Form 5471 Late Filing Penalty

Form 5471 Late Filing Penalty - Web the penalty for failing to timely file a form 5471 or correctly file a form 5471 is $10,000 per year, with an additional $10,000 penalties accruing (ninety days after notification of. When is irs form 5471. Penalties for the failure to file a form. The form 5471 penalties are one the rise. Persons with respect to certain foreign corporations, and/or form 5472,. Web late filing the irs form 5471. 6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Criminal penalties may also apply for. Web this article explains circumstances in which taxpayers must file forms 5471, stringent standards that the irs and courts apply when considering potential abatement of.

Web (8) irm 20.1.9.3.5 (3) — clarified abatement policy for penalties systemically assessed when a form 5471 is attached to a late filed form 1120 or form 1065. When is irs form 5471. Criminal penalties may also apply for. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Persons with respect to certain foreign corporations, and/or form 5472,. Web this article explains circumstances in which taxpayers must file forms 5471, stringent standards that the irs and courts apply when considering potential abatement of. Form 5471, information return of u.s. Tax court has ruled that the irs doesn't have authority to assess penalties for failure to file form 5471. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. The form 5471 penalties are one the rise.

Penalties for the failure to file a form. 6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. These penalties may apply to each required form 5471 on an annual basis. Criminal penalties may also apply for. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. Web the maximum continuation penalty per form 5471 is $50,000. For any of these three. The form 5471 penalties are one the rise. Web late filing the irs form 5471. Web we summarize the irs form 5471 late & delinquent filing penalty.

