Form 5330 Instructions

Form 5330 Instructions - Web plans in endangered or critical been payable to the participant in cash, a form 5330 must be filed by any of status the pension protection act of the amount involved is based on the following. Web form 5330 omb no. April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions) number, street, and room or suite no. Web form 5330, return of excise taxes related to employee benefit plans pdf; Web filing a form 5330 is required for a variety of prohibited actions plan participants, sponsors, and administrators can make while managing a benefits plan. 2006 states that a failure to comply with interest on those elective deferrals. Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service Web this form is used to report and pay the excise tax related to employee benefit plans. Prohibited tax shelter transactions and disqualified benefits, as well as excess benefits or contributions. Instructions for form 5330 pdf;

A failure to comply with a funding improvement or rehabilitation plan (section 4971 (g) (2)); Internal revenue service center, ogden, ut 84201. A minimum funding deficiency (section 4971 (a) and (b)); April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions) number, street, and room or suite no. A failure to pay liquidity shortfall (section 4971 (f)); Web filing a form 5330 is required for a variety of prohibited actions plan participants, sponsors, and administrators can make while managing a benefits plan. What kind of excise taxes? Web form 5330 omb no. A plan entity manager of a Web this form is used to report and pay the excise tax related to employee benefit plans.

April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions) number, street, and room or suite no. Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service Web form 5330 faqs what is form 5330? The form lists more than 20 different types of excise taxes that could come into play, but the most common ones are. Some of those circumstances include: A minimum funding deficiency (section 4971 (a) and (b)); What kind of excise taxes? Prohibited tax shelter transactions and disqualified benefits, as well as excess benefits or contributions. Web file form 5330 to report the tax on: Web form 5330 omb no.

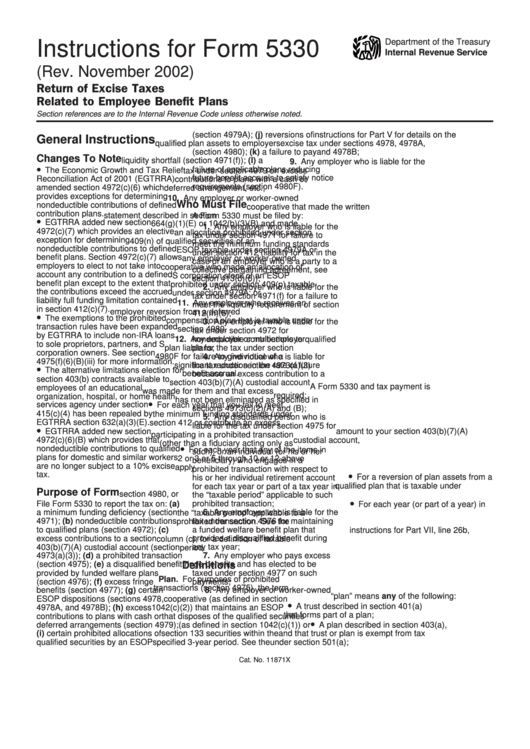

Instructions For Form 5330 November 2002 printable pdf download

April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions) number, street, and room or suite no. A failure to comply with a funding improvement or rehabilitation plan (section 4971 (g) (2));.

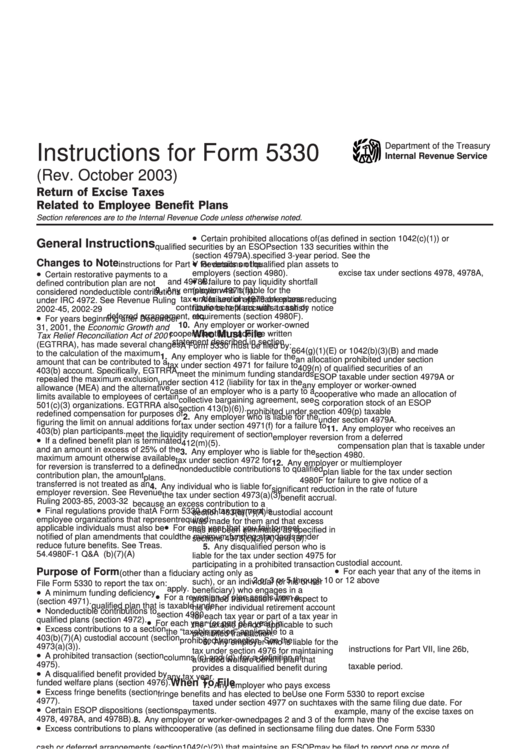

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

The form lists more than 20 different types of excise taxes that could come into play, but the most common ones are. April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions).

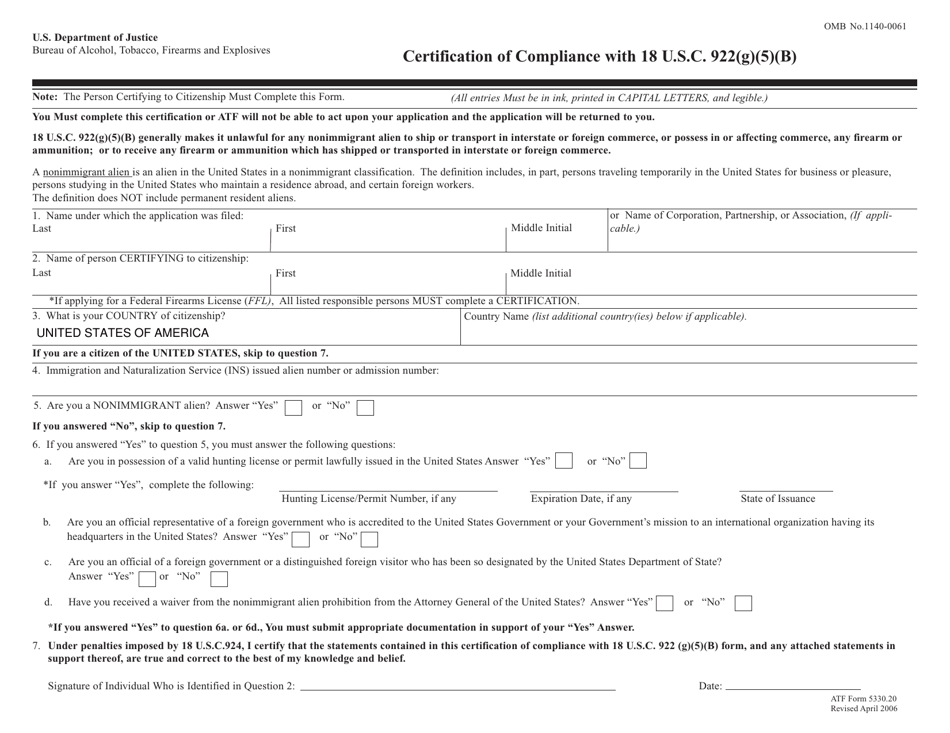

ATF Form 5330.20 Download Fillable PDF or Fill Online Certification of

A failure to pay liquidity shortfall (section 4971 (f)); Some of those circumstances include: The form lists more than 20 different types of excise taxes that could come into play, but the most common ones are. April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue.

2013 Form DHS CG5330 Fill Online, Printable, Fillable, Blank pdfFiller

Instructions for form 5330 pdf; A plan entity manager of a Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service Web this form is used to report and pay the excise tax related to employee benefit plans. Internal revenue service center, ogden, ut 84201.

The Plain English Guide to Form 5330

Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service Web form 5330, return of excise taxes related to employee benefit plans pdf; Web filing a form 5330 is required for a variety of prohibited actions plan participants, sponsors, and administrators can make while managing a benefits plan. Tips for.

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

A prohibited tax shelter transaction (section 4965 (a) (2)); Web plans in endangered or critical been payable to the participant in cash, a form 5330 must be filed by any of status the pension protection act of the amount involved is based on the following. Web this form is used to report and pay the excise tax related to employee.

Formulaire 5330 A Plain English Guide Impulse

April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions) number, street, and room or suite no. Web form 5330 omb no. Web file form 5330 with the: You can use certain.

Instructions For Form 5330 Return Of Excise Taxes Related To Employee

Some of those circumstances include: Tips for preparing form 5330: Prohibited tax shelter transactions and disqualified benefits, as well as excess benefits or contributions. Web this form is used to report and pay the excise tax related to employee benefit plans. What kind of excise taxes?

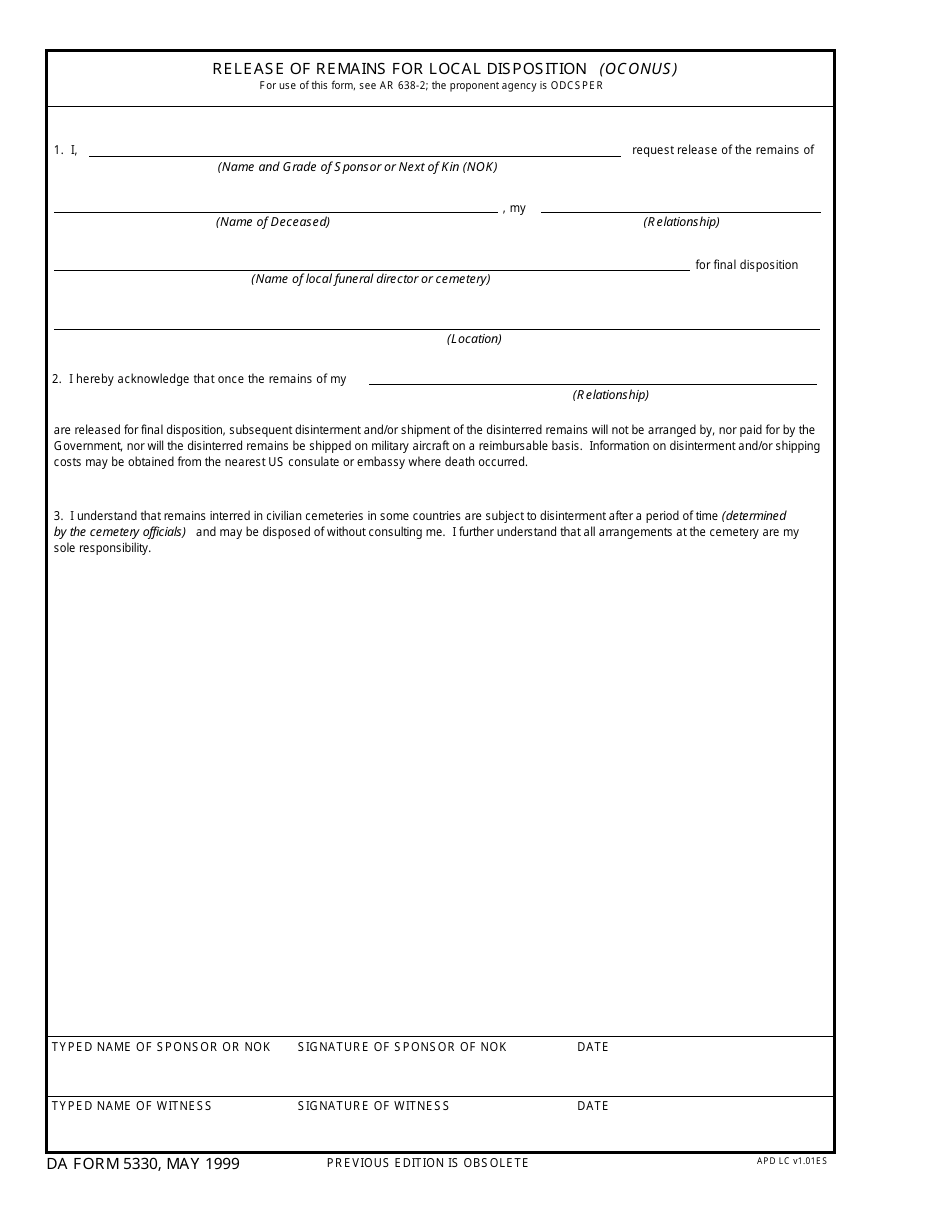

DA Form 5330 Download Fillable PDF or Fill Online Release of Remains

December 2022) return of excise taxes related to employee benefit plans. Current revision form 5330pdf about form 5330, return of excise taxes related to employee benefit plans | internal revenue service A minimum funding deficiency (section 4971 (a) and (b)); A prohibited tax shelter transaction (section 4965 (a) (2)); Web form 5330 faqs what is form 5330?

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

The form lists more than 20 different types of excise taxes that could come into play, but the most common ones are. Prohibited tax shelter transactions and disqualified benefits, as well as excess benefits or contributions. April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue.

Web Form 5330, Return Of Excise Taxes Related To Employee Benefit Plans Pdf;

Web filing a form 5330 is required for a variety of prohibited actions plan participants, sponsors, and administrators can make while managing a benefits plan. Double check the plan number file separate form 5330s to report two or more excise taxes with different due dates A minimum funding deficiency (section 4971 (a) and (b)); A plan entity manager of a

Department Of The Treasury Internal Revenue Service.

Web plans in endangered or critical been payable to the participant in cash, a form 5330 must be filed by any of status the pension protection act of the amount involved is based on the following. Web this form is used to report and pay the excise tax related to employee benefit plans. 2006 states that a failure to comply with interest on those elective deferrals. Web form 5330 is used to report and pay a variety of excise taxes related to employee benefit plans.

Internal Revenue Service Center, Ogden, Ut 84201.

Web file form 5330 with the: Sign the form 5330 use the correct plan number do not leave plan number blank; Web file form 5330 to report the tax on: For instructions and the latest information.

December 2022) Return Of Excise Taxes Related To Employee Benefit Plans.

Some of those circumstances include: April 2009) internal revenue service (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) filer tax year beginning , and ending , name of filer (see instructions) number, street, and room or suite no. (under sections 4965, 4971, 4972, 4973(a)(3), 4975, 4976, 4977, 4978, 4979, 4979a, 4980, and 4980f of the internal revenue code) go to. A failure to comply with a funding improvement or rehabilitation plan (section 4971 (g) (2));