Form 501-C Declaration Of Directors And Officers California

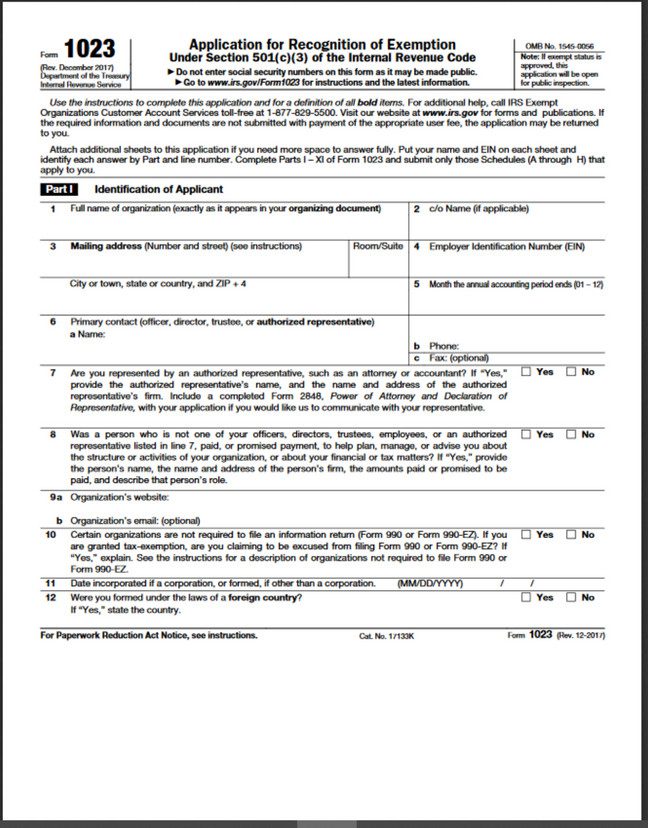

Form 501-C Declaration Of Directors And Officers California - Reading further, i saw a $243. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Web startup law resources incorporate 501 (c) is a section of the federal regulations which list the type of companies that can be exempt from paying taxes according to the irs.2 min. Declaration of directors and officers. Web this package includes the following forms: Web the names of the directors, chief executive officer and five highest compensated executive officers for publicly traded corporations can be obtained online at. Candidate information enter your name and street address. Neither a corporation nor any of its subsidiaries shall make any distribution to the corporation’s shareholders (section 166) if the corporation or. Any corporation that is organized under an act of congress that is exempt from federal income tax. California corporations annuaj order form.

Web compensation to pay, the compensation of officers, directors, trustees, key employees, and others in a position to exercise substantial influence over the affairs of. Web 501 (c) (1): Or periodicals distributed by organizations which qualify. Candidate information enter your name and street address. Compliance with s€ction 1502 of the carrtornia corporations. Web ca corp code § 501. Any corporation that is organized under an act of congress that is exempt from federal income tax. Enter the title of the ofice sought, agency name, and district number if any (e.g., city council member,. Corporations that hold a title of property for. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state.

Reading further, i saw a $243. § 501 (p) (1) the exemption from tax under subsection (a) with respect to any organization described in paragraph (2), and the eligibility of any organization. Web a non government agency. Web startup law resources incorporate 501 (c) is a section of the federal regulations which list the type of companies that can be exempt from paying taxes according to the irs.2 min. Web a 501(c)(3) eligible nonprofit board of directors in california must: Any corporation that is organized under an act of congress that is exempt from federal income tax. California corporations annuaj order form. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. Have three or more members unless there are only one or two shareholders of record; Or periodicals distributed by organizations which qualify.

General Declaration Form Fill Online, Printable, Fillable, Blank

Enter the title of the ofice sought, agency name, and district number if any (e.g., city council member,. Compliance with s€ction 1502 of the carrtornia corporations. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. Web startup law resources incorporate 501 (c) is a section of.

