Form 5498 Instructions

Form 5498 Instructions - Your ira custodian—not you—is required to file this form with the irs, usually by may 31. Web irs form 5498 is used to report any money or assets transferred into an ira. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. It is not necessary to file a form 5498 for each investment under one plan. Web in form 5498, you must include basic details, such as the trustee’s name and address, trustee’s tin, participant’s tin, and participant name and address. What’s new escheat to state. An ira includes all investments under one ira plan. You may also be required to take rmds if you inherited an ira. Web form 5498 for required minimum distributions (rmds) you need to make a required minimum distribution from the account each year if you reached age 72 (70½ if you reached 70½ prior to january 1, 2020). Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file.

Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Web in form 5498, you must include basic details, such as the trustee’s name and address, trustee’s tin, participant’s tin, and participant name and address. This includes contributions, catch up contributions, rollovers from another retirement account, roth conversions into the ira, and recharacterizations of roth contributions. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). You won't find this form in turbotax, nor do you file it with your tax return. Web form 5498 reports your total annual contributions to an ira account and identifies the type of retirement account you have, such as a traditional ira, roth ira, sep ira or simple ira. Your ira custodian—not you—is required to file this form with the irs, usually by may 31. File this form for each person for whom you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. What’s new escheat to state.

What’s new escheat to state. You may also be required to take rmds if you inherited an ira. You won't find this form in turbotax, nor do you file it with your tax return. Web form 5498 for required minimum distributions (rmds) you need to make a required minimum distribution from the account each year if you reached age 72 (70½ if you reached 70½ prior to january 1, 2020). It is not necessary to file a form 5498 for each investment under one plan. Web in form 5498, you must include basic details, such as the trustee’s name and address, trustee’s tin, participant’s tin, and participant name and address. You must also include the ira contribution, rollover, fmv, recharacterized contributions, and fmv, and select the type of ira using the checkbox. Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. This includes contributions, catch up contributions, rollovers from another retirement account, roth conversions into the ira, and recharacterizations of roth contributions.

File Form 5498 Online in Few Minutes Efile Form 5498 for 2020 Tax Year

Web form 5498 for required minimum distributions (rmds) you need to make a required minimum distribution from the account each year if you reached age 72 (70½ if you reached 70½ prior to january 1, 2020). Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any.

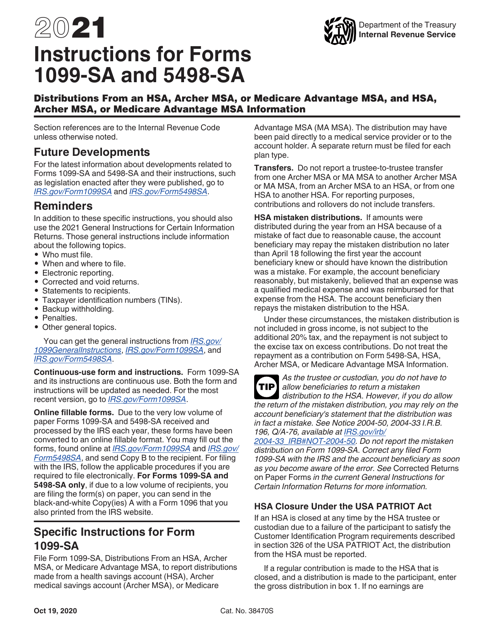

Form 8889 Instructions & Information on the HSA Tax Form

An ira includes all investments under one ira plan. File this form for each person for whom you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). What’s new escheat to state. You must also include the ira contribution, rollover, fmv, recharacterized contributions, and fmv, and select the type of ira using the checkbox. You may.

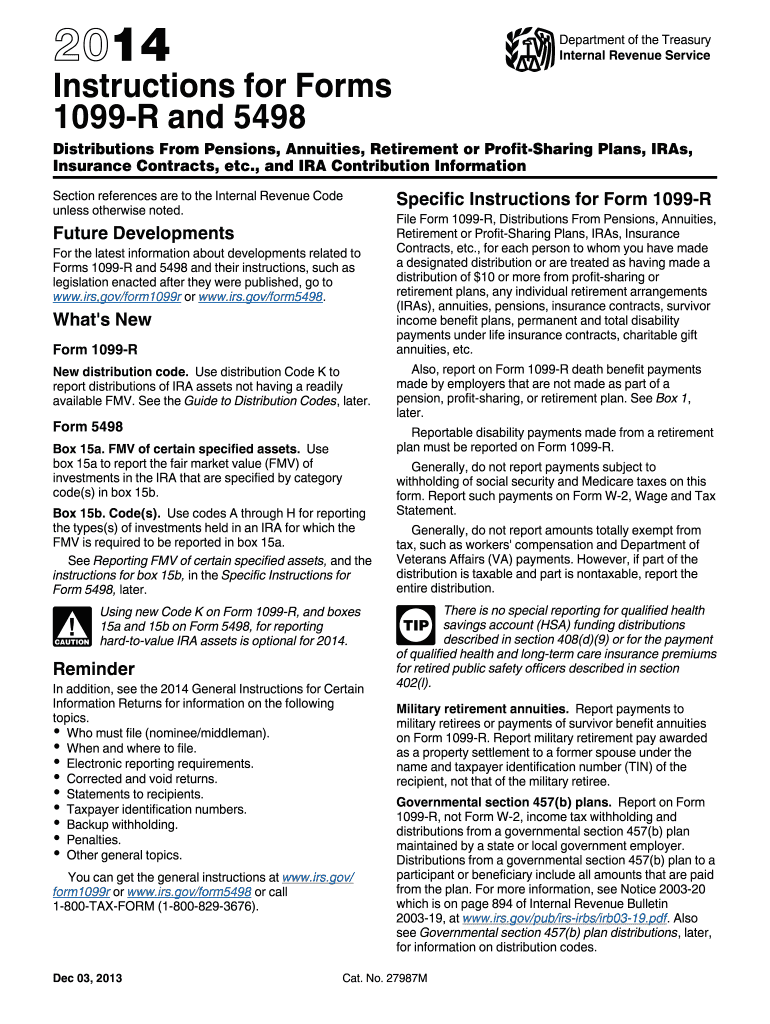

IRS Form Instruction 1099R & 5498 2019 2020 Printable & Fillable

Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. An ira includes all investments under one ira plan. Your ira custodian—not you—is required to file this form with the irs, usually by may 31. This includes contributions, catch up contributions, rollovers from another retirement account, roth conversions into.

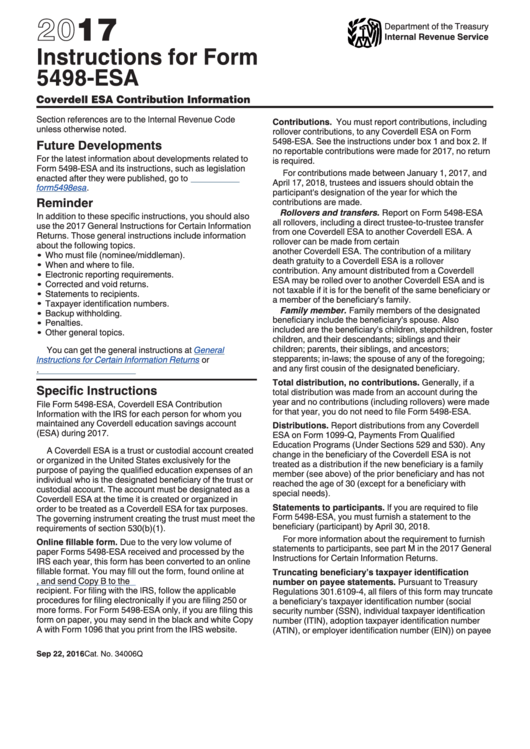

Instructions For Form 5498Esa 2017 printable pdf download

You must also include the ira contribution, rollover, fmv, recharacterized contributions, and fmv, and select the type of ira using the checkbox. You won't find this form in turbotax, nor do you file it with your tax return. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file..

5498 Software EFile TIN Matching Tax Forms Envelopes Irs

You won't find this form in turbotax, nor do you file it with your tax return. Web form 5498 reports your total annual contributions to an ira account and identifies the type of retirement account you have, such as a traditional ira, roth ira, sep ira or simple ira. Web information about form 5498, ira contribution information (info copy only),.

2014 1099 Template Fill Out and Sign Printable PDF Template signNow

Web irs form 5498 is used to report any money or assets transferred into an ira. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Your ira custodian—not you—is required to file this form with the irs, usually by may 31. Web form 5498 reports your total.

Roth Ira Form For Taxes Universal Network

Your ira custodian—not you—is required to file this form with the irs, usually by may 31. Form 5498 will also report amounts that you roll over or transfer from other types of retirement accounts into this ira. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained.

Instructions to Fill Out a Tax Form 5498 [StepbyStep Guide] EaseUS

Web in form 5498, you must include basic details, such as the trustee’s name and address, trustee’s tin, participant’s tin, and participant name and address. Form 5498 will also report amounts that you roll over or transfer from other types of retirement accounts into this ira. Your ira custodian—not you—is required to file this form with the irs, usually by.

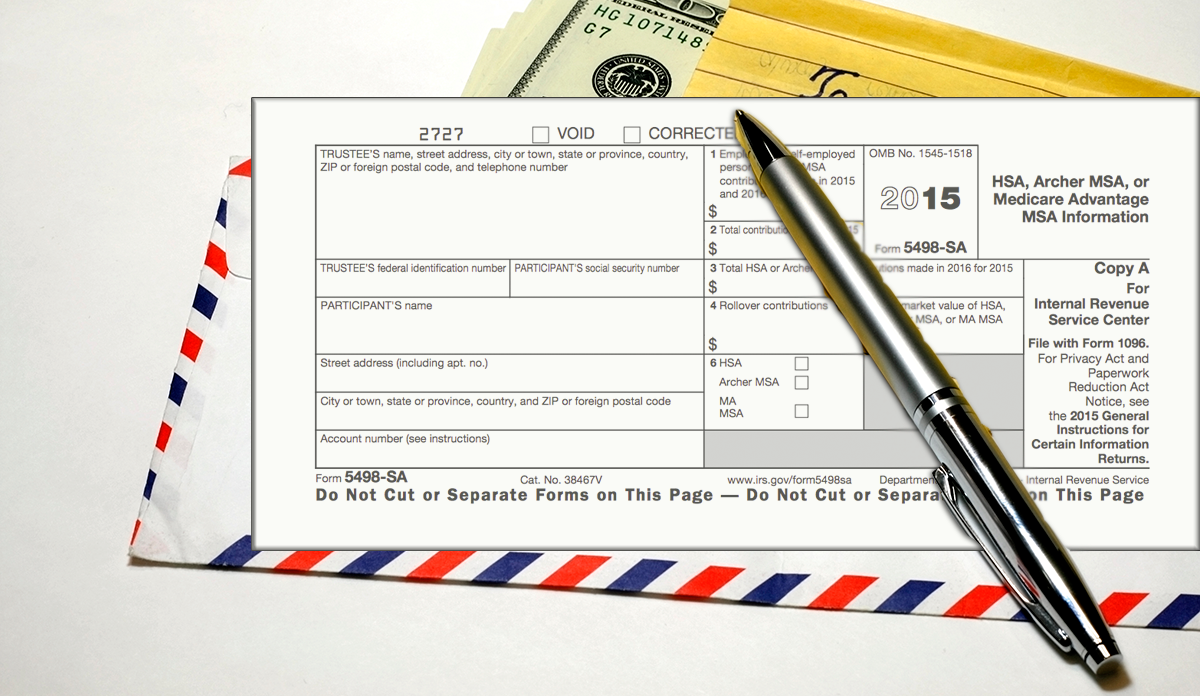

What is IRS Form 5498SA? BRI Benefit Resource

You won't find this form in turbotax, nor do you file it with your tax return. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Form 5498 will also report amounts that you roll over or transfer from other types of retirement accounts into this ira. An.

Download Instructions for IRS Form 1099SA, 5498SA PDF, 2021

Web form 5498 reports your total annual contributions to an ira account and identifies the type of retirement account you have, such as a traditional ira, roth ira, sep ira or simple ira. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement.

It Is Not Necessary To File A Form 5498 For Each Investment Under One Plan.

This includes contributions, catch up contributions, rollovers from another retirement account, roth conversions into the ira, and recharacterizations of roth contributions. You won't find this form in turbotax, nor do you file it with your tax return. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. What’s new escheat to state.

Web Form 5498 Reports Your Total Annual Contributions To An Ira Account And Identifies The Type Of Retirement Account You Have, Such As A Traditional Ira, Roth Ira, Sep Ira Or Simple Ira.

Your ira custodian—not you—is required to file this form with the irs, usually by may 31. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including a deemed ira under section 408(q). An ira includes all investments under one ira plan. Web in form 5498, you must include basic details, such as the trustee’s name and address, trustee’s tin, participant’s tin, and participant name and address.

Web Form 5498 For Required Minimum Distributions (Rmds) You Need To Make A Required Minimum Distribution From The Account Each Year If You Reached Age 72 (70½ If You Reached 70½ Prior To January 1, 2020).

Ira contributions information reports to the irs your ira contributions for the year along with other information about your ira account. Form 5498 will also report amounts that you roll over or transfer from other types of retirement accounts into this ira. You must also include the ira contribution, rollover, fmv, recharacterized contributions, and fmv, and select the type of ira using the checkbox. You may also be required to take rmds if you inherited an ira.

File This Form For Each Person For Whom You Maintained Any Individual Retirement Arrangement (Ira), Including A Deemed Ira Under Section 408(Q).

Web irs form 5498 is used to report any money or assets transferred into an ira.

![Instructions to Fill Out a Tax Form 5498 [StepbyStep Guide] EaseUS](https://pdf.easeus.com/images/pdf-editor/en/resource/tax-form-5498.png)