Form Il 1120

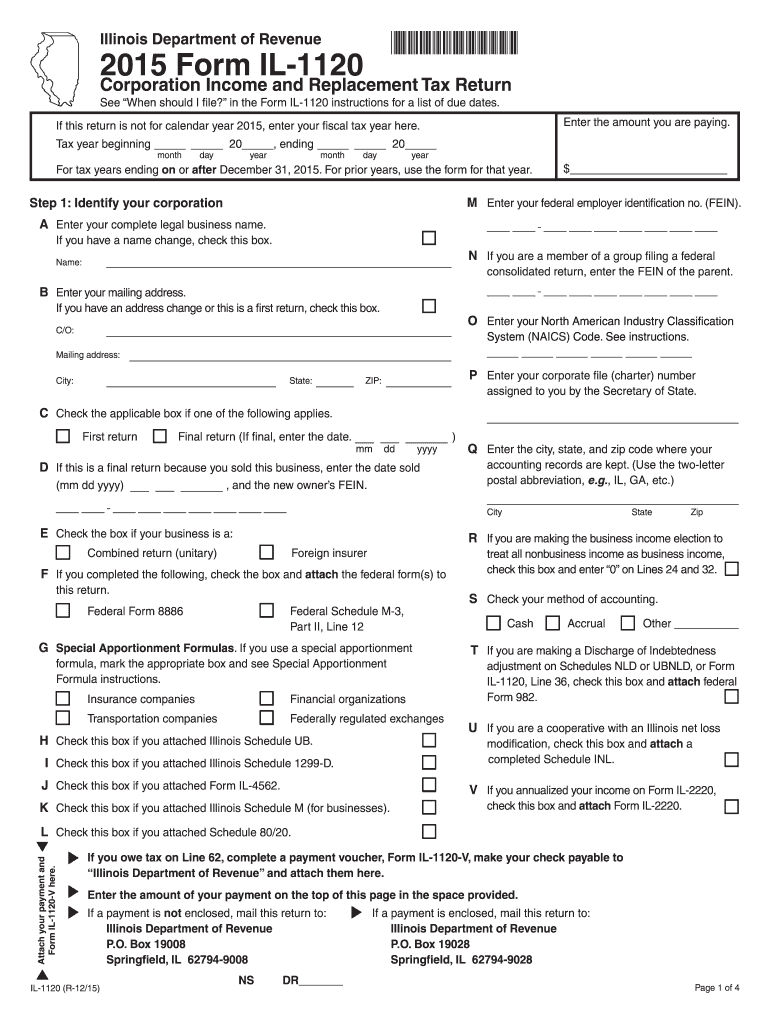

Form Il 1120 - B enter your mailing address. Tax year beginning month if you are filing an amended return for tax years ending day year , ending month day Enter your complete legal business name. How do i register my business? Step 9 — figure your refund or balance due Illinois department of revenue, p.o. Corporation income and replacement tax return. Indicate what tax year you are amending: Identify your small business corporation a. For tax years ending before december 31, 2022, use the 2021 form.

B enter your mailing address. How do i register my business? Tax year beginning , ending. Amended corporation income and replacement tax return. Corporation income and replacement tax return. Illinois department of revenue, p.o. Using the wrong form will delay the processing of your return. To file a federal income tax return (regardless of net income or loss). Payment voucher for amended corporation income and replacement tax. For tax years ending before december 31, 2022, use the 2021 form.

Payment voucher for 2021 corporation income and replacement tax. Amended corporation income and replacement tax return. Tax year beginning , ending. Amended corporation income and replacement tax return. Corporation income and replacement tax return. Identify your small business corporation a. We will compute any penalty or interest dueand notify you. For all other situations, see instructions to determine the correct form to use. B enter your mailing address. Or • is qualified to do business in the state of illinois and is required.

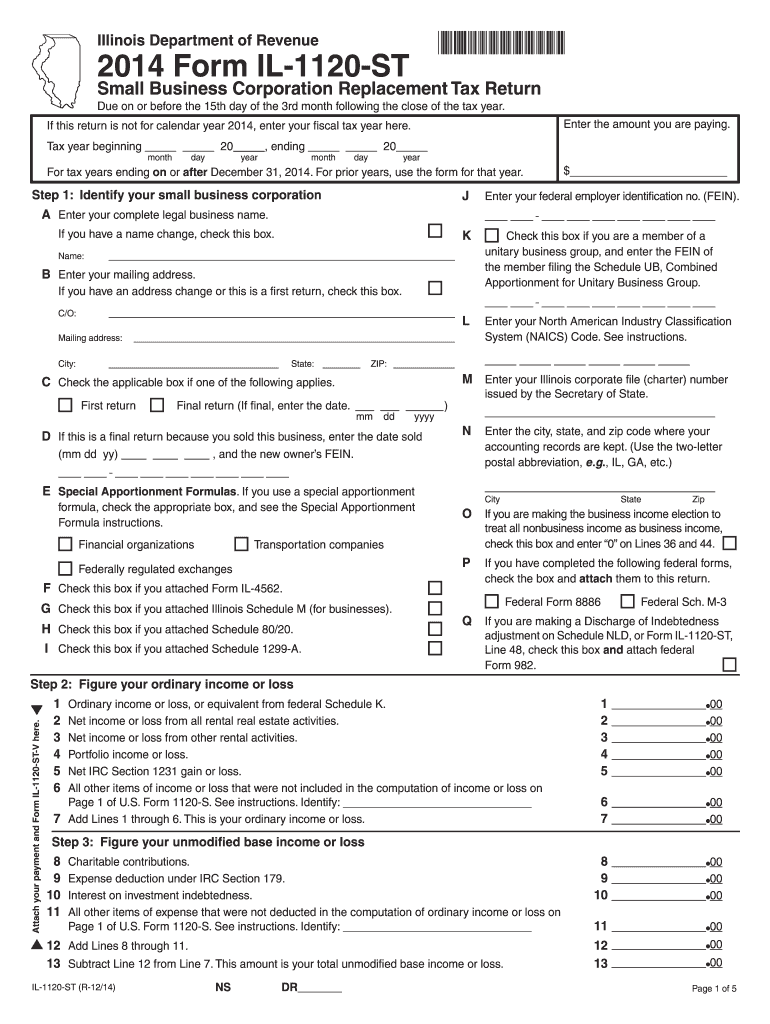

2014 Form IL DoR IL1120ST Fill Online, Printable, Fillable, Blank

If you have a name change, check this box. How do i register my business? To file a federal income tax return (regardless of net income or loss). For all other situations, see instructions to determine the correct form to use. Corporation income and replacement tax return.

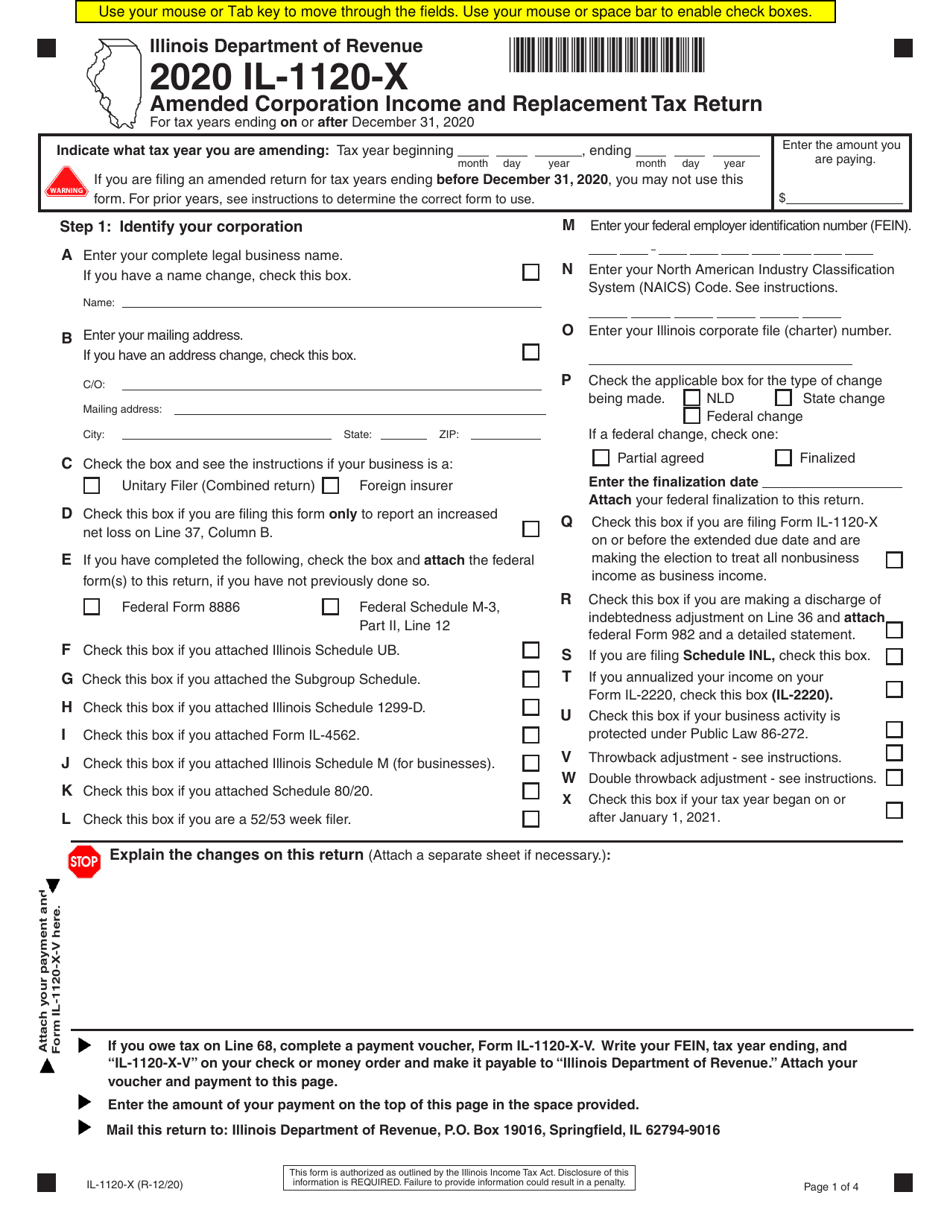

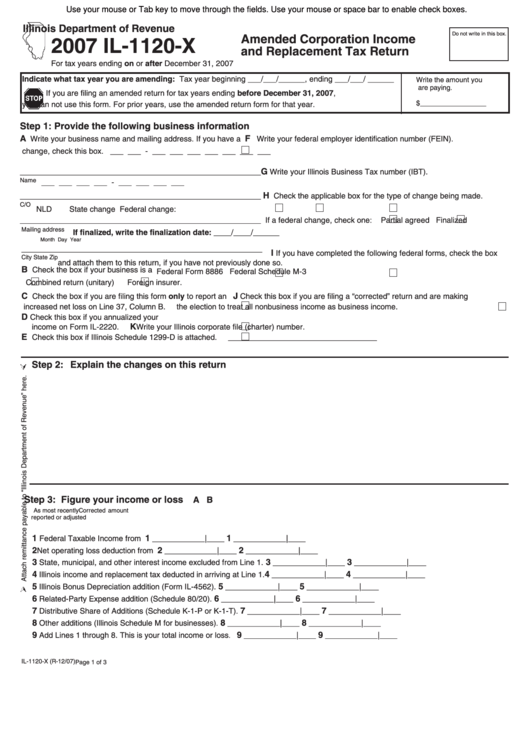

Form IL1120X Download Fillable PDF or Fill Online Amended Corporation

How do i register my business? Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. Identify your small business corporation a. Payment voucher for amended corporation income and replacement tax. Using the wrong form will delay the processing of your return.

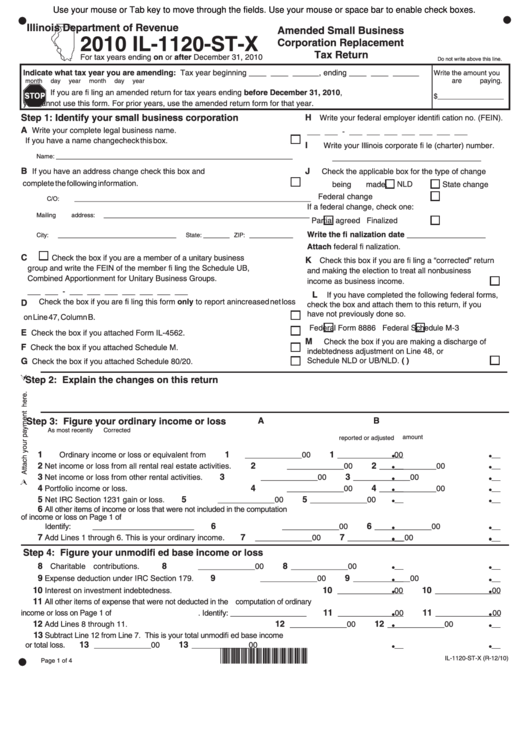

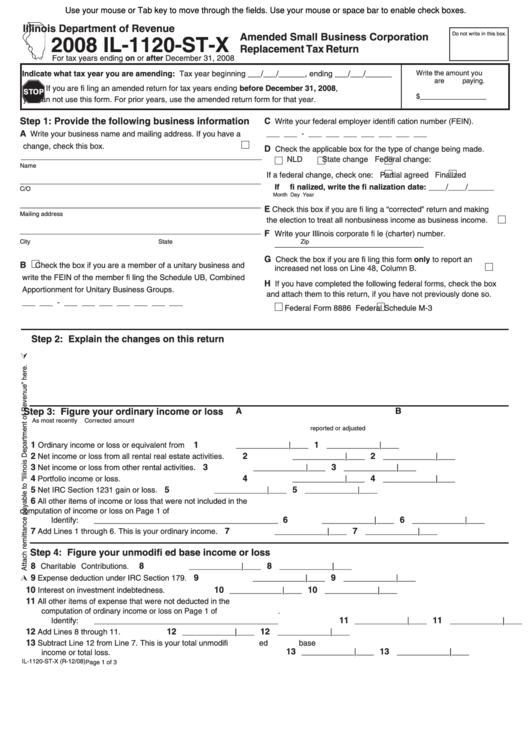

Fillable Form Il1120StX Amended Small Business Corporation

Illinois department of revenue, p.o. For all other situations, see instructions to determine the correct form to use. For tax years ending before december 31, 2022, use the 2021 form. Corporation income and replacement tax return. Payment voucher for 2021 corporation income and replacement tax.

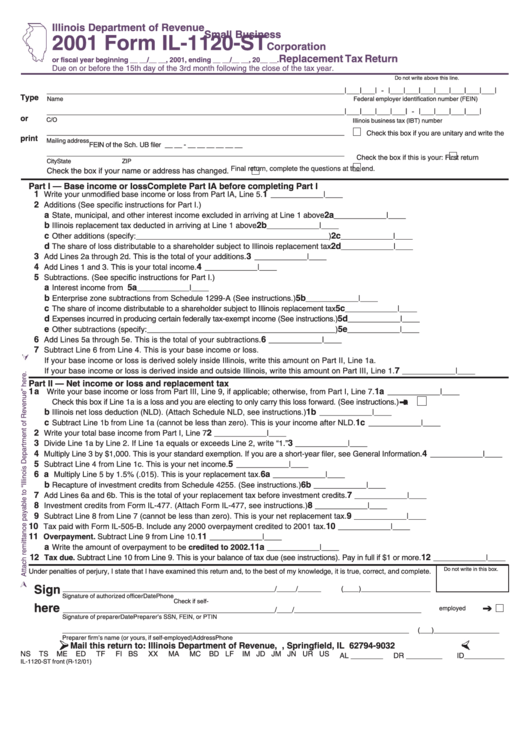

Form Il1120St Small Business Corporation Replacement Tax Return

B enter your mailing address. Corporation income and replacement tax return. Indicate what tax year you are amending: We will compute any penalty or interest dueand notify you. Tax year beginning month if you are filing an amended return for tax years ending day year , ending month day

Fillable Form Il1120X Amended Corporation And Replacement

We will compute any penalty or interest dueand notify you. For tax years ending before december 31, 2022, use the 2021 form. Illinois department of revenue, p.o. If you have a name change, check this box. For all other situations, see instructions to determine the correct form to use.

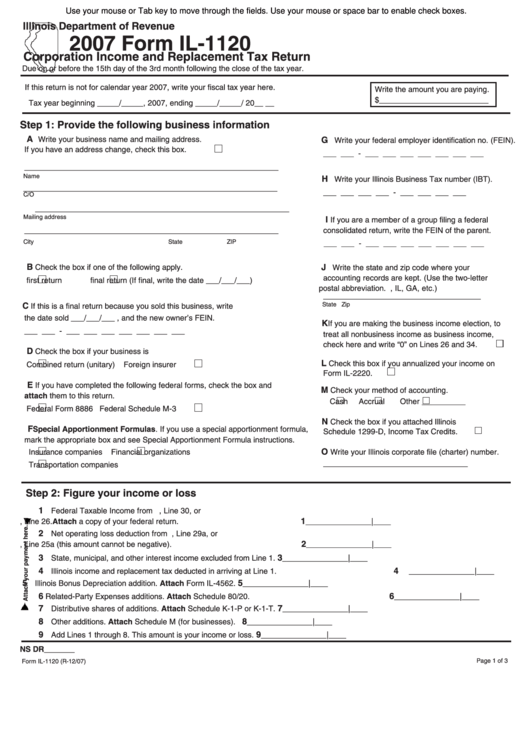

Fillable Form Il1120 Corporation And Replacement Tax Return

For tax years ending before december 31, 2022, use the 2021 form. How do i register my business? In order to avoid late payment penalties, you must attach proof of the federal finalization date, Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. Amended corporation income and replacement tax return.

2015 Form IL DoR IL1120 Fill Online, Printable, Fillable, Blank

In order to avoid late payment penalties, you must attach proof of the federal finalization date, Corporation income and replacement tax return. Payment voucher for 2021 corporation income and replacement tax. Using the wrong form will delay the processing of your return. Or • is qualified to do business in the state of illinois and is required.

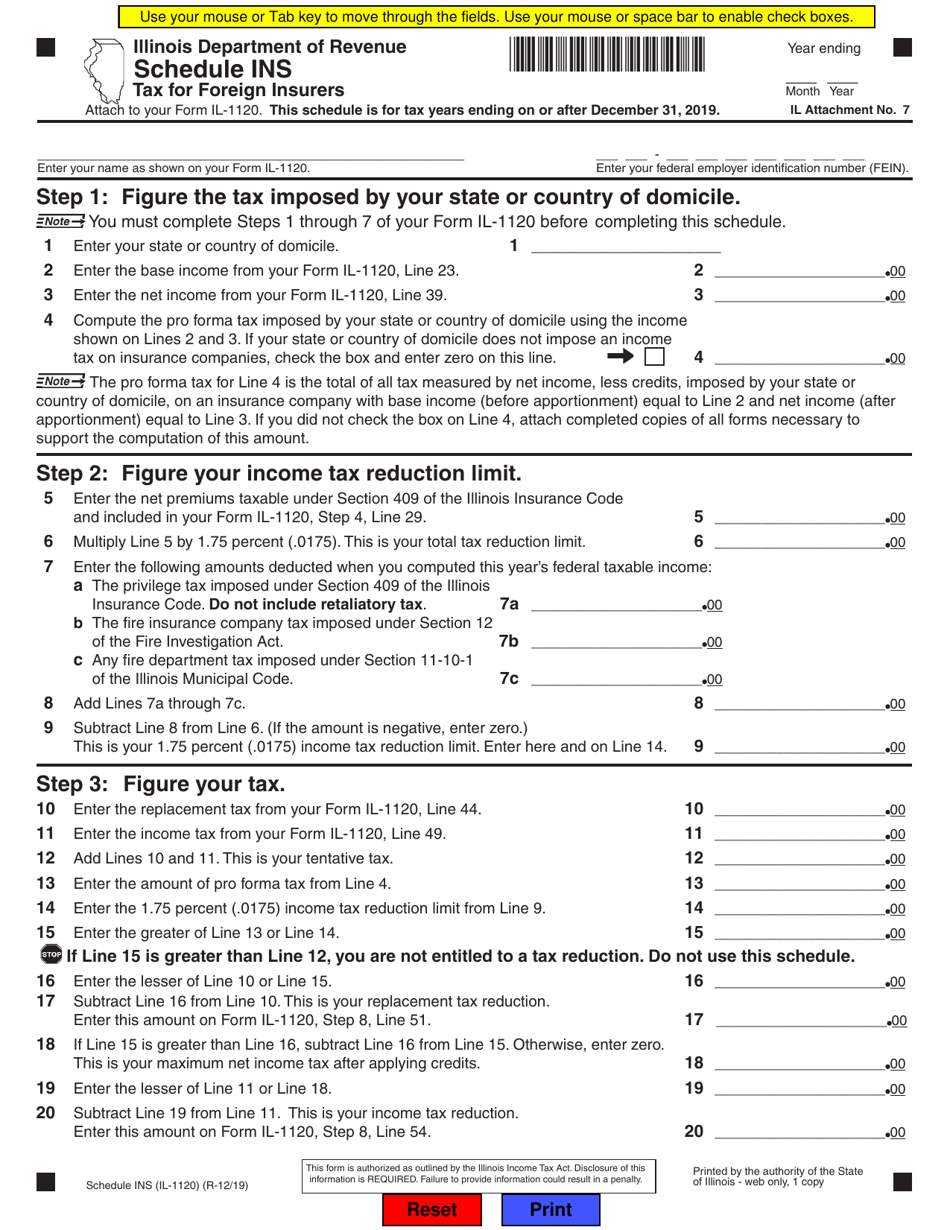

Form IL1120 Schedule INS Download Fillable PDF or Fill Online Tax for

Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. How do i register my business? If you have a name change, check this box. Illinois department of revenue, p.o. To file a federal income tax return (regardless of net income or loss).

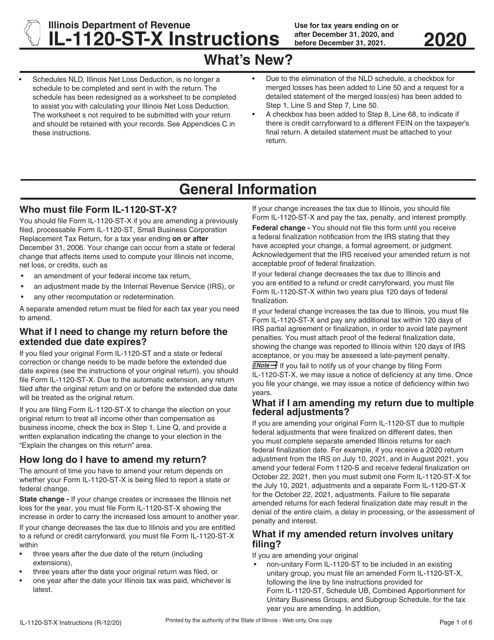

Download Instructions for Form IL1120STX Amended Small Business

Illinois department of revenue, p.o. If you have a name change, check this box. Amended corporation income and replacement tax return. Enter your complete legal business name. For all other situations, see instructions to determine the correct form to use.

Corporation Income And Replacement Tax Return.

Enter your complete legal business name. Using the wrong form will delay the processing of your return. To file a federal income tax return (regardless of net income or loss). Or • is qualified to do business in the state of illinois and is required.

For Tax Years Ending Before December 31, 2022, Use The 2021 Form.

Identify your small business corporation a. Step 9 — figure your refund or balance due Corporation income and replacement tax return. In order to avoid late payment penalties, you must attach proof of the federal finalization date,

Tax Year Beginning , Ending.

Payment voucher for 2021 corporation income and replacement tax. Tax year beginning month if you are filing an amended return for tax years ending day year , ending month day We will compute any penalty or interest dueand notify you. Amended corporation income and replacement tax return.

How Do I Register My Business?

For all other situations, see instructions to determine the correct form to use. If you have a name change, check this box. Web this form is for tax years ending on or after december 31, 2021, and before december 31, 2022. Indicate what tax year you are amending: