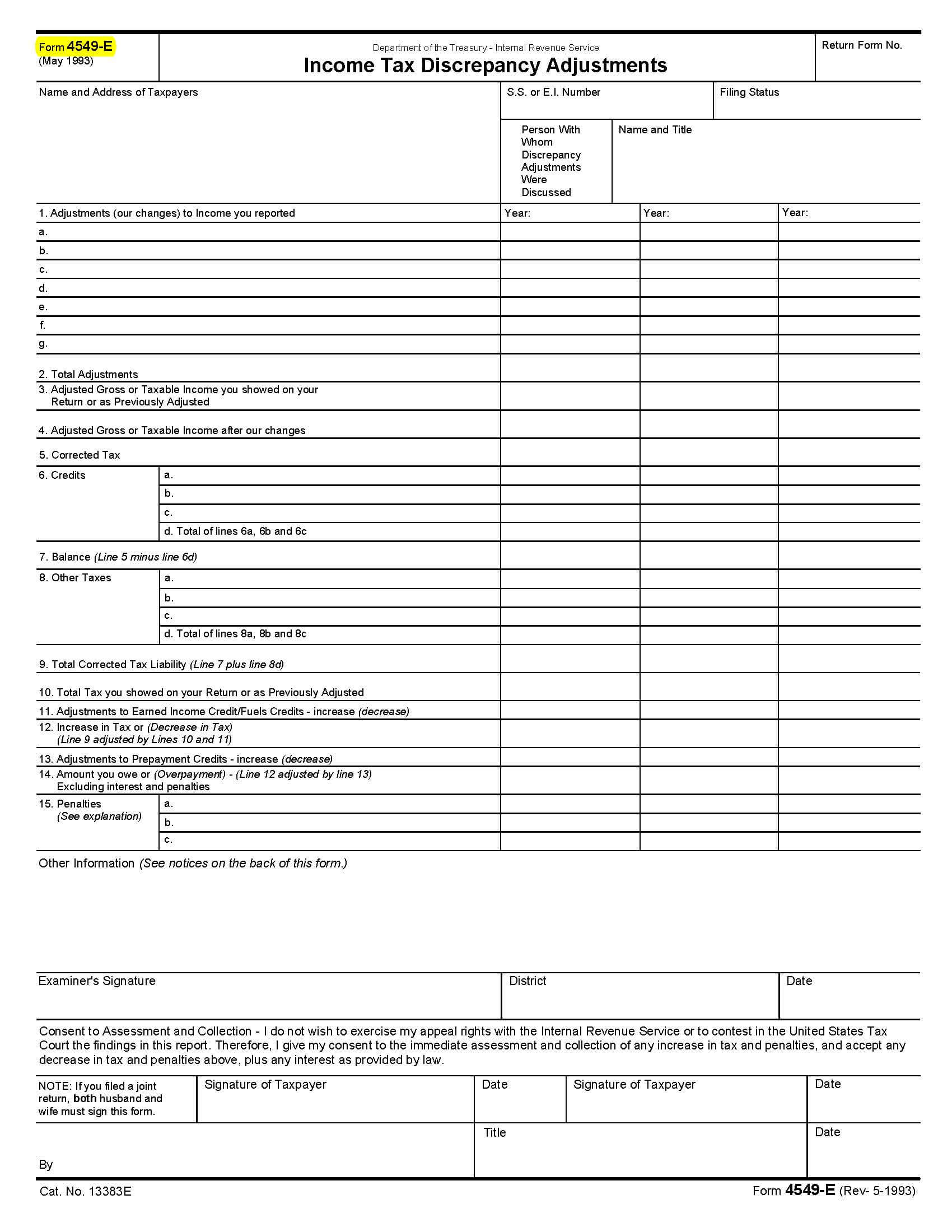

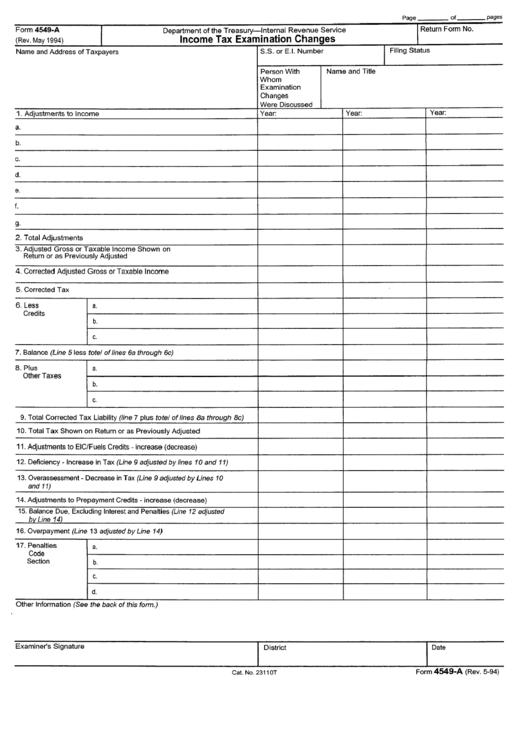

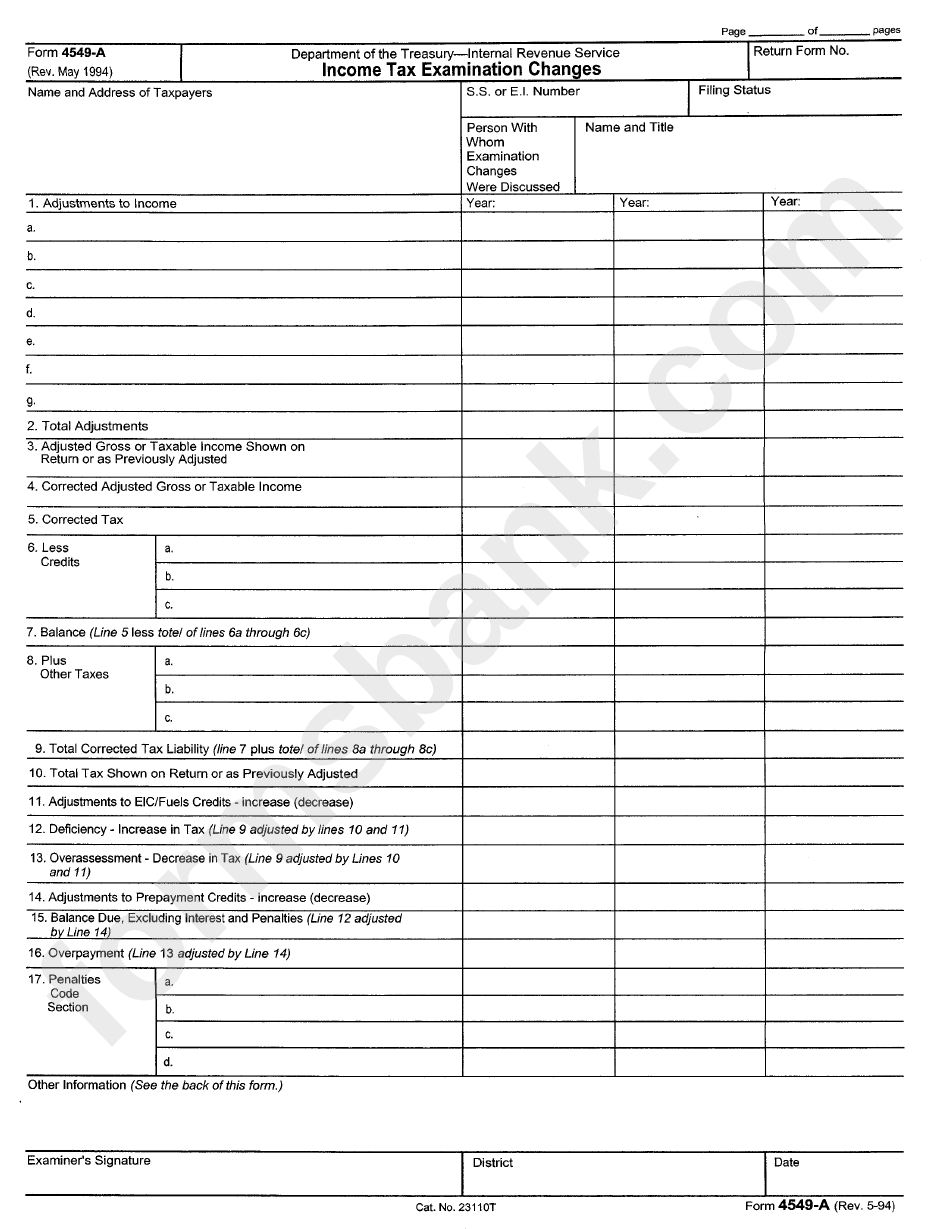

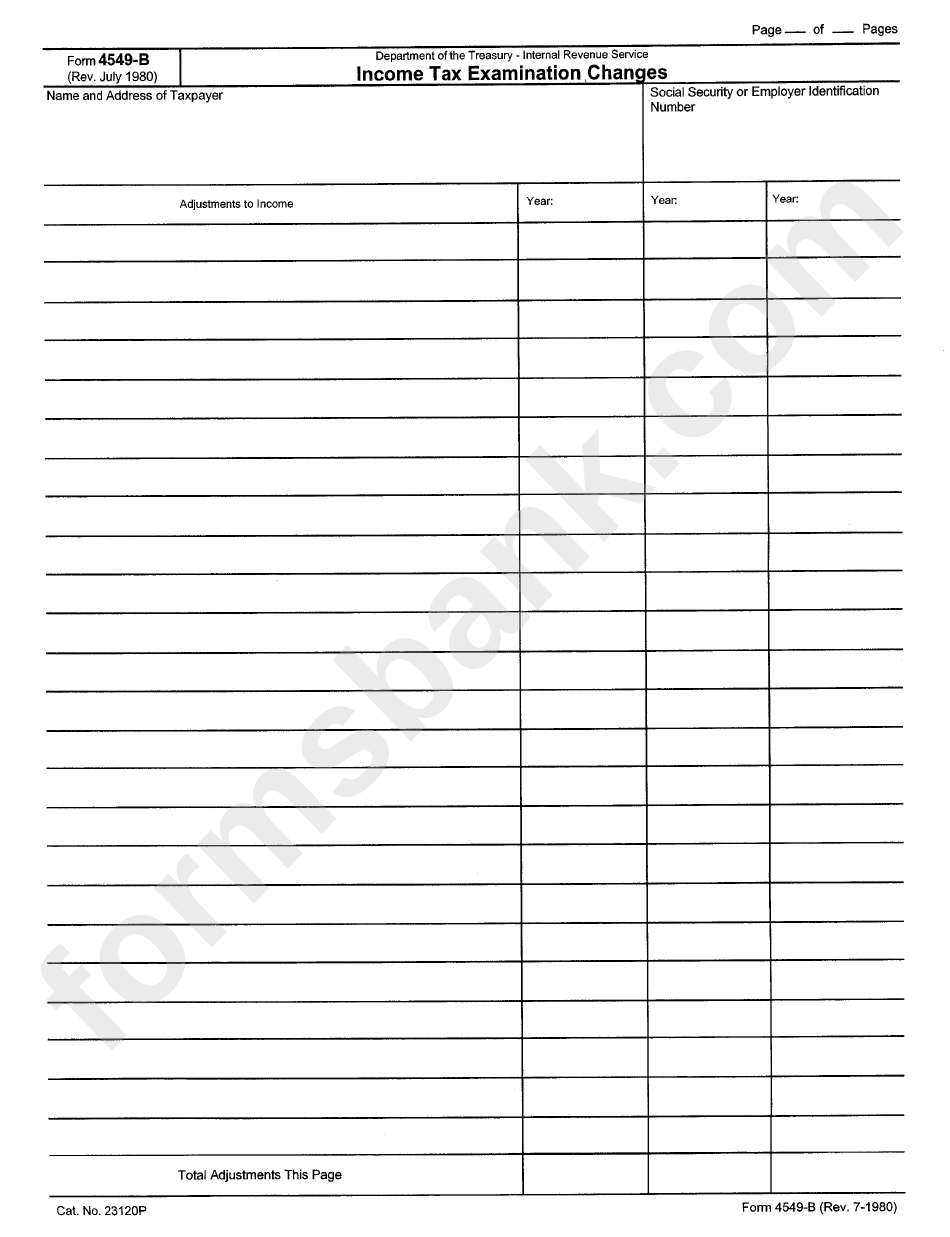

Form 4549-A

Form 4549-A - Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Catalog number 23105a www.irs.gov form 4549 (rev. Form 4666, summary of employment tax. Web the irs form 4549 is the income tax examination changes letter. In chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. Web a regular agreed report (form 4549) may contain up to three tax years. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. Web form 4549, income tax examination changes, is used for cases that result in:

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Web form 4549, income tax examination changes, is used for cases that result in: Web a regular agreed report (form 4549) may contain up to three tax years. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim. Web the irs form 4549 is the income tax examination changes letter. If you sign form 870, you give up your right to contest the audit. In chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Form 4666, summary of employment tax.

Web the irs uses form 4549 when the audit is complete. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. This letter is also used as an initial reporting tool. It will include information, including: Web the irs form 4549 is the income tax examination changes letter. Web form 4549, income tax examination changes, is used for cases that result in: Catalog number 23105a www.irs.gov form 4549 (rev. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form.

Audit Form 4549 Tax Lawyer Response to IRS Determination

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Form 4666, summary of employment tax. In chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

In chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. Web form 4549, income tax examination changes, is used for cases that result in: Form 4666, summary of employment tax. It will include information, including: Web the irs uses.

Form 4549A Tax Examination Changes printable pdf download

Web form 4549, income tax examination changes, is used for cases that result in: Web the irs uses form 4549 when the audit is complete. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Form 4666, summary of employment tax. Irs also ruled on other.

Form 4549A Tax Examination Changes printable pdf download

Form 4666, summary of employment tax. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim. If you sign form 870, you give up your right to contest the audit. Adjustments to income or deduction items don’t affect or warrant a change in tax liability or.

4.10.8 Report Writing Internal Revenue Service

Web a regular agreed report (form 4549) may contain up to three tax years. Web form 4549, income tax examination changes, is used for cases that result in: Form 4666, summary of employment tax. But there are certain times when they are more likely to use this letter. It will include information, including:

Form 4549B Tax Examitation Changes printable pdf download

Web a regular agreed report (form 4549) may contain up to three tax years. Web the irs form 4549 is the income tax examination changes letter. This letter is also used as an initial reporting tool. Form 4666, summary of employment tax. Web form 4549, income tax examination changes, is used for cases that result in:

IRS Audit Letter 692 Sample 1

Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim. Web form 4549, income tax examination changes, is used for cases that result in: Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director,.

the first step in writing a report is Spencer Mortur

Web the irs form 4549 is the income tax examination changes letter. Adjustments to income or deduction items don’t affect or warrant a change in tax liability or refundable credits on the return audited. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Web form.

4.10.8 Report Writing Internal Revenue Service

Web the irs uses form 4549 when the audit is complete. Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement. This letter is also used as an initial reporting tool. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area.

13 FORM 4549 PAYMENT FormPayment

If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Catalog number 23105a www.irs.gov form.

The Form Will Include A Summary Of The Proposed Changes To The Tax Return, Penalties, And Interest Determined As An Outcome Of The Audit.

Adjustments to income or deduction items don’t affect or warrant a change in tax liability or refundable credits on the return audited. Web form 4549, income tax examination changes, is used for cases that result in: Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Normally, the irs will use the form for the initial report only, and the irs reasonably expects agreement.

Web The Irs Form 4549 Is The Income Tax Examination Changes Letter.

Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Web chief counsel advice 201921013. It will include information, including: In chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim.

Generally, Letter 525 Is Issued If Your Audit Was Conducted By Mail And Letter 915 Is Issued If Your Audit Was Conducted In Person.

This letter is also used as an initial reporting tool. Web a regular agreed report (form 4549) may contain up to three tax years. Web the irs uses form 4549 when the audit is complete. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form.

Catalog Number 23105A Www.irs.gov Form 4549 (Rev.

If you sign form 870, you give up your right to contest the audit. But there are certain times when they are more likely to use this letter. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim. Form 4666, summary of employment tax.