Form 706 Gs D 1

Form 706 Gs D 1 - General instructions purpose of form who must file. I know i have to mail a copy to the irs. Preparation of the federal gift tax return — form 709. Web who must file. Do i report this information on my taxes? Web information regarding beneficiaries acquiring property from a decedent — form 8971. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. The trust involved in a transfer described in the. Web form 706gs (d) must be filed in accordance with its instructions for any taxable distribution (as defined in section 2612 (b)). This form may be used in.

Do i report this information on my taxes? This form may be used in. I know i have to mail a copy to the irs. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web information regarding beneficiaries acquiring property from a decedent — form 8971. Trustees are required to report taxable. General instructions purpose of form who must file. United states (english) united states. Web who must file. Web form 706gs (d) must be filed in accordance with its instructions for any taxable distribution (as defined in section 2612 (b)).

Web form 706gs (d) must be filed in accordance with its instructions for any taxable distribution (as defined in section 2612 (b)). General instructions purpose of form who must file. Do i report this information on my taxes? I know i have to mail a copy to the irs. Preparation of the federal gift tax return — form 709. The trust involved in a transfer described in the. Web who must file. United states (english) united states. Web information regarding beneficiaries acquiring property from a decedent — form 8971. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the.

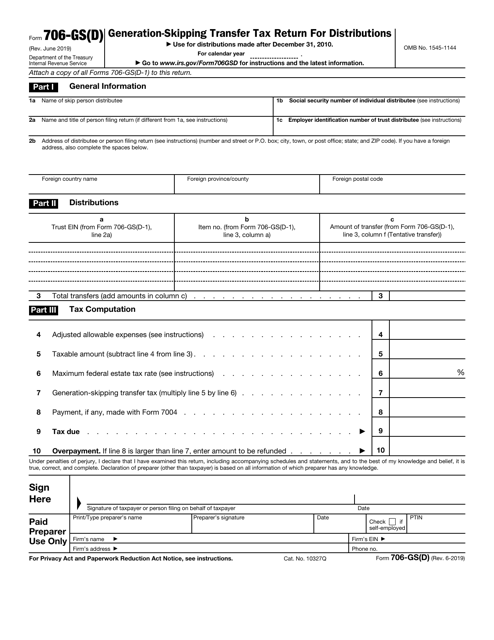

IRS Form 706GS(D) Download Fillable PDF or Fill Online Generation

Web form 706gs (d) must be filed in accordance with its instructions for any taxable distribution (as defined in section 2612 (b)). I know i have to mail a copy to the irs. Trustees are required to report taxable. The trust involved in a transfer described in the. Do i report this information on my taxes?

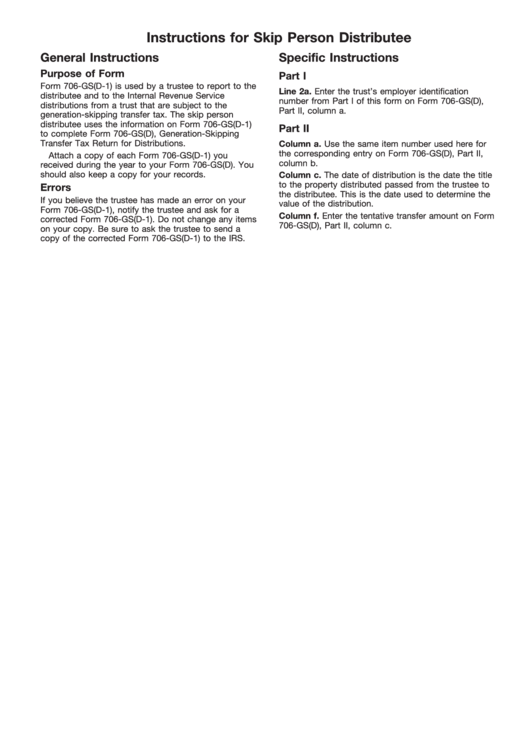

Instructions For Form 706Gs(D1) printable pdf download

Preparation of the federal gift tax return — form 709. General instructions purpose of form who must file. United states (english) united states. Web information regarding beneficiaries acquiring property from a decedent — form 8971. Web who must file.

