Form 706 Portability

Form 706 Portability - The executor must note at the top of the form 706, that it is “filed pursuant to rev. By intuitupdated january 13, 2023. A tax form distributed by the internal revenue service (irs) that used to. That deadline can be extended automatically with form 4768,. Web as of this writing, an estate will be considered to have made the portability election by timely filing a properly prepared and complete form 706, without the need to make an. Web to elect portability in maryland, a form 706 must accompany the state estate tax return anyway. Web form 706 generally must be submitted to the irs within nine months of the first spouse’s death. Web george’s other lectures have included topics such as portability, decanting, trustee selection and duties, the principal and income act, current developments in estate. Web effective july 8, 2022, rev. The following items are frequently asked questions preparers have.

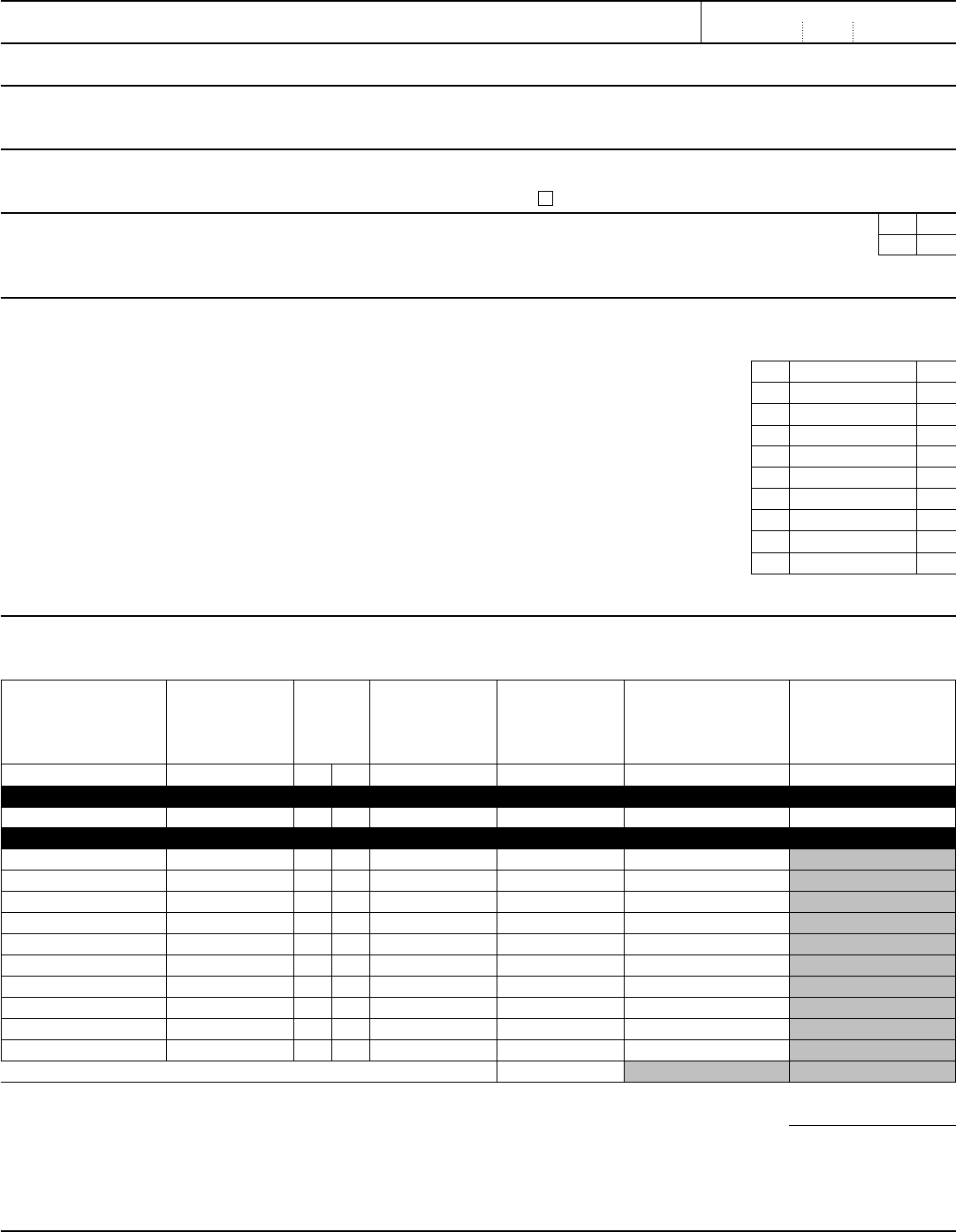

Web common questions about filing 706 returns in lacerte. Thus, without coordination from the states, the new federal. Web form 706 generally must be submitted to the irs within nine months of the first spouse’s death. Web this estate tax return is known as a form 706. Web current revision form 706 pdf instructions for form 706 ( print version pdf) recent developments correction to the september 2022 revision of the instructions for form. Web form 706 must be filed within nine months of the date of death. That deadline can be extended automatically with form 4768,. Web form 706 provides a procedure for estates required to file because the gross estate’s value exceeds the corresponding exclusion amount or for another. Web to qualify for relief for a late portability election, the estate’s executor must complete and properly prepare form 706 on or before the fifth anniversary of the. The executor must note at the top of the form 706, that it is “filed pursuant to rev.

