Form 5564 Notice Of Deficiency

Form 5564 Notice Of Deficiency - If you disagree you have the right to challenge this determination in u.s. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and send it back to the agency that issued it. Contact the third party that furnished the. Along with notice cp3219a, you should receive form 5564. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. If you are making a. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either an irs audit appeal, petition, 5564 form, 1040x form,. How to complete the ir's form 5564 notice.

Web this letter explains the changes and your right to challenge the increase in tax court. If you agree with the information on your notice,. Along with notice cp3219a, you should receive form 5564. Web these letters provide taxpayers with information about their right to challenge proposed irs adjustments in the united states tax court by filing a petition within 90. If you are making a. How to complete the ir's form 5564 notice. If you disagree you have the right to challenge this determination in u.s. This form notifies the irs that you agree with the proposed additional tax due. It is important to take note of the different. Contact the third party that furnished the.

If you disagree you have the right to challenge this determination in u.s. Web this letter explains the changes and your right to challenge the increase in tax court. This form notifies the irs that you agree with the proposed additional tax due. Web jul 27, 2021 1 min read form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Contact the third party that furnished the. How to complete the ir's form 5564 notice. Review the changes and compare them to your tax return. United states (english) united states (spanish) canada (english) canada (french) tax refund. If you agree with the information on your notice,.

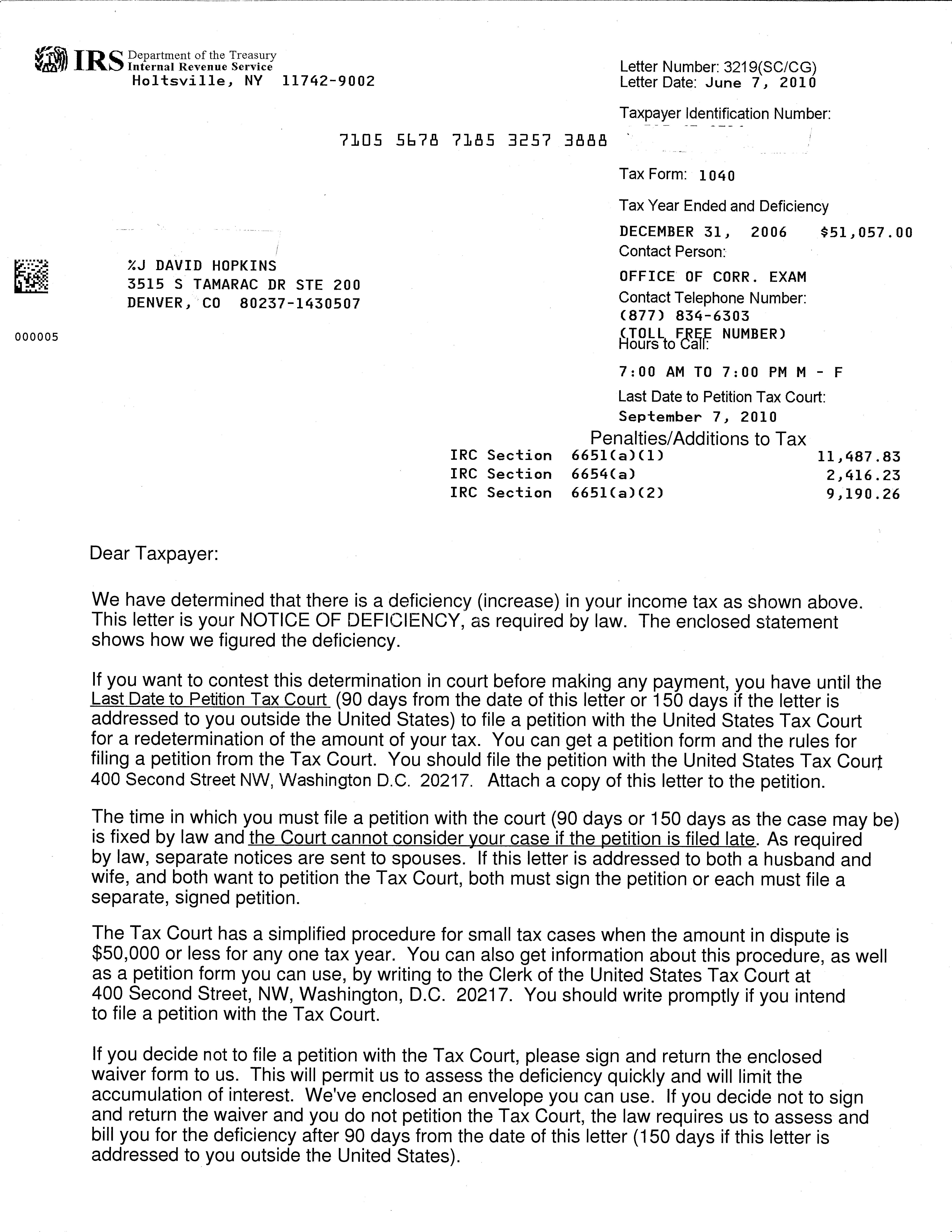

IRS Notice of Deficiency Colonial Tax Consultants

Review the changes and compare them to your tax return. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. If you disagree you have the right to challenge this determination in u.s. Web if you agree with the notice of deficiency and don’t.

