Form 5330 Due Date

Form 5330 Due Date - Tax on excess fringe benefits (section 4977) reported by the last day of the 7th month after the end of the return of excise taxes. The employer's tax year ends 12/31/04. Web the prohibited transaction penalty is equal to at least 15 percent of the lost earnings on late deposits due for any taxable year. •a minimum funding deficiency (section 4971(a) and (b)); Current revision form 5558 pdf recent developments none at this time. Web form 5330, return of excise taxes related to employee benefit plans. Web file form 5330 to report the tax on: Complete, edit or print tax forms instantly. Web 15 // deadline to apply to the irs for a waiver of the minimum funding standard for db and money purchase pension plans—i.e., no later than the 15th day of. Ad download or email irs 5330 & more fillable forms, register and subscribe now!

Nondeductible contributions to qualified plans (section 4972). If the taxes are due 8. Web the filing due date for section 4971 taxes is changed to the 15th day of the 10th month after the last day of the plan year. Web excise tax due dates 7. The employer's tax year ends 12/31/04. The delinquency is identified and lost earnings deposited in late 2013, and the. Web file form 5330 to report the tax on: An employer liable for the tax under section 4972 for nondeductible contributions to qualified plans. Web form 5330, return of excise taxes related to employee benefit plans. File irs form 5330, return.

Web the prohibited transaction penalty is equal to at least 15 percent of the lost earnings on late deposits due for any taxable year. The employer's tax year ends 12/31/04. Tax on excess fringe benefits (section 4977) reported by the last day of the 7th month after the end of the return of excise taxes. •a prohibited tax shelter transaction (section 4965(a)(2)); An employer liable for the tax under section 4972 for nondeductible contributions to qualified plans. Web excise tax due dates the tax under section 4971(g)(4) for failure to adopt a rehabilitation plan. Ad download or email irs 5330 & more fillable forms, register and subscribe now! September 15, last date to make 2022 contributions for single and multiemployer defined benefit pension plans. The delinquency is identified and lost earnings deposited in late 2013, and the. Once lost earnings have been.

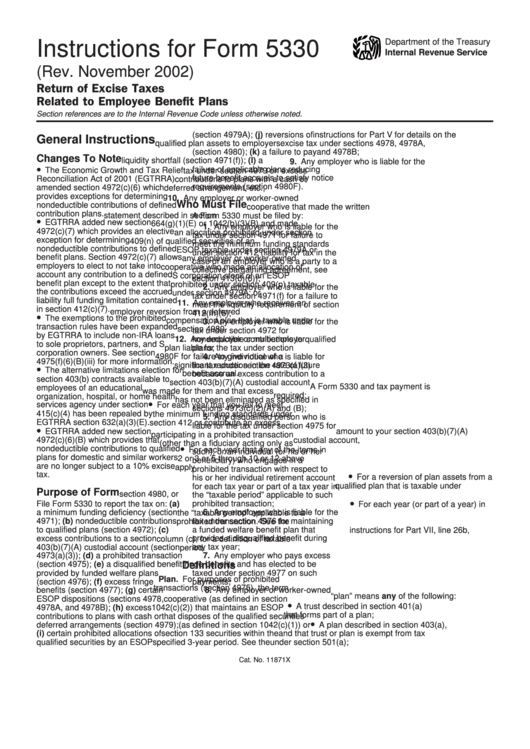

Instructions For Form 5330 November 2002 printable pdf download

Web x 1615 / fund: Web file form 5330 to report the tax on: Web form 5330, return of excise taxes related to employee benefit plans. Web 15 // deadline to apply to the irs for a waiver of the minimum funding standard for db and money purchase pension plans—i.e., no later than the 15th day of. Nondeductible contributions to.