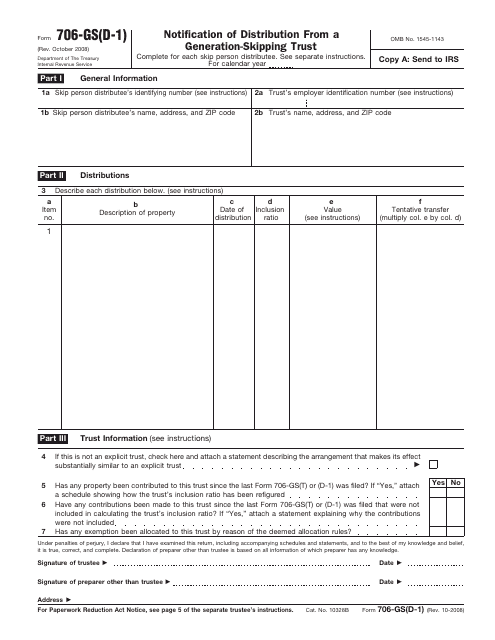

IRS Form 706GS(D1) Download Fillable PDF or Fill Online Notification

Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web information regarding beneficiaries acquiring property from a decedent — form 8971. The trust involved in a transfer described in the. This form may be used in. Web form.

3.11.106 Estate and Gift Tax Returns Internal Revenue Service

This form may be used in. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web who must file. General instructions purpose of form who must file. Preparation of the federal gift tax return — form 709.

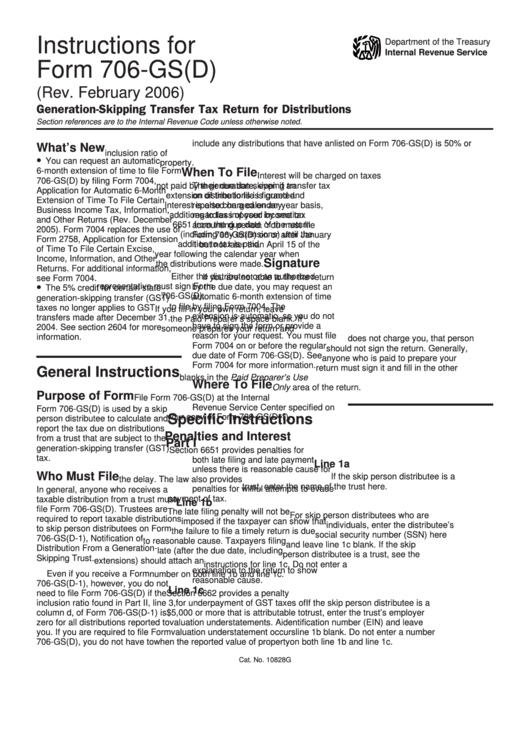

Instructions For Form 706Gs(D) (Rev. February 2006) printable pdf download

I know i have to mail a copy to the irs. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web information regarding beneficiaries acquiring property from a decedent — form 8971. Do i report this information on.

Instructions for Form 706GS(D1) (Rev. January 2007) Estate Tax In

Web information regarding beneficiaries acquiring property from a decedent — form 8971. Web form 706gs (d) must be filed in accordance with its instructions for any taxable distribution (as defined in section 2612 (b)). General instructions purpose of form who must file. United states (english) united states. Web form 706 is used by an executor of a decedent’s estate to.

Instructions For Form 706Gs(D1) 2016 printable pdf download

Preparation of the federal gift tax return — form 709. Do i report this information on my taxes? Trustees are required to report taxable. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web who must file.

Form 706GS(D1) Arbitrage Rebate, Yield Reduction and Penalty in

Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Web who must file. United states (english) united states. Web form 706gs (d) must be filed in accordance with its instructions for any taxable distribution (as defined in section.

Instructions For Form 706Gs(D) (Rev. February 2011) printable pdf

Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. Preparation of the federal gift tax return — form 709. Web form 706gs (d) must be filed in accordance with its instructions for any taxable distribution (as defined in.

Instructions For Form 706Gs(D) printable pdf download

United states (english) united states. Web who must file. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. General instructions purpose of form who must file. This form may be used in.

Preparation Of The Federal Gift Tax Return — Form 709.

General instructions purpose of form who must file. This form may be used in. Trustees are required to report taxable. Do i report this information on my taxes?

Web Information Regarding Beneficiaries Acquiring Property From A Decedent — Form 8971.

I know i have to mail a copy to the irs. Web form 706 is used by an executor of a decedent’s estate to calculate estate tax owed, according to chapter 11 of the internal revenue code (irc), and to calculate the. The trust involved in a transfer described in the. Web who must file.

United States (English) United States.

Web form 706gs (d) must be filed in accordance with its instructions for any taxable distribution (as defined in section 2612 (b)).