Web common questions about filing 706 returns in lacerte. That deadline can be extended automatically with form 4768,. Thus, without coordination from the states, the new federal. The executor must note at the top of the form 706, that it is “filed pursuant to rev. Web as of this writing, an estate will be considered to have made the portability election by timely filing a properly prepared and complete form 706, without the need to make an. Web this estate tax return is known as a form 706. Web current revision form 706 pdf instructions for form 706 ( print version pdf) recent developments correction to the september 2022 revision of the instructions for form. The following items are frequently asked questions preparers have. Web george’s other lectures have included topics such as portability, decanting, trustee selection and duties, the principal and income act, current developments in estate. Web effective july 8, 2022, rev.

Form 706GS(T) GenerationSkipping Transfer Tax Return for

The executor must note at the top of the form 706, that it is “filed pursuant to rev. Web form 706 generally must be submitted to the irs within nine months of the first spouse’s death. Web form 706 provides a procedure for estates required to file because the gross estate’s value exceeds the corresponding exclusion amount or for another..

Form 706 Edit, Fill, Sign Online Handypdf

Web effective july 8, 2022, rev. The executor must note at the top of the form 706, that it is “filed pursuant to rev. Web as of this writing, an estate will be considered to have made the portability election by timely filing a properly prepared and complete form 706, without the need to make an. Web form 706 generally.

Form 706 United States Estate (and GenerationSkipping Transfer) Tax

A tax form distributed by the internal revenue service (irs) that used to. Thus, without coordination from the states, the new federal. Web in order to elect portability of the decedent's unused exclusion amount (deceased spousal unused exclusion (dsue) amount) for the benefit of the surviving spouse, the estate's. Web george’s other lectures have included topics such as portability, decanting,.

Form 706 Edit, Fill, Sign Online Handypdf

The executor must note at the top of the form 706, that it is “filed pursuant to rev. Web to elect portability in maryland, a form 706 must accompany the state estate tax return anyway. Thus, without coordination from the states, the new federal. Web form 706 generally must be submitted to the irs within nine months of the first.

Form 706A United States Additional Estate Tax Return (2013) Free

Thus, without coordination from the states, the new federal. Web common questions about filing 706 returns in lacerte. Web form 706 provides a procedure for estates required to file because the gross estate’s value exceeds the corresponding exclusion amount or for another. Web current revision form 706 pdf instructions for form 706 ( print version pdf) recent developments correction to.

Form 706 Edit, Fill, Sign Online Handypdf

That deadline can be extended automatically with form 4768,. Web effective july 8, 2022, rev. The executor must note at the top of the form 706, that it is “filed pursuant to rev. Web george’s other lectures have included topics such as portability, decanting, trustee selection and duties, the principal and income act, current developments in estate. Thus, without coordination.