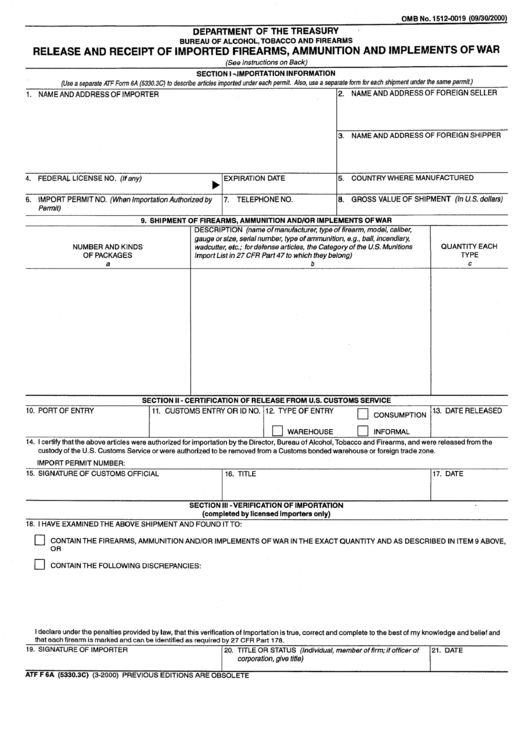

Form Atf F 6a (5330.3c) Release And Receipt Of Imported Firearms

Web file form 5330 to report the tax on: Web for example, assume a deposit that was due in december 2012 is actually made in january 2013. Complete, edit or print tax forms instantly. A minimum funding deficiency (section 4971). The employer's tax year ends 12/31/04.

Atf Eform Fill Out and Sign Printable PDF Template signNow

Web file form 5330 to report the tax on: A minimum funding deficiency (section 4971). The employer's tax year ends 12/31/04. Web form 5330 is due by the last day of the 7th month following the close of the plan year in which the excise tax originated. Once lost earnings have been.

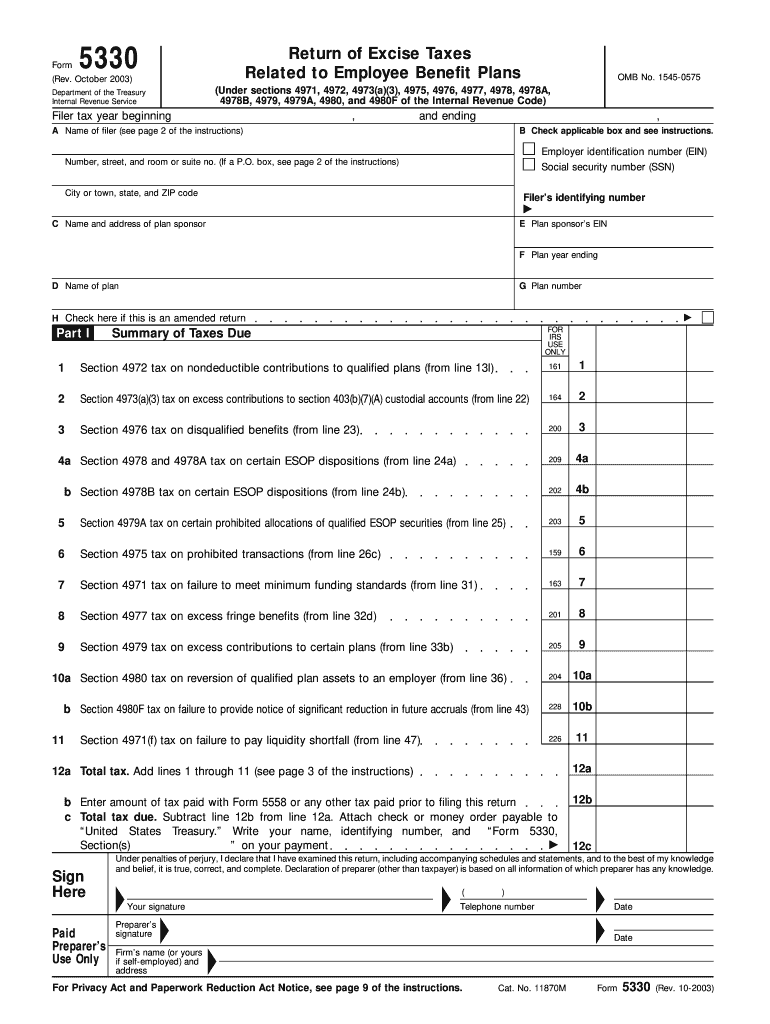

Form 5330 Fillable Form Fill Out and Sign Printable PDF Template

Complete, edit or print tax forms instantly. September 15, last date to make 2022 contributions for single and multiemployer defined benefit pension plans. Current revision form 5558 pdf recent developments none at this time. Web 15 // deadline to apply to the irs for a waiver of the minimum funding standard for db and money purchase pension plans—i.e., no later.

The Plain English Guide to Form 5330

Tax on excess fringe benefits (section 4977) reported by the last day of the 7th month after the end of the return of excise taxes. The employer's tax year ends 12/31/04. Web the form 5330 proposal would take effect for taxable years ending on or after the date final rules are published. •a minimum funding deficiency (section 4971(a) and (b));.

Form 5330 Everything You Need to Know DWC

The delinquency is identified and lost earnings deposited in late 2013, and the. Web x 1615 / fund: Current revision form 5558 pdf recent developments none at this time. Web form 5330 instructions say the due date is the 7th month after the employer's tax year. If the taxes are due 8.

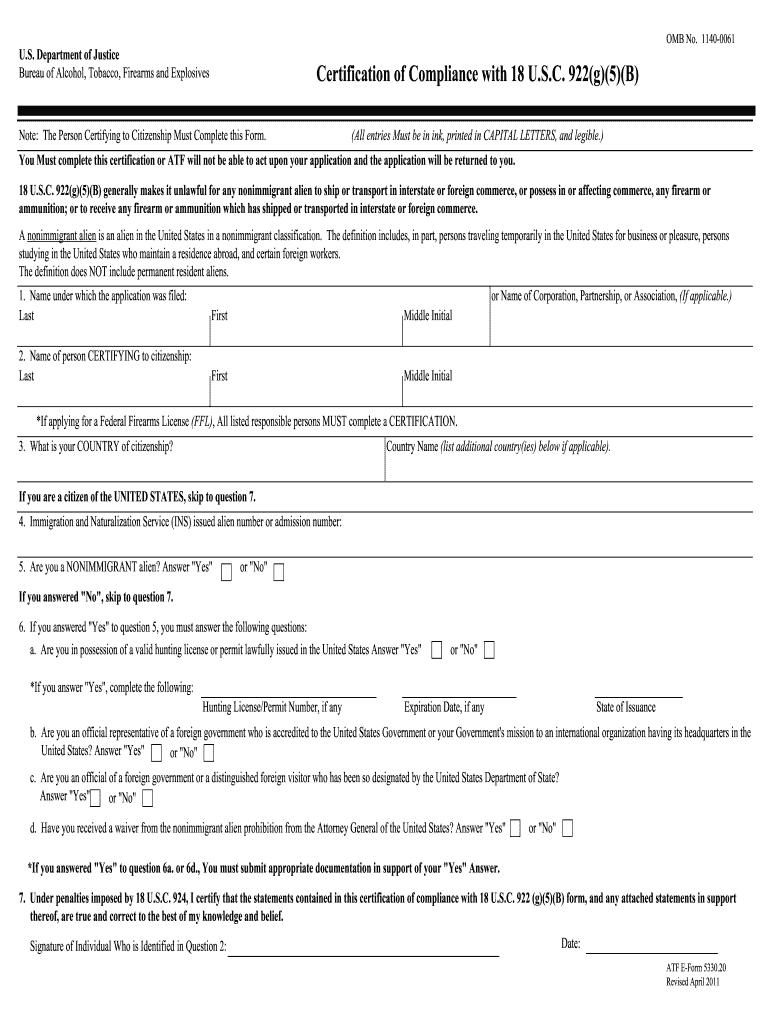

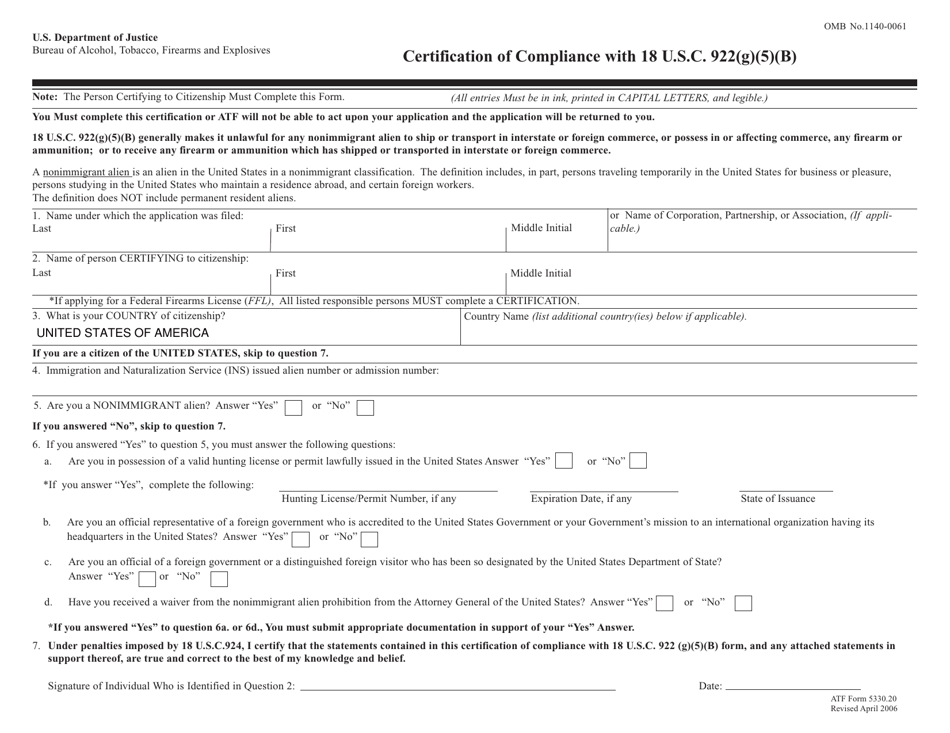

ATF Form 5330.20 Download Fillable PDF or Fill Online Certification of

Ad download or email irs 5330 & more fillable forms, register and subscribe now! Once lost earnings have been. A minimum funding deficiency (section 4971). Web file form 5330 to report the tax on: Web excise tax due dates 7.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

Web form 5330, return of excise taxes related to employee benefit plans. Web file form 5330 to report the tax on: Web 15 // deadline to apply to the irs for a waiver of the minimum funding standard for db and money purchase pension plans—i.e., no later than the 15th day of. An employer liable for the tax under section.

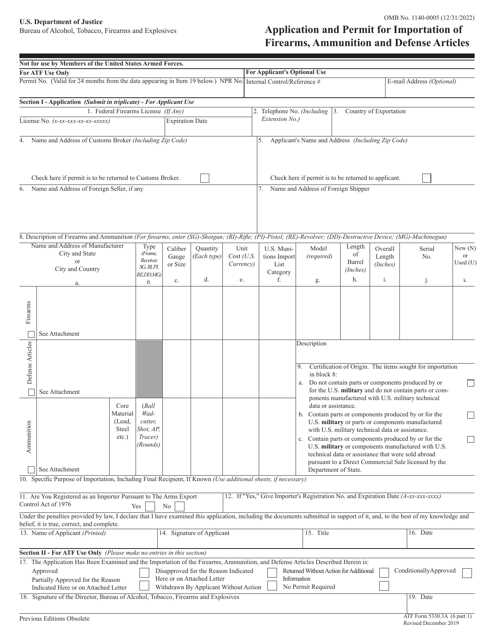

ATF Form 6 (5330.3A) Part 1 Download Fillable PDF or Fill Online

Web file form 5330 to report the tax on: Web the form 5330 proposal would take effect for taxable years ending on or after the date final rules are published. Web form 5330, return of excise taxes related to employee benefit plans. Web the prohibited transaction penalty is equal to at least 15 percent of the lost earnings on late.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

Web form 5330 instructions say the due date is the 7th month after the employer's tax year. Web excise tax due dates the tax under section 4971(g)(4) for failure to adopt a rehabilitation plan. •a minimum funding deficiency (section 4971(a) and (b)); Nondeductible contributions to qualified plans (section 4972). Web the prohibited transaction penalty is equal to at least 15.

The Delinquency Is Identified And Lost Earnings Deposited In Late 2013, And The.

Web form 5330, return of excise taxes related to employee benefit plans. The employer's tax year ends 12/31/04. Web excise tax due dates the tax under section 4971(g)(4) for failure to adopt a rehabilitation plan. Complete, edit or print tax forms instantly.

If The Taxes Due Are Then, Except For Section 4965, File Form 5330 By The Last Day.

The employer files a 5558. Web for example, assume a deposit that was due in december 2012 is actually made in january 2013. Web excise tax due dates 7. A minimum funding deficiency (section 4971).

File Irs Form 5330, Return.

Web a form 5330, “return of excise taxes related to employee benefit plans,” for an excise tax under section 4965 that was due on or before october 4, 2007, will be deemed to. Web x 1615 / fund: An employer liable for the tax under section 4972 for nondeductible contributions to qualified plans. Tax on excess fringe benefits (section 4977) reported by the last day of the 7th month after the end of the return of excise taxes.

If The Taxes Are Due 8.

Ad download or email irs 5330 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Ad download or email irs 5330 & more fillable forms, register and subscribe now! Web form 5330 is due by the last day of the 7th month following the close of the plan year in which the excise tax originated.