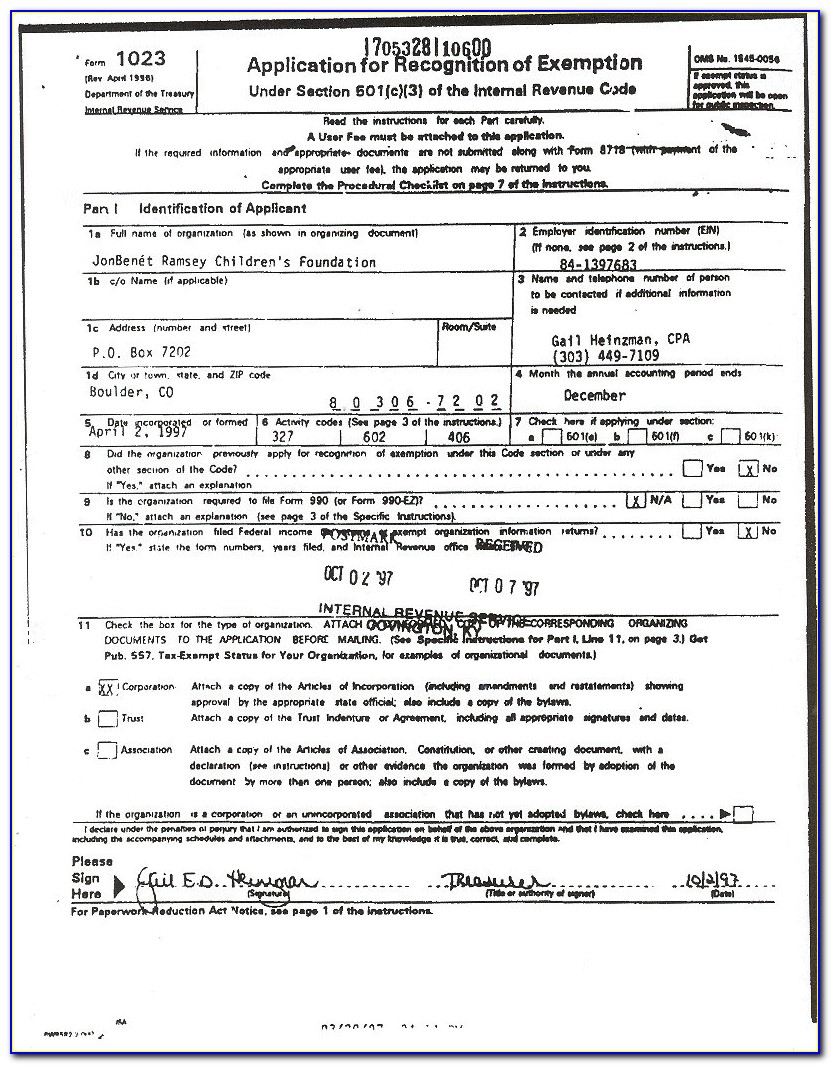

NonProfit with Full 501(c)(3) Application in FL Patel Law

California corporations annuaj order form. Web this package includes the following forms: Have three or more members unless there are only one or two shareholders of record; Web the names of the directors, chief executive officer and five highest compensated executive officers for publicly traded corporations can be obtained online at. Corporations that hold a title of property for.

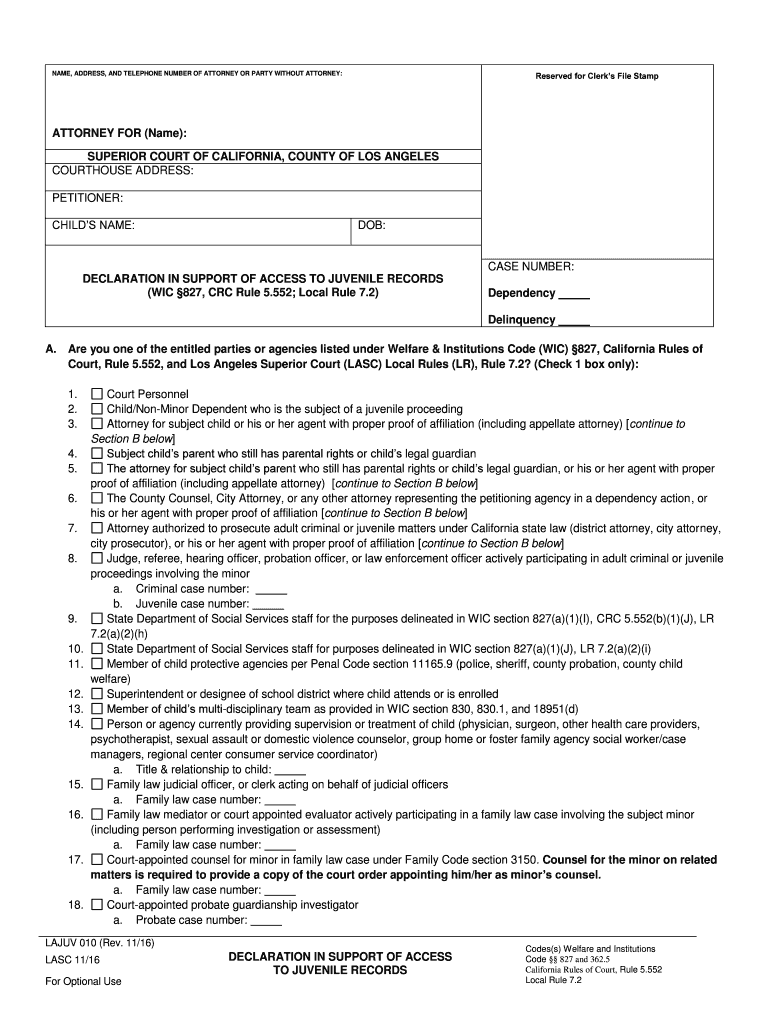

California Declaration Support Form Fill Out and Sign Printable PDF

Reading further, i saw a $243. Declaration of directors and officers. Neither a corporation nor any of its subsidiaries shall make any distribution to the corporation’s shareholders (section 166) if the corporation or. Web secretary of state business programs division business entities 1500 11th street, sacramento, ca 95814 p.o. Web this package includes the following forms:

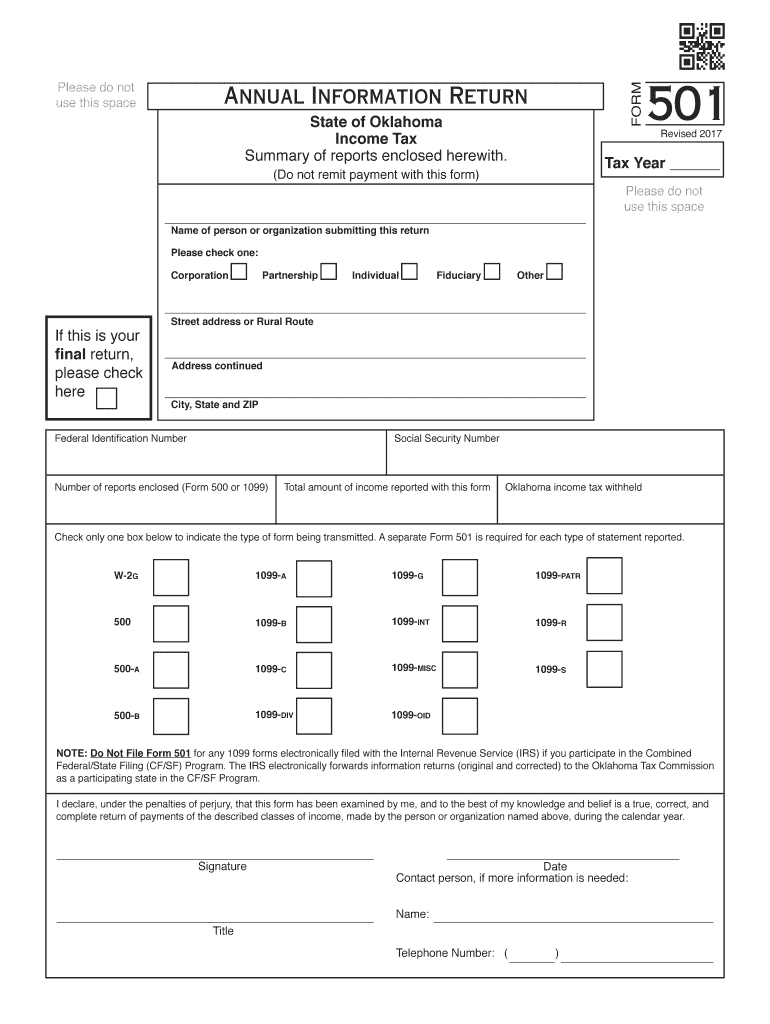

Oklahoma w4 form 2019 Fill out & sign online DocHub

Candidate information enter your name and street address. Web this package includes the following forms: Reading further, i saw a $243. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. Web ca corp code § 501.

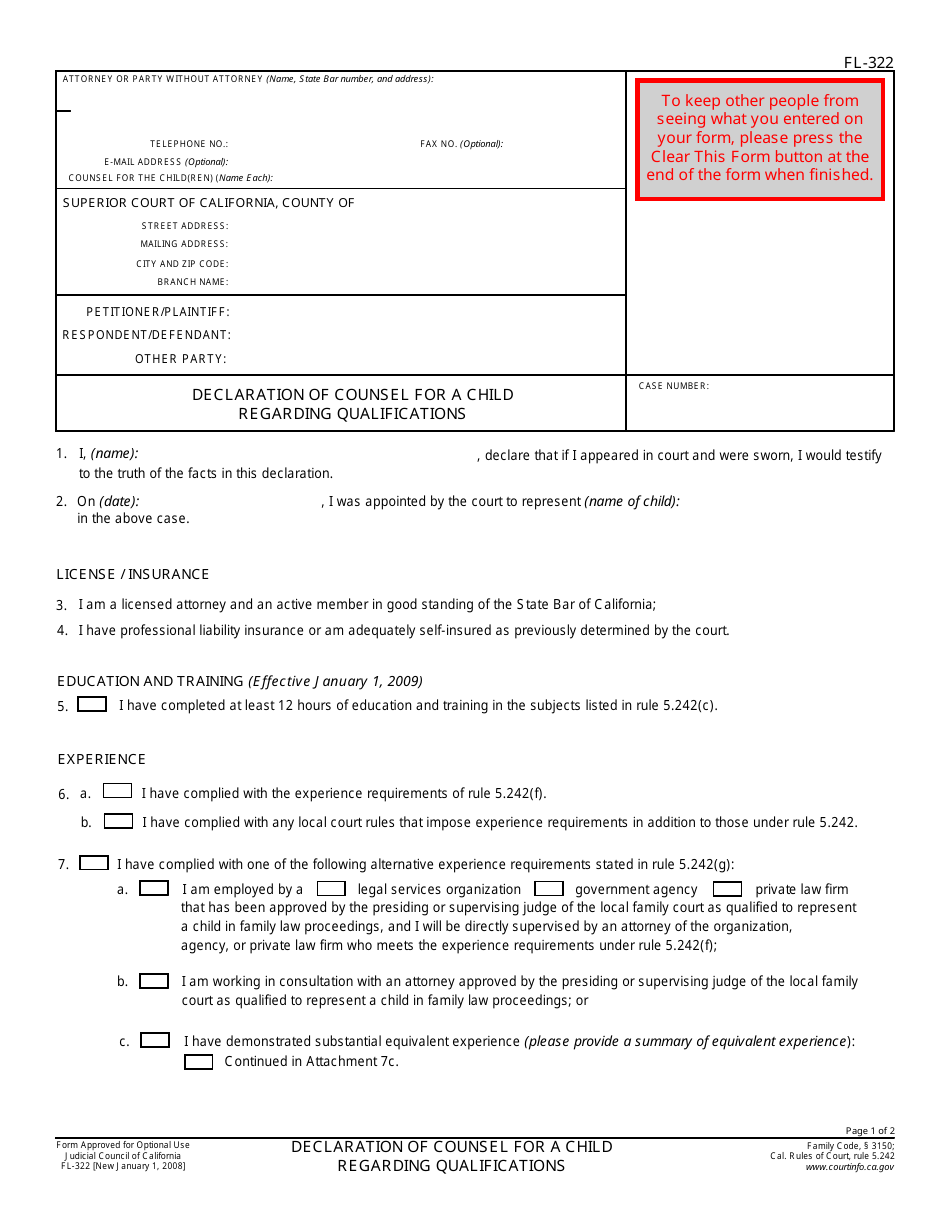

Form FL322 Download Fillable PDF or Fill Online Declaration of Counsel

Web secretary of state business programs division business entities 1500 11th street, sacramento, ca 95814 p.o. Or periodicals distributed by organizations which qualify. Web ca corp code § 501. Compliance with s€ction 1502 of the carrtornia corporations. Candidate information enter your name and street address.