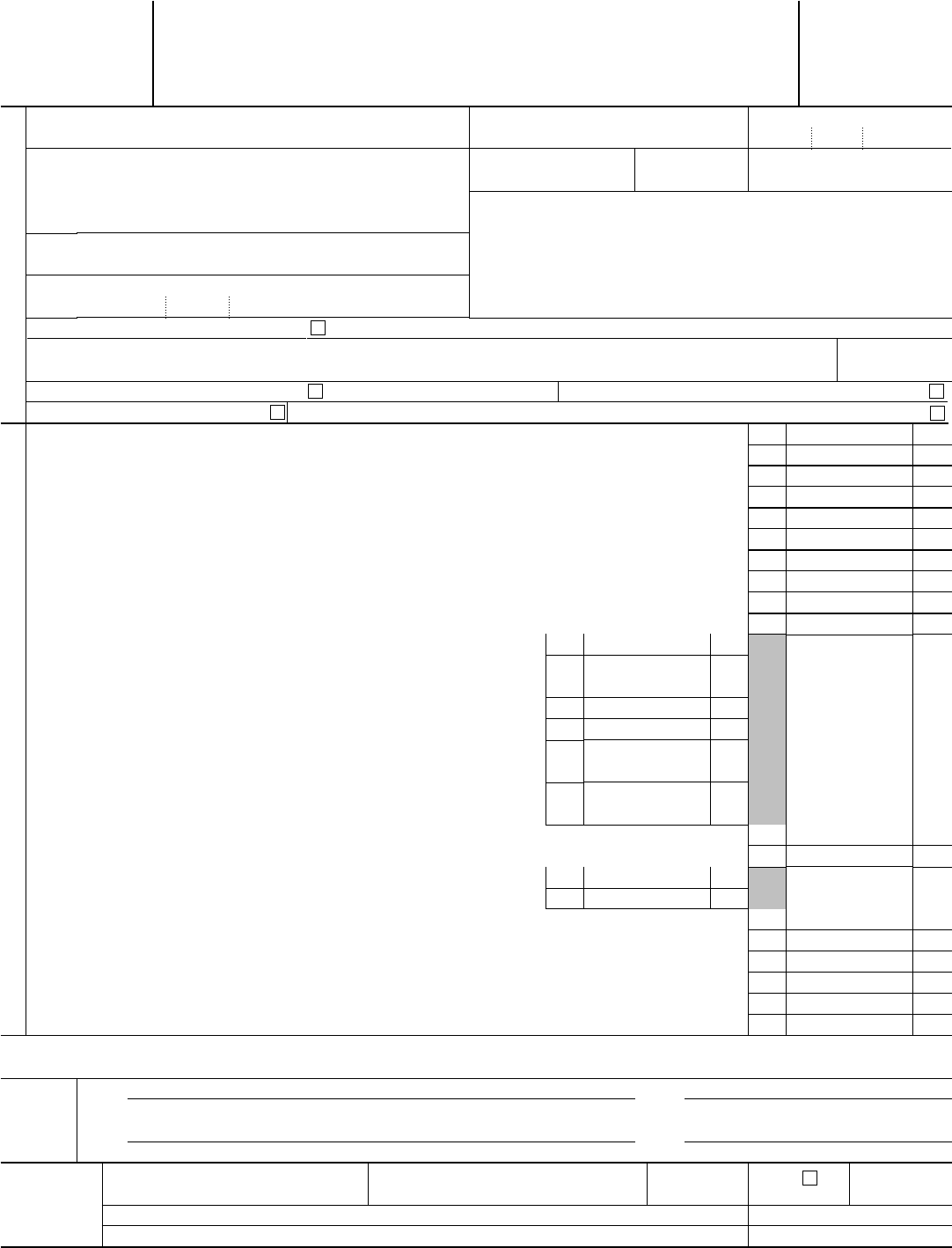

Instructions For Form 706Na United States Estate (And Generation

Web form 706 provides a procedure for estates required to file because the gross estate’s value exceeds the corresponding exclusion amount or for another. Web george’s other lectures have included topics such as portability, decanting, trustee selection and duties, the principal and income act, current developments in estate. That deadline can be extended automatically with form 4768,. Web in order.

Form 706QDT U.S. Estate Tax Return for Qualified Domestic Trusts

Web form 706 must be filed within nine months of the date of death. Web effective july 8, 2022, rev. Web to elect portability in maryland, a form 706 must accompany the state estate tax return anyway. The executor must note at the top of the form 706, that it is “filed pursuant to rev. Web in order to elect.

Deceased Spousal Unused Exclusion (DSUE) Portability

The executor must note at the top of the form 706, that it is “filed pursuant to rev. A tax form distributed by the internal revenue service (irs) that used to. Web to elect portability in maryland, a form 706 must accompany the state estate tax return anyway. Web common questions about filing 706 returns in lacerte. Web effective july.

Portability Election Extension IRS Form 706 Hamilton CPA Firm

That deadline can be extended automatically with form 4768,. The executor must note at the top of the form 706, that it is “filed pursuant to rev. Web to qualify for relief for a late portability election, the estate’s executor must complete and properly prepare form 706 on or before the fifth anniversary of the. Web current revision form 706.

Web As Of This Writing, An Estate Will Be Considered To Have Made The Portability Election By Timely Filing A Properly Prepared And Complete Form 706, Without The Need To Make An.

Web in order to elect portability of the decedent's unused exclusion amount (deceased spousal unused exclusion (dsue) amount) for the benefit of the surviving spouse, the estate's. Web form 706 provides a procedure for estates required to file because the gross estate’s value exceeds the corresponding exclusion amount or for another. Web form 706 generally must be submitted to the irs within nine months of the first spouse’s death. Web current revision form 706 pdf instructions for form 706 ( print version pdf) recent developments correction to the september 2022 revision of the instructions for form.

Thus, Without Coordination From The States, The New Federal.

The following items are frequently asked questions preparers have. Web this estate tax return is known as a form 706. By intuitupdated january 13, 2023. A tax form distributed by the internal revenue service (irs) that used to.

Web Effective July 8, 2022, Rev.

Web to qualify for relief for a late portability election, the estate’s executor must complete and properly prepare form 706 on or before the fifth anniversary of the. Web george’s other lectures have included topics such as portability, decanting, trustee selection and duties, the principal and income act, current developments in estate. That deadline can be extended automatically with form 4768,. Web to elect portability in maryland, a form 706 must accompany the state estate tax return anyway.

Web Form 706 Must Be Filed Within Nine Months Of The Date Of Death.

Web common questions about filing 706 returns in lacerte. The executor must note at the top of the form 706, that it is “filed pursuant to rev.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)