Form 5471 Schedule J Instructions

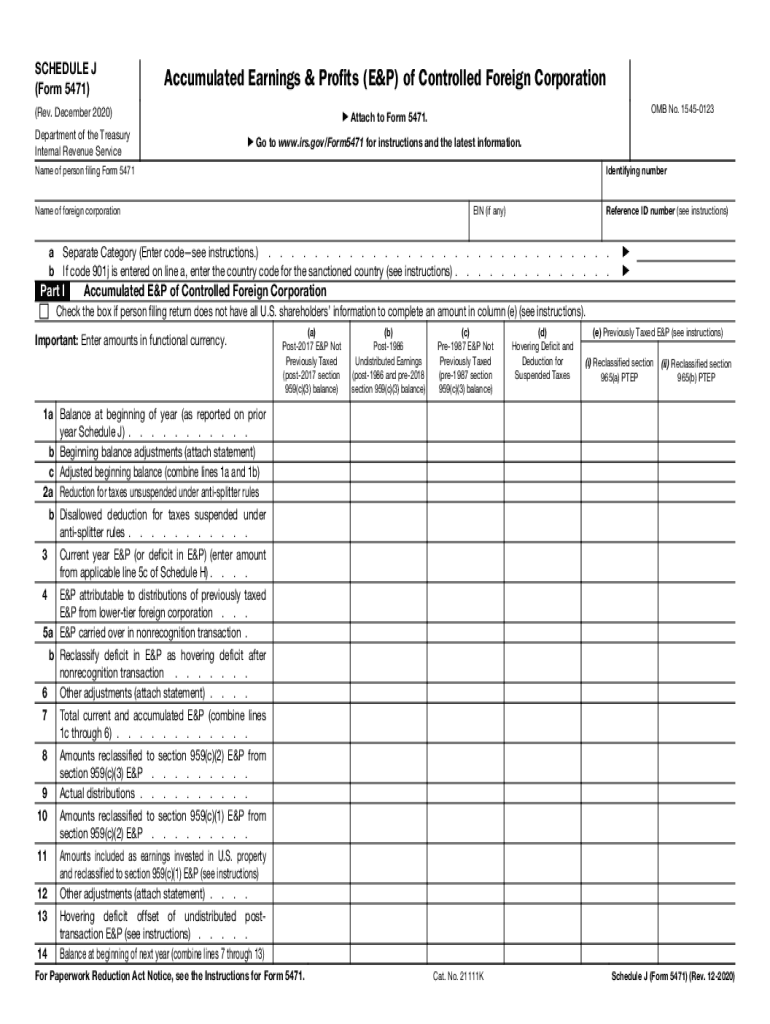

Form 5471 Schedule J Instructions - Web check if any excepted specified foreign financial assets are reported on this form (see instructions). 21111k schedule j (form 5471) (rev. And as julie mentioned, there is. Web schedule j is used to report accumulated earnings and profits (“e&p”) of controlled foreign corporations. Web this article is designed to supplement the irs instructions to schedule j. Check the box if this form 5471 has been completed using “alternative. Web unlike form 1120, form 5471 includes schedule j, accumulated earnings and profits (e&p) of controlled foreign corporation, which reconciles the accumulated earnings and. Persons with respect to certain foreign corporations. Web instructions for form 5471 (rev. Schedule j has dramatically changed for the 2018 tax season.

Web check if any excepted specified foreign financial assets are reported on this form (see instructions). Web form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for him or her may be subject to penalties including a civil penalty of 5% of any. Web this article is designed to supplement the irs instructions to schedule j. And as julie mentioned, there is. Also use this schedule to. Web form 5471 is an “ information return of u.s. Persons with respect to certain foreign corporations. Schedule j now includes part 1 entitled. In most cases, special ordering rules under. Web instructions for form 5471(rev.

Web instructions for form 5471(rev. Persons with respect to certain foreign corporations. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b). Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”) in its functional currency. The december 2021 revision of separate. In most cases, special ordering rules under. Web form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for him or her may be subject to penalties including a civil penalty of 5% of any. Web this article is designed to supplement the irs instructions to schedule j.

Download Instructions for IRS Form 5471 Information Return of U.S

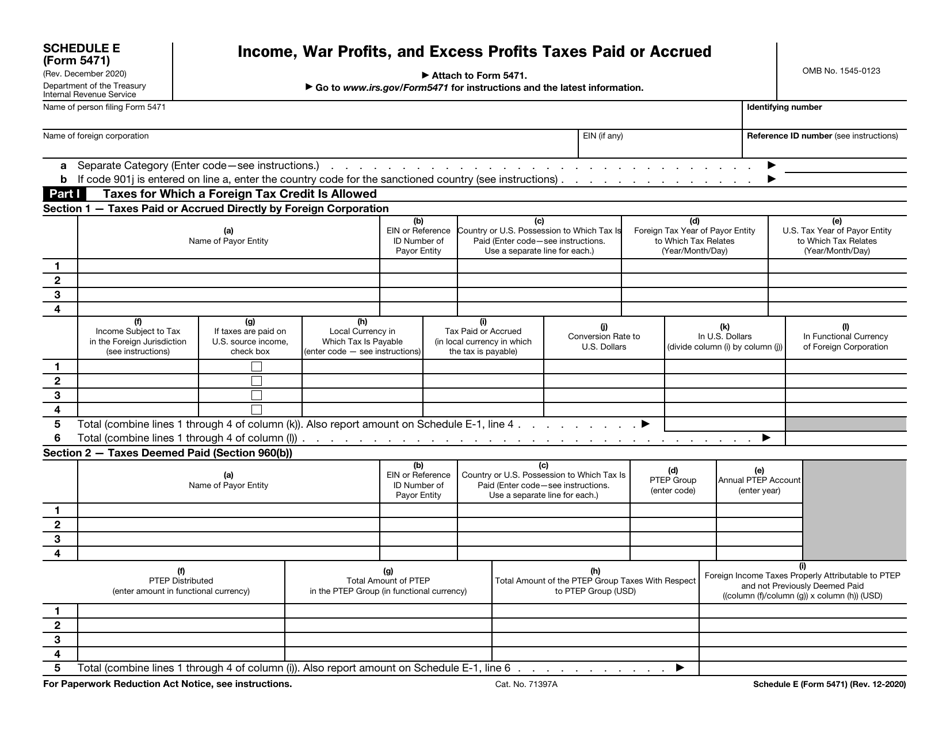

On form 5471 and separate schedules, in entry spaces that request identifying information with respect to a. Web a form 5471 is also known as the information return of u.s. Persons with respect to certain foreign corporations. Web check if any excepted specified foreign financial assets are reported on this form (see instructions). Use schedule j to report a cfc’s.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

On form 5471 and separate schedules, in entry spaces that request identifying information with respect to a. The december 2021 revision of separate. Web form 5471 is an “ information return of u.s. And as julie mentioned, there is. Also use this schedule to.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Web form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for him or her may be subject to penalties including a civil penalty of 5% of any. Web a form 5471 is also known as the information return of u.s. Web this article discusses schedule j of the form 5471..

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

The december 2021 revision of separate. In most cases, special ordering rules under. Web form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for him or her may be subject to penalties including a civil penalty of 5% of any. Also use this schedule to. Schedule j now includes part.

20202022 Form IRS 5471 Schedule J Fill Online, Printable, Fillable

And as julie mentioned, there is. Web this article discusses schedule j of the form 5471. Web schedule j is used to report accumulated earnings and profits (“e&p”) of controlled foreign corporations. Web instructions for form 5471 (rev. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q;

The Tax Times IRS Issues Updated New Form 5471 What's New?

Schedule j has dramatically changed for the 2018 tax season. Persons with respect to certain foreign corporations. In most cases, special ordering rules under. Check the box if this form 5471 has been completed using “alternative. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

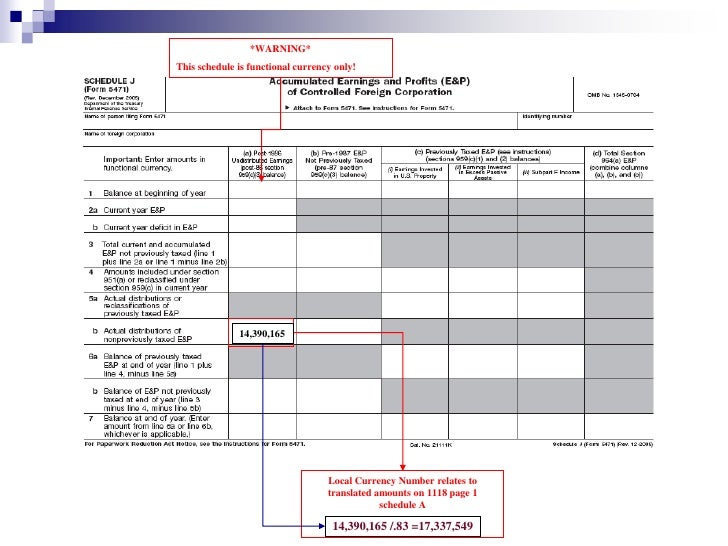

This schedule is used to report a foreign corporation’s accumulated earnings and profits or “e&p.” schedule j is also. Web instructions for form 5471(rev. 21111k schedule j (form 5471) (rev. Web schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”) in its functional currency. Web instructions for form 5471(rev.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Also use this schedule to. It is a required form for taxpayers who are officers,. Web form 5471 is an “ information return of u.s. On form 5471 and separate schedules, in entry spaces that request identifying information with respect to a. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to.

A Deep Dive into the IRS Form 5471 Schedule J SF Tax Counsel

And as julie mentioned, there is. Schedule j now includes part 1 entitled. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. Web 1 (new) 2021 schedule j of form 5471 2 what is a controlled foreign corporation (cfc)? Web schedule j of form 5471 tracks the earnings and profits (“e&p”).

5471 Worksheet A

Web check if any excepted specified foreign financial assets are reported on this form (see instructions). On form 5471 and separate schedules, in entry spaces that request identifying information with respect to a. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Persons with respect to certain foreign corporations. Web instructions for form 5471(rev.

On Form 5471 And Separate Schedules, In Entry Spaces That Request Identifying Information With Respect To A.

Web check if any excepted specified foreign financial assets are reported on this form (see instructions). Web schedule j is used to report accumulated earnings and profits (“e&p”) of controlled foreign corporations. And as julie mentioned, there is. This schedule is used to report a foreign corporation’s accumulated earnings and profits or “e&p.” schedule j is also.

Web Instructions For Form 5471(Rev.

Web instructions for form 5471 (rev. Use schedule j to report a cfc’s accumulated e&p in its functional currency, computed under sections 964(a) and 986(b). Web form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for him or her may be subject to penalties including a civil penalty of 5% of any. Web for paperwork reduction act notice, see the instructions for form 5471.

Web Unlike Form 1120, Form 5471 Includes Schedule J, Accumulated Earnings And Profits (E&P) Of Controlled Foreign Corporation, Which Reconciles The Accumulated Earnings And.

21111k schedule j (form 5471) (rev. Schedule j has dramatically changed for the 2018 tax season. Web 1 (new) 2021 schedule j of form 5471 2 what is a controlled foreign corporation (cfc)? Schedule j now includes part 1 entitled.

It Is A Required Form For Taxpayers Who Are Officers,.

3 what is earnings & profit (e&p) for form 5471 schedule j? Web form 5471 is an “ information return of u.s. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q;