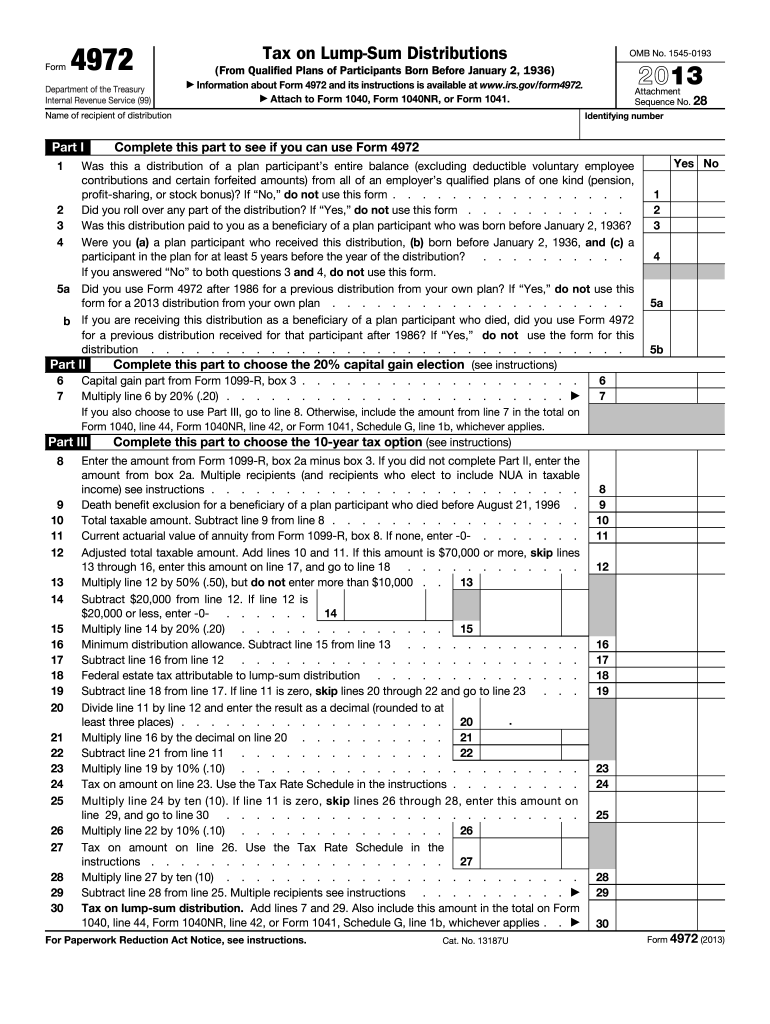

Form 4972 Tax On Lump Sum Distributions

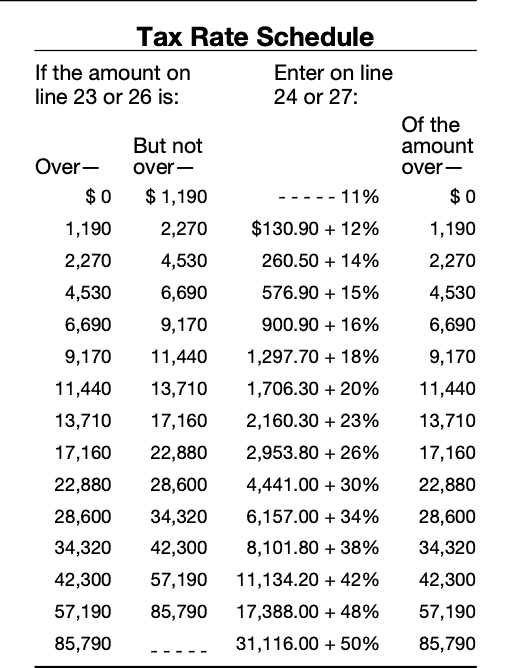

Form 4972 Tax On Lump Sum Distributions - Use distribution code a and. Try it for free now! Click tools to expand the category and then click forms assistant. Web to determine if the distribution qualifies, see the instructions for federal form 4972, tax on lump‑sum distributions. Finally, add the values in line 7 and 30. Upload, modify or create forms. This is your tax on. This form is usually required when:. Instead, enter the value obtained in line 25 in line 29. Complete, edit or print tax forms instantly.

This form is usually required when:. Finally, add the values in line 7 and 30. Online navigation instructions sign in to. Use distribution code a and. Complete, edit or print tax forms instantly. Click + add to create a new copy of the form or click form to. Upload, modify or create forms. How to use the form. Distributions that don’t qualify for. Web if the value in line 11 in zero, you need to omit lines 26, 27, and 28;

It allows beneficiaries to receive their. A distribution that is partially rolled. Instead, enter the value obtained in line 25 in line 29. This form is usually required when:. Use distribution code a and. How to use the form. Complete, edit or print tax forms instantly. Finally, add the values in line 7 and 30. Upload, modify or create forms. Try it for free now!

Form 4972 Tax on LumpSum Distributions Stock Photo Image of checking

Click + add to create a new copy of the form or click form to. How to use the form. It allows beneficiaries to receive their. Online navigation instructions sign in to. Web if the value in line 11 in zero, you need to omit lines 26, 27, and 28;

Tax on Lump Sum Distributions

Instead, enter the value obtained in line 25 in line 29. This is your tax on. How to use the form. Upload, modify or create forms. Click + add to create a new copy of the form or click form to.

2011 Form IRS 4972 Fill Online, Printable, Fillable, Blank PDFfiller

Online navigation instructions sign in to. Upload, modify or create forms. How to use the form. Instead, enter the value obtained in line 25 in line 29. Use distribution code a and.

We did the math to see if it's worth buying a ticket for the 650

Web if the value in line 11 in zero, you need to omit lines 26, 27, and 28; Use distribution code a and. Web to determine if the distribution qualifies, see the instructions for federal form 4972, tax on lump‑sum distributions. It allows beneficiaries to receive their. Click tools to expand the category and then click forms assistant.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Online navigation instructions sign in to. Click tools to expand the category and then click forms assistant. Try it for free now! How to use the form. Ad download or email irs 4972 & more fillable forms, register and subscribe now!

IRS Form 4972A Guide to Tax on LumpSum Distributions

Complete, edit or print tax forms instantly. Click + add to create a new copy of the form or click form to. It allows beneficiaries to receive their. A distribution that is partially rolled. Finally, add the values in line 7 and 30.