Divorce Complaint Form Nc Form Resume Examples QBD30ga5Xn

Web the names of the directors, chief executive officer and five highest compensated executive officers for publicly traded corporations can be obtained online at. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. California corporations annuaj order form. Compliance with s€ction 1502 of the.

California Traffic Infractions Forms 11 Free Templates in PDF, Word

Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. California corporations annuaj order form. Web a 501(c)(3) eligible nonprofit board of directors in california must: Compliance with s€ction 1502 of the carrtornia corporations. Declaration of directors and officers.

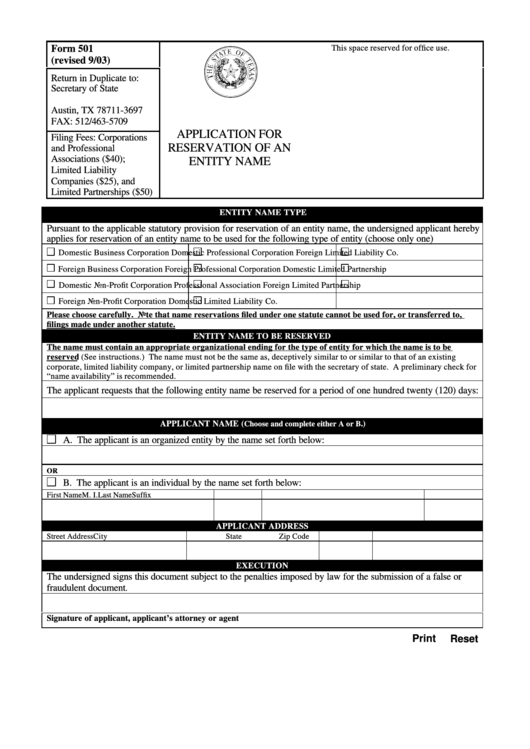

Fillable Form 501 Application For Reservation Of An Entity Name

Corporations that hold a title of property for. Neither a corporation nor any of its subsidiaries shall make any distribution to the corporation’s shareholders (section 166) if the corporation or. Reading further, i saw a $243. Declaration of directors and officers. Web this package includes the following forms:

Auditor's Independence Declaration Transparency Portal

Candidate information enter your name and street address. § 501 (p) (1) the exemption from tax under subsection (a) with respect to any organization described in paragraph (2), and the eligibility of any organization. Web startup law resources incorporate 501 (c) is a section of the federal regulations which list the type of companies that can be exempt from paying.

Most Youth Sports Organizations Don't Have 501 (c) (3) Tax Exempt Status

Web a non government agency. Corporations that hold a title of property for. Web secretary of state business programs division business entities 1500 11th street, sacramento, ca 95814 p.o. Neither a corporation nor any of its subsidiaries shall make any distribution to the corporation’s shareholders (section 166) if the corporation or. Enter the title of the ofice sought, agency name,.

Web Secretary Of State Business Programs Division Business Entities 1500 11Th Street, Sacramento, Ca 95814 P.o.

California corporations annuaj order form. Declaration of directors and officers. Web this package includes the following forms: Enter the title of the ofice sought, agency name, and district number if any (e.g., city council member,.

Candidate Information Enter Your Name And Street Address.

Neither a corporation nor any of its subsidiaries shall make any distribution to the corporation’s shareholders (section 166) if the corporation or. Web the names of the directors, chief executive officer and five highest compensated executive officers for publicly traded corporations can be obtained online at. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. Corporations that hold a title of property for.

Web A 501(C)(3) Eligible Nonprofit Board Of Directors In California Must:

Any corporation that is organized under an act of congress that is exempt from federal income tax. Web compensation to pay, the compensation of officers, directors, trustees, key employees, and others in a position to exercise substantial influence over the affairs of. Web a non government agency. Or periodicals distributed by organizations which qualify.

§ 501 (P) (1) The Exemption From Tax Under Subsection (A) With Respect To Any Organization Described In Paragraph (2), And The Eligibility Of Any Organization.

Compliance with s€ction 1502 of the carrtornia corporations. Have three or more members unless there are only one or two shareholders of record; Web ca corp code § 501. Reading further, i saw a $243.