Form 480.6 C Instructions

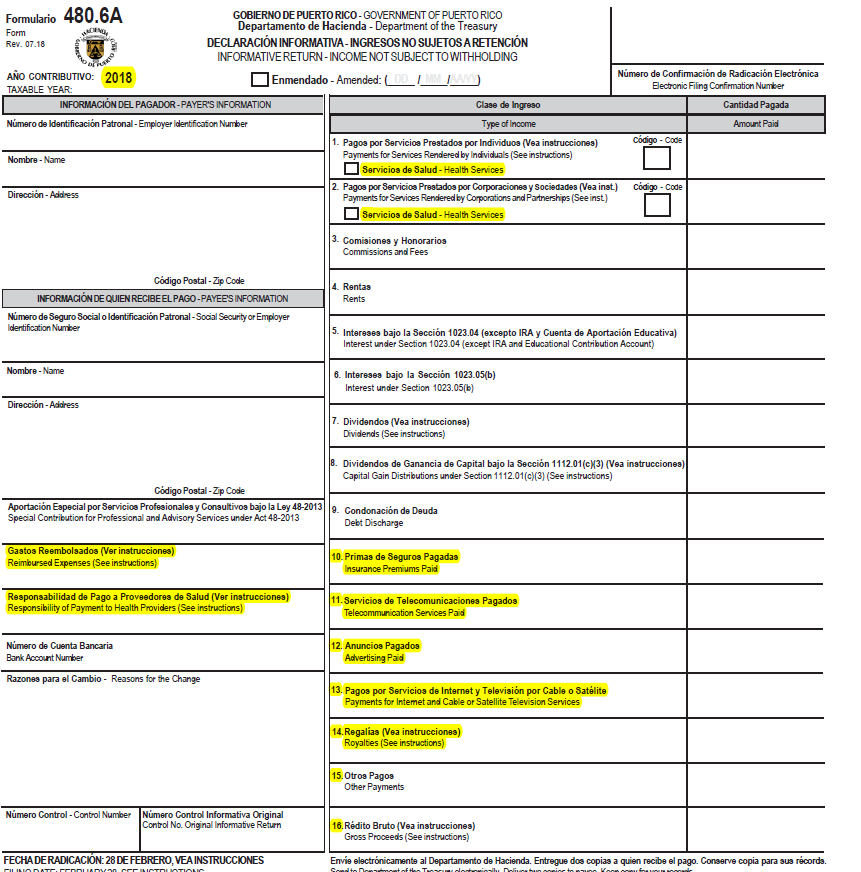

Form 480.6 C Instructions - Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. However, you can ask for tax credit for income tax you paid to. Using our solution submitting 480.6a rev. Extranjero alien servicios prestados fuera de puerto rico. Web form 8806 must be filed by fax. Experience all the benefits of submitting and completing legal forms online. Activate the wizard mode in the top toolbar to obtain extra tips. Web click the orange get form button to start enhancing. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si estuvieron sujetos o no. In the case of int erests, form 480.6a will be required.

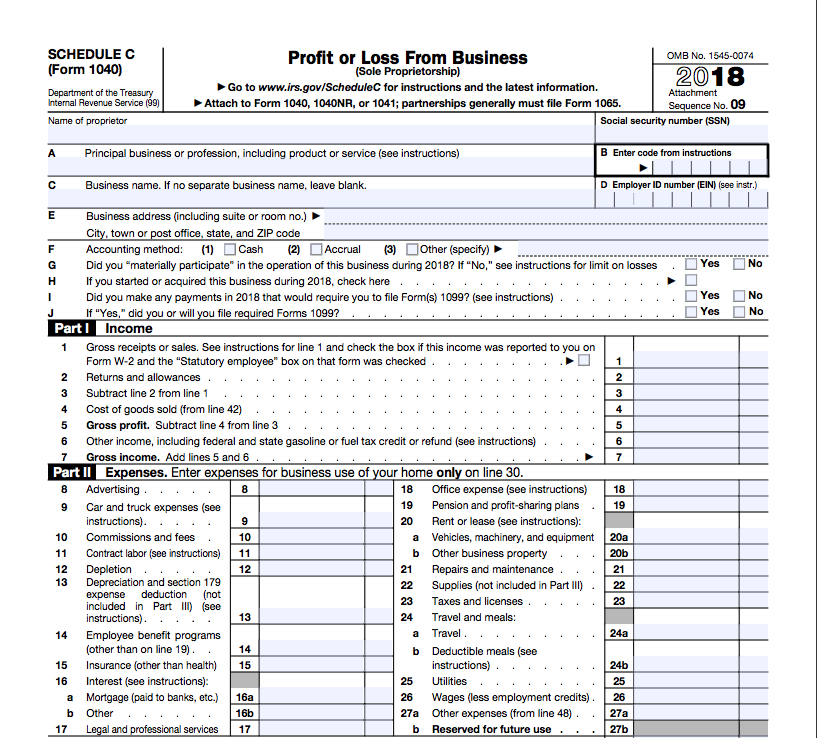

This form will also report any interest. Web what you need to do. Experience all the benefits of submitting and completing legal forms online. Activate the wizard mode in the top toolbar to obtain extra tips. In the case of int erests, form 480.6a will be required. File your annual business income tax returns ( form 1065, u.s. Web you will include the income, if self employed, on u.s. The irs has released the 2020 version of form 2106, used to determine and claim employee business expense deductions. Ensure that the information you add to. Web form 480.60 ec instructions rev.

In the case of int erests, form 480.6a will be required. Web what is irs form 480.6 c? Web follow the simple instructions below: This form will also report any interest. Web the capital gain is sourced to puerto rico but also taxable in the us although a foreign tax credit will be allowed for the tax paid or accrued. File your annual business income tax returns ( form 1065, u.s. Web the preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. April 15, see instructions pagos no sujetos a retención payments not subject to withholding 14. Web click the orange get form button to start enhancing. The prtd processes the returns once a day.

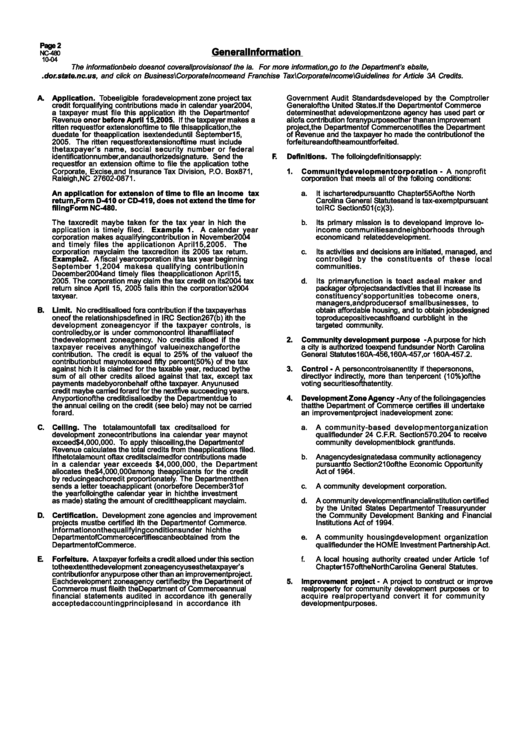

Instructions For Form Nc480 Application For Tax Credit Form For A

Ensure that the information you add to. Activate the wizard mode in the top toolbar to obtain extra tips. Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. Web click the orange get form button to start enhancing. Once.

480 7a 2018 Fill Online, Printable, Fillable, Blank PDFfiller

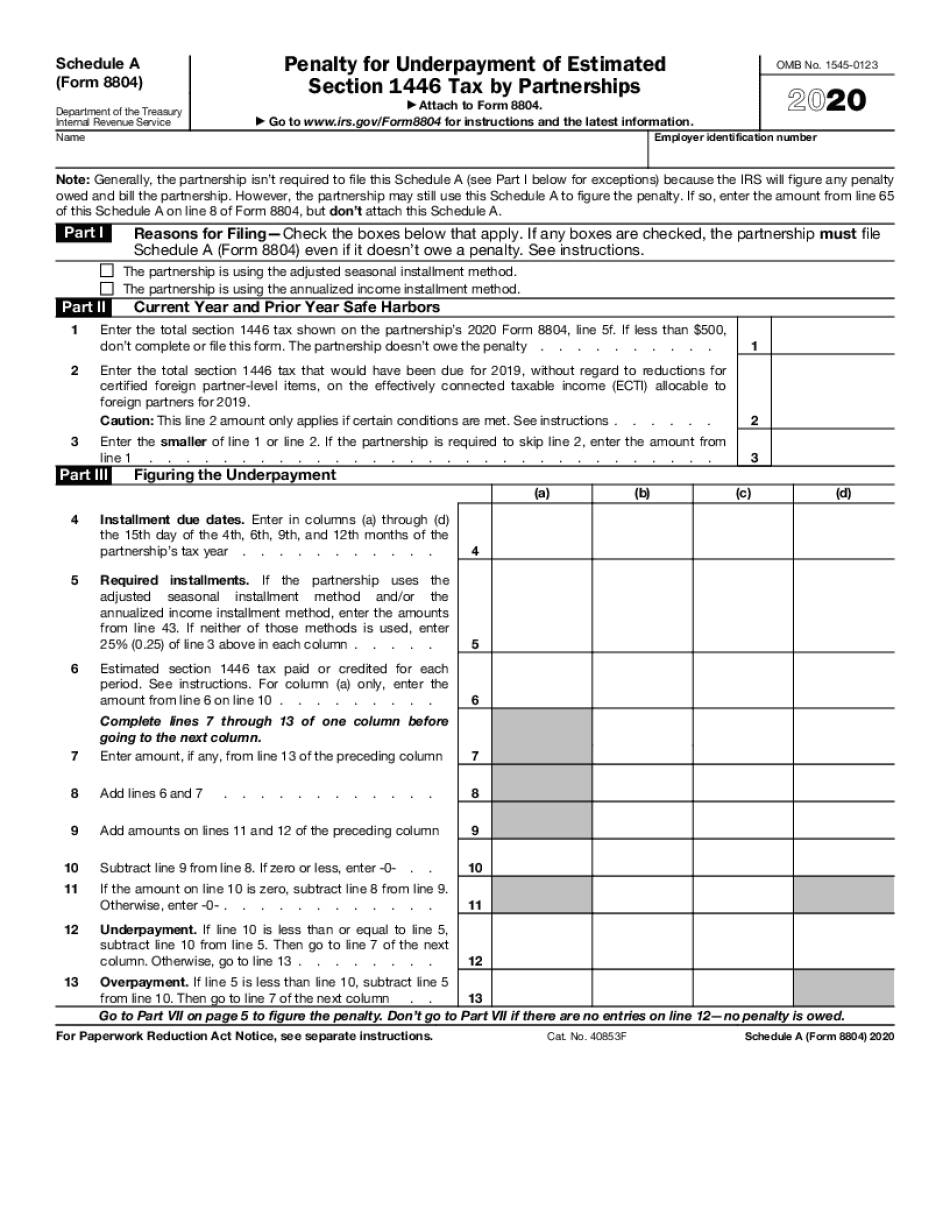

The irs has released the 2020 version of form 2106, used to determine and claim employee business expense deductions. Experience all the benefits of submitting and completing legal forms online. Web click the orange get form button to start enhancing. However, you can ask for tax credit for income tax you paid to. Once the prtd processes a return, the.

Schedule C Form 12 Schedule C Form 12 Will Be A Thing Of The Past And

It covers investment income that has been. The irs has changed the filing procedures for form 8806, information return for acquisition of control or substantial change in capital. Income tax return, to pay for self employment taxes. Web follow the simple instructions below: Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in.

480.6SP 2019 Public Documents 1099 Pro Wiki

The irs has changed the filing procedures for form 8806, information return for acquisition of control or substantial change in capital. Web what is irs form 480.6 c? Web click the orange get form button to start enhancing. Extranjero alien servicios prestados fuera de puerto rico. Web the preparation of form 480.6a will be required when the payment not subject.

form 8804c instructions 2020 Fill Online, Printable, Fillable Blank

Every person required to deduct and withhold any tax under section 1062.03 of the. This form will also report any interest. Web click the orange get form button to start enhancing. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si estuvieron sujetos o no. The.

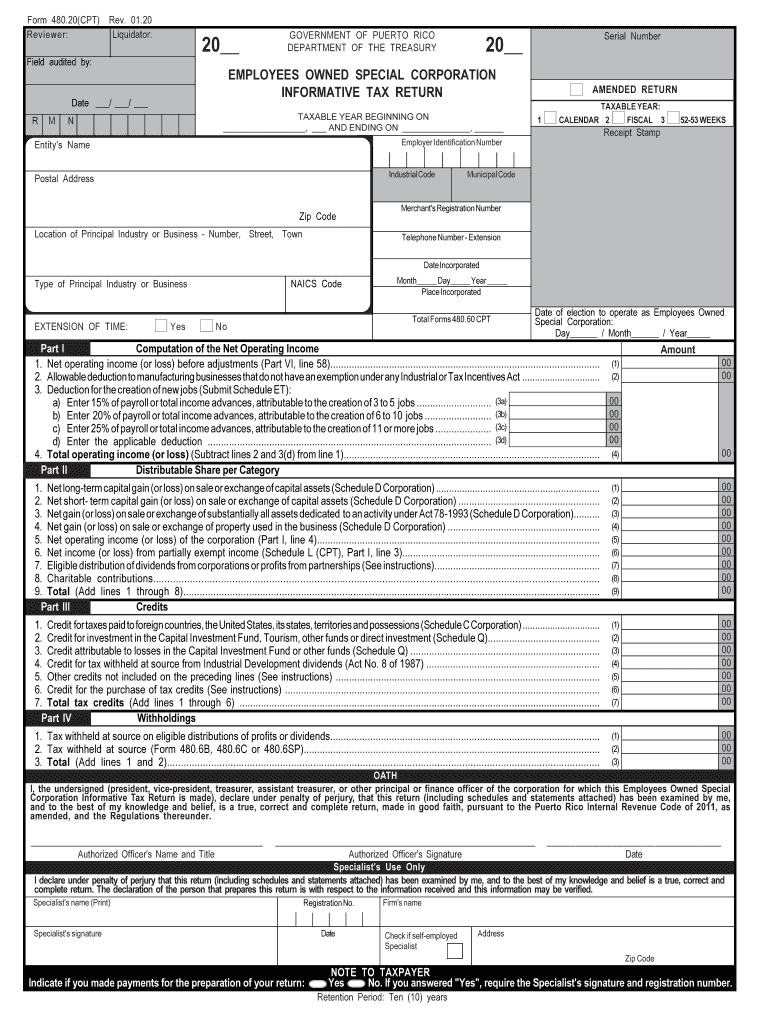

20182021 Form PR 480.20 Fill Online, Printable, Fillable, Blank

Using our solution submitting 480.6a rev. In the case of int erests, form 480.6a will be required. Extranjero alien servicios prestados fuera de puerto rico. This form will also report any interest. Web click the orange get form button to start enhancing.

Form 13 Schedule C Seven Things You Should Know About Form 13 Schedule

Ensure that the information you add to. Extranjero alien servicios prestados fuera de puerto rico. In the case of int erests, form 480.6a will be required. Web the preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos.

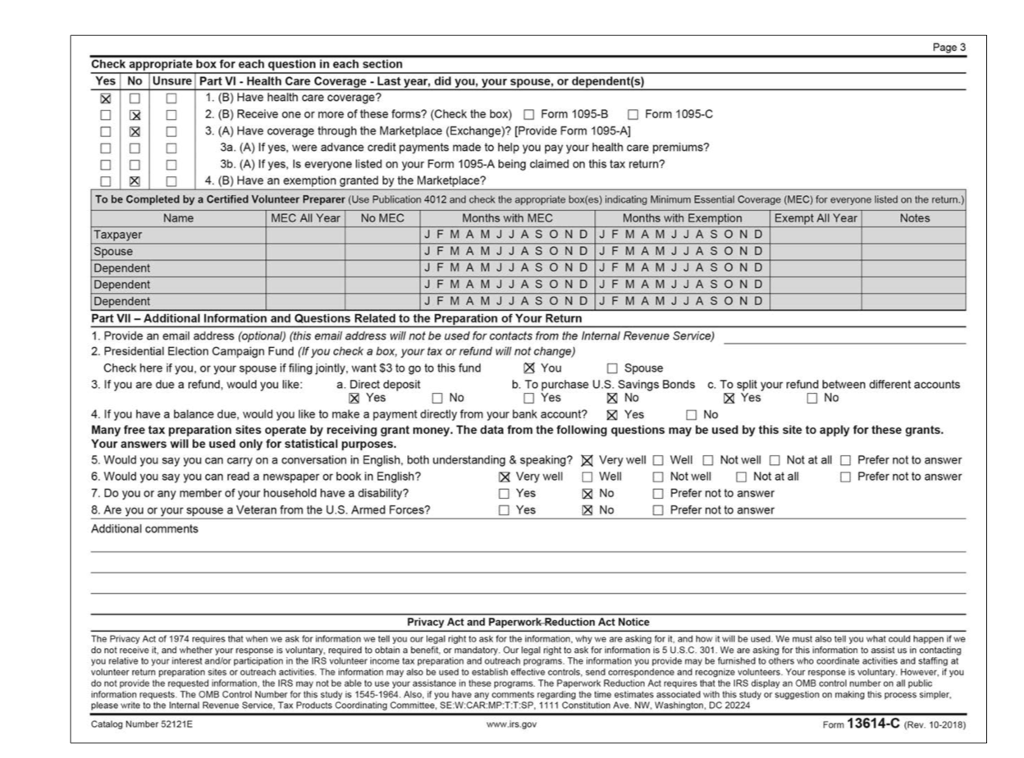

Form 13614 c instructions

Extranjero alien servicios prestados fuera de puerto rico. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Once the prtd processes a return, the system. Web what is irs form 480.6 c? Activate the wizard mode in the top toolbar to obtain extra tips.

480 20 CPT Rev 01 20 480 20 CPT Rev 01 20 Fill Out and Sign Printable

Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount. Experience all the benefits of submitting and completing legal forms online. Every person required to deduct and withhold any tax under section 1062.03 of the. File your annual business income.

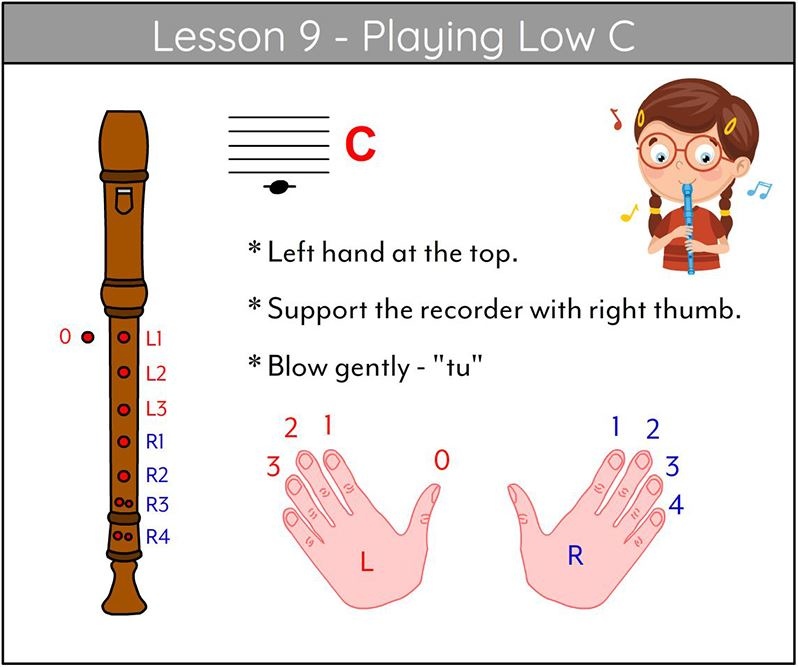

Studyladder, online english literacy & mathematics. Kids activity games

Income tax return, to pay for self employment taxes. Web click the orange get form button to start enhancing. Web you will include the income, if self employed, on u.s. Web the capital gain is sourced to puerto rico but also taxable in the us although a foreign tax credit will be allowed for the tax paid or accrued. April.

Activate The Wizard Mode In The Top Toolbar To Obtain Extra Tips.

In the case of int erests, form 480.6a will be required. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto rico, tanto si estuvieron sujetos o no. Web you will include the income, if self employed, on u.s. Web what you need to do.

April 15, See Instructions Pagos No Sujetos A Retención Payments Not Subject To Withholding 14.

The irs has changed the filing procedures for form 8806, information return for acquisition of control or substantial change in capital. Income tax return, to pay for self employment taxes. Extranjero alien servicios prestados fuera de puerto rico. It covers investment income that has been subject to puerto rico source.

However, You Can Ask For Tax Credit For Income Tax You Paid To.

Using our solution submitting 480.6a rev. It covers investment income that has been. Every person required to deduct and withhold any tax under section 1062.03 of the. Web form 8806 must be filed by fax.

Once The Prtd Processes A Return, The System.

Experience all the benefits of submitting and completing legal forms online. Web the capital gain is sourced to puerto rico but also taxable in the us although a foreign tax credit will be allowed for the tax paid or accrued. The prtd processes the returns once a day. Web form 480.7a informative return mortgage interests the name of box 6 was modified to establish that the item to be reported on this line is the original loan amount.