Form 4797 Instructions

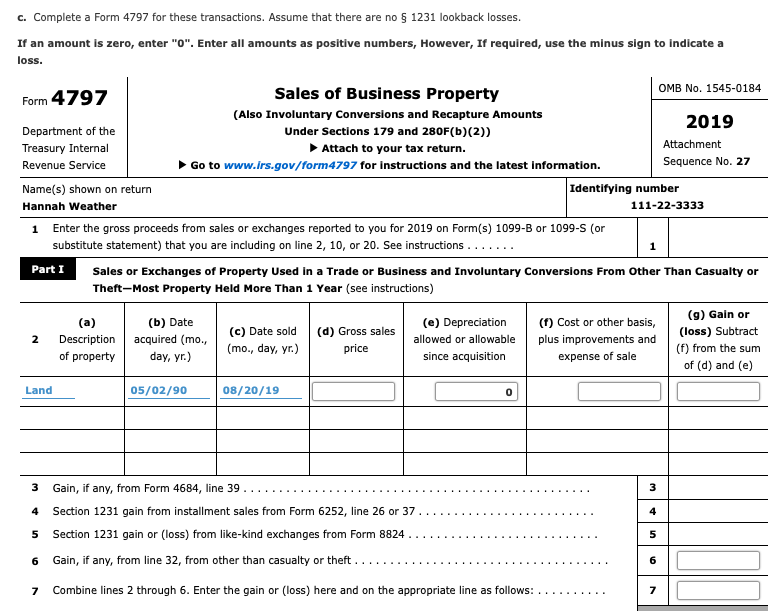

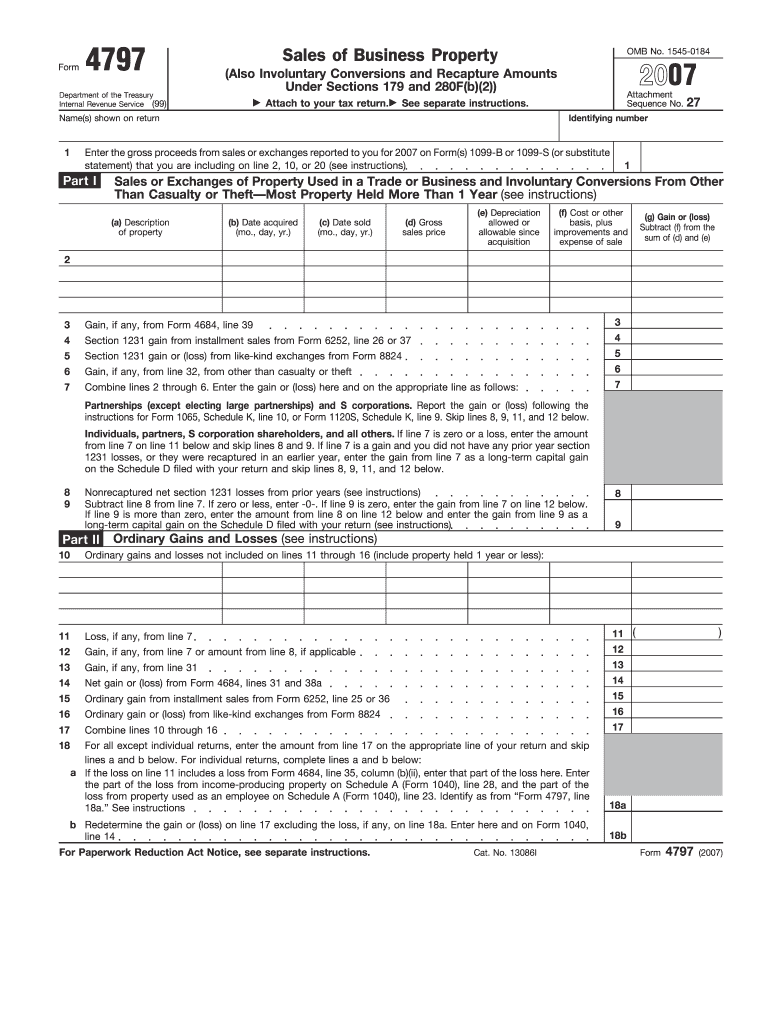

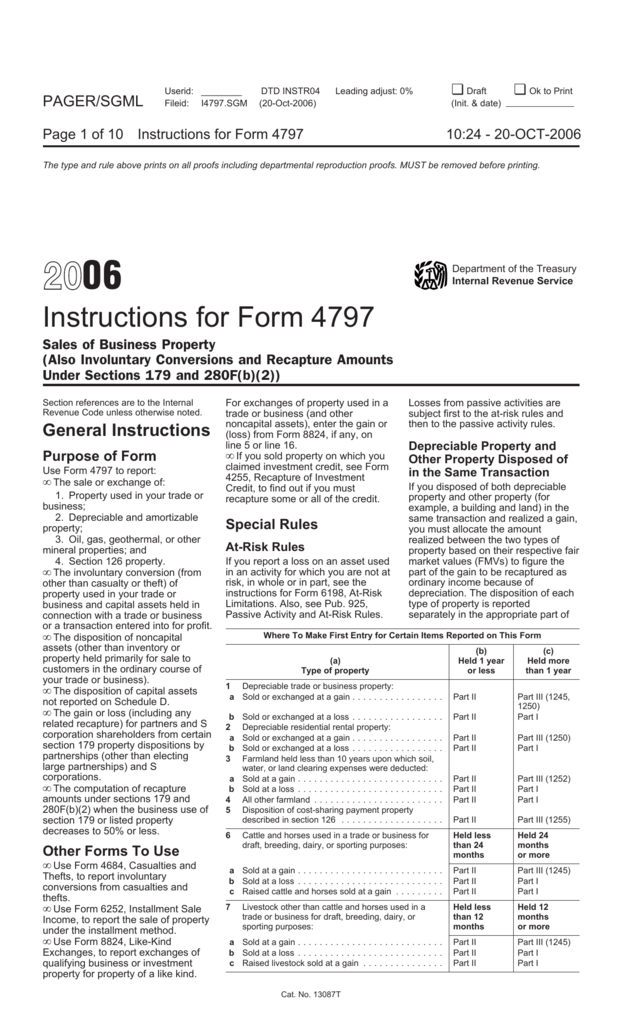

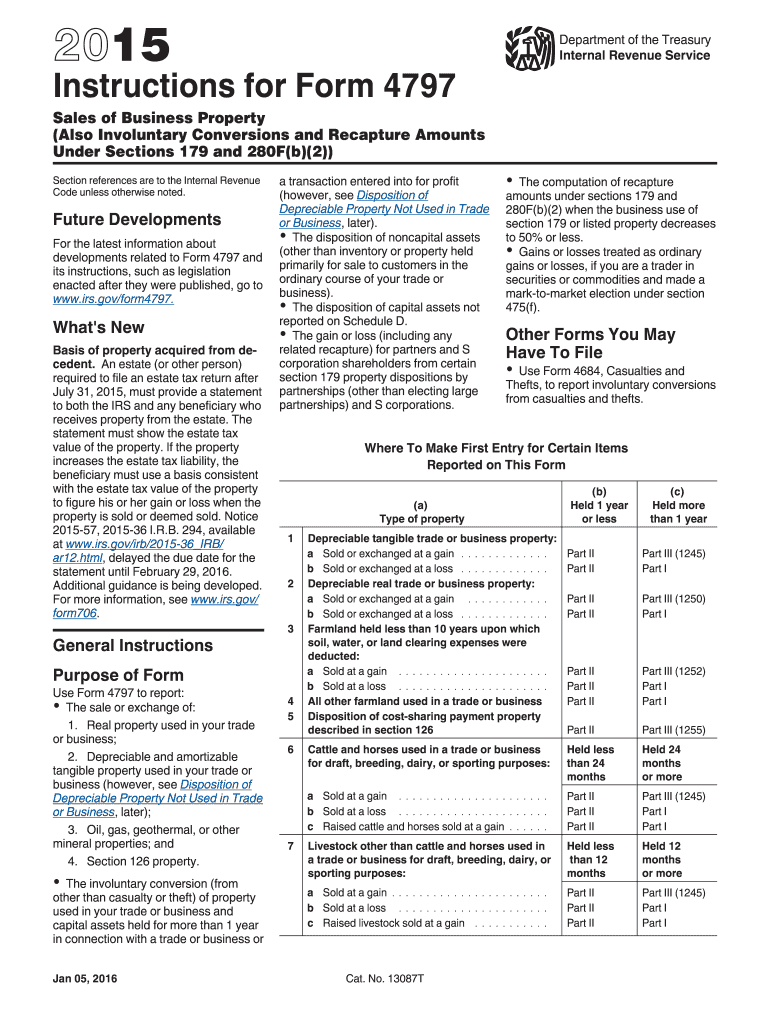

Form 4797 Instructions - Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources. Sales or exchanges of property the first section of form 4749 will cover line 2 through line 9 and deals primarily with the subject property’s sale and exchange. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Web what is form 4797? Web sale of a portion of a macrs asset. Go to www.irs.gov/form4797 for instructions and the latest information. Claim for refund due a deceased taxpayer: See the instructions for lines 1b and 1c. Nonrecapture net §1231 losses from prior years.

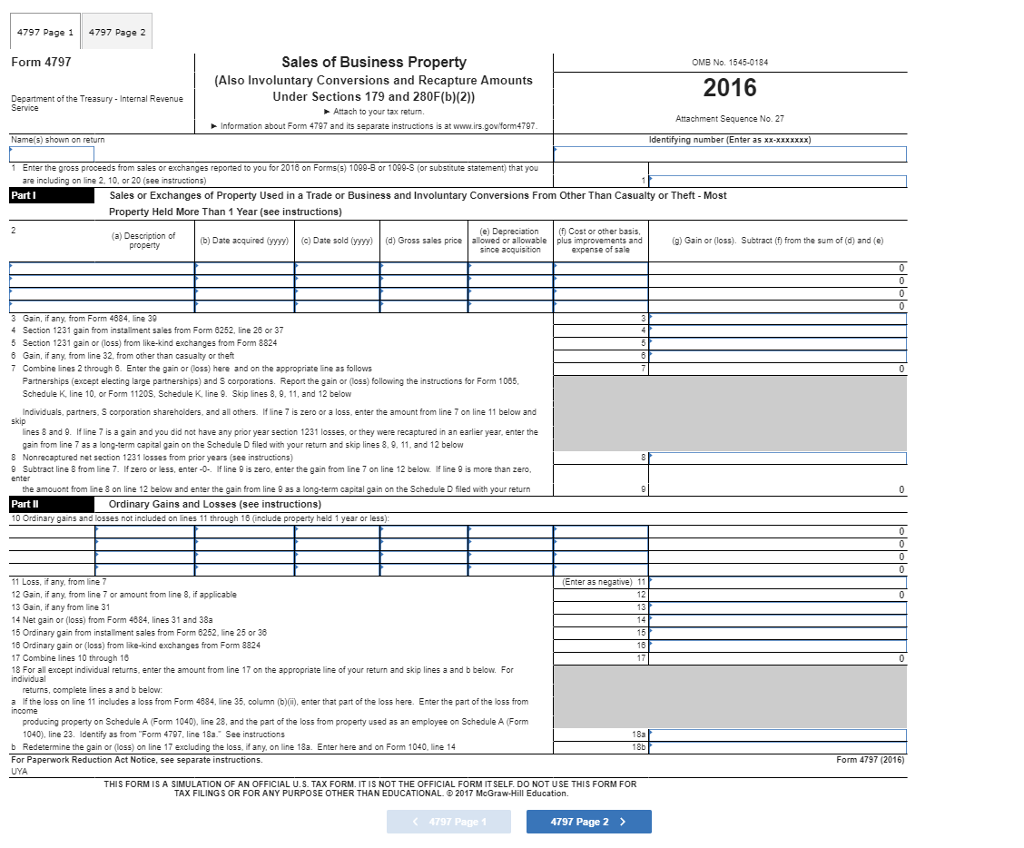

Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Sales or exchanges of property the first section of form 4749 will cover line 2 through line 9 and deals primarily with the subject property’s sale and exchange. Web form 4797 (sales of business property), issued by the irs, is used to report financial gains made from the sale or exchange of business property. Involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Web what is form 4797? On line 1, enter the gross proceeds from sales to you for the year 2022. Web instructions included on form: Income from part iii, line 32. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Go to www.irs.gov/form4797 for instructions and the latest information.

Web instructions included on form: Income from part iii, line 32. Claim for refund due a deceased taxpayer: Web sale of a portion of a macrs asset. Web form 4797 instructions part i: On line 1, enter the gross proceeds from sales to you for the year 2022. Line 2 is where tax filers will record any properties they purchased or sold and held for longer than a year. See the instructions for lines 1b and 1c. Adjustments of gains and losses from sales of business property:. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return.

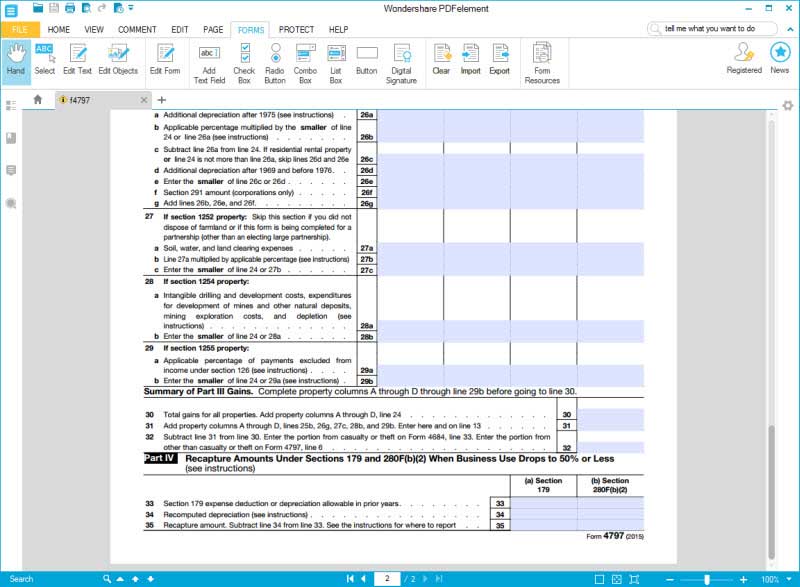

Form 4797 (2019) Page 2 Part III Gain From

Web form 4797 instructions part i: Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources. Nonrecapture net §1231 losses from.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Web form 4797 instructions part i: Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources. Claim for refund due a.

Irs Form 4797 Instructions 2022 Fill online, Printable, Fillable Blank

Involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Underpayment of estimated income tax: Web form 4797 instructions part i: Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. On line 1,.

Publication 225 Farmer's Tax Guide; Farmer's Tax Guide

Adjustments of gains and losses from sales of business property:. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Web form 4797 instructions part i: Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and.

Instructions for Form 4797 Internal Revenue Service Fill Out and Sign

See the instructions for lines 1b and 1c. Involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Line 2 is where tax filers will record any properties they purchased or sold and held for longer than a year. First of all, you can get this form from the department of treasury or you.

IRS Form 4797 Instructions (2006) Exeter 1031 Exchange Services

Underpayment of estimated income tax: Go to www.irs.gov/form4797 for instructions and the latest information. See the instructions for lines 1b and 1c. Web instructions included on form: Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets.

Solved 3. Complete Moab Inc.’s Form 4797 For The Year. Mo...

Involuntary conversion of a portion of a macrs asset other than from a casualty or theft. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for.

Ir's Form 4797 Instructions Fill Out and Sign Printable PDF Template

Web form 4797 instructions part i: Web sale of a portion of a macrs asset. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. First of all, you can get this form from the department of treasury or you.

IRS Form 4797 Guide for How to Fill in IRS Form 4797

First of all, you can get this form from the department of treasury or you can just download the irs form 4797 here. Line 2 is where tax filers will record any properties they purchased or sold and held for longer than a year. Form 4797 is a tax form required to be filed with the internal revenue service (irs).

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Sales or exchanges of property the first section of form 4749 will cover line 2 through line 9 and deals primarily with the subject property’s sale and exchange. Web form 4797 instructions part i: Income from part iii, line 32. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file..

Claim For Refund Due A Deceased Taxpayer:

Web what is form 4797? Web sale of a portion of a macrs asset. Go to www.irs.gov/form4797 for instructions and the latest information. Form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources.

First Of All, You Can Get This Form From The Department Of Treasury Or You Can Just Download The Irs Form 4797 Here.

Nonrecapture net §1231 losses from prior years. The form requires a variety of information to be. Income from part iii, line 32. Adjustments of gains and losses from sales of business property:.

Web Information About Form 4797, Sales Of Business Property, Including Recent Updates, Related Forms And Instructions On How To File.

Web form 4797 (sales of business property), issued by the irs, is used to report financial gains made from the sale or exchange of business property. On line 1, enter the gross proceeds from sales to you for the year 2022. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web form 4797 instructions part i:

Enter The Name And Identifying Number At The Top Of The Form.

Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Underpayment of estimated income tax: See the instructions for lines 1b and 1c. Line 2 is where tax filers will record any properties they purchased or sold and held for longer than a year.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://s3.studylib.net/store/data/008748435_1-a318c5b0f089eda377635734aeaf3bda.png)