Delinquency Notice Template Master Template

If you disagree you have the right to challenge this determination in u.s. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. This form notifies the irs that you agree with the proposed additional tax due. Web.

Audit Letter 3219 Tax Attorney Response & Answer to the IRS

Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and send it back to the agency that issued it. Contact the third party that furnished the. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either.

IRS Audit Letter CP3219A Sample 1

Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and send it back to the agency that issued it. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. If you are making a..

Form 4089A Notice Of Deficiency Statement printable pdf download

If you agree with the information on your notice,. Contact the third party that furnished the. Web this letter is your notice of deficiency, as required by law. Review the changes and compare them to your tax return. Web what is irs form 5564?

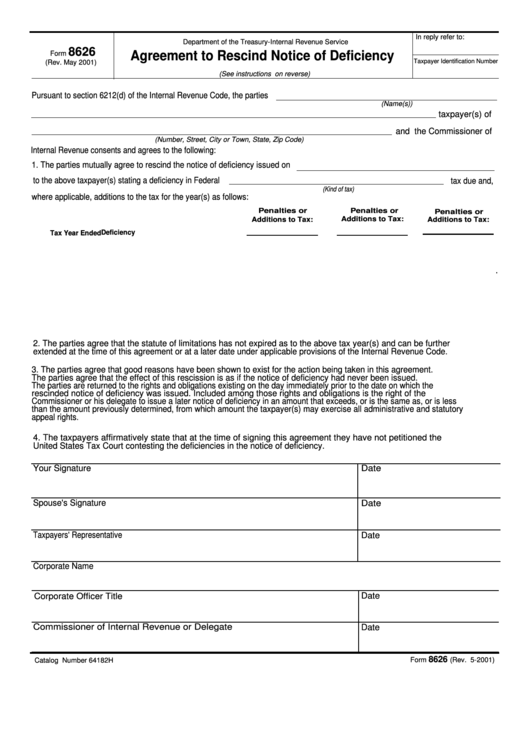

Fillable Form 8626 Agreement To Rescind Notice Of Deficiency

Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. If you are making a. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either an irs audit appeal, petition, 5564 form, 1040x form,. Web mail or fax form 5564 back to the address on.

Form 121 Download Fillable PDF or Fill Online Warranty Deficiency

Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. This form notifies the irs that you agree with the proposed additional tax due. Web if the irs sends you a notice of deficiency stating adenine discrepancy in your tax refund so resulted in an underpayment off steuer, the.

FIA Historic Database

Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and send it back to the agency that issued it. If you disagree you have the right to challenge this determination in u.s. Web mail or fax form 5564 back to the address on the notice.

This is how you react to a severely disabled person's pass (2023)

This form notifies the irs that you agree with the proposed additional tax due. Along with notice cp3219a, you should receive form 5564. Web this letter is your notice of deficiency, as required by law. Web if the irs sends you a notice of deficiency stating adenine discrepancy in your tax refund so resulted in an underpayment off steuer, the.

Web What Is Irs Form 5564?

If you are making a. If you disagree you have the right to challenge this determination in u.s. This form notifies the irs that you agree with the proposed additional tax due. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a.

Contact The Third Party That Furnished The.

Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web these letters provide taxpayers with information about their right to challenge proposed irs adjustments in the united states tax court by filing a petition within 90. Web this letter is your notice of deficiency, as required by law. Web this letter explains the changes and your right to challenge the increase in tax court.

Web Jul 27, 2021 1 Min Read Form 5564 Notice Of Deficiency Waiver If The Irs Believes That You Owe More Tax Than What Was Reported On Your Tax Return, The Irs Will.

Review the changes and compare them to your tax return. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency, and send it back to the agency that issued it. If you agree with the information on your notice,. How to complete the ir's form 5564 notice.

It Is Important To Take Note Of The Different.

Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web if the irs sends you a notice of deficiency stating adenine discrepancy in your tax refund so resulted in an underpayment off steuer, the inhabitant can choose to agree by the. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either an irs audit appeal, petition, 5564 form, 1040x form,. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice.