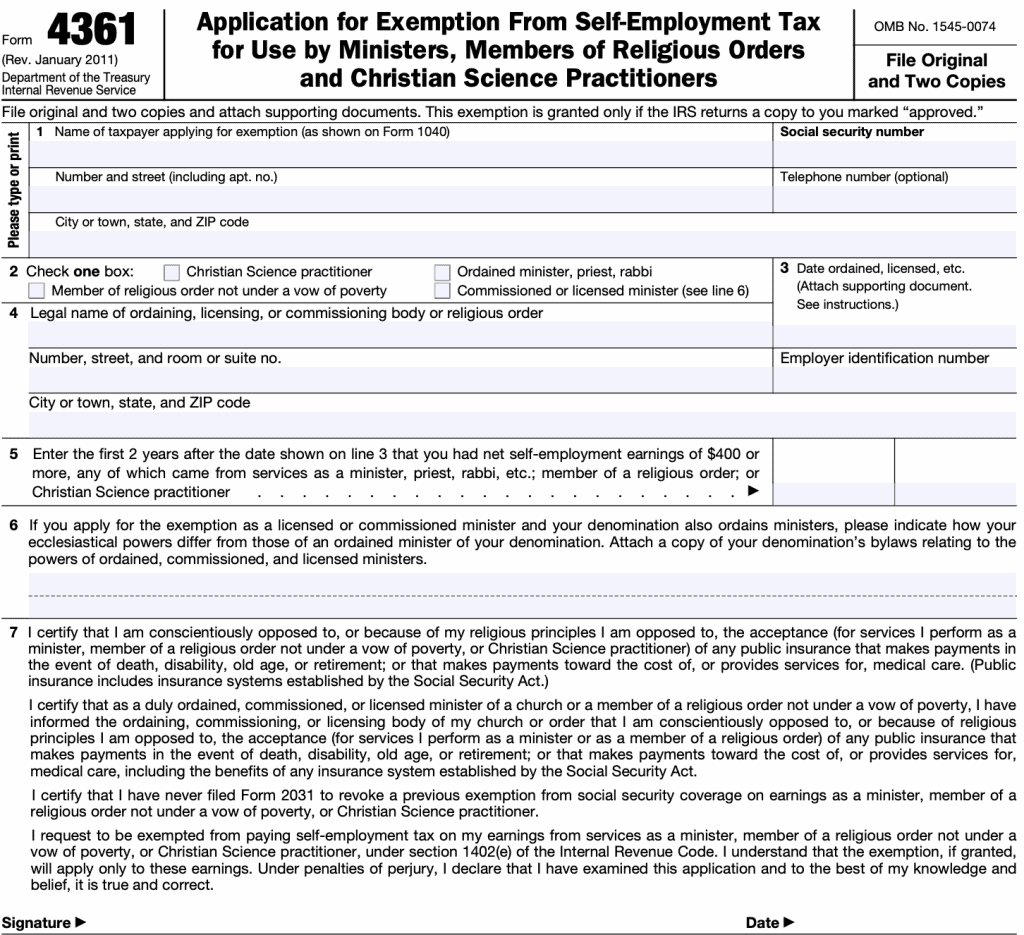

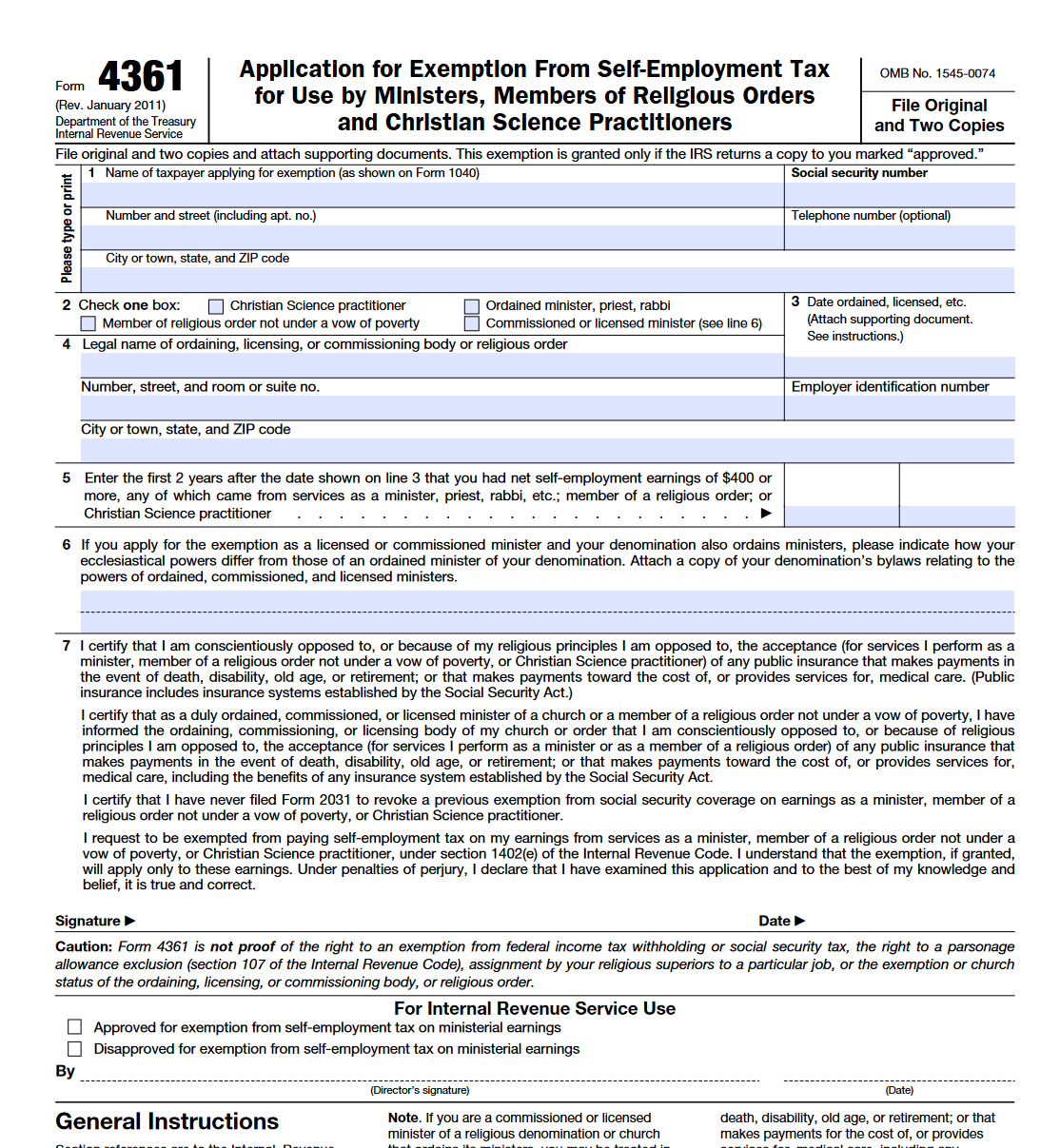

Form 4361 Instructions

Form 4361 Instructions - Web in this article, we’ll walk through irs form 4361 so you can better understand: Web irs form 4361: Section references are to the internal revenue code unless otherwise noted. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Before your application can be approved, the irs must verify. (the taxpayer will know if they. Before your application can be approved, the. Application for exemption from self. However, if you change to a new. Web once completed you can sign your fillable form or send for signing.

41586h an ordained, commissioned, or licensedminister of a church; However, if you change to a new. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Requesting taxpayer advocate assistance irs form 8283 instructions what do you. Web when an inquiry for the status or a request for a copy of the irs form 4361 is received, follow the instructions in rm 04906.001c to process the request. File form 4361 to apply for an exemption from. Web irs form 4361: Merely changing churches does not reset the two year window of opportunity. Before your application can be approved, the. Before your application can be approved, the irs must verify.

All forms are printable and downloadable. Application for exemption from self. Web to indicate you are a clergy member, minister, member of a religious order, or christian science practitioner, and filed form 4361 application for exemption from self. Web once completed you can sign your fillable form or send for signing. 41586h an ordained, commissioned, or licensedminister of a church; Web in this article, we’ll walk through irs form 4361 so you can better understand: Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Before your application can be approved, the irs must verify. Section references are to the internal revenue code unless otherwise noted. Merely changing churches does not reset the two year window of opportunity.

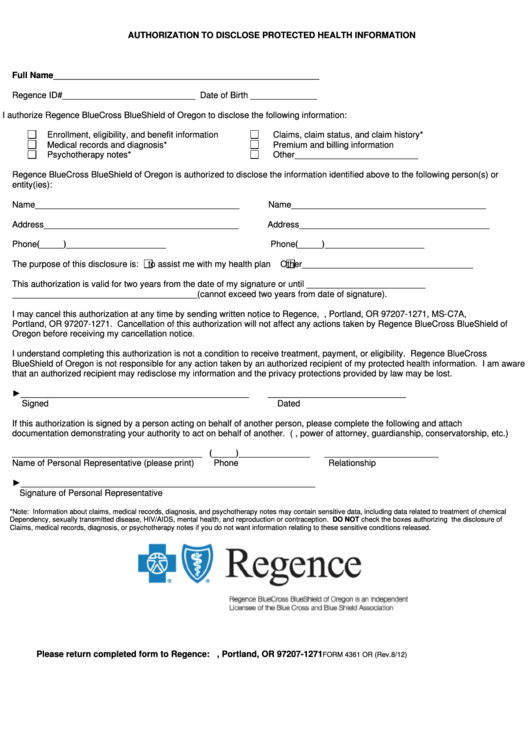

Form 4361 Or Authorization To Disclose Protected Health Information

However, if you change to a new. (the taxpayer will know if they. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Application for exemption from self. Requesting taxpayer advocate assistance irs form 8283 instructions what do you.

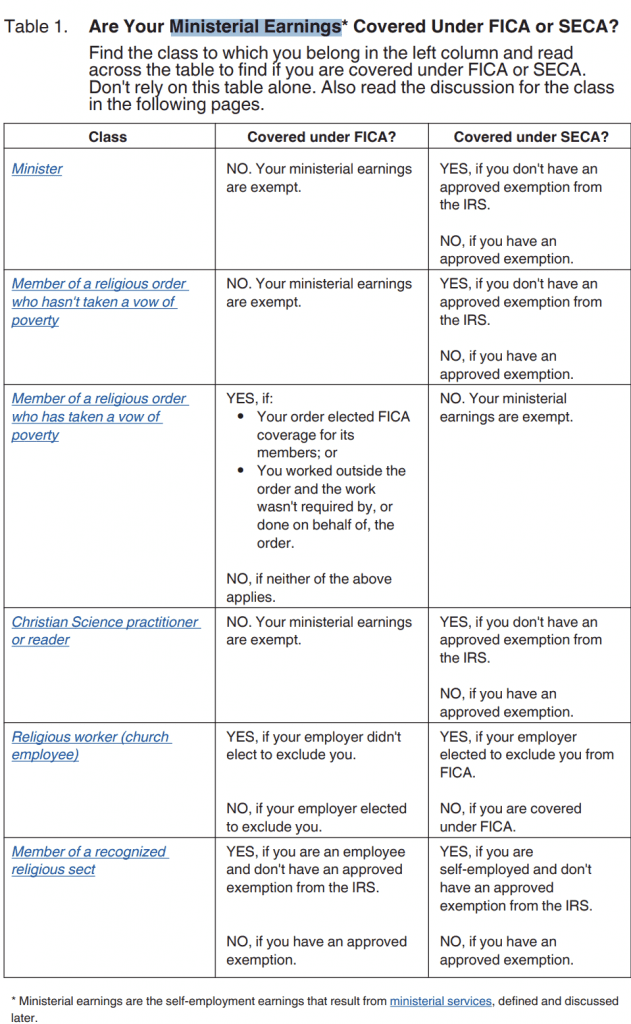

form 4361 vs 4029 Fill Online, Printable, Fillable Blank

Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Section references are to the internal revenue code unless otherwise noted. (the taxpayer will know if.

Fill Free fillable Form 4361 Application for Exemption From Self

Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Merely changing churches does not reset the two year window of opportunity. Web when an inquiry.

Fillable Form 4361 Application For Exemption printable pdf download

Web general instructions purpose of form. 41586h an ordained, commissioned, or licensedminister of a church; Before your application can be approved, the. All forms are printable and downloadable. Web in this article, we’ll walk through irs form 4361 so you can better understand:

IRS Form 4029 Instructions

Web when an inquiry for the status or a request for a copy of the irs form 4361 is received, follow the instructions in rm 04906.001c to process the request. Merely changing churches does not reset the two year window of opportunity. (the taxpayer will know if they. Web general instructions purpose of form. Web a minister who wishes to.

4DWNPERF05 4up Blank W2 Form Horizontal (with Employee

All forms are printable and downloadable. Merely changing churches does not reset the two year window of opportunity. 41586h an ordained, commissioned, or licensedminister of a church; Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. File form 4361 to apply for an exemption from.

IRS Form 4361 Exemption From SelfEmployment Tax

Section references are to the internal revenue code unless otherwise noted. Before your application can be approved, the irs must verify. All forms are printable and downloadable. Web to indicate you are a clergy member, minister, member of a religious order, or christian science practitioner, and filed form 4361 application for exemption from self. File form 4361 to apply for.

IRS Form 4361 Exemption From SelfEmployment Tax

Before your application can be approved, the irs must verify. Web to indicate you are a clergy member, minister, member of a religious order, or christian science practitioner, and filed form 4361 application for exemption from self. Web in this article, we’ll walk through irs form 4361 so you can better understand: Web irs form 4361: (the taxpayer will know.

IRS Form 4361 Forms Docs 2023

Web once completed you can sign your fillable form or send for signing. However, if you change to a new. 41586h an ordained, commissioned, or licensedminister of a church; An ordained, commissioned, or licensedminister of a church; Merely changing churches does not reset the two year window of opportunity.

17 [PDF] FORM 4361 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2

All forms are printable and downloadable. 41586h an ordained, commissioned, or licensedminister of a church; Requesting taxpayer advocate assistance irs form 8283 instructions what do you. Application for exemption from self. File form 4361 to apply for an exemption from.

An Ordained, Commissioned, Or Licensedminister Of A Church;

Merely changing churches does not reset the two year window of opportunity. However, if you change to a new. 41586h an ordained, commissioned, or licensedminister of a church; Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval.

Web One Of The Choices Is That You Have An Approved Form 4361 Exemption.

Requesting taxpayer advocate assistance irs form 8283 instructions what do you. Web once completed you can sign your fillable form or send for signing. (the taxpayer will know if they. Web to indicate you are a clergy member, minister, member of a religious order, or christian science practitioner, and filed form 4361 application for exemption from self.

File Form 4361 To Apply For An Exemption From.

Application for exemption from self. Web when an inquiry for the status or a request for a copy of the irs form 4361 is received, follow the instructions in rm 04906.001c to process the request. Before your application can be approved, the. Web irs form 4361:

Web A Minister Who Wishes To Be Exempt From Social Security/Medicare Tax Must File A Form 4361 With The Irs For Approval.

Before your application can be approved, the irs must verify. All forms are printable and downloadable. Web in this article, we’ll walk through irs form 4361 so you can better understand: Section references are to the internal revenue code unless otherwise noted.

![17 [PDF] FORM 4361 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2](https://3.bp.blogspot.com/-qTJKFRd5GAA/UhiL9mr-pTI/AAAAAAAA6HQ/lxfIrVan3Go/s1600/IMG_4361.jpg)