Form 7004 Electronic Filing

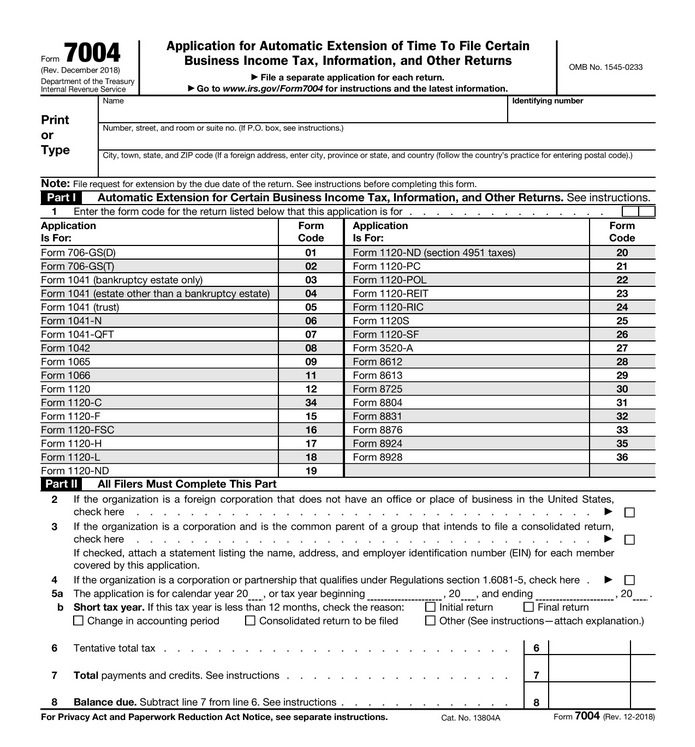

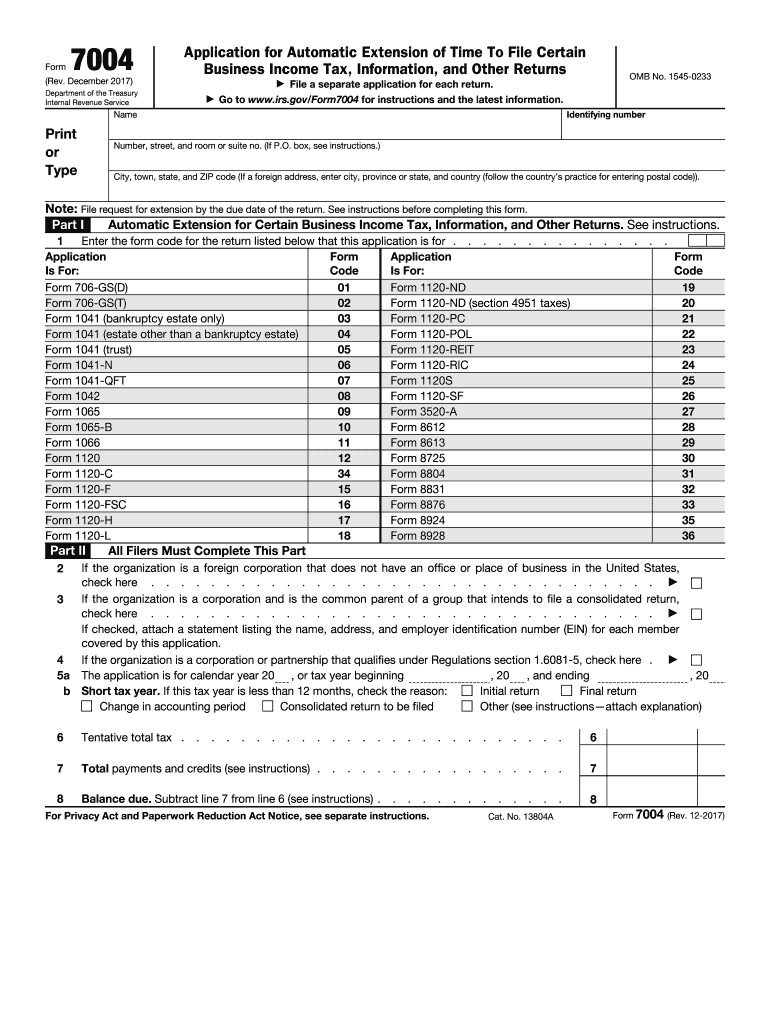

Form 7004 Electronic Filing - Ad filing your tax extension just became easier! File your taxes like a pro. Enter code 25 in the box on form 7004, line 1. Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Ad filing your tax extension just became easier! Web application for automatic extension of time to file certain business income tax, information, and other returns form 7004 (rev. For details on electronic filing, visit irs.gov/efile7004. Web you can extend filing form 1120s when you file form 7004. Open the return for which you wish to complete the extension and. Payment of tax line 1a—extension date.

Ad complete irs tax forms online or print government tax documents. To file form 7004 using taxact. Web deadlines for filing form 7004. Then file form 7004 at: If the year ends on december 31st,. Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year. Ad filing your tax extension just became easier! Open the return for which you wish to complete the extension and. Web how to file form 7004 electronically. December 2018) 7004 form (rev.

Web how to file form 7004 electronically. 5 months (to september 15, 2023) for forms 1065, us return of partnership income and 1120s, us income tax return for. December 2018) 7004 form (rev. Ad filing your tax extension just became easier! To file form 7004 using taxact. Ad filing your tax extension just became easier! But those who choose to mail their 7004 tax form should understand that it takes longer. For details on electronic filing, visit irs.gov/efile7004. Web you can extend filing form 1120s when you file form 7004. Web completing form 7004 for electronic filing.

Tax extension form 7004

Enter code 25 in the box on form 7004, line 1. For details on electronic filing, visit irs.gov/efile7004. Application for automatic extension of time to file certain business income tax,. If the year ends on december 31st,. December 2018) department of the treasury internal revenue service.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web signature requirements for form 7004. But those who choose to mail their 7004 tax form should understand that it takes longer. Web irs form 7004 extends the filing deadline for another: Enter code 25 in the box on form 7004, line 1. Application for automatic extension of time to file certain business income tax,.

Tax filing mistakes to avoid when filing IRS extension Forms 4868 and

Solved • by intuit • 28 • updated july 13, 2022. To file form 7004 using taxact. December 2018) 7004 form (rev. Ad complete irs tax forms online or print government tax documents. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related.

2017 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

Ad complete irs tax forms online or print government tax documents. To file form 7004 using taxact. Web deadlines for filing form 7004. Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Ad filing your tax extension just became easier!

This Is Where You Need To Mail Your Form 7004 This Year Blog

For details on electronic filing, visit irs.gov/efile7004. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year. 5 months (to september 15, 2023) for forms 1065, us return of partnership income and 1120s, us.

Corporation return due date is March 16, 2015Cary NC CPA

Ad filing your tax extension just became easier! Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Application for automatic extension of time to file certain business income tax,. Then file form 7004 at: File your taxes like a pro.

Where to file Form 7004 Federal Tax TaxUni

File your taxes like a pro. Ad complete irs tax forms online or print government tax documents. Web file form 7004 based on the appropriate tax form shown below: If the year ends on december 31st,. Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically.

A Simple Guide to Filing the 2020 Form 7004 for Businesses Blog

Web file form 7004 by the 15th day of the 6th month following the close of the tax year. Web file form 7004 based on the appropriate tax form shown below: Then file form 7004 at: File your taxes like a pro. Open the return for which you wish to complete the extension and.

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Payment of tax line 1a—extension date. And the settler is (or was at death). Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates,.

Form 8878A IRS EFile Electronic Funds Withdrawal Authorization for

But those who choose to mail their 7004 tax form should understand that it takes longer. Web signature requirements for form 7004. Then file form 7004 at: For details on electronic filing, visit irs.gov/efile7004. Ad complete irs tax forms online or print government tax documents.

If The Year Ends On December 31St,.

Enter code 25 in the box on form 7004, line 1. But those who choose to mail their 7004 tax form should understand that it takes longer. Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year. File your taxes like a pro.

And The Settler Is (Or Was At Death).

Open the return for which you wish to complete the extension and. When filing an extension request form 7004 signatures may be required. Web signature requirements for form 7004. Ad filing your tax extension just became easier!

Web Irs Form 7004 Extends The Filing Deadline For Another:

Web application for automatic extension of time to file certain business income tax, information, and other returns form 7004 (rev. 5 months (to september 15, 2023) for forms 1065, us return of partnership income and 1120s, us income tax return for. Web file form 7004 by the 15th day of the 6th month following the close of the tax year. For details on electronic filing, visit irs.gov/efile7004.

Web Completing Form 7004 For Electronic Filing.

Web file form 7004 based on the appropriate tax form shown below: Web deadlines for filing form 7004. Payment of tax line 1a—extension date. Web you can extend filing form 1120s when you file form 7004.