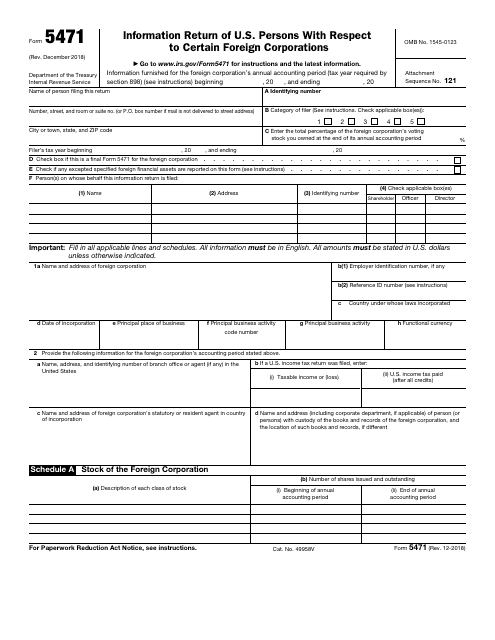

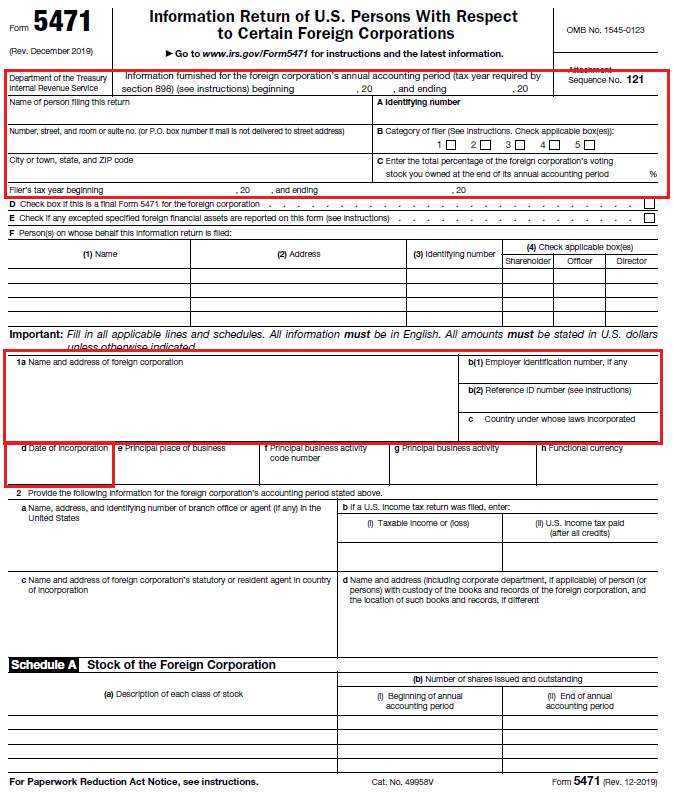

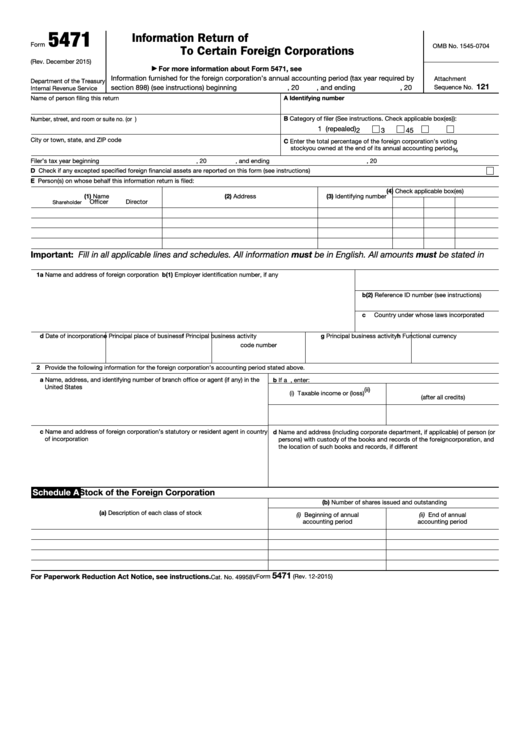

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Web the ipu provides that penalties under sec. These penalties may apply to each required form 5471 on an annual basis. The 5471 form is due when the filer is required to file a tax return. Web the maximum annual penalty for failure to include information with respect to a listed transaction is $100,000 in the case of an individual.

Penalty for Late Filing Form 2290 Computer Tech Reviews

Web the penalty for failing to timely file a form 5471 or correctly file a form 5471 is $10,000 per year, with an additional $10,000 penalties accruing (ninety days after notification of. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. The 5471 form is due when the filer is required to file.

What is a CFC for Purposes of Filing a Form 5471? SF Tax Counsel

6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. Web the maximum continuation penalty per form 5471 is $50,000. Web (8) irm 20.1.9.3.5 (3) — clarified abatement policy for penalties systemically assessed when a form 5471 is attached to a late filed form 1120 or form 1065. The form 5471.

IRS Form 5471 Download Fillable PDF or Fill Online Information Return

Penalties for the failure to file a form. The 5471 form is due when the filer is required to file a tax return. Web we summarize the irs form 5471 late & delinquent filing penalty. Web for example, the notice states that penalty relief is available for forms 5471 and 5472 attached to a late filed form 1120 or 1065,.

The Tax Times IRS Issues Updated New Form 5471 What's New?

These penalties may apply to each required form 5471 on an annual basis. Tax court has ruled that the irs doesn't have authority to assess penalties for failure to file form 5471. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return..

IRS Letter and 10,000 Penalty for Late 5471 Hutcheson & Co.

Web late filing the irs form 5471. Persons with respect to certain foreign corporations, and/or form 5472,. 6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. Web the ipu provides that penalties under sec. Web when a taxpayer misses filing form 5471, they may become subject to fines and penalties.

What is a Dormant Foreign Corporation?

The 5471 form is due when the filer is required to file a tax return. The form 5471 penalties are one the rise. Web the maximum continuation penalty per form 5471 is $50,000. Tax court has ruled that the irs doesn't have authority to assess penalties for failure to file form 5471. Web the penalty for failing to timely file.

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

Web this article explains circumstances in which taxpayers must file forms 5471, stringent standards that the irs and courts apply when considering potential abatement of. For any of these three. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. 6038 may apply when a form 5471 is filed late, is substantially incomplete, or.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web late filing the irs form 5471. The 5471 form is due when the filer is required to file a tax return. The form 5471 penalties are one the rise. For any of these three. Persons with respect to certain foreign corporations, and/or form 5472,.

Substantial Compliance Form 5471 Advanced American Tax

Web the ipu provides that penalties under sec. The form 5471 penalties are one the rise. Tax court today held that the irs did not have statutory authority to assess penalties under section 6038 (b) against a taxpayer who willfully failed to file. Web the penalty for failing to timely file a form 5471 or correctly file a form 5471.

Learn How This Could Impact Your Business.

Penalties for the failure to file a form. Web (8) irm 20.1.9.3.5 (3) — clarified abatement policy for penalties systemically assessed when a form 5471 is attached to a late filed form 1120 or form 1065. Web for example, the notice states that penalty relief is available for forms 5471 and 5472 attached to a late filed form 1120 or 1065, but the notice does not make clear. Criminal penalties may also apply for.

Web When A Taxpayer Misses Filing Form 5471, They May Become Subject To Fines And Penalties.

Persons with respect to certain foreign corporations, and/or form 5472,. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. These penalties may apply to each required form 5471 on an annual basis. Web the penalty for failing to timely file a form 5471 or correctly file a form 5471 is $10,000 per year, with an additional $10,000 penalties accruing (ninety days after notification of.

The 5471 Form Is Due When The Filer Is Required To File A Tax Return.

Web penalties systematically assessed when a form 5471, information return of u.s. 6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. Web the maximum annual penalty for failure to include information with respect to a listed transaction is $100,000 in the case of an individual and $200,000 in any other case. Tax court has ruled that the irs doesn't have authority to assess penalties for failure to file form 5471.

Web The Form 547 1 Filing Is Attached To Your Individual Income Tax Return And Is To Be Filed By The Due Date (Including Extensions) For That Return.

Web late filing the irs form 5471. Tax court today held that the irs did not have statutory authority to assess penalties under section 6038 (b) against a taxpayer who willfully failed to file. Web this article explains circumstances in which taxpayers must file forms 5471, stringent standards that the irs and courts apply when considering potential abatement of. Web we summarize the irs form 5471 late & delinquent filing penalty.