Form 4797 Examples

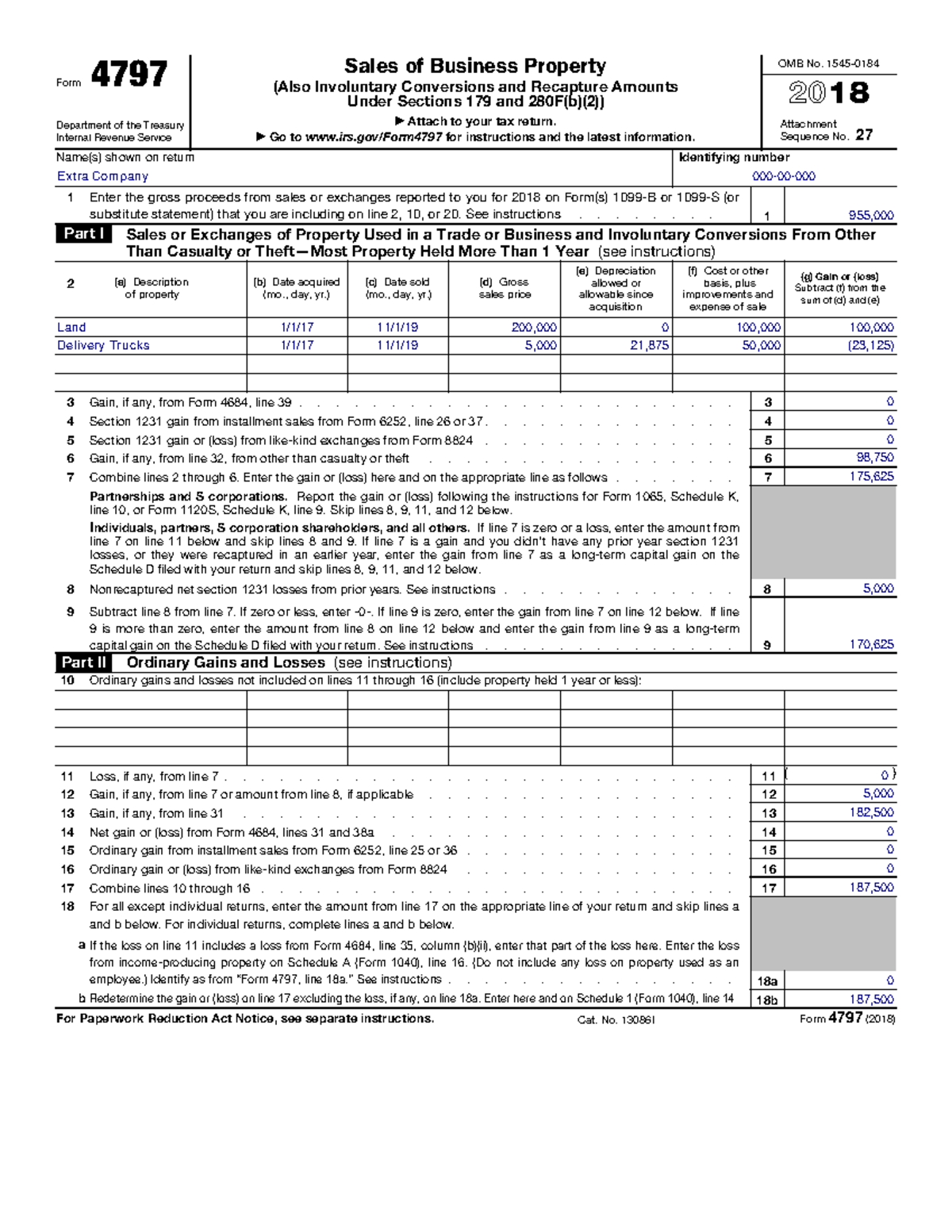

Form 4797 Examples - Taxpayers may also report a home that was used as a business on form. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. The duplex was purchased in 2007 for $240,000 and sold in 2013 for $251,900. As a result, when you sell this property at a gain, you’ll report that gain on form 4797. Hello all, i am trying to figure out how to fill out form 4797 for the tax year 2013. Web business property that is reported on form 4797 may include property that is purchased in order to produce rental income. Web the disposition of each type of property is reported separately in the appropriate part of form. Go to www.irs.gov/form4797 for instructions and the latest information. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. What is the difference between a schedule d and form 4797?

The duplex was purchased in 2007 for $240,000 and sold in 2013 for $251,900. What is the difference between a schedule d and form 4797? Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale of inventory goodwill acquired or created before 8/10/93 sale of a partnership interest schedule d sale of c or s corporation stock schedule d exception = §1244 stock Get started now in this article do i need to fill out form 4797? Web if, for example, a property was put in service to generate cash flow or used as a business and then sold for a profit, the owner realizing the capital gains will be required to file irs form 4797 with the irs. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Hello all, i am trying to figure out how to fill out form 4797 for the tax year 2013. But, business owners also use form 4797 to report the sale of business property that results in a loss. As a result, when you sell this property at a gain, you’ll report that gain on form 4797. Taxpayers may also report a home that was used as a business on form.

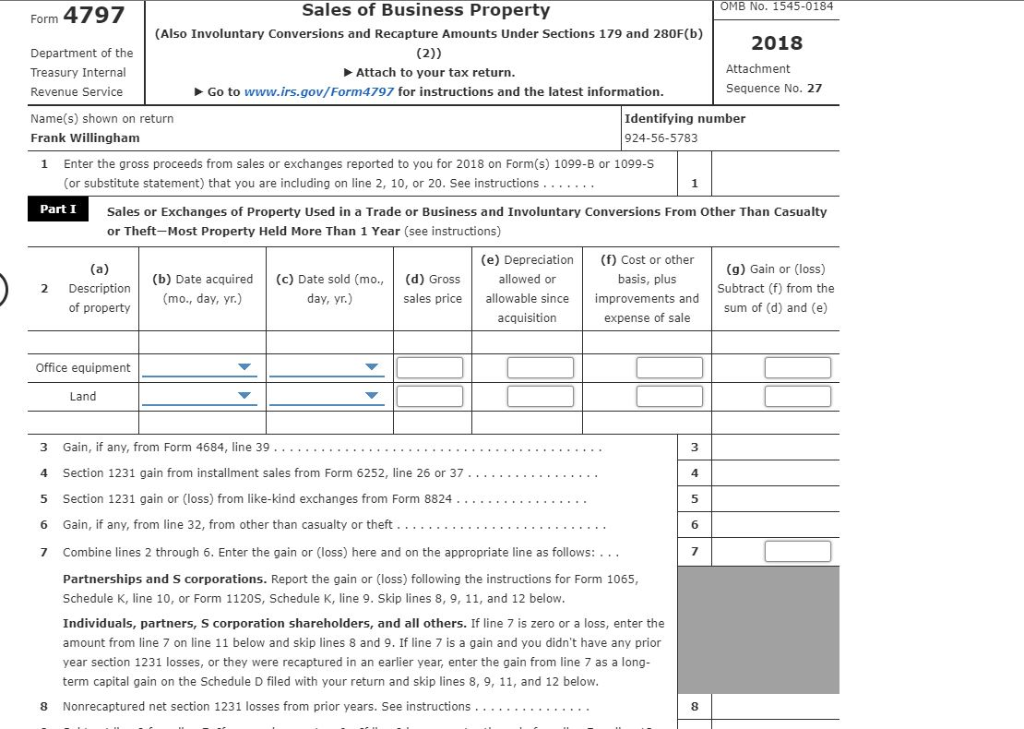

Web if, for example, a property was put in service to generate cash flow or used as a business and then sold for a profit, the owner realizing the capital gains will be required to file irs form 4797 with the irs. The duplex was purchased in 2007 for $240,000 and sold in 2013 for $251,900. Get started now in this article do i need to fill out form 4797? Go to www.irs.gov/form4797 for instructions and the latest information. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. What is the difference between a schedule d and form 4797? Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale of inventory goodwill acquired or created before 8/10/93 sale of a partnership interest schedule d sale of c or s corporation stock schedule d exception = §1244 stock How to complete form 4797 other forms you may have to file with form 4797 the bottom line:

IRS Instructions 4797 2019 2020 Fill out and Edit Online PDF Template

Go to www.irs.gov/form4797 for instructions and the latest information. What is the difference between a schedule d and form 4797? Hello all, i am trying to figure out how to fill out form 4797 for the tax year 2013. Web if, for example, a property was put in service to generate cash flow or used as a business and then.

How to Report the Sale of a U.S. Rental Property Madan CA

Web get access to 250+ online classes learn directly from the world’s top investors & entrepreneurs. Web business property that is reported on form 4797 may include property that is purchased in order to produce rental income. Web the disposition of each type of property is reported separately in the appropriate part of form. For a brief idea of what.

Form 4797 Edit, Fill, Sign Online Handypdf

Web get access to 250+ online classes learn directly from the world’s top investors & entrepreneurs. For a brief idea of what information needs to be gathered, this includes but is not limited to: Go to www.irs.gov/form4797 for instructions and the latest information. As a result, when you sell this property at a gain, you’ll report that gain on form.

Form 4797 Final This Document has the filled out Form 4797 for the

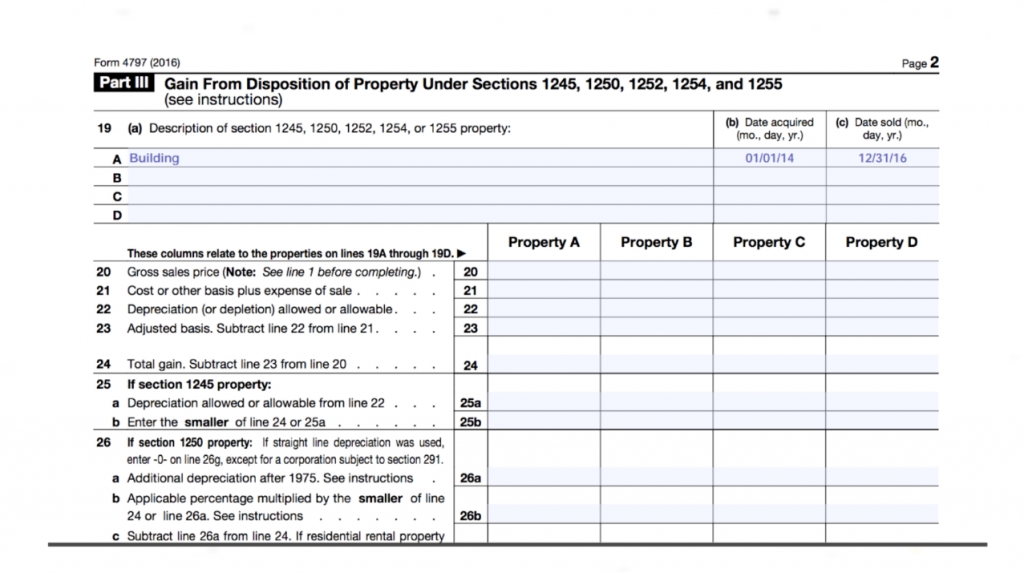

Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale of inventory goodwill acquired or created before 8/10/93 sale of a partnership interest schedule d sale of c or s corporation stock schedule d exception = §1244 stock Web the disposition.

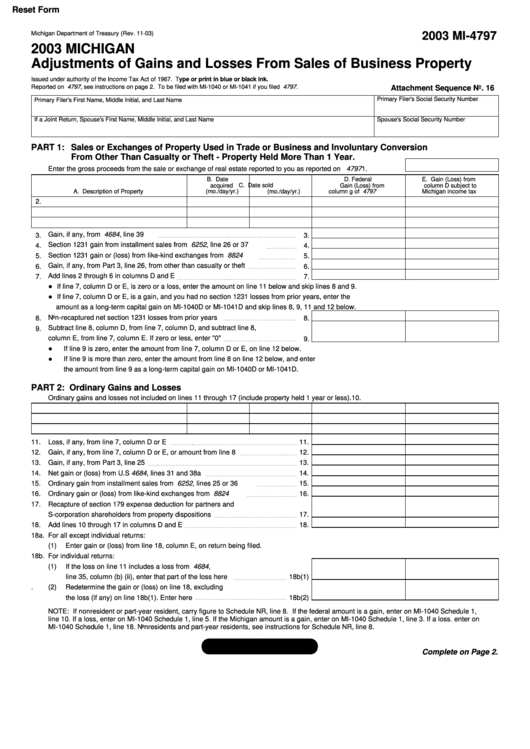

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale of.

IRS 8990 20202021 Fill and Sign Printable Template Online US Legal

Web get access to 250+ online classes learn directly from the world’s top investors & entrepreneurs. But, business owners also use form 4797 to report the sale of business property that results in a loss. As a result, when you sell this property at a gain, you’ll report that gain on form 4797. For a brief idea of what information.

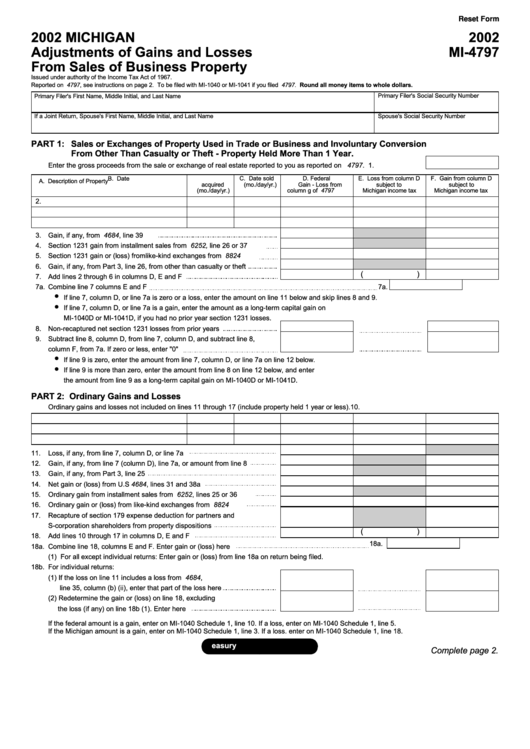

Form Mi4797 Michigan Adjustments Of Gains And Losses From Sales Of

The duplex was purchased in 2007 for $240,000 and sold in 2013 for $251,900. Web community discussions taxes investors & landlords bigbarr25 new member how do i fill out tax form 4797 after sale of a rental property? Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain.

Form 4797 Sales of Business Property Definition

Web the disposition of each type of property is reported separately in the appropriate part of form. Hello all, i am trying to figure out how to fill out form 4797 for the tax year 2013. Web business property that is reported on form 4797 may include property that is purchased in order to produce rental income. Web get access.

Fillable Form Mi4797 Michigan Adjustments Of Gains And Losses From

Go to www.irs.gov/form4797 for instructions and the latest information. Web the disposition of each type of property is reported separately in the appropriate part of form. Web business property that is reported on form 4797 may include property that is purchased in order to produce rental income. How to complete form 4797 other forms you may have to file with.

Calculation of Gain or Loss, Section 1231 Gains and

How to complete form 4797 other forms you may have to file with form 4797 the bottom line: Web get access to 250+ online classes learn directly from the world’s top investors & entrepreneurs. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on.

Hello All, I Am Trying To Figure Out How To Fill Out Form 4797 For The Tax Year 2013.

Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Go to www.irs.gov/form4797 for instructions and the latest information. Web business property that is reported on form 4797 may include property that is purchased in order to produce rental income. Web the disposition of each type of property is reported separately in the appropriate part of form.

Web Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property (Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280F(B)(2)) Attach To Your Tax Return.

How to complete form 4797 other forms you may have to file with form 4797 the bottom line: Taxpayers may also report a home that was used as a business on form. Web community discussions taxes investors & landlords bigbarr25 new member how do i fill out tax form 4797 after sale of a rental property? The duplex was purchased in 2007 for $240,000 and sold in 2013 for $251,900.

Web Get Access To 250+ Online Classes Learn Directly From The World’s Top Investors & Entrepreneurs.

What is the difference between a schedule d and form 4797? For a brief idea of what information needs to be gathered, this includes but is not limited to: Web if, for example, a property was put in service to generate cash flow or used as a business and then sold for a profit, the owner realizing the capital gains will be required to file irs form 4797 with the irs. Web sale of business assets taking the mystery out of form 4797 recapture = ordinary income ordinary income 1245 1250 other recapture do not report on form 4797 sale of inventory goodwill acquired or created before 8/10/93 sale of a partnership interest schedule d sale of c or s corporation stock schedule d exception = §1244 stock

Get Started Now In This Article Do I Need To Fill Out Form 4797?

As a result, when you sell this property at a gain, you’ll report that gain on form 4797. But, business owners also use form 4797 to report the sale of business property that results in a loss. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://media.cheggcdn.com/media/a30/a30da289-81cf-40ec-9a9f-f199303815c7/image)

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)