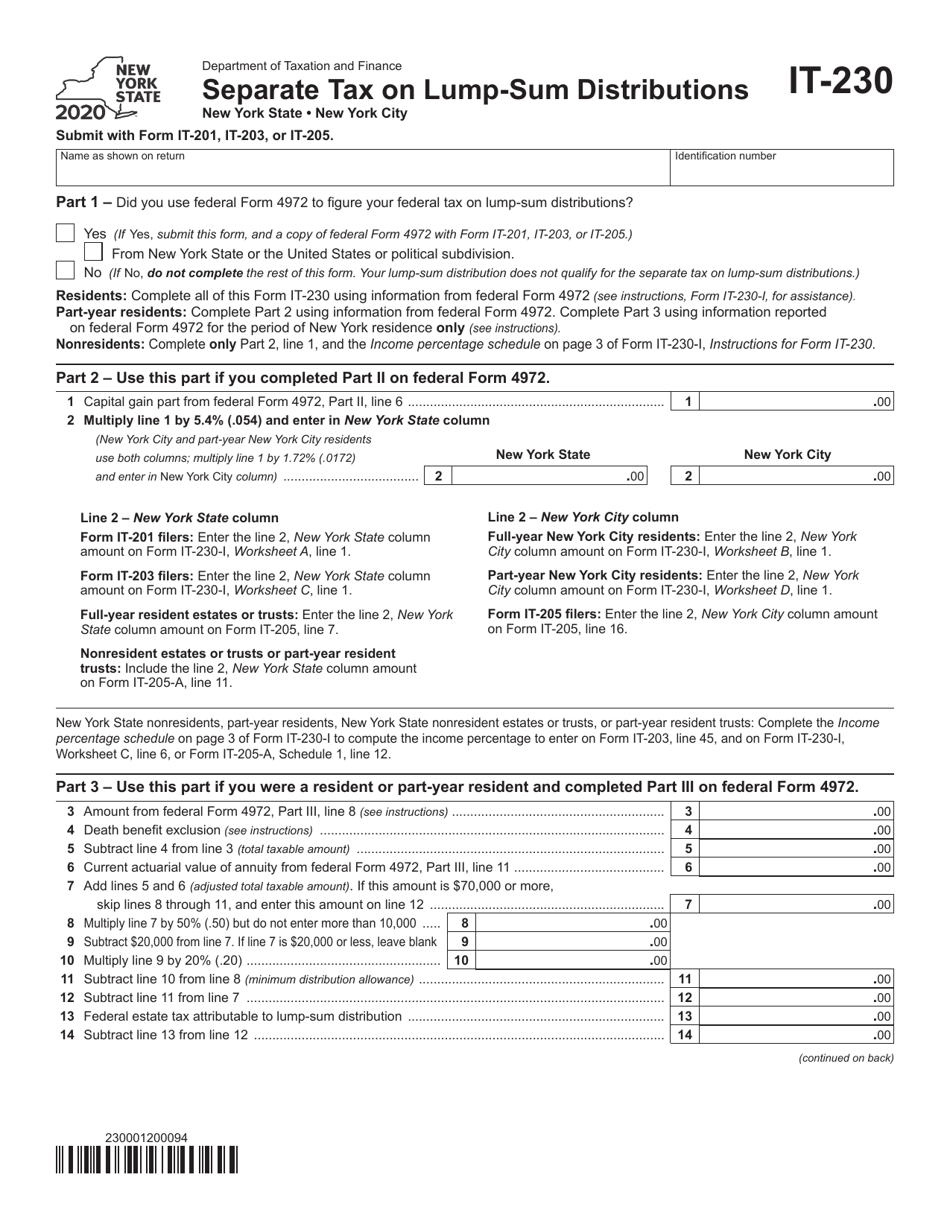

Form IT230 Download Fillable PDF or Fill Online Separate Tax on Lump

Complete, edit or print tax forms instantly. Try it for free now! Web up to 10% cash back free downloads of customizable forms. Finally, add the values in line 7 and 30. Upload, modify or create forms.

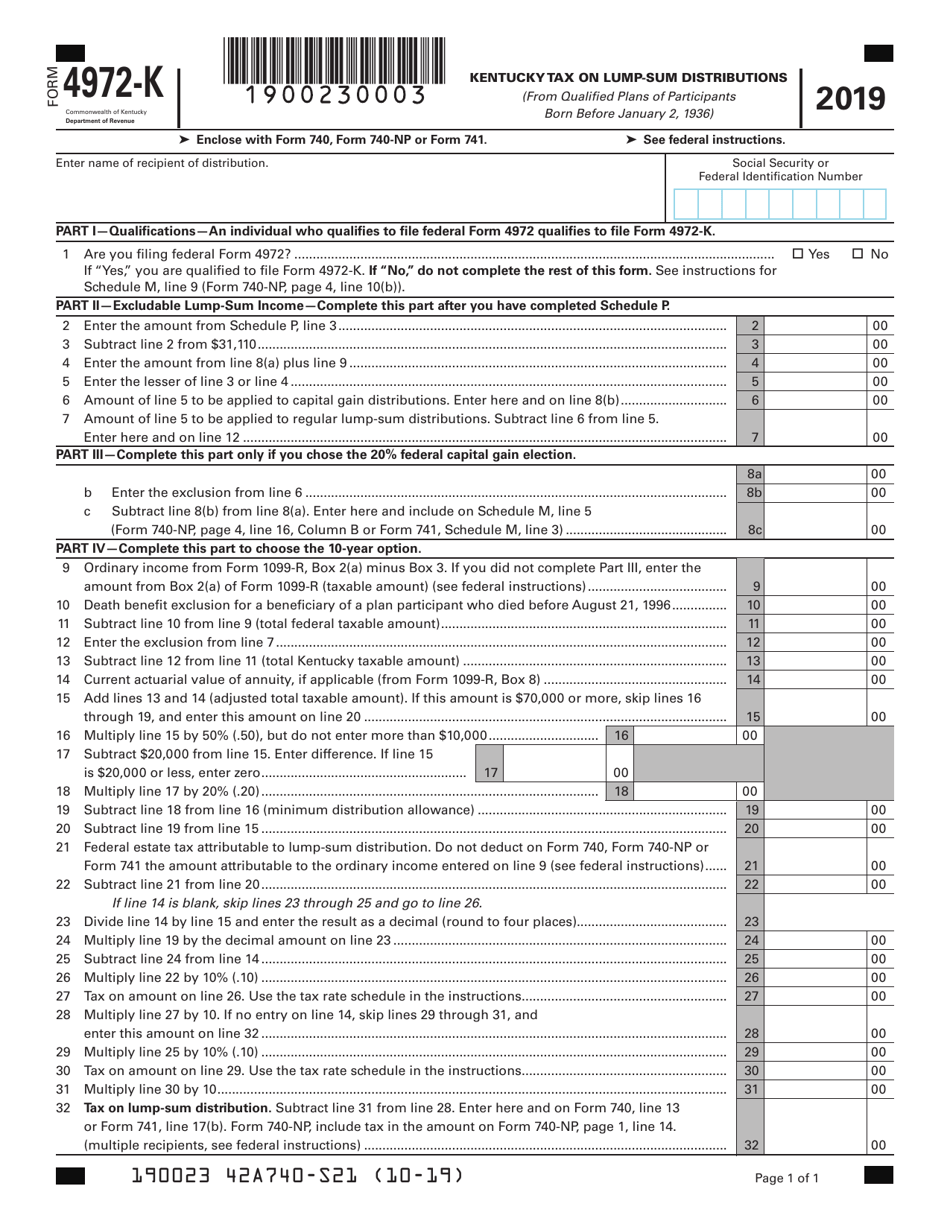

Form 4972K Download Fillable PDF or Fill Online Kentucky Tax on Lump

Instead, enter the value obtained in line 25 in line 29. Distributions that don’t qualify for. It allows beneficiaries to receive their. Web to determine if the distribution qualifies, see the instructions for federal form 4972, tax on lump‑sum distributions. Online navigation instructions sign in to.

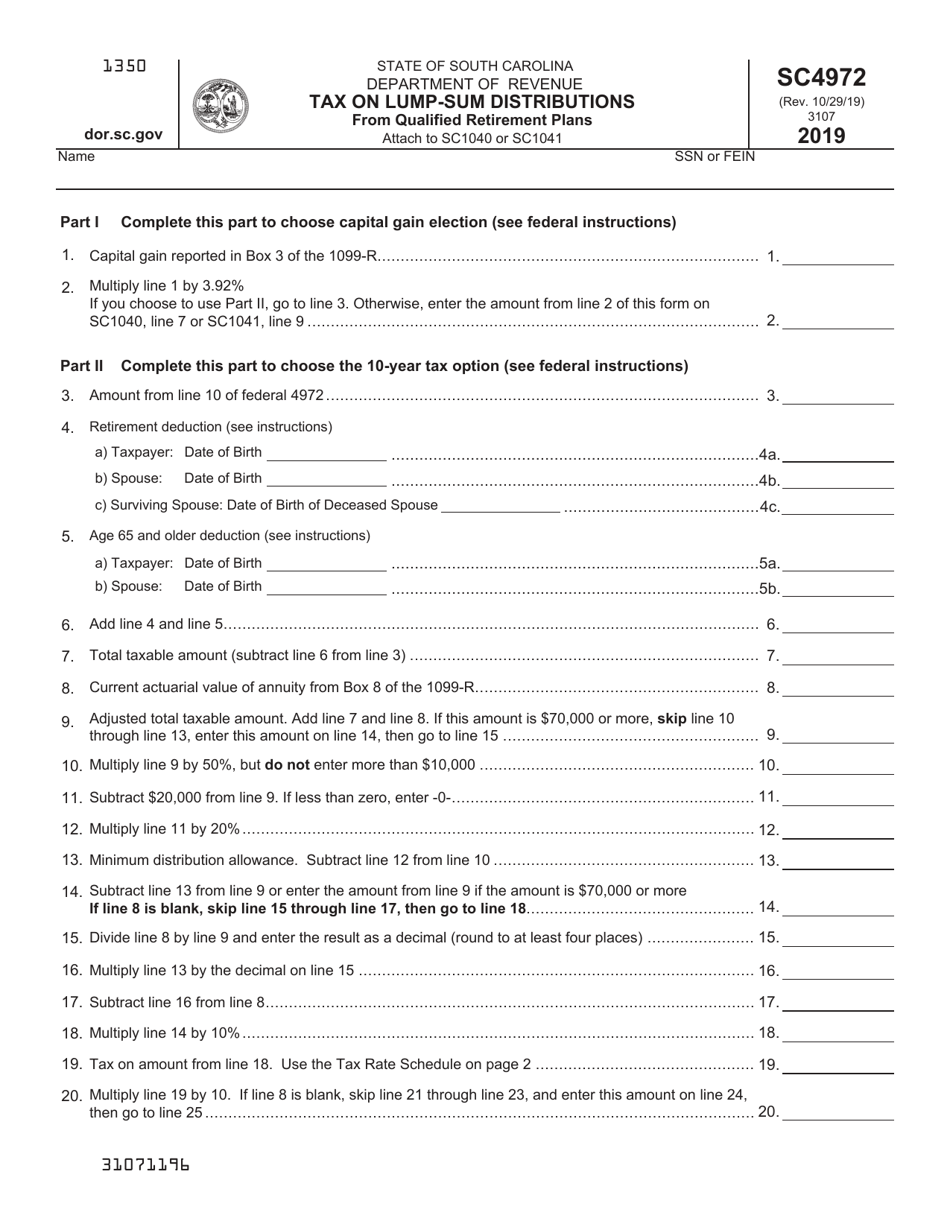

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

Ad download or email irs 4972 & more fillable forms, register and subscribe now! This is your tax on. Upload, modify or create forms. Web to determine if the distribution qualifies, see the instructions for federal form 4972, tax on lump‑sum distributions. This form is usually required when:.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Ad download or email irs 4972 & more fillable forms, register and subscribe now! Try it for free now! Click tools to expand the category and then click forms assistant. This form is usually required when:. Web if the value in line 11 in zero, you need to omit lines 26, 27, and 28;

Online Navigation Instructions Sign In To.

Use distribution code a and. Instead, enter the value obtained in line 25 in line 29. You can download or print current. This form is usually required when:.

Distributions That Don’t Qualify For.

Click tools to expand the category and then click forms assistant. Web if the value in line 11 in zero, you need to omit lines 26, 27, and 28; Web up to 10% cash back free downloads of customizable forms. A distribution that is partially rolled.

Try It For Free Now!

How to use the form. Web to determine if the distribution qualifies, see the instructions for federal form 4972, tax on lump‑sum distributions. Upload, modify or create forms. Complete, edit or print tax forms instantly.

Click + Add To Create A New Copy Of The Form Or Click Form To.

It allows beneficiaries to receive their. Finally, add the values in line 7 and 30. Ad download or email irs 4972 & more fillable forms, register and subscribe now! This is